Answered step by step

Verified Expert Solution

Question

1 Approved Answer

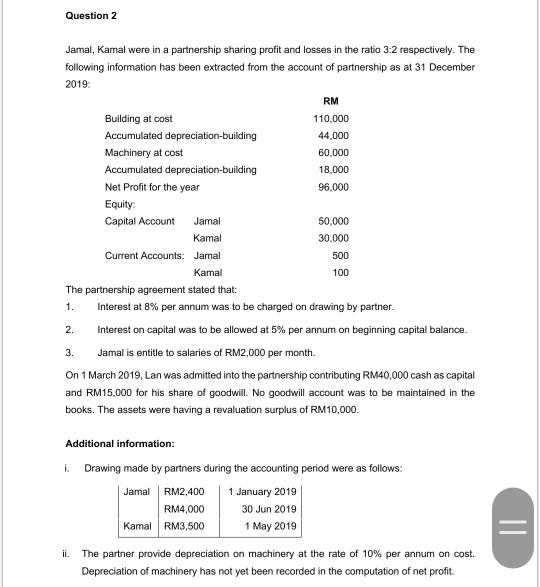

pls help Question 2 Jamal, Kamal were in a partnership sharing profit and losses in the ratio 3:2 respectively. The following information has been extracted

pls help

Question 2 Jamal, Kamal were in a partnership sharing profit and losses in the ratio 3:2 respectively. The following information has been extracted from the account of partnership as at 31 December 2019 RM Building at cost 110,000 Accumulated depreciation-building 44,000 Machinery at cost 60,000 Accumulated depreciation-building 18,000 Net Profit for the year 96,000 Equity Capital Account Jamal 50,000 Kamal 30,000 Current Accounts: Jamal 500 Kamal The partnership agreement stated that: 1. Interest at 8% per annum was to be charged on drawing by partner. 100 2. Interest on capital was to be allowed at 5% per annum on beginning capital balance. 3. Jamal is entitle to salaries of RM2,000 per month On 1 March 2019Lan was admitted into the partnership contributing RM40,000 cash as capital and RM15,000 for his share of goodwill. No goodwill account was to be maintained in the books. The assets were having a revaluation surplus of RM10,000. Additional information: i. Drawing made by partners during the accounting period were as follows: Jamal RM2,400 RM4,000 Kamal RM3,500 1 January 2019 30 Jun 2019 1 May 2019 II. The partner provide depreciation on machinery at the rate of 10% per annum on cost. Depreciation of machinery has not yet been recorded in the computation of net profit. FEBRUARY 2020 CONFIDENTIAL iii. Upon admission of Lan, the following agreement was made: a. Profit and losses of partnership were to be divided between Jamal, Kamal and Lan equally. b. Interest on beginning capital is to be allowed at 6% per annum. c. Interest on drawing were remain unchanged. d. Each partners is entitled to a monthly salary of RM1,000. Required: (a) Goodwill and revaluation account. (8 marks) (b) Prepare the appropriation statement for the year ended 31 December 2019. (8 marks) (c) Prepare the partners' current account and capital account. (9 marks) [25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started