Question

Pr. 15-17-130 Trading equity securities. Perez Company began operations in 2011. Since then, it has reported the following gains and losses for its investments in

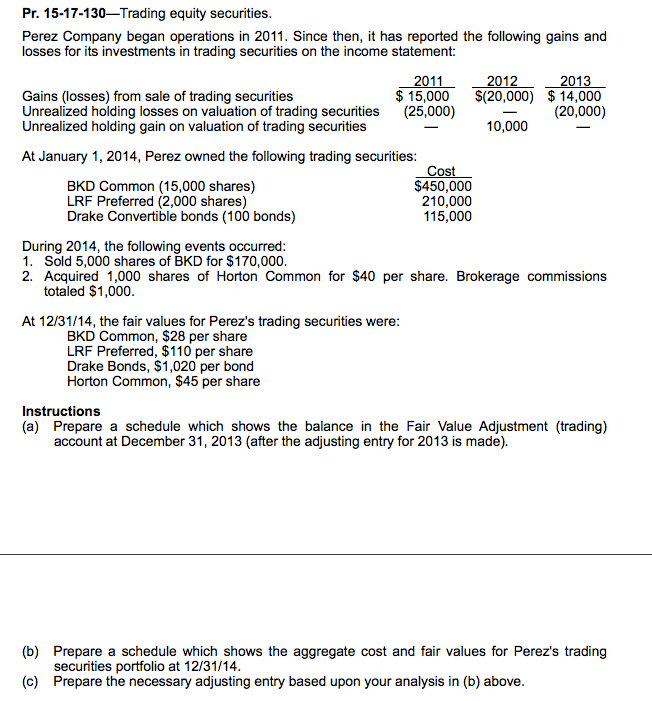

Pr. 15-17-130Trading equity securities.

Perez Company began operations in 2011. Since then, it has reported the following gains and losses for its investments in trading securities on the income statement:

2011 2012 2013

Gains (losses) from sale of trading securities $ 15,000 $(20,000) $ 14,000

Unrealized holding losses on valuation of trading securities (25,000) (20,000)

Unrealized holding gain on valuation of trading securities 10,000

At January 1, 2014, Perez owned the following trading securities:

Cost

BKD Common (15,000 shares) $450,000

LRF Preferred (2,000 shares) 210,000

Drake Convertible bonds (100 bonds) 115,000

During 2014, the following events occurred:

1. Sold 5,000 shares of BKD for $170,000.

2. Acquired 1,000 shares of Horton Common for $40 per share. Brokerage commissions totaled $1,000.

At 12/31/14, the fair values for Perez's trading securities were:

BKD Common, $28 per share

LRF Preferred, $110 per share

Drake Bonds, $1,020 per bond

Horton Common, $45 per share

Instructions

(a) Prepare a schedule which shows the balance in the Fair Value Adjustment (trading) account at December 31, 2013 (after the adjusting entry for 2013 is made).

(b) Prepare a schedule which shows the aggregate cost and fair values for Perez's trading securities portfolio at 12/31/14.

(c) Prepare the necessary adjusting entry based upon your analysis in (b) above.

Pr. 15-17-130 Trading equity securities Perez Company began operations in 2011 Since then, it has reported the following gains and losses for its investments in trading securities on the income statement: 2011 2012 2013 Gains (losses) from sale of trading securities 15,000 (20,000) 14,000 (20,000) Unrealized holding losses on valuation of trading securities (25,000) 10,000 Unrealized holding gain on valuation of trading securities At January 1, 2014, Perez owned the following trading securities: Cost BKD Common (15,000 shares) $450,000 210,000 LRF Preferred (2,000 shares) Drake Convertible bonds (100 bonds) 115,000 During 2014, the following events occurred: 1. Sold 5,000 shares of BKD for $170,000. 2. Acquired 1,000 shares of Horton Common for $40 per share. Brokerage commissions totaled $1,000. At 12/31/14, the fair values for Perez's trading securities were BKD Common, $28 per share LRF Preferred, $110 per share Drake Bonds, $1,020 per bond Horton Common, $45 per share Instructions (a) Prepare a schedule which shows the balance in the Fair Value Adjustment (trading) account at December 31, 2013 (after the adjusting entry for 2013 is made). (b) Prepare a schedule which shows the aggregate cost and fair values for Perez's trading securities portfolio at 12/31/14. (c) Prepare the necessary adjusting entry based upon your analysis in (b) aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started