Answered step by step

Verified Expert Solution

Question

1 Approved Answer

posting this AGAIN please put the answer exactly along with the questions in the picture pls dont be complicated! The following information is avallable for

posting this AGAIN please put the answer exactly along with the questions in the picture pls dont be complicated!

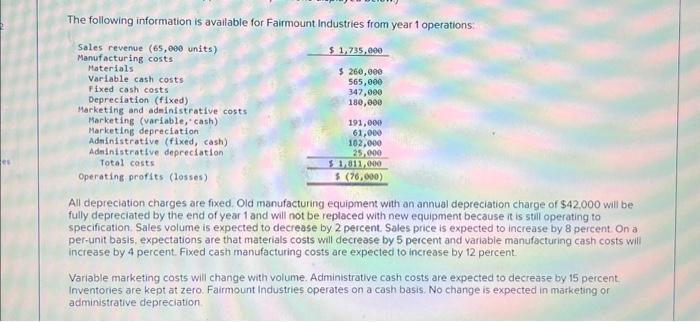

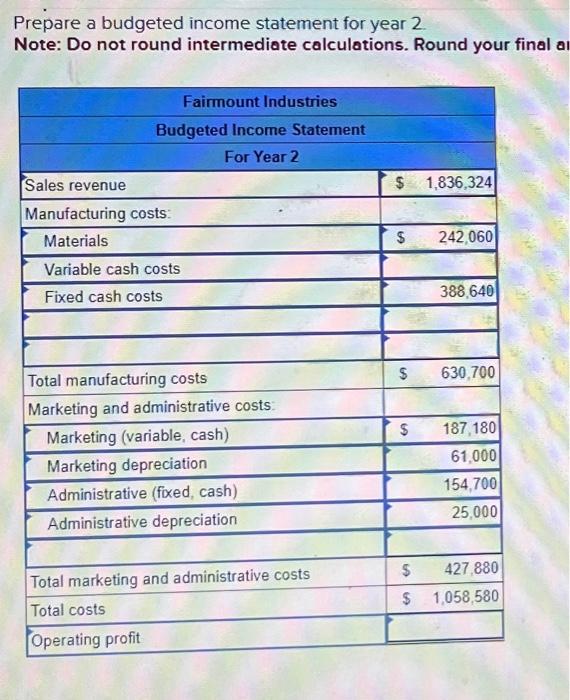

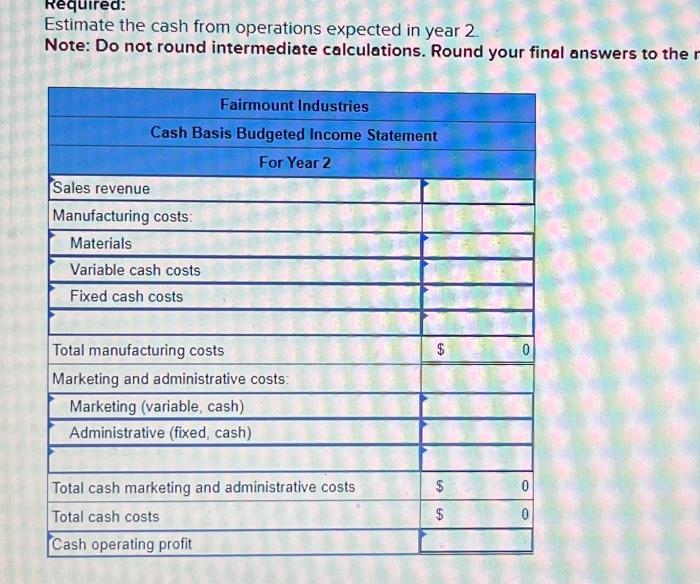

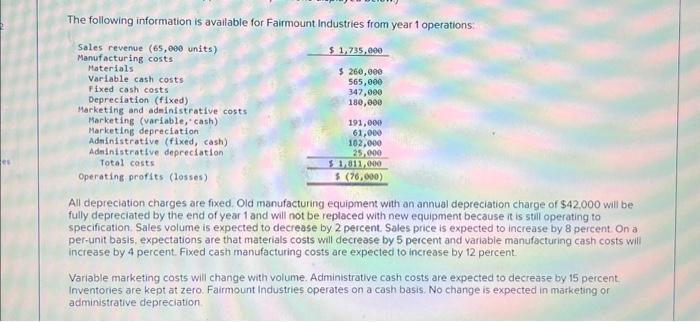

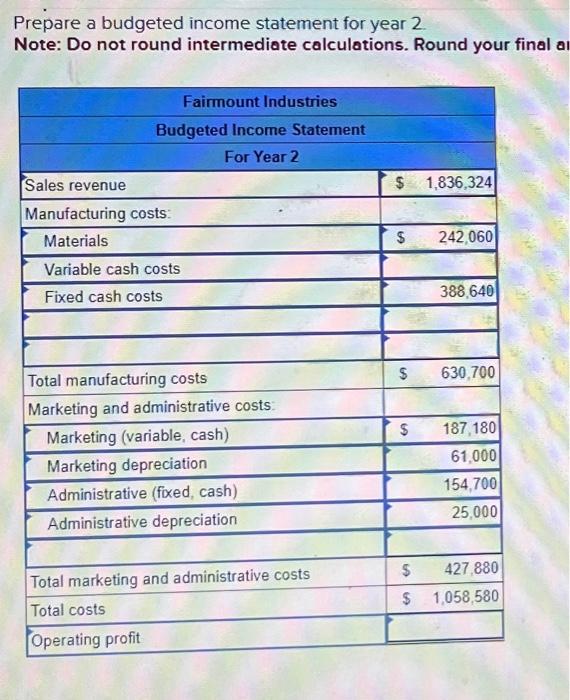

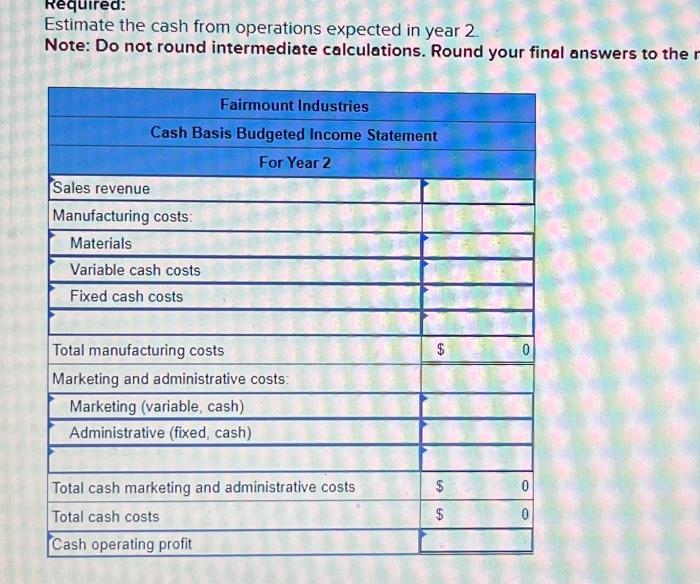

The following information is avallable for Fairmount Industries from year 1 operations: All depreciation charges are fixed. Old manufacturing equipment with an annual depreciation charge of $42.000 will be fully depreciated by the end of year 1 and will not be replaced with new equipment because it is still operating to specification. Sales volume is expected to decrease by 2 percent. Sales price is expected to increase by 8 percent On a per-unit basis, expectations are that materials costs will decrease by 5 percent and variable manufacturing cash costs will increase by 4 percent. Fixed cash manufacturing costs are expected to increase by 12 percent. Variable marketing costs will change with volume. Administrative cash costs are expected to decrease by 15 percent Inventories are kept at zero. Fairmount Industries operates on a cash basis. No change is expected in mafketing or administrative depreciation. Prepare a budgeted income statement for year 2 Note: Do not round intermediate calculations. Round your final a Estimate the cash from operations expected in year 2 . Note: Do not round intermediate calculations. Round your final answers to the The following information is avallable for Fairmount Industries from year 1 operations: All depreciation charges are fixed. Old manufacturing equipment with an annual depreciation charge of $42.000 will be fully depreciated by the end of year 1 and will not be replaced with new equipment because it is still operating to specification. Sales volume is expected to decrease by 2 percent. Sales price is expected to increase by 8 percent On a per-unit basis, expectations are that materials costs will decrease by 5 percent and variable manufacturing cash costs will increase by 4 percent. Fixed cash manufacturing costs are expected to increase by 12 percent. Variable marketing costs will change with volume. Administrative cash costs are expected to decrease by 15 percent Inventories are kept at zero. Fairmount Industries operates on a cash basis. No change is expected in mafketing or administrative depreciation. Prepare a budgeted income statement for year 2 Note: Do not round intermediate calculations. Round your final a Estimate the cash from operations expected in year 2 . Note: Do not round intermediate calculations. Round your final answers to the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started