Question

Pocket Woman, Incorporated provided the following financial statement information for 2021: Credit sales 2,700,000 Retained earnings, January 1, 2021 1,400,000 Cash sales 500,000 Selling and

Pocket Woman, Incorporated provided the following financial statement information for 2021:

| Credit sales | 2,700,000 |

| Retained earnings, January 1, 2021 | 1,400,000 |

| Cash sales | 500,000 |

| Selling and administrative expenses | 920,000 |

| Restructuring gain (pretax) | 700,000 |

| Cash dividends declared | 120,000 |

| Cost of goods sold | 1,785,000 |

| Error correction: 2016 rent was unpaid and unrecorded | 30,000 |

| Interest income | 380,000 |

| Interest expense | 620,000 |

| Gain on sale of investments (pre-tax) | 200,000 |

On January 1, 2021, Pocket Woman changed its plant and equipment accounting for depreciation from the double-declining balance method to the straight-line method. Pocket Woman purchased the assets on January 1, 2020 for $600,000; they had no scrap value and useful lives of 10 years. The balance in the accumulated depreciation account at January 1, 2021 amounted to $120,000. Pocket Woman recorded the straight-line depreciation expense in 2021 and included it in the $920,000 reported for selling and administrative expenses. Depreciation expense would have been $96,000 for 2021 if Pocket Woman had still used the double-declining balance method.

Bad debt expense for 2021 of $54,000 is included in selling and administrative expenses on the income statement. Pocket Woman uses the percentage of accounts receivable method of estimating bad debt expense. The estimated percentage was 7% in both 2019 and 2020 but changed to 10% in 2021. At December 31, 2021, the Accounts Receivable balance is $600,000, and the Allowance for Uncollectible Accounts (before adjustment) was $6,000 credit balance.

Required:

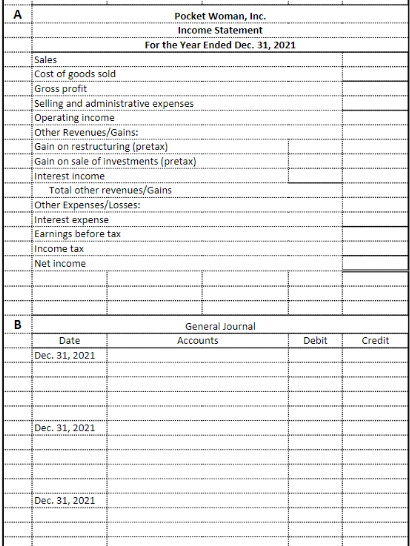

A. Assuming a tax rate of 35%, prepare the multiple-step income statement for Pocket Woman for the year ended December 31, 2021.

B. Prepare the journal entries to record the accounting changes and corrections made in 2021.

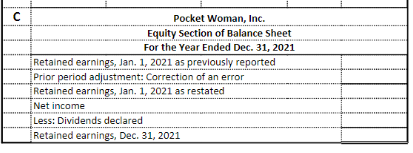

C. Prepare the retained earnings section of the statement of stockholders equity for the year ended December 31, 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started