Question: Portfolio X has a 1% allocation to 100 different Canadian stocks, where all 100 stocks satisfy the conditions of the single index model, where

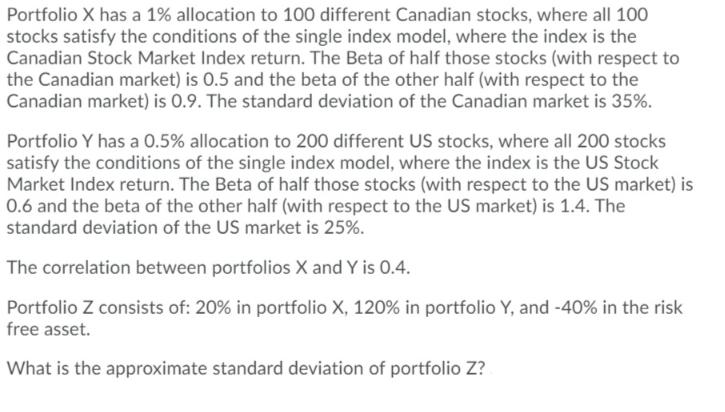

Portfolio X has a 1% allocation to 100 different Canadian stocks, where all 100 stocks satisfy the conditions of the single index model, where the index is the Canadian Stock Market Index return. The Beta of half those stocks (with respect to the Canadian market) is 0.5 and the beta of the other half (with respect to the Canadian market) is 0.9. The standard deviation of the Canadian market is 35%. Portfolio Y has a 0.5% allocation to 200 different US stocks, where all 200 stocks satisfy the conditions of the single index model, where the index is the US Stock Market Index return. The Beta of half those stocks (with respect to the US market) is 0.6 and the beta of the other half (with respect to the US market) is 1.4. The standard deviation of the US market is 25%. The correlation between portfolios X and Y is 0.4. Portfolio Z consists of: 20% in portfolio X, 120% in portfolio Y, and -40% in the risk free asset. What is the approximate standard deviation of portfolio Z?

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

To calculate the approximate standard deviation of portfolio Z we need to consider the individual st... View full answer

Get step-by-step solutions from verified subject matter experts