Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help with those 3 questions. Thanks! The following information relates to Questions 1 and 3. Round each answer to 2 dec places (if rounding

plz help with those 3 questions. Thanks!

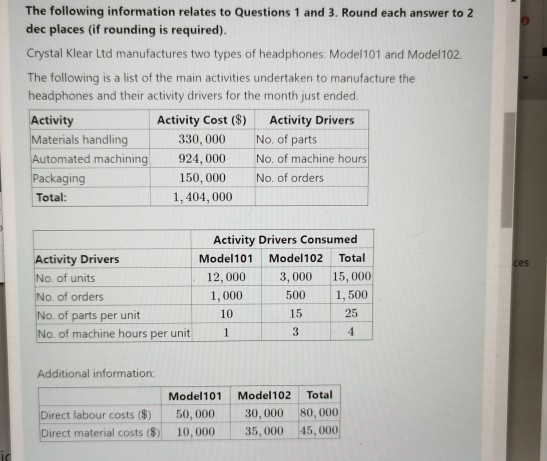

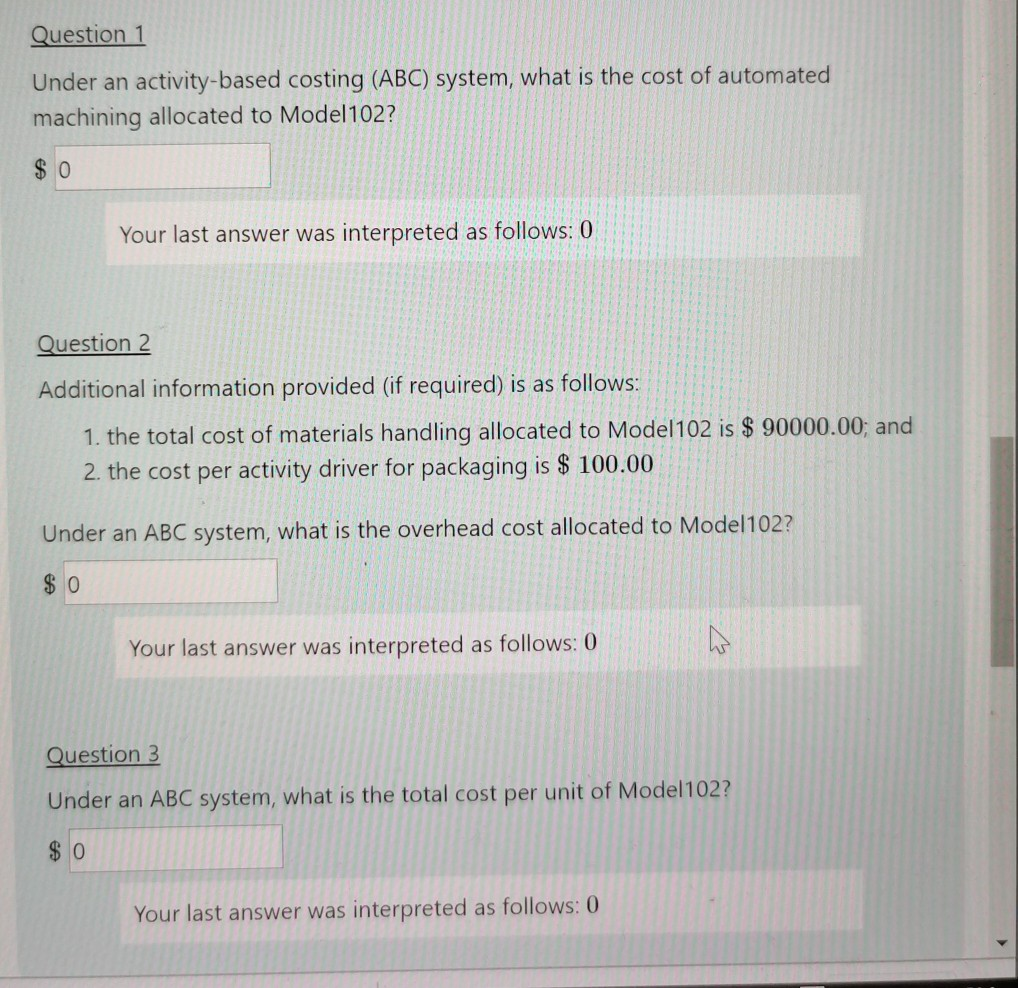

The following information relates to Questions 1 and 3. Round each answer to 2 dec places (if rounding is required). Crystal Klear Ltd manufactures two types of headphones: Model101 and Model102. The following is a list of the main activities undertaken to manufacture the headphones and their activity drivers for the month just ended. Activity Activity Cost ($) Activity Drivers Materials handling 330,000 No. of parts Automated machining 924,000 No. of machine hours Packaging 150,000 No. of orders Total: 1.404,000 Activity Drivers No. of units No. of orders No. of parts per unit No. of machine hours per unit Activity Drivers Consumed Model 101 Model102 Total 12,000 3,000 15,000 1,000 500 1,500 10 15 25 4 Additional information: Direct labour costs ($) osts ($) Model101 Model 102 50,000 30,000 10,000 35,000 Total 80,000 45,000 Question 1 Under an activity-based costing (ABC) system, what is the cost of automated machining allocated to Model102? $ 0 Your last answer a Question 2 Additional information provided (if required) is as follows: 1. the total cost of materials handling allocated to Model 102 is $ 90000.00; and 2. the cost per activity driver for packaging is $ 100.00 Under an ABC system, what is the overhead cost allocated to Model102? $ 0 Your last answer was interpreted as follows: 0 Question 3 Under an ABC system, what is the total cost per unit of Model 102? $ 0 Your last answer was interpreted as follows: 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started