Answered step by step

Verified Expert Solution

Question

1 Approved Answer

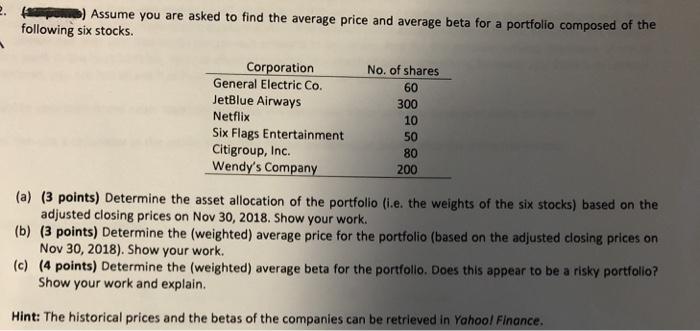

poe) Assume you are asked to find the average price and average beta for a portfolio composed of the following six stocks. Corporation General

poe) Assume you are asked to find the average price and average beta for a portfolio composed of the following six stocks. Corporation General Electric Co. No. of shares 60 JetBlue Airways 300 Netflix 10 Six Flags Entertainment 50 Citigroup, Inc. 80 Wendy's Company 200 (a) (3 points) Determine the asset allocation of the portfolio (i.e. the weights of the six stocks) based on the adjusted closing prices on Nov 30, 2018. Show your work. (b) (3 points) Determine the (weighted) average price for the portfolio (based on the adjusted closing prices on Nov 30, 2018). Show your work. (c) (4 points) Determine the (weighted) average beta for the portfolio. Does this appear to be a risky portfolio? Show your work and explain. Hint: The historical prices and the betas of the companies can be retrieved in Yahoo! Finance.

Step by Step Solution

★★★★★

3.28 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the asset allocation of the portfolio we first need to calculate the total value of the portfolio based on the adjusted closing prices ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started