Answered step by step

Verified Expert Solution

Question

1 Approved Answer

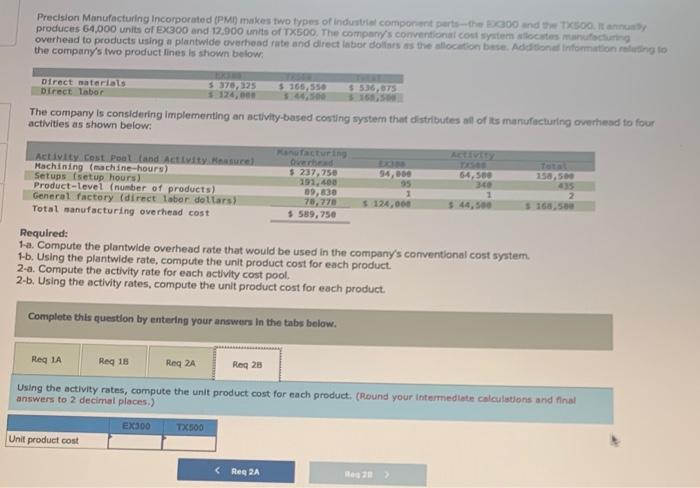

pls help BO Problem 4-12 (Algo) Contrasting ABC and Conventional Product Cost (L04-2, L04-3, L04-41 Precision Manufacturing Incorporated (PM) makes two types of industrial component

pls help

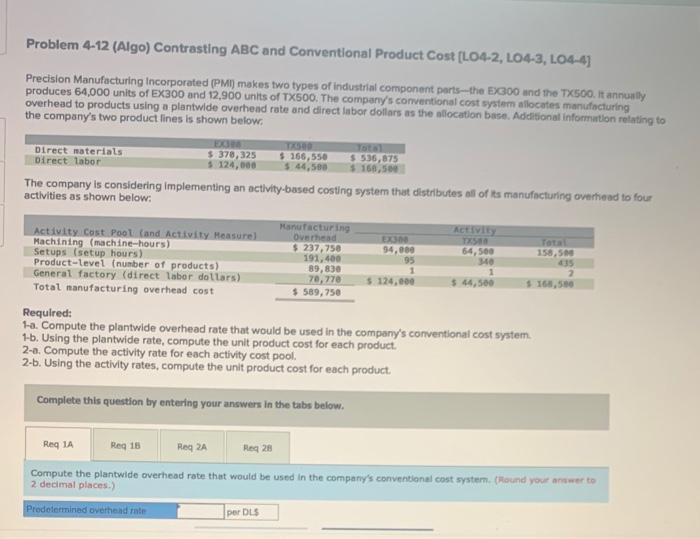

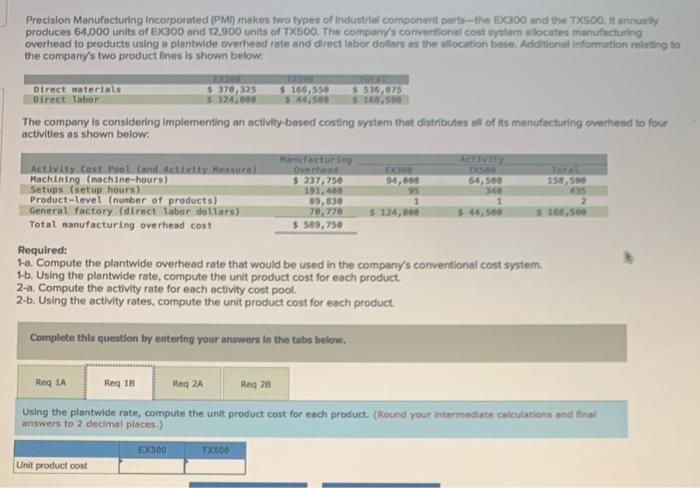

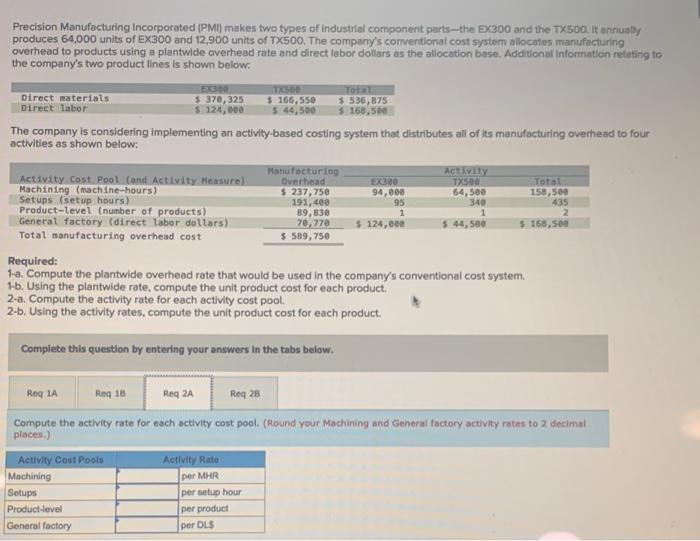

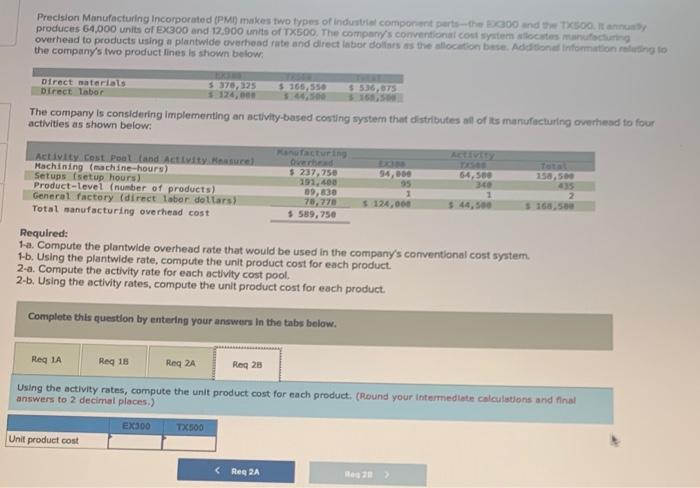

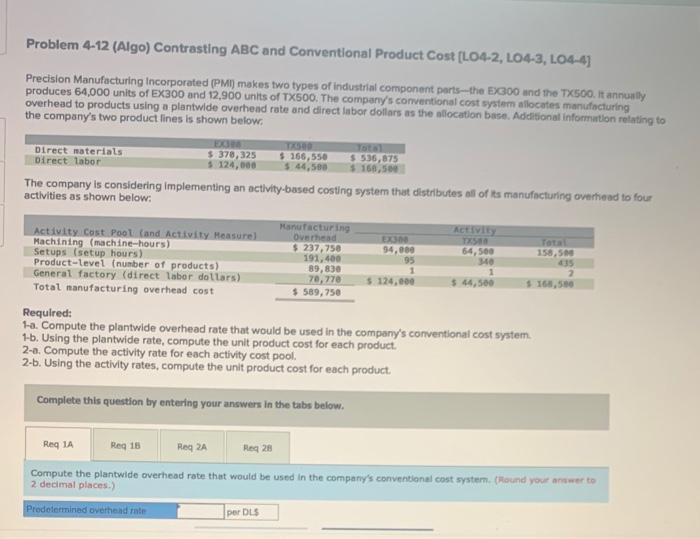

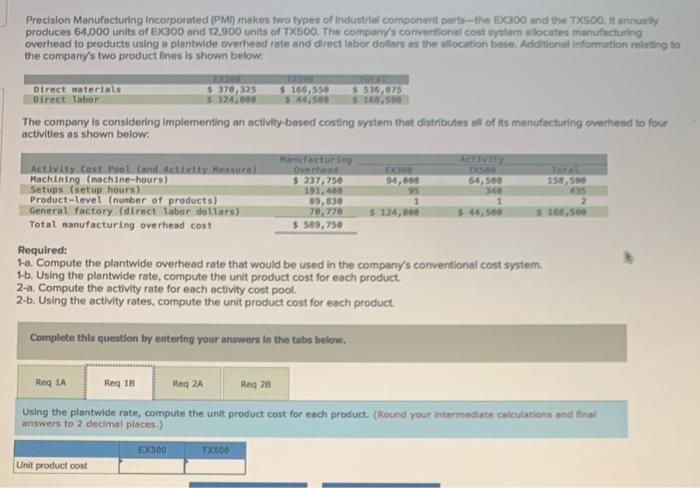

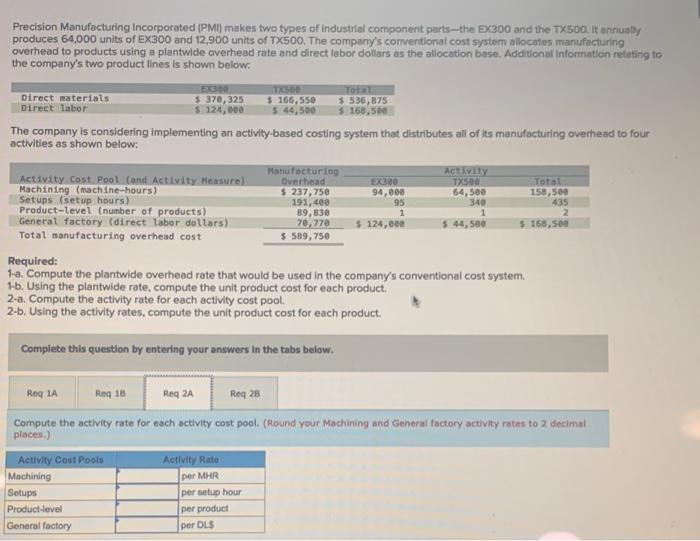

BO Problem 4-12 (Algo) Contrasting ABC and Conventional Product Cost (L04-2, L04-3, L04-41 Precision Manufacturing Incorporated (PM) makes two types of industrial component parts--the EX300 und the TX500. It annually produces 64,000 units of EX300 and 12,900 units of TX500. The company's conventional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below. Total Direct materials $ 370, 325 $ 166,550 $ 536,875 Direct labor $ 124,000 5.44,500 $ 168,500 The company is considering Implementing an activity-based costing system that distributes all of its manufacturing overhead to four activities as shown below. Activity Cost Pool and Activity Heasure Manufacturing activity Overhead EXO Total Machining (machine-hours) $ 237,758 34.000 64,500 158.500 Setups (setup hours) 191,400 05 Product-level (number of products) 89,830 1 General factory (direct labor dollars) 70,270 $ 124,600 $168,500 Total manufacturing overhead cost $589,750 Required: 1-a. Compute the plantwide overhead rate that would be used in the company's conventional cost system 1-b. Using the plantwide rate, compute the unit product cost for each product. 2-a. Compute the activity rate for each activity cost pool. 2-6. Using the activity rates, compute the unit product cost for each product 95 1 Complete this question by entering your answers in the tabs below. Reg 1A Reg 16 Reg 2 Reg 28 Compute the plantwide overhead rate that would be used in the company's conventional cost system (Round your answer to 2 decimal places.) Predetermined overhead inte per DLS Precision Manufacturing Incorporated (PMI) makes two types of Industrial component parts--the EX300 and the TX500 Ranely produces 64,000 units of EX300 and 12.900 units of TX500. The company's conventional cost system allocates manufacturing overhead to products using a plontwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below. 4 Direct materiais $ 370,125 $ 166,550 5536,875 Direct labor The company is considering implementing on activity-based costing system that distributes off of its manufacturing overhead to four activities as shown below: Manufacturing Activity Cost Pool and Activity Dunched Machining machine-hours) $ 237,750 94.000 54,500 158,500 Setups (setup hours) 191,400 Product-level (number of products) 89,830 General factory (direct labor dollars) 70,778 $ 124, 3.44,500 3168,500 Total manufacturing overhead cost $ 589,758 Required: 1-a. Compute the plantwide overhead rate that would be used in the company's conventional cost system 1-6. Using the plantwide rate, compute the unit product cost for each product. 2-a. Compute the activity rate for each activity cost pool. 2-b. Using the activity rates, compute the unit product cost for each product 95 1 140 1 2 Complete this question by entering your answers in the tabs below. Regla Reg 18 Pe 2A Reg 20 Using the plantwide rate, compute the unit product cost for each product. (Round your intermediate calculations and final answers to 2 decimal places.) EX300 TX500 Unit product cost Precision Manufacturing Incorporated (PMI) makes two types of Industrial component parts--the EX300 and the TX500. It annually produces 64,000 units of EX300 and 12,900 units of TX500. The company's conventional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional Information relating to the company's two product lines is shown below. EX TISOD Total Direct materials $ 370, 325 $ 166,550 3 536,875 Direct labor $ 124,000 $ 44,500 168,500 The company is considering implementing an activity-based costing system that distributes all of its manufacturing overhead to four activities as shown below: Manufacturing Activity Activity Cost Pool (and Activity Measure) Overhead EX300 TX500 Total Machining machine-hours) $ 237,758 94,000 64,500 158,500 Setups (setup hours) 191,400 95 340 435 Product-level (number of products) 89,830 1 2 General factory (direct labor dollars) 70,770 $ 124,000 $ 44,500 $ 168,500 Total manufacturing overhead cost $ 589,750 Required: 1-a. Compute the plantwide overhead rate that would be used in the company's conventional cost system. 1-6. Using the plantwide rate, compute the unit product cost for each product 2-a. Compute the activity rate for each activity cost pool. 2-b. Using the activity rates, compute the unit product cost for each product 1 Complete this question by entering your answers in the tabs below. Reg 1A Reg 18 Req 2A Reg 28 Compute the activity rate for each activity cost pool. (Round your Machining and General factory activity rates to 2 decimal places.) Activity Cost Pools Activity Ruto Machining Setups per MHR per setup hour per product Product-level General factory per DLS Precision Manufacturing Incorporated (PMI) makes two types of industrial component parts--the 3000 and TX500 any produces 64,000 units of EX300 and 12,900 units of TX500. The company's conventional cost system sonucune overhead to products using a plantwide overhead tube and direct latior dos as the allocation base. Additional information relating to the company's two product lines is shown below, Direct materiais $ 370, 325 $ 166,550 $536, 075 Direct Tabor 124.00 16. The company is considering implementing an activity-based costing system that distributes all of its manufacturing overhead to four activities as shown below: Manufacturing Activity Cost pool and Activity assure Overhead Machining machine-hours) $ 237,750 94,00 64,500 250, 500 Setups (setup hours) 191.400 95 30 Product-level (number of products) 09,630 General factory (direct labor dollars) 78,770 $ 124,000 $44,500 $168.5 Total manufacturing overhead cost $589,750 Required: 1-a. Compute the plantwide overhead rate that would be used in the company's conventional cost system 1-b. Using the plantwide rate, compute the unit product cost for each product. 2-a. Compute the activity rate for each activity cost pool, 2-6. Using the activity rates, compute the unit product cost for each product 1 1 2 Complete this question by entering your answers in the tabs below. Reg 1A Reg 18 Reg 2A Req 28 Using the activity rates, compute the unit product cost for each product. (round your intermediate calculations and final answers to 2 decimal places.) EX300 TX500 Unit product cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started