Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plss only answer if you can cover all the points! also' if you could just write aside the formulas you used so i can put

plss only answer if you can cover all the points! also' if you could just write aside the formulas you used so i can put it on the excel sheet accordingly i would appreciate it a lot!!

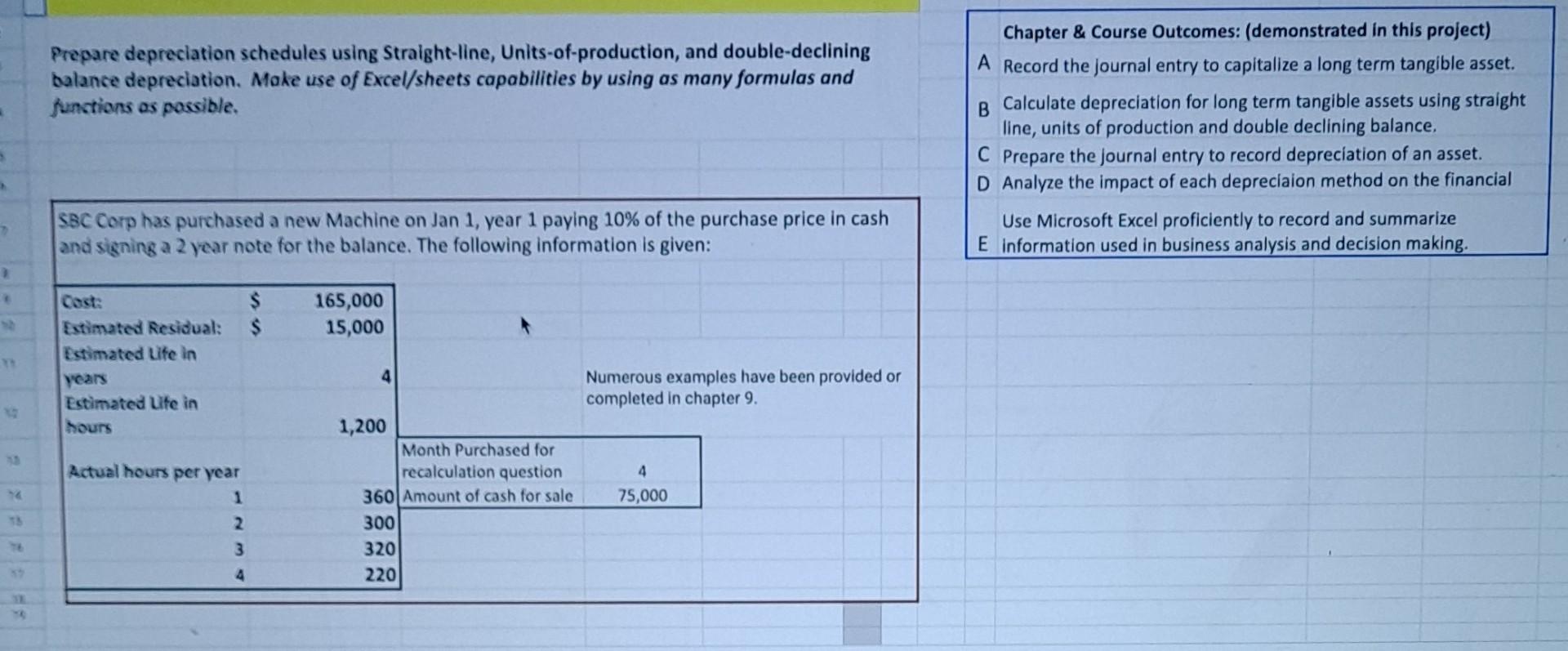

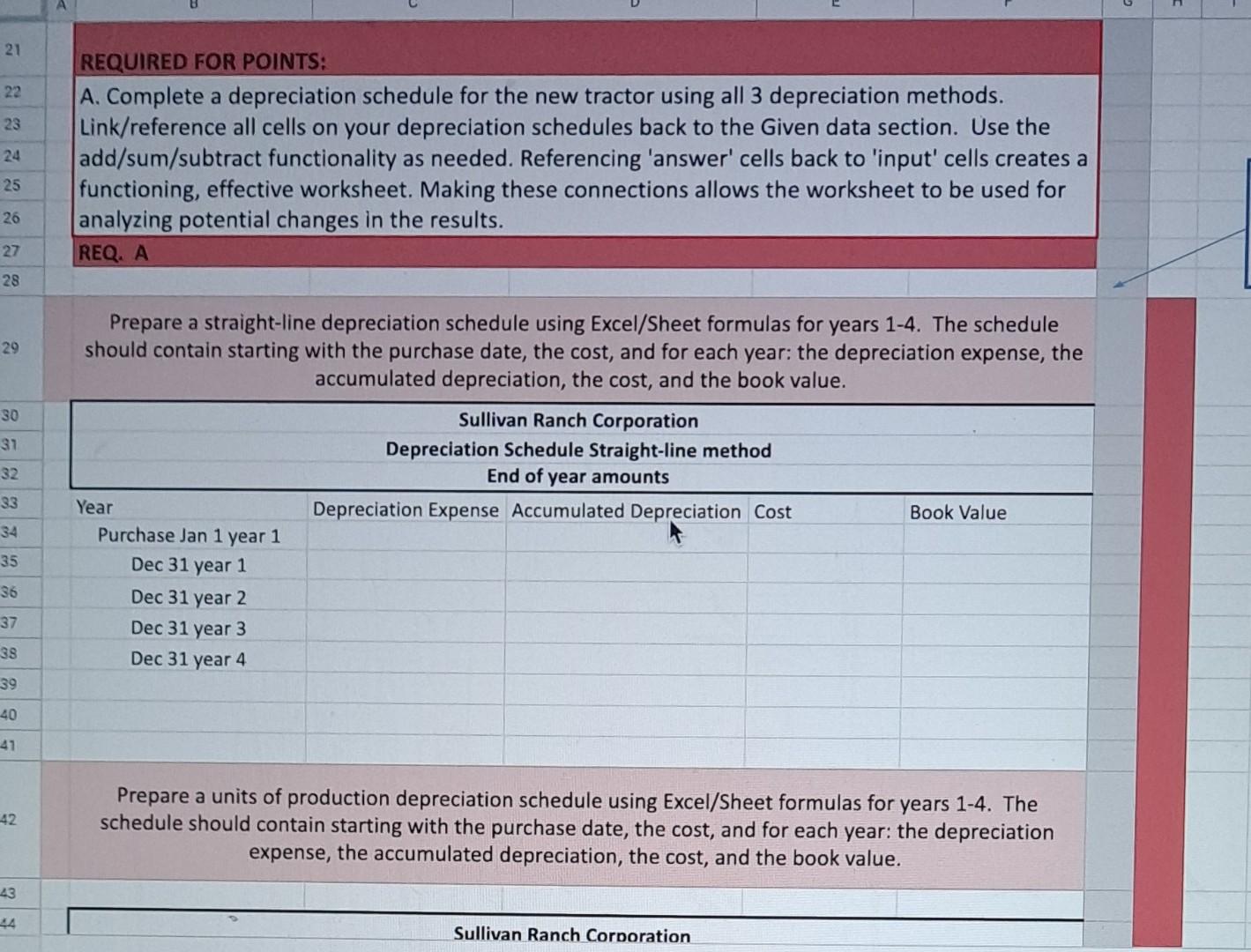

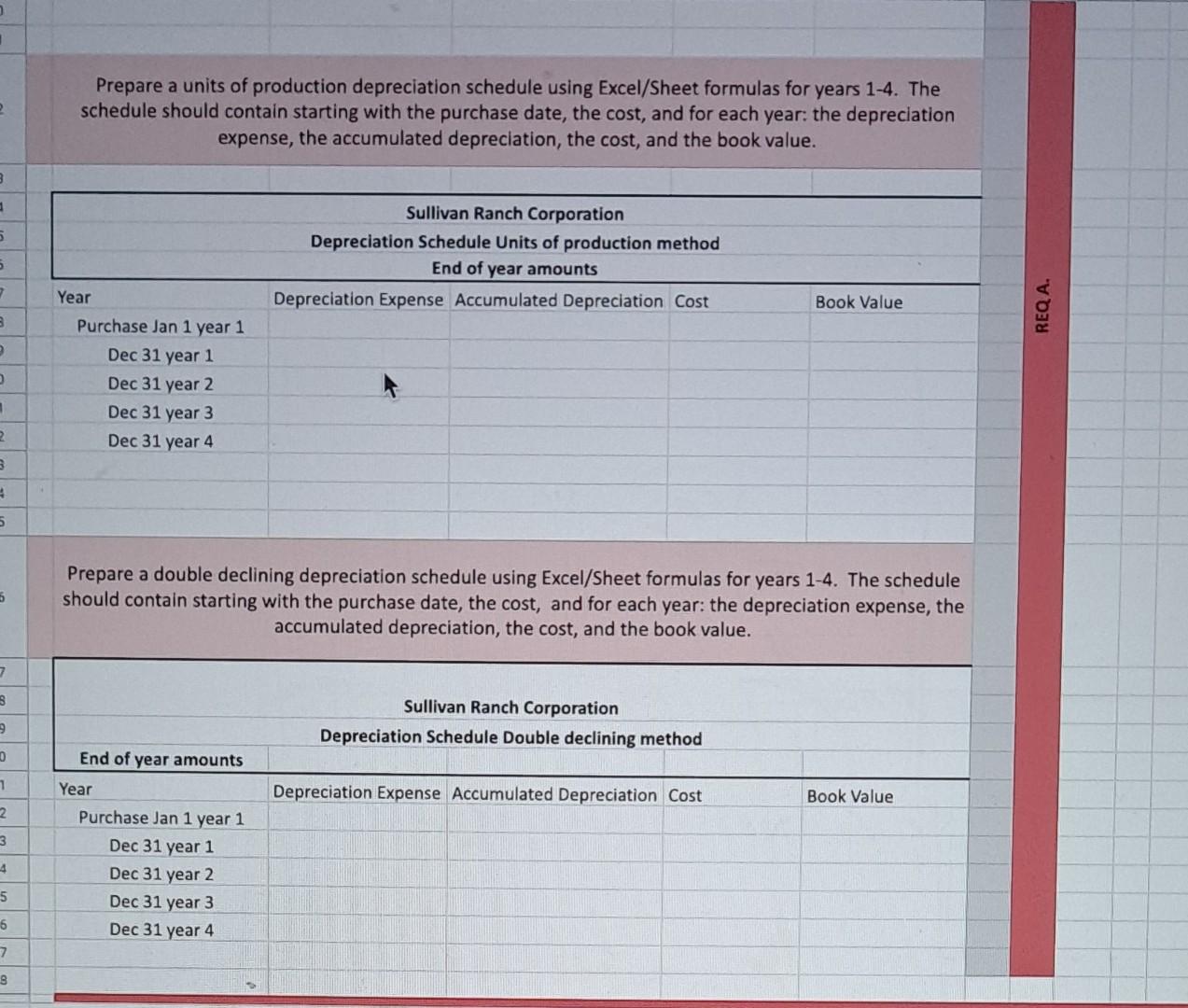

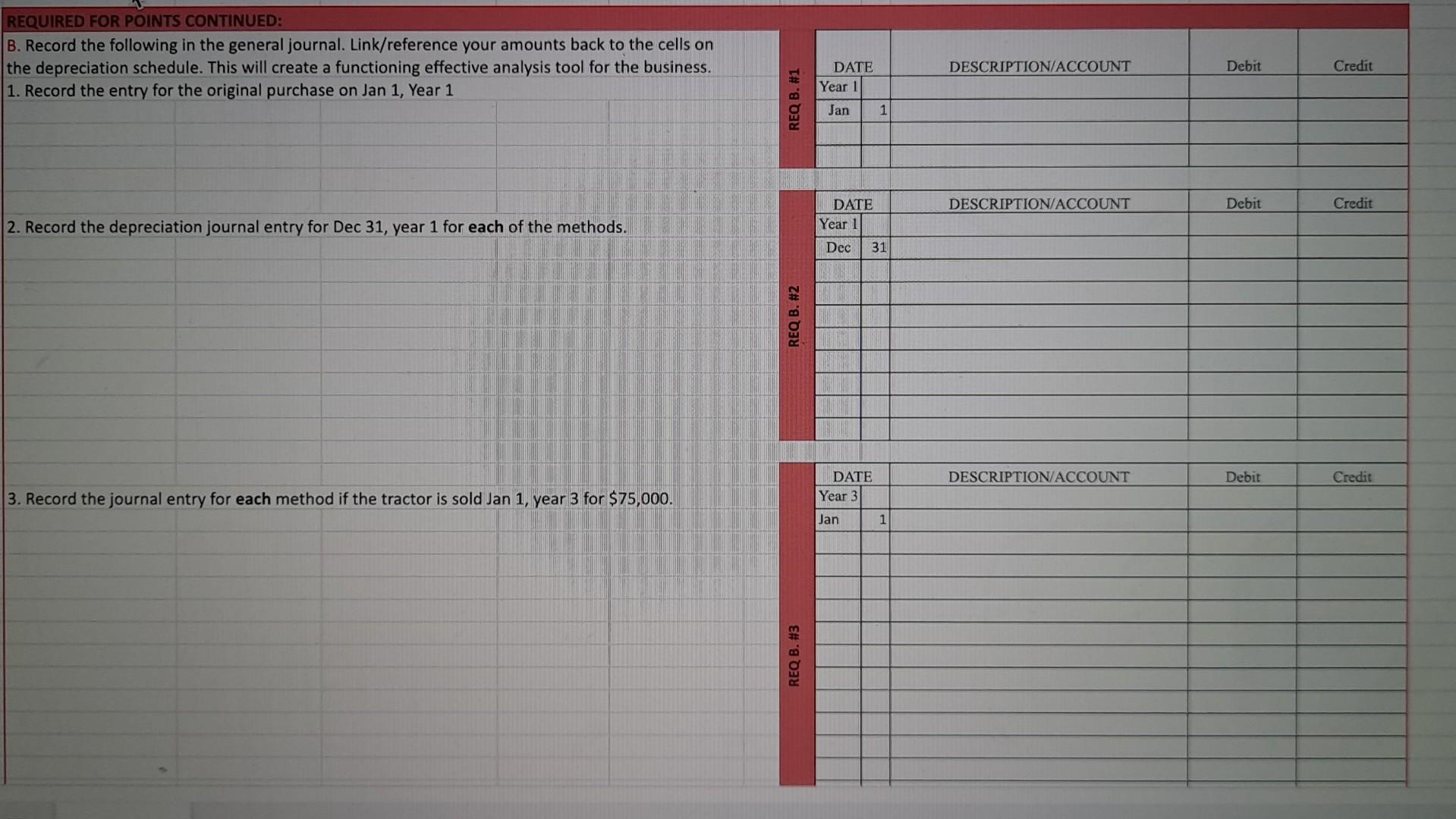

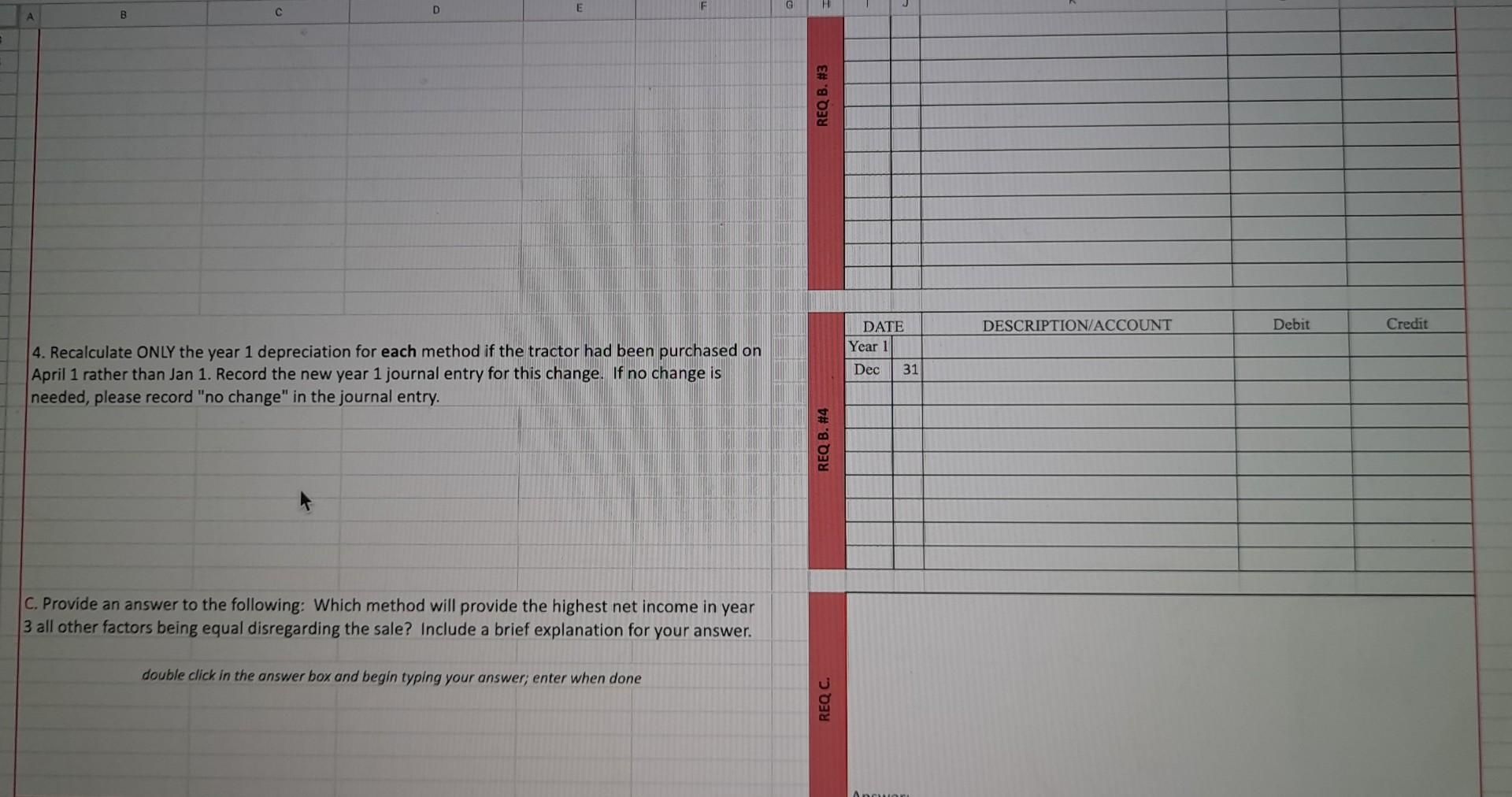

Prepare depreciation schedules using Straight-line, Units-of-production, and double-declining balance depreciation. Make use of Excel/sheets capabilities by using as many formulas and functions as passible. S8C Corp has purchased a new Machine on Jan 1 , year 1 paying 10% of the purchase price in cash and signing a 2 year note for the balance. The following information is given: A. Complete a depreciation schedule for the new tractor using all 3 depreciation methods. Link/reference all cells on your depreciation schedules back to the Given data section. Use the add/sum/subtract functionality as needed. Referencing 'answer' cells back to 'input' cells creates a functioning, effective worksheet. Making these connections allows the worksheet to be used for analyzing potential changes in the results. REQ. A Prepare a straight-line depreciation schedule using Excel/Sheet formulas for years 1-4. The schedule should contain starting with the purchase date, the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Prepare a units of production depreciation schedule using Excel/Sheet formulas for years 1-4. The schedule should contain starting with the purchase date, the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. Prepare a units of production depreciation schedule using Excel/Sheet formulas for years 1-4. The schedule should contain starting with the purchase date, the cost, and for each year: the depreciation expense, the accumulated depreclation, the cost, and the book value. Prepare a double declining depreciation schedule using Excel/Sheet formulas for years 1-4. The schedule should contain starting with the purchase date, the cost, and for each year: the depreciation expense, the accumulated depreciation, the cost, and the book value. B. Record the following in the general journal. Link/reference your amounts back to the cells on the depreciation schedule. This will create a functioning effective analysis tool for the business. 1. Record the entry for the original purchase on Jan 1, Year 1 2. Record the depreciation journal entry for Dec 31 , year 1 for each of the methods. 3. Record the journal entry for each method if the tractor is sold Jan 1, year 3 for $75,000. 4. Recalculate ONLY the year 1 depreciation for each method if the tractor had been purchased on April 1 rather than Jan 1 . Record the new year 1 journal entry for this change. If no change is needed, please record "no change" in the journal entry. C. Provide an answer to the following: Which method will provide the highest net income in year 3 all other factors being equal disregarding the sale? Include a brief explanation for your answer. double click in the onswer box and begin typing your answer; enter when done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started