Answered step by step

Verified Expert Solution

Question

1 Approved Answer

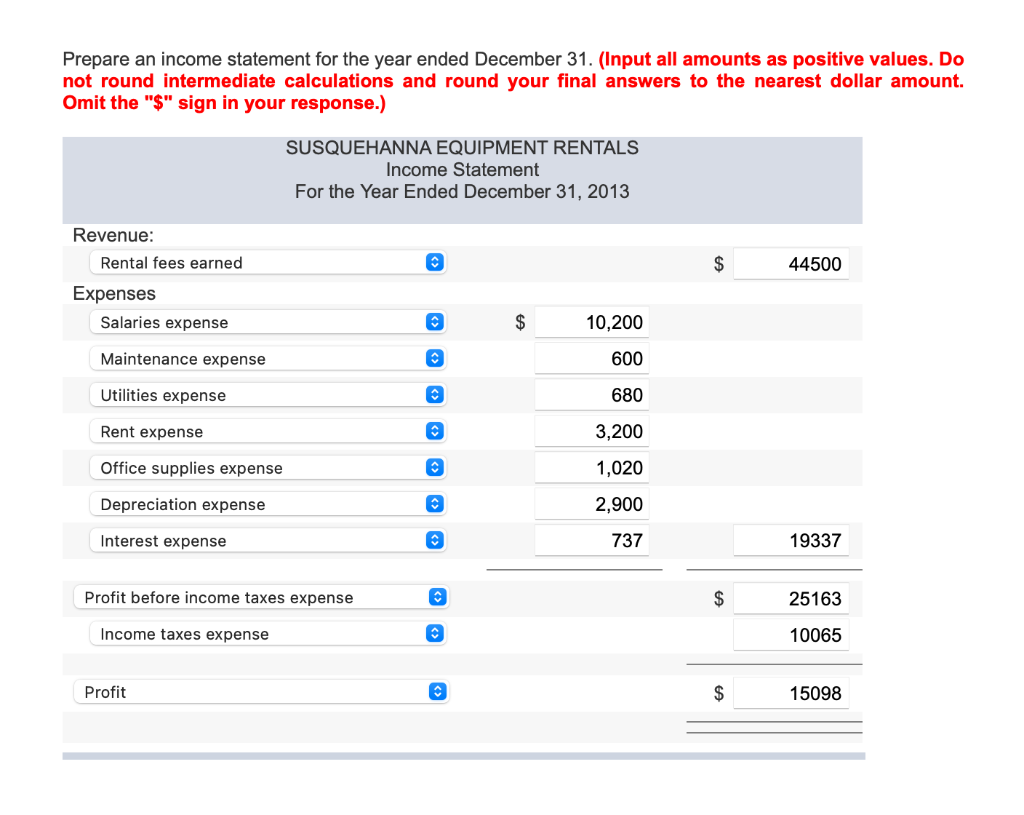

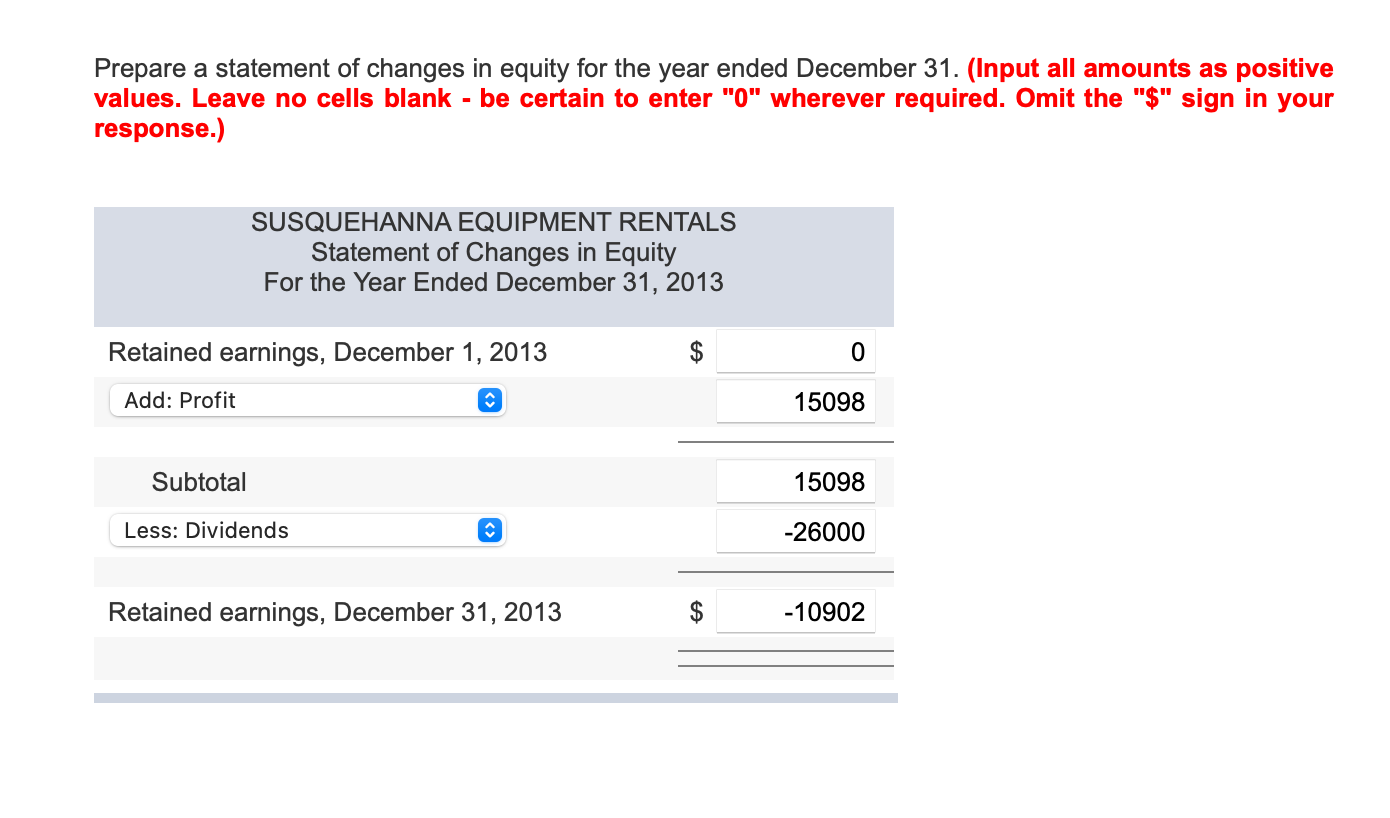

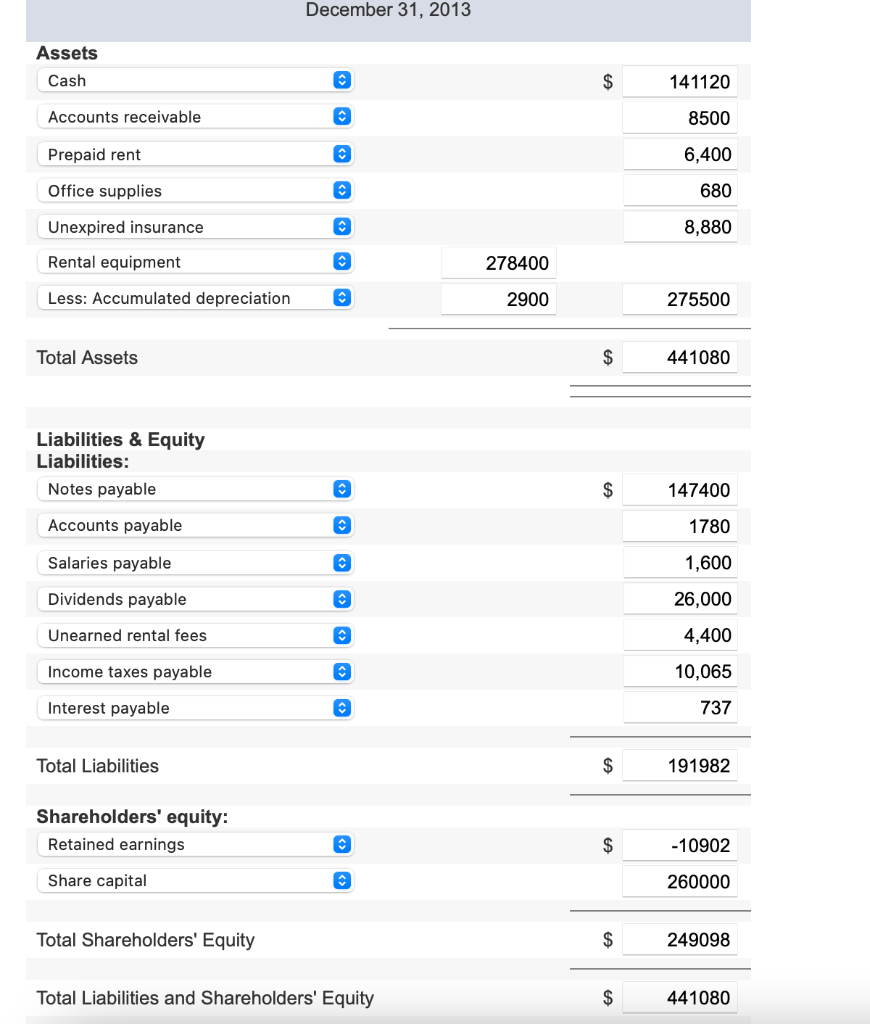

Prepare an after-closing trial balance as of December 31. (The items in the Trial Balance should be grouped as follows: Assets (in order of their

| Prepare an after-closing trial balance as of December 31. (The items in the Trial Balance should be grouped as follows: Assets (in order of their liquidity), Liabilities (in order of their liquidity) and Equity. Omit the "$" sign in your response.) |

| SUSQUEHANNA EQUIPMENT RENTALS | |||

| After-Closing Trial Balance | |||

| December 31, 2013 | |||

| Debit | Credit | ||

| (Click to select)Interest payableUnexpired insuranceRental equipmentPrepaid rentSalaries payableOffice suppliesCash | $ | ||

| (Click to select)Rental equipmentInterest payablePrepaid rentUnexpired insuranceOffice suppliesSalaries payableAccounts receivable | |||

| (Click to select)Prepaid rentDividends payableUnearned rental feesOffice suppliesRental equipmentInterest payableUnexpired insurance | |||

| (Click to select)Dividends payableUnearned rental feesPrepaid rentRental equipmentUnexpired insuranceInterest payableOffice supplies | |||

| (Click to select)Interest payableRental equipmentUnearned rental feesOffice suppliesUnexpired insuranceDividends payablePrepaid rent | |||

| (Click to select)Prepaid rentRental equipmentInterest payableUnexpired insuranceDividends payableUnearned rental feesOffice supplies | |||

| (Click to select)Dividends payableOffice suppliesUnexpired insurancePrepaid rentAccumulated depreciation: Rental equipmentRental equipmentSalaries payable | $ | ||

| (Click to select)Retained earningsAccounts receivableUnexpired insurancePrepaid rentOffice suppliesNotes payableRental equipment | |||

| (Click to select)Accounts payablePrepaid rentAccounts receivableUnexpired insuranceOffice suppliesRetained earningsRental equipment | |||

| (Click to select)Income taxes payableSalaries payableDividends payable Interest payableAccounts payableUnearned rental feesRetained earnings | |||

| (Click to select)Dividends payableUnearned rental fees Interest payableRetained earningsAccounts payableIncome taxes payableSalaries payable | |||

| (Click to select) Interest payableRetained earningsIncome taxes payableUnearned rental feesSalaries payableDividends payableAccounts payable | |||

| (Click to select)Income taxes payableUnearned rental feesSalaries payableRetained earningsDividends payable Interest payableAccounts payable | |||

| (Click to select)Dividends payableSalaries payable Interest payableRetained earningsIncome taxes payableAccounts payableUnearned rental fees | |||

| (Click to select)Prepaid rentAccounts payableSalaries payableDividends payableOffice suppliesShare capitalRetained earnings | |||

| (Click to select)Share capitalOffice suppliesPrepaid rentRetained earningsDividends payableSalaries payableAccounts payable | |||

| Totals | $ | $ | |

| |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started