Question

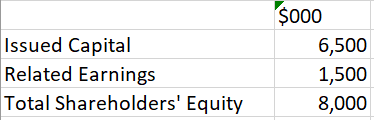

Pound Ltd acquired 75% of the issued capital of Yen Ltd on 1 July 2019 for a cash consideration of $7,000,000. At this date, the

Pound Ltd acquired 75% of the issued capital of Yen Ltd on 1 July 2019 for a cash consideration of $7,000,000. At this date, the sharehoders' equity of Yen Ltd was as follows:

At the date of acquisition, all of the identifiable assets and assuemed liabilities of Yen Ltd were considered to be recorded at fair value in Yen Ltd's statement of financial position except Land which had a fair value of $600,000 and a carrying amount of $450,000.Additional information:

At the date of acquisition, all of the identifiable assets and assuemed liabilities of Yen Ltd were considered to be recorded at fair value in Yen Ltd's statement of financial position except Land which had a fair value of $600,000 and a carrying amount of $450,000.Additional information:

On 1 April 2020, Yen Ltd purchased inventory of $10,000 from an external supplier, and then sold it to Pound Ltd for $15,000. Pound Ltd still held 100% of the inventory at 30 June 2020.

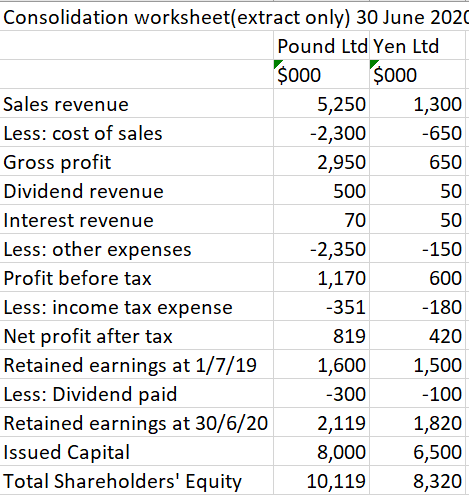

The Pound Ltd Group has adopted the proportionate method of recording goodwill. Yen Ltd is the only subsidiary in the Pound Ltd group. Assume a tax rate of 30% for all accounting periods. An extract of the consolidated worsheet one year after acquisitionis provided:

| NCI Memorandum | Yen Ltd | NCI |

Q2: Based on Q1, assume Pound Ltd Group has adopted the full method to record goodwill, and the fair value of the non-controlling interest at 1 July 2019 was $2,800,000. Re-calculate the total NCI in eauity for the Pound Ltd Group at 30 June 2020. Show workings.

Issued Capital Related Earnings Total Shareholders' Equity $000 6,500 1,500 8,000 Consolidation worksheet(extract only) 30 June 2020 Pound Ltd Yen Ltd $000 $000 Sales revenue 5,250 1,300 Less: cost of sales -2,300 -650 Gross profit 2,950 650 Dividend revenue 500 50 Interest revenue 70 50 Less: other expenses -2,350 -150 Profit before tax 1,170 600 Less: income tax expense -351 -180 Net profit after tax 819 420 Retained earnings at 1/7/19 1,600 1,500 Less: Dividend paid -300 -100 Retained earnings at 30/6/20 2,119 1,820 Issued Capital 8,000 6,500 Total Shareholders' Equity 10,119 8,320Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started