Answered step by step

Verified Expert Solution

Question

1 Approved Answer

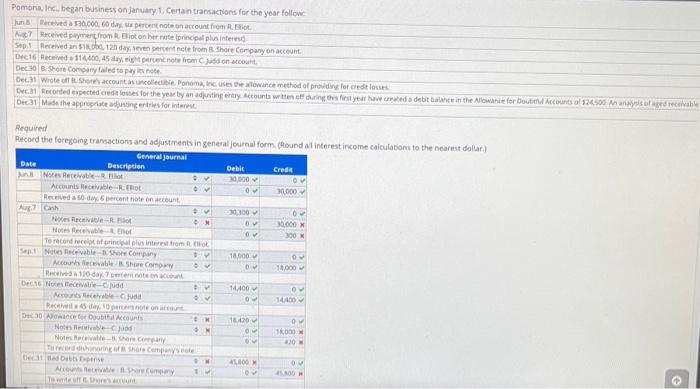

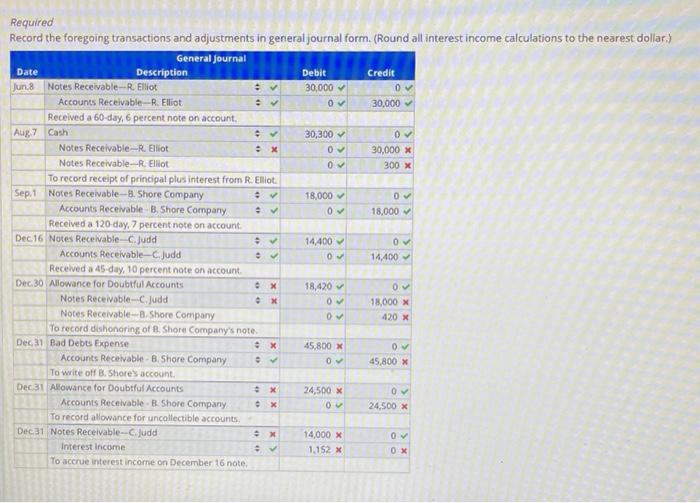

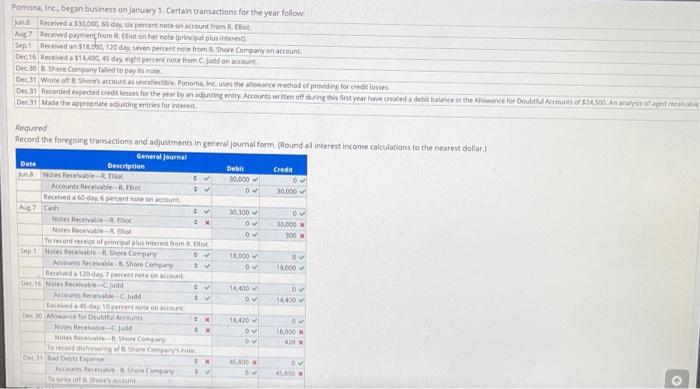

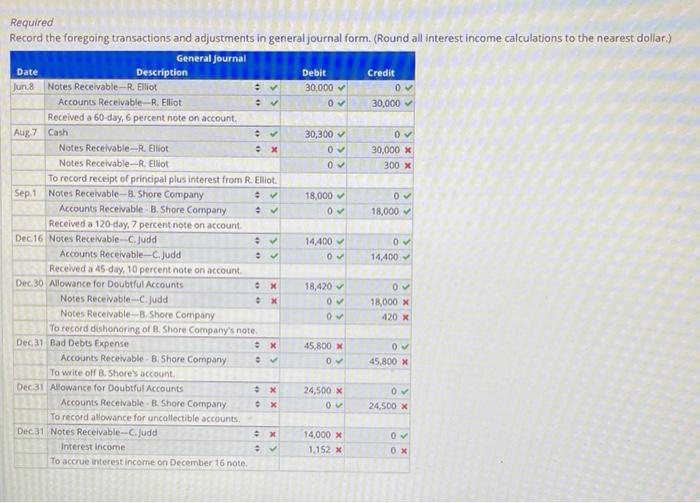

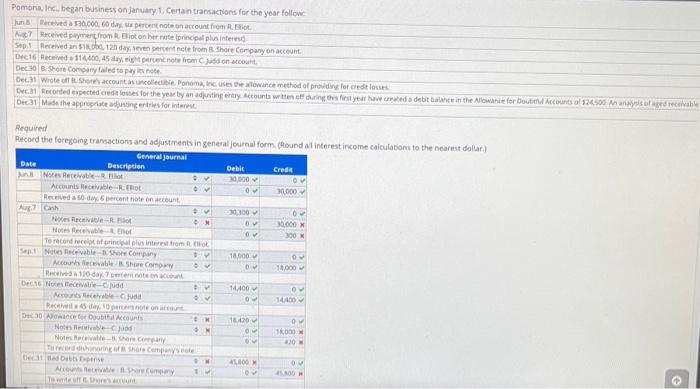

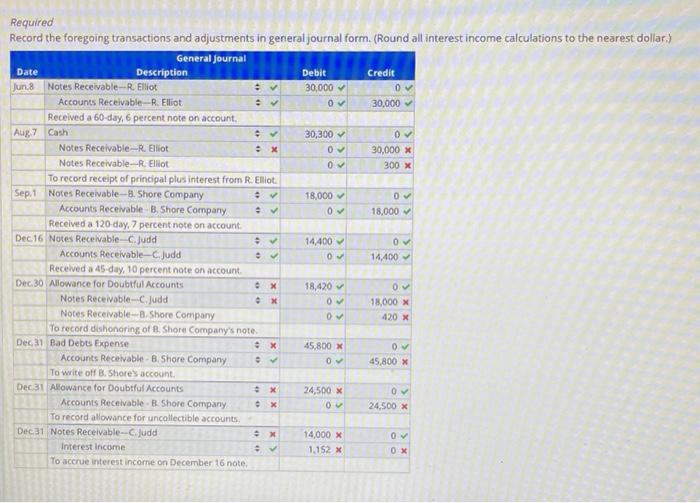

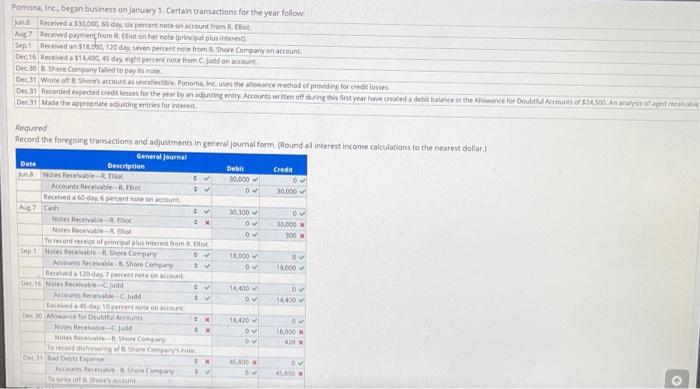

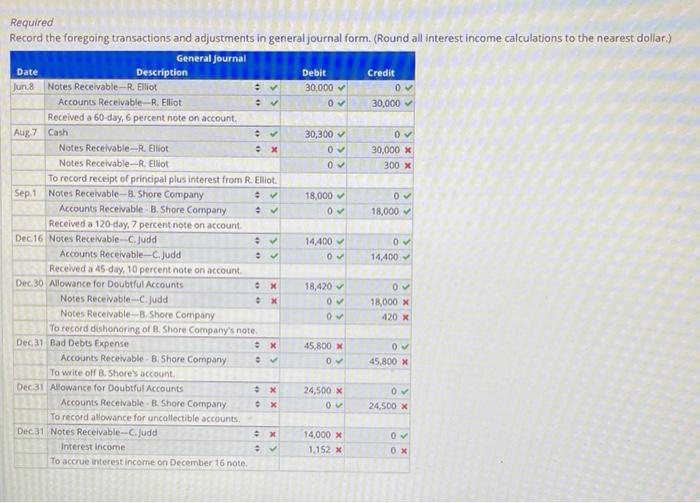

Pomona, Inc. began business on January 1. Certain transactions for the year follow Jun Raceed 330.000. 60 percent on account from R. Ett A Received

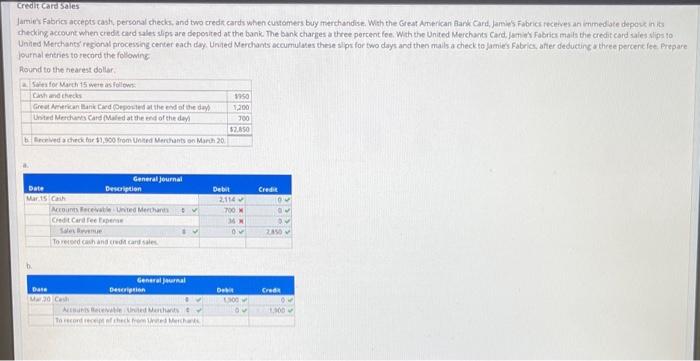

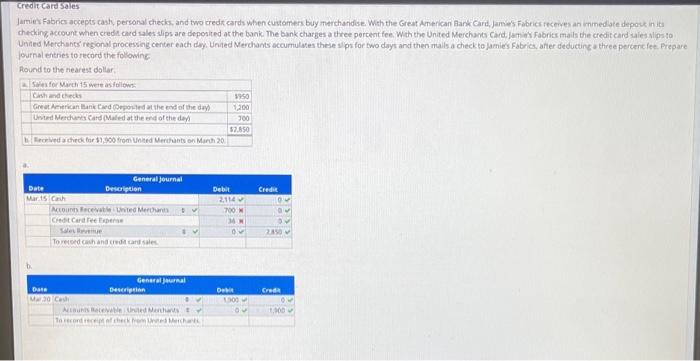

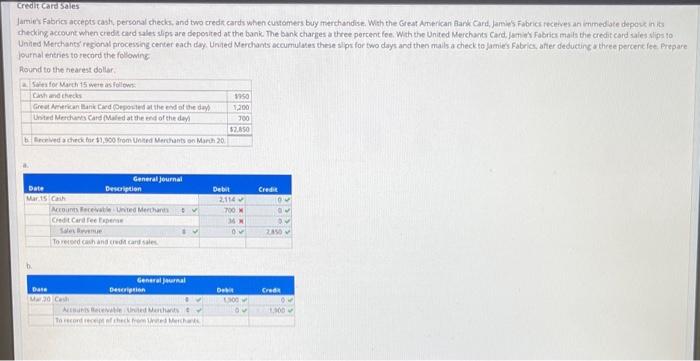

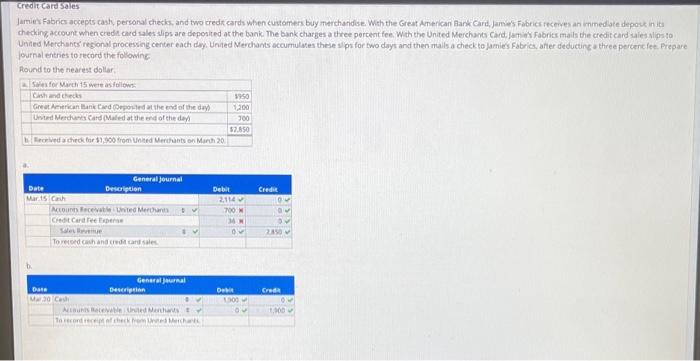

Pomona, Inc. began business on January 1. Certain transactions for the year follow Jun Raceed 330.000. 60 percent on account from R. Ett A Received payment from Briton her note principal plus interest Specived and 120 day even een rote from Share Company on account Dec 16 Received 116400, 45 day per romjud on account Deco Shore Company failed to pay Deci Wiate of it. She's account as uncollectible. Ponoma, nes the lowance method of providing for credito Dec. 21 Recorded expected credit fomes for the year by an adjusting entry Accounts we off during the first year heated debit bine in the lowance for Accounts anys taped recevable Dec 31 Made the appropriate incenties for interest Required Record the foregoing transactions and adjustments in general journal form. (Round interest income calculations to the nearest dollar) General Journal Date Description Debit Credit Nores Recevole O 30.000 Accounts Receivable to 0 30.000 Received a 56- cercnt note on account Anh 10300 0 Merce- Ov 30.000 Nos en 0 300 M Te recent record plus interest from the Sant Notes levable - Short Company 18.000 Ow Movie Share 0 14.000 Received 120date on Dec 16 Noved 14400 O Acecebeu O 10 Ron 30 Ace for Doubtful Accounts M 1420 O Now OV 1000 Novel Company 30 Turf Share Company Detta beton 10 0 Alchemy O 07 Required Record the foregoing transactions and adjustments in general journal form. (Round all interest income calculations to the nearest dollar.) General Journal Date Description Debit Credit Jun Notes Receivable--R. Elliot 30,000 0 Accounts Receivable - R. Elliot 0 30,000 Received a 60-day, 6 percent note on account Aug 7 Cash e 30,300 0 Notes Receivable-R. Elliot X 0 30,000 X Notes Receivable-R. Elliot 300 x To record receipt of principal plus interest from R. Elliot Sep.1 Notes Receivable-8. Shore Company . 18,000 0 Accounts Receivable B. Shore Company 07 18,000 Received a 120-day, 7 percent note on account Dec 16 Notes Receivable-C. Judd . 14400 0 Accounts Receivable-C. Judd 0 14,400 Received a 45-day, 10 percent note on account Dec 30 Allowance for Doubtful Accounts ex 18,420 0 Notes Receivable C Judd 0 18,000 x Notes Receivable. Shore Company 0 420 X To record dishonoring of B. Shore Company's note Dec 31 Bad Debts Expense X 45,800 X 07 Accounts Receivable-. Shore Company 0 45.800 X To write off B. Shore's account. Dec 31 Allowance for Doubtful Accounts 24,500 X 0 Accounts Receivable Shore Company X 0 24,500 X To record allowance for uncollectible accounts Dec 31 Notes Receivable--C.judd 14,000 X 0 Interest income 1.152 X OX To accrue interest income on December 16 note Credit Card Sales Jamie's Fabrics accepts cas personal checks, and two credit cards when customers buy merchandise. With the Great American Bank Card, James Fabrics receive an immediate deportinis checking account when credit card sales slips are deposited at the bank. The bank charges a three percent fee with the United Merchants Card jame Fabrics mails the credit card sales lips to United Merchants regional processing center each day. United Merchants accumulares these sips for two days and then mals a check to Jamie's Fabrica, after deducting three percene let. Prepare Journal entries to record the following Round to the nearest dollar for 15 were as follow Cash and checks Great American Bank Card (Openthead of the day Ustad Merchar Card (Maled at the end of the day 9950 7200 700 52.850 B Recrewed a check for 33,900 Son Lined Merchants on March 20|| Date Credit General Journal Description Marth Account cevatented Merchant Credit Card ree See Toxed Chandicate Debut 2,114 700 M MH 2 Cred General Journal Dane Description 30 C NIBUS Bieder To reconhecerca 00 100 Pomona, Inc. began business on January 1. Certain transactions for the year follow un ved a 130.000 60 day percent on count from. Ett A Received payment from Botoner rote principal plus interest Specived and 120 day even percent from shore Company on account De Hace 114.400, 45 day, fromad on account Deco Short Companyated to pay Dee Wiate of itShe's account as unico. Ponoma, nes the allowance method of providing for credit losses Dec. Recorded expected credit fosses for the year by an adjune entry. Accounts we offering the first year www.reddebit balance in the Allowance for Accounts of S. An analysis of aged recevable De Made the appropriateadusting entries for interest Required Record the foregoing transactions and adjustments in general Journal form. (Round al interest income calculation to the nearest dollar) General journal DATE Description Debit Crede Nos Receivable et O 10.000 Accounts Receivable hot 0 30.000 Reserved - note an account Augh. 10300 0 NR-R Ov 33.000 W Not to 0 300 W Te record record plus interest from the S. Nos fecevable for company 18.000 Account Shore Como 18.000 leche 120-day peront Dec Nov cudd 14,400 Acebeu D 100 R10 pont 30 Acer Double counts 1420 0 Nov O No de recoman Turn Shore Company Debut 100 O Recher Company O 300 Required Record the foregoing transactions and adjustments in general journal form. (Round all interest income calculations to the nearest dollar.) General Journal Date Description Debit Credit Jun Notes Receivable--R. Elliot 30,000 0 Accounts Receivable -R. Elliot 0 30,000 Received a 60-day, 6 percent note on account Aug 7 Cash 30,300 0 Notes Receivable--R. Elliot X 0 30,000 X Notes Receivable--R. Elliot 0 300 x To record receipt of principal plus interest from R. Elliot Sep.1 Notes Receivable-8. Shore Company 18,000 0 Accounts Receivable B. Shore Company 0 18,000 Received a 120-day, 7 percent note on account Dec 16 Notes Receivable-C. Judd . 14.400 0 Accounts Receivable-C. Judd 0 14,400 Received a 45-day, 10 percent note on account Dec 30 Allowance for Doubtful Accounts ex 18,420 0 Notes Receivable-C Judd 0 18,000 Notes Receivable 3. Shore Company 0 420 X To record dishonoring of B. Shore Company's note Dec 31 Bad Debts Expense 45,800 X 0 Accounts Receivable - B. Shore Company . 0 45.800 x To write off B. Shores account Dec 31 Allowance for Doubtful Accounts 24,500 x 0 Accounts Receivable B. Shore Company 0 24,500 X To record allowance for uncollectible accounts Dec 31 Notes Receivable --Cludd 14,000 X 0 Interest income . 1.152 X OX To accrue interest income on December 16 note X Credit Card 5005 Jamie's Fabrics accepts cas personal checks and two credit cards when customers buy merchandise. With the Great Amerkan Bank Card, James Fabrics receive an immediate depot in it checking account when credit card sales slips are deposited at the bank. The bank charges a three percent fee. With the United Merchants Card, James Fabrics mails the credit card sales lips to United Merchants regional processing center each day. United Merchants accumulates these sps for two days and then mails check to James Fabrica, after deducting three percent let. Prepare Journal entries to record the following Round to the nearest dollar ses for March 15 were as follows Glish and checks Great American Bank Depot the end of the day Ustad Merdu Card (Maled at the end of the day 3950 200 700 52.850 Received a check for 37,900 from United Merchants on March 2011 Date Credit General Journal Description Marts cach Accouncted Merchants Credit Card Reader Debut 2,114 700 M 9 250 0 Tooth and credite Cred General Journal Dane Description MC NIBURI Bed Me To reconhecer De 1300

Pomona, Inc. began business on January 1. Certain transactions for the year follow Jun Raceed 330.000. 60 percent on account from R. Ett A Received payment from Briton her note principal plus interest Specived and 120 day even een rote from Share Company on account Dec 16 Received 116400, 45 day per romjud on account Deco Shore Company failed to pay Deci Wiate of it. She's account as uncollectible. Ponoma, nes the lowance method of providing for credito Dec. 21 Recorded expected credit fomes for the year by an adjusting entry Accounts we off during the first year heated debit bine in the lowance for Accounts anys taped recevable Dec 31 Made the appropriate incenties for interest Required Record the foregoing transactions and adjustments in general journal form. (Round interest income calculations to the nearest dollar) General Journal Date Description Debit Credit Nores Recevole O 30.000 Accounts Receivable to 0 30.000 Received a 56- cercnt note on account Anh 10300 0 Merce- Ov 30.000 Nos en 0 300 M Te recent record plus interest from the Sant Notes levable - Short Company 18.000 Ow Movie Share 0 14.000 Received 120date on Dec 16 Noved 14400 O Acecebeu O 10 Ron 30 Ace for Doubtful Accounts M 1420 O Now OV 1000 Novel Company 30 Turf Share Company Detta beton 10 0 Alchemy O 07 Required Record the foregoing transactions and adjustments in general journal form. (Round all interest income calculations to the nearest dollar.) General Journal Date Description Debit Credit Jun Notes Receivable--R. Elliot 30,000 0 Accounts Receivable - R. Elliot 0 30,000 Received a 60-day, 6 percent note on account Aug 7 Cash e 30,300 0 Notes Receivable-R. Elliot X 0 30,000 X Notes Receivable-R. Elliot 300 x To record receipt of principal plus interest from R. Elliot Sep.1 Notes Receivable-8. Shore Company . 18,000 0 Accounts Receivable B. Shore Company 07 18,000 Received a 120-day, 7 percent note on account Dec 16 Notes Receivable-C. Judd . 14400 0 Accounts Receivable-C. Judd 0 14,400 Received a 45-day, 10 percent note on account Dec 30 Allowance for Doubtful Accounts ex 18,420 0 Notes Receivable C Judd 0 18,000 x Notes Receivable. Shore Company 0 420 X To record dishonoring of B. Shore Company's note Dec 31 Bad Debts Expense X 45,800 X 07 Accounts Receivable-. Shore Company 0 45.800 X To write off B. Shore's account. Dec 31 Allowance for Doubtful Accounts 24,500 X 0 Accounts Receivable Shore Company X 0 24,500 X To record allowance for uncollectible accounts Dec 31 Notes Receivable--C.judd 14,000 X 0 Interest income 1.152 X OX To accrue interest income on December 16 note Credit Card Sales Jamie's Fabrics accepts cas personal checks, and two credit cards when customers buy merchandise. With the Great American Bank Card, James Fabrics receive an immediate deportinis checking account when credit card sales slips are deposited at the bank. The bank charges a three percent fee with the United Merchants Card jame Fabrics mails the credit card sales lips to United Merchants regional processing center each day. United Merchants accumulares these sips for two days and then mals a check to Jamie's Fabrica, after deducting three percene let. Prepare Journal entries to record the following Round to the nearest dollar for 15 were as follow Cash and checks Great American Bank Card (Openthead of the day Ustad Merchar Card (Maled at the end of the day 9950 7200 700 52.850 B Recrewed a check for 33,900 Son Lined Merchants on March 20|| Date Credit General Journal Description Marth Account cevatented Merchant Credit Card ree See Toxed Chandicate Debut 2,114 700 M MH 2 Cred General Journal Dane Description 30 C NIBUS Bieder To reconhecerca 00 100 Pomona, Inc. began business on January 1. Certain transactions for the year follow un ved a 130.000 60 day percent on count from. Ett A Received payment from Botoner rote principal plus interest Specived and 120 day even percent from shore Company on account De Hace 114.400, 45 day, fromad on account Deco Short Companyated to pay Dee Wiate of itShe's account as unico. Ponoma, nes the allowance method of providing for credit losses Dec. Recorded expected credit fosses for the year by an adjune entry. Accounts we offering the first year www.reddebit balance in the Allowance for Accounts of S. An analysis of aged recevable De Made the appropriateadusting entries for interest Required Record the foregoing transactions and adjustments in general Journal form. (Round al interest income calculation to the nearest dollar) General journal DATE Description Debit Crede Nos Receivable et O 10.000 Accounts Receivable hot 0 30.000 Reserved - note an account Augh. 10300 0 NR-R Ov 33.000 W Not to 0 300 W Te record record plus interest from the S. Nos fecevable for company 18.000 Account Shore Como 18.000 leche 120-day peront Dec Nov cudd 14,400 Acebeu D 100 R10 pont 30 Acer Double counts 1420 0 Nov O No de recoman Turn Shore Company Debut 100 O Recher Company O 300 Required Record the foregoing transactions and adjustments in general journal form. (Round all interest income calculations to the nearest dollar.) General Journal Date Description Debit Credit Jun Notes Receivable--R. Elliot 30,000 0 Accounts Receivable -R. Elliot 0 30,000 Received a 60-day, 6 percent note on account Aug 7 Cash 30,300 0 Notes Receivable--R. Elliot X 0 30,000 X Notes Receivable--R. Elliot 0 300 x To record receipt of principal plus interest from R. Elliot Sep.1 Notes Receivable-8. Shore Company 18,000 0 Accounts Receivable B. Shore Company 0 18,000 Received a 120-day, 7 percent note on account Dec 16 Notes Receivable-C. Judd . 14.400 0 Accounts Receivable-C. Judd 0 14,400 Received a 45-day, 10 percent note on account Dec 30 Allowance for Doubtful Accounts ex 18,420 0 Notes Receivable-C Judd 0 18,000 Notes Receivable 3. Shore Company 0 420 X To record dishonoring of B. Shore Company's note Dec 31 Bad Debts Expense 45,800 X 0 Accounts Receivable - B. Shore Company . 0 45.800 x To write off B. Shores account Dec 31 Allowance for Doubtful Accounts 24,500 x 0 Accounts Receivable B. Shore Company 0 24,500 X To record allowance for uncollectible accounts Dec 31 Notes Receivable --Cludd 14,000 X 0 Interest income . 1.152 X OX To accrue interest income on December 16 note X Credit Card 5005 Jamie's Fabrics accepts cas personal checks and two credit cards when customers buy merchandise. With the Great Amerkan Bank Card, James Fabrics receive an immediate depot in it checking account when credit card sales slips are deposited at the bank. The bank charges a three percent fee. With the United Merchants Card, James Fabrics mails the credit card sales lips to United Merchants regional processing center each day. United Merchants accumulates these sps for two days and then mails check to James Fabrica, after deducting three percent let. Prepare Journal entries to record the following Round to the nearest dollar ses for March 15 were as follows Glish and checks Great American Bank Depot the end of the day Ustad Merdu Card (Maled at the end of the day 3950 200 700 52.850 Received a check for 37,900 from United Merchants on March 2011 Date Credit General Journal Description Marts cach Accouncted Merchants Credit Card Reader Debut 2,114 700 M 9 250 0 Tooth and credite Cred General Journal Dane Description MC NIBURI Bed Me To reconhecer De 1300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started