pls answer 13-17

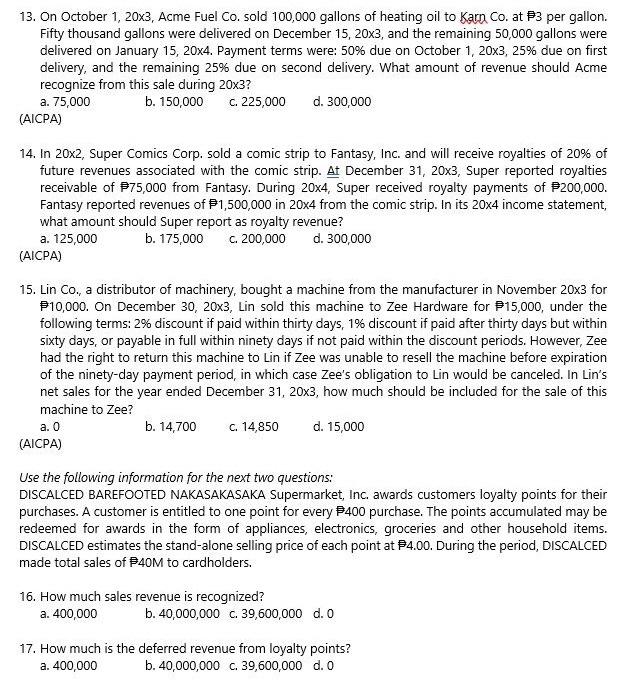

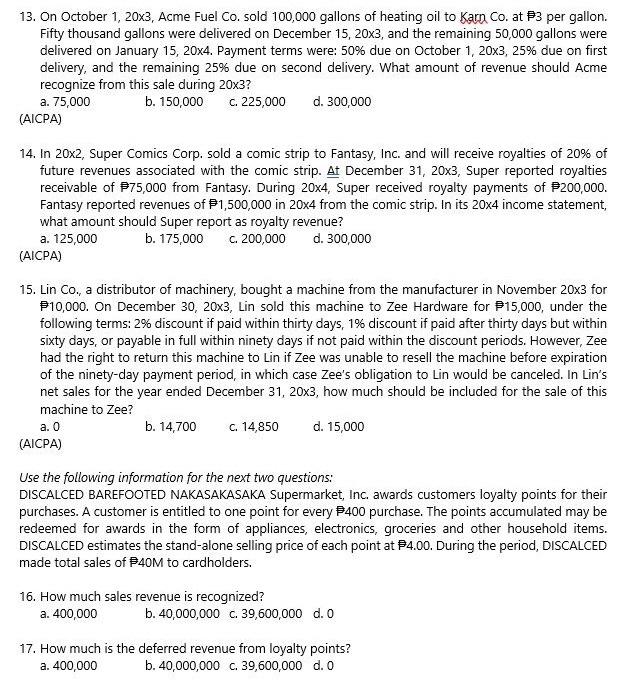

13. On October 1, 20x3, Acme Fuel Co. sold 100,000 gallons of heating oil to Karn Co. at 3 per gallon. Fifty thousand gallons were delivered on December 15, 20x3, and the remaining 50,000 gallons were delivered on January 15, 20x4. Payment terms were: 50% due on October 1, 20x3, 25% due on first delivery, and the remaining 25% due on second delivery. What amount of revenue should Acme recognize from this sale during 20x3? a. 75,000 b. 150,000 C. 225,000 d. 300,000 (AICPA) 14. In 20x2, Super Comics Corp. sold a comic strip to Fantasy, Inc. and will receive royalties of 20% of future revenues associated with the comic strip. Af December 31, 20x3, Super reported royalties receivable of $75,000 from Fantasy. During 20x4, Super received royalty payments of $200,000. Fantasy reported revenues of 1,500,000 in 20x4 from the comic strip. In its 20x4 income statement, what amount should Super report as royalty revenue? a. 125,000 b. 175,000 C. 200,000 d. 300,000 (AICPA) 15. Lin Co., a distributor of machinery, bought a machine from the manufacturer in November 20x3 for P10,000. On December 30, 20x3, Lin sold this machine to Zee Hardware for $15,000, under the following terms: 2% discount if paid within thirty days, 1% discount if paid after thirty days but within sixty days, or payable in full within ninety days if not paid within the discount periods. However, Zee had the right to return this machine to Lin if Zee was unable to resell the machine before expiration of the ninety-day payment period, in which case Zee's obligation to Lin would be canceled. In Lin's net sales for the year ended December 31, 20x3, how much should be included for the sale of this machine to Zee? a. O b. 14,700 c. 14,850 d. 15,000 (AICPA) Use the following information for the next two questions: DISCALCED BAREFOOTED NAKASAKASAKA Supermarket, Inc. awards customers loyalty points for their purchases. A customer is entitled to one point for every $400 purchase. The points accumulated may be redeemed for awards in the form of appliances, electronics, groceries and other household items. DISCALCED estimates the stand-alone selling price of each point at $4.00. During the period, DISCALCED made total sales of $40M to cardholders. 16. How much sales revenue is recognized? a. 400,000 b. 40,000,000 c. 39,600,000 d. O 17. How much is the deferred revenue from loyalty points? a. 400,000 b. 40,000,000 C. 39,600,000 d. O

pls answer 13-17

pls answer 13-17