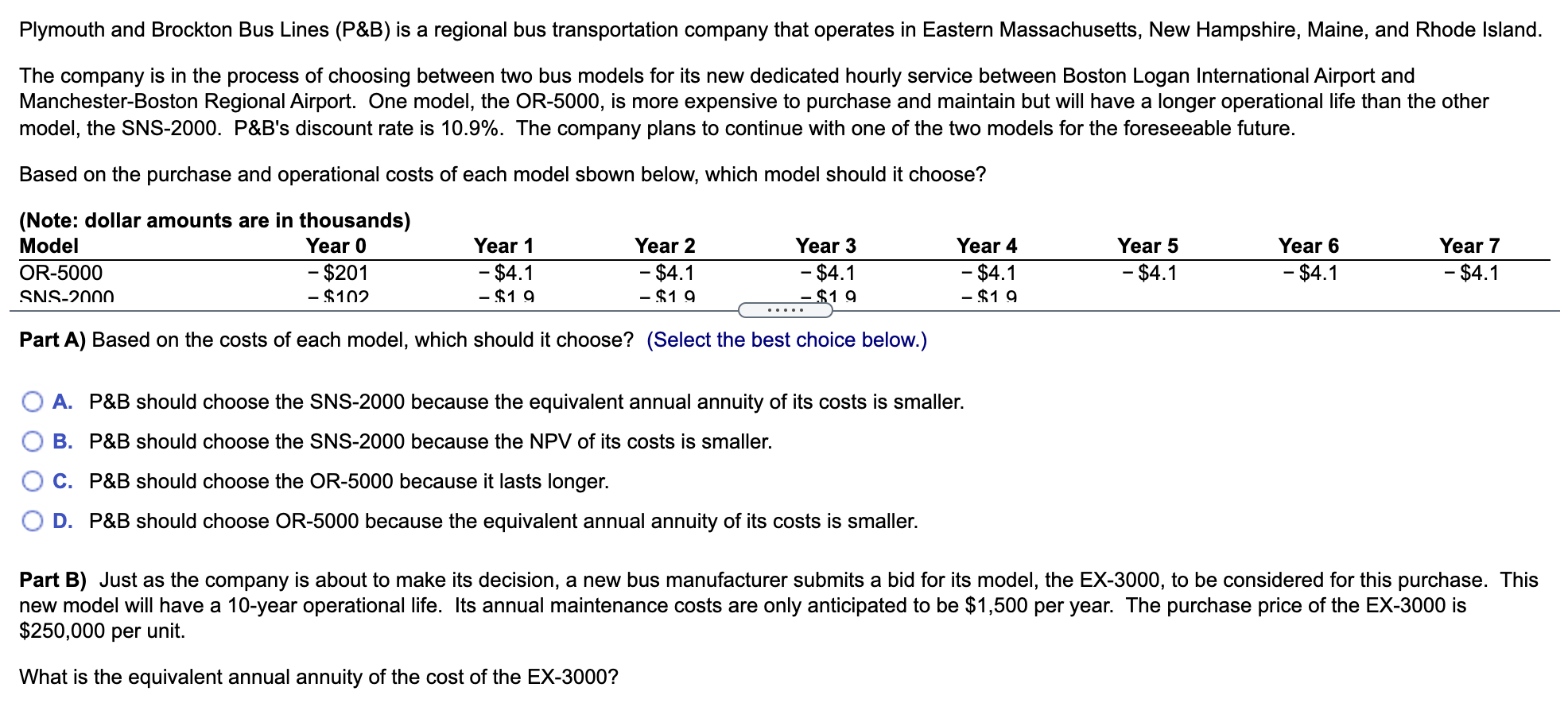

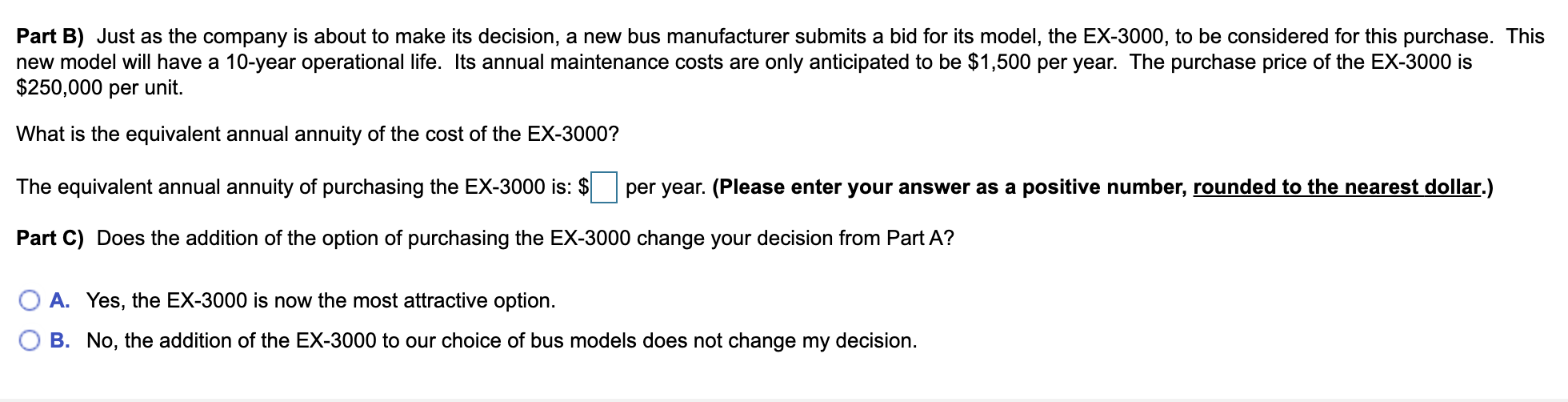

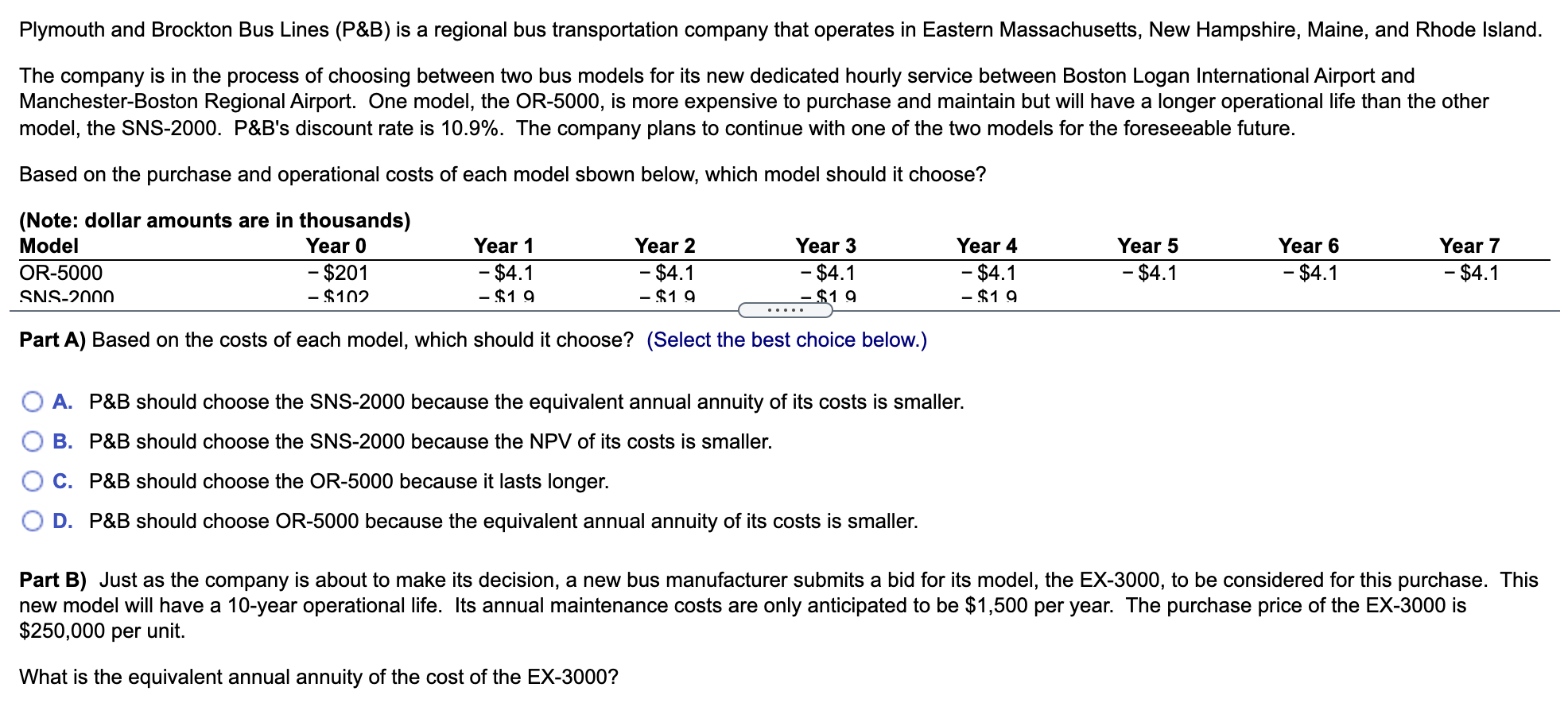

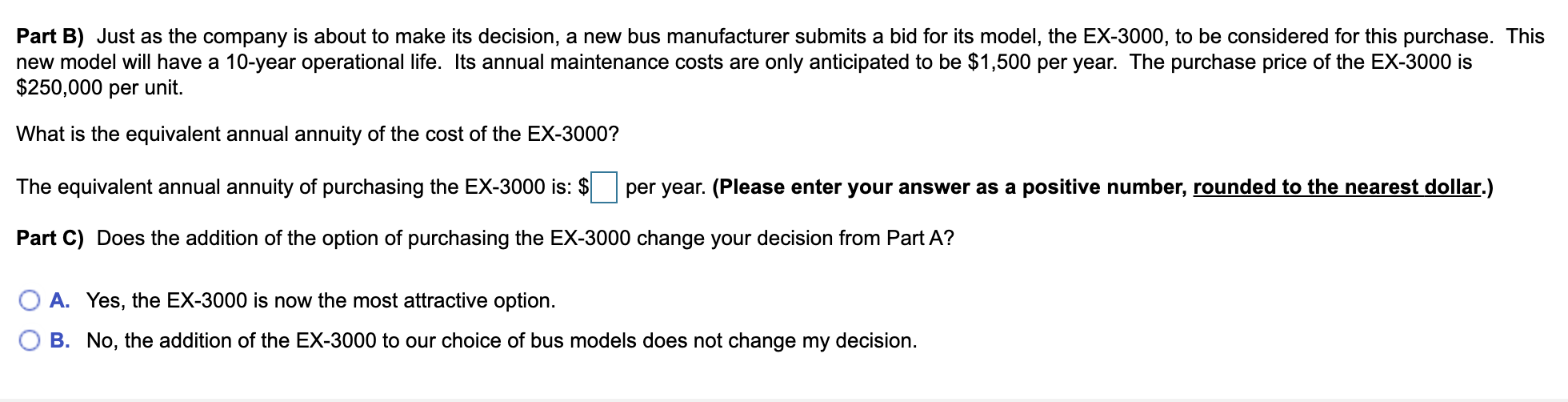

Plymouth and Brockton Bus Lines (P&B) is a regional bus transportation company that operates in Eastern Massachusetts, New Hampshire, Maine, and Rhode Island. The company is in the process of choosing between two bus models for its new dedicated hourly service between Boston Logan International Airport and Manchester-Boston Regional Airport. One model, the OR-5000, is more expensive to purchase and maintain but will have a longer operational life than the other model, the SNS-2000. P&B's discount rate is 10.9%. The company plans to continue with one of the two models for the foreseeable future. Based on the purchase and operational costs of each model sbown below, which model should it choose? (Note: dollar amounts are in thousands) Model Year 0 OR-5000 - $201 SNS-2000 - $102 Year 1 - $4.1 -$19 Year 2 - $4.1 - $19 Year 3 - $4.1 -$19 Year 4 - $4.1 - $19 Year 5 - $4.1 Year 6 - $4.1 Year 7 - $4.1 Part A) Based on the costs of each model, which should it choose? (Select the best choice below.) O A. P&B should choose the SNS-2000 because the equivalent annual annuity of its costs is smaller. B. P&B should choose the SNS-2000 because the NPV of its costs is smaller. C. P&B should choose the OR-5000 because it lasts longer. D. P&B should choose OR-5000 because the equivalent annual annuity of its costs is smaller. Part B) Just as the company is about to make its decision, a new bus manufacturer submits a bid for its model, the EX-3000, to be considered for this purchase. This new model will have a 10-year operational life. Its annual maintenance costs are only anticipated to be $1,500 per year. The purchase price of the EX-3000 is $250,000 per unit. What is the equivalent annual annuity of the cost of the EX-3000? Part B) Just as the company is about to make its decision, a new bus manufacturer submits a bid for its model, the EX-3000, to be considered for this purchase. This new model will have a 10-year operational life. Its annual maintenance costs are only anticipated to be $1,500 per year. The purchase price of the EX-3000 is $250,000 per unit. What is the equivalent annual annuity of the cost of the EX-3000? The equivalent annual annuity of purchasing the EX-3000 is: $ per year. (Please enter your answer as a positive number, rounded to the nearest dollar.) Part C) Does the addition of the option of purchasing the EX-3000 change your decision from Part A? A. Yes, the EX-3000 is now the most attractive option. B. No, the addition of the EX-3000 to our choice of bus models does not change my decision