Answered step by step

Verified Expert Solution

Question

1 Approved Answer

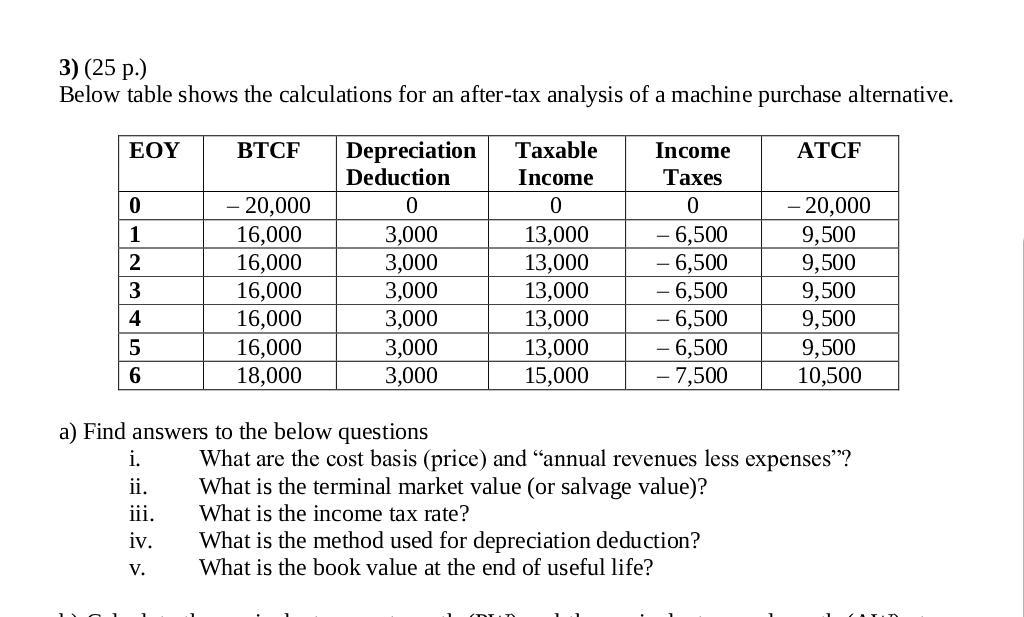

please write bet keyboard or clear handwrittin 3) (25 p.) Below table shows the calculations for an after-tax analysis of a machine purchase alternative. EOY

please write bet keyboard or clear handwrittin

3) (25 p.) Below table shows the calculations for an after-tax analysis of a machine purchase alternative. EOY BTCF ATCF 0 1 2 Depreciation Deduction 0 3,000 3,000 3,000 3,000 3,000 3,000 - 20,000 16,000 16,000 16,000 16,000 16,000 18,000 Taxable Income 0 13,000 13,000 13,000 13,000 13,000 15,000 Income Taxes 0 -6,500 - 6,500 -6,500 - 6,500 - 6,500 - 7,500 3 4 - 20,000 9,500 9,500 9,500 9,500 9,500 10,500 5 6 a) Find answers to the below questions i. What are the cost basis (price) and annual revenues less expenses? ii. What is the terminal market value (or salvage value)? iii. What is the income tax rate? iv. What is the method used for depreciation deduction? What is the book value at the end of useful life? VStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started