Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare an estate tax return for Benny as of the end of the current year after any recommended transfers. Assume he dies on December 31

Prepare an estate tax return for Benny as of the end of the current year after any recommended transfers. Assume he dies on December 31 of the current year. Assume the combined last medical and funeral costs are $100,000 and the estate administration cost is $150,000.

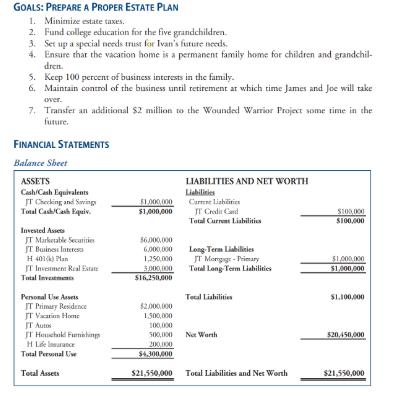

GOALS: PREPARE A PROPER ESTATE PLAN 1. Minimize estate taxes. 2. Fund college education for the five grandchildren. 3. Set up a special needs trust for Ivan's futute needs. 4. Ensure thar the vacation home is a permanent family home for children and grandchil- dren. 5. Keep 100 percent of business interests in the family. 6. Maintain control of the business until retirement ar which time James and Joe will take over. 7. Transfer an additional $2 million to the Wounded Warrior Project some time in the future. FINANCIAL STATEMENTS Balance Sheet ASSETS LIABILITIES AND NET WORTH Cash/Cash Equivalents T Checking and Saving Total CashCash Eauiv. Liabilities $1.000.000 $1,000,000 Carre liabiiries IT Crodir Cand S100,000 S100,000 Total Carrent Lisbilitis Invested Asses JT Marketable Secatitie S6000.00 IT Buines lateresa H 401k) Man 6.000.000 Long- Term Liabilicies IT Monggr - Primary Total Lang Term Liahilities 1,250,000 51.000.000 $1.000.000 IT Invesment Real Estate Total Investment S16.250,000 Personal Ue Asets IT Primary Residence T Vaation Home IT Autos JT Heuehald Funishinp Tetal Liahilities SL.100.000 $2.000.000 1.500,000 100,000 Net Worth 520,450,000 Total Pernal Uw $4.300,00 Total Assets $21,550,000 Total Liabilities and Net Worth $21,550.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Benny and Martha should take these steps immediately to reduce their gross estate and achieve their goals Step 1 Prepare a proper estate plan This m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started