Question

Prepare a data input section in the exact order as given below. Naming of the input 'sheet' should be INPUT . Do NOT cellprotect the

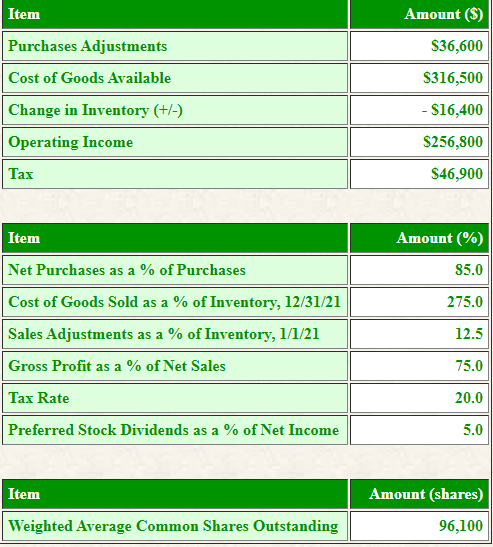

Prepare a data input section in the exact order as given below. Naming of the input 'sheet' should be "INPUT". Do NOT cellprotect the numeric data of this section, as you must allow for the possibility of change to this information. Use the amounts given as a test of your output. Enter Pct as the %, not decimal (80% entered as 80, not 0.80). Your input should be placed in the following rows/columns (the heading "INPUT SECTION" should be centered over all columns to which it relates):

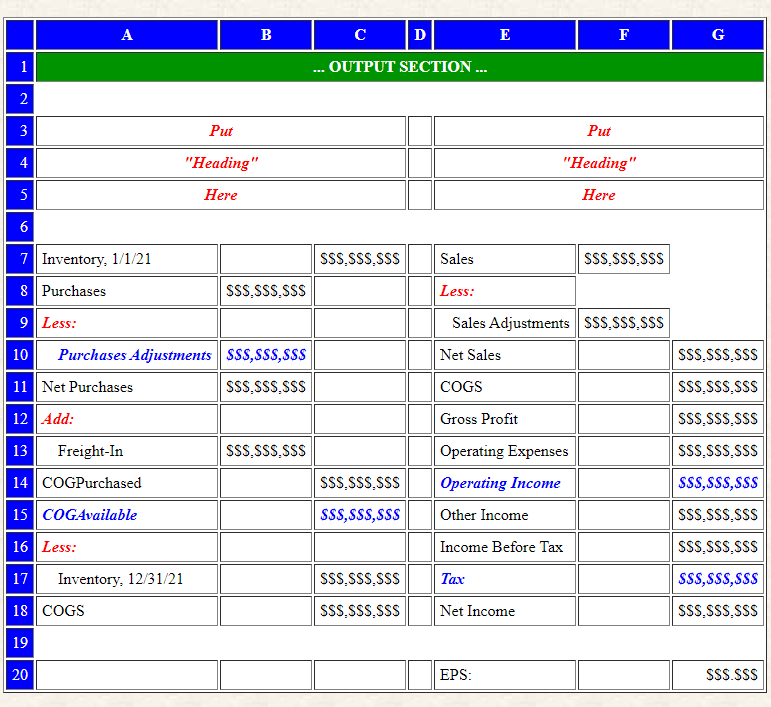

Prepare an output section that produces the following items: 1) "COGS Schedule", and 2) "Income Statement". The reporting period is for the calendar year of 2021. The output items should be placed on a separate 'sheet' (the heading "OUTPUT SECTION" should be centered over all columns to which it relates: [A1..G1]). Naming of the output 'sheet' should be "OUTPUT". No number (dollar amount, shares, or percentage) or company name (the company name should be shown in a "script" font) should be typed (hard coded) directly into any cell in the output section, as this would prevent your output from being correct when the input is changed. Instead, the output section must reference the appropriate amounts (shares, dollars, and percents) and name from the input and/or output sections. Your output should be placed in the following spreadsheet rows/columns, using the color scheme as shown, where $$$ represent dollar amounts:

Item Amount ($) Purchases Adjustments $36,600 Cost of Goods Available $316,500 Change in Inventory (+/-) - $16,400 Operating Income $256,800 Tax $46,900 Item Amount (%) Net Purchases as a % of Purchases 85.0 275.0 Cost of Goods Sold as a % of Inventory, 12/31/21 Sales Adjustments as a % of Inventory, 1/1/21 Gross Profit as a % of Net Sales 12.5 75.0 Tax Rate 20.0 Preferred Stock Dividends as a % of Net Income 5.0 Item Amount (shares) Weighted Average Common Shares Outstanding 96,100 . B C D E F G 1 ... OUTPUT SECTION ... 2 3 Put Put 4 "Heading" "Heading" 5 Here Here 6 SSSSSSSSS Sales SSSSSSSSS 7 Inventory, 1/1/21 8 Purchases SSSSSSSSS Less: 9 Less: Sales Adjustments SSSSSSSSS Net Sales 10 Purchases Adjustments SSS SSS SSS 11 Net Purchases SSSSSSSSS 12 Add: COGS SSSSSSSSS SSSSSSSSS SSSSSSSSS Gross Profit SSS.SSS.SSS SSSSSSSSS SSSSSSSSS Operating Expenses Operating Income Other Income SSSSSSSSS SSSSSS, SSS SSS.SSSSSS 13 Freight-In 14 COGPurchased 15 COG. Available 16 Less: 17 Inventory, 12/31/21 18 COGS Income Before Tax SSS SSS SSS SSSSSSSSS Tax SSS SSS SSS SSSSSSSSS Net Income SSS.SSSSSS 19 20 EPS: SSSSSS Item Amount ($) Purchases Adjustments $36,600 Cost of Goods Available $316,500 Change in Inventory (+/-) - $16,400 Operating Income $256,800 Tax $46,900 Item Amount (%) Net Purchases as a % of Purchases 85.0 275.0 Cost of Goods Sold as a % of Inventory, 12/31/21 Sales Adjustments as a % of Inventory, 1/1/21 Gross Profit as a % of Net Sales 12.5 75.0 Tax Rate 20.0 Preferred Stock Dividends as a % of Net Income 5.0 Item Amount (shares) Weighted Average Common Shares Outstanding 96,100 . B C D E F G 1 ... OUTPUT SECTION ... 2 3 Put Put 4 "Heading" "Heading" 5 Here Here 6 SSSSSSSSS Sales SSSSSSSSS 7 Inventory, 1/1/21 8 Purchases SSSSSSSSS Less: 9 Less: Sales Adjustments SSSSSSSSS Net Sales 10 Purchases Adjustments SSS SSS SSS 11 Net Purchases SSSSSSSSS 12 Add: COGS SSSSSSSSS SSSSSSSSS SSSSSSSSS Gross Profit SSS.SSS.SSS SSSSSSSSS SSSSSSSSS Operating Expenses Operating Income Other Income SSSSSSSSS SSSSSS, SSS SSS.SSSSSS 13 Freight-In 14 COGPurchased 15 COG. Available 16 Less: 17 Inventory, 12/31/21 18 COGS Income Before Tax SSS SSS SSS SSSSSSSSS Tax SSS SSS SSS SSSSSSSSS Net Income SSS.SSSSSS 19 20 EPS: SSSSSS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started