Question

Prepare Form 1 1 2 0 for federal tax purposes for tax year 2 0 2 3 .

Prepare Form for federal tax purposes for tax year

Do NOT prepare any state tax returns.

The return should include the and related statementsschedulesforms and forms AE Schedule D and form

Prepare Schedule M

Prepare Schedule M

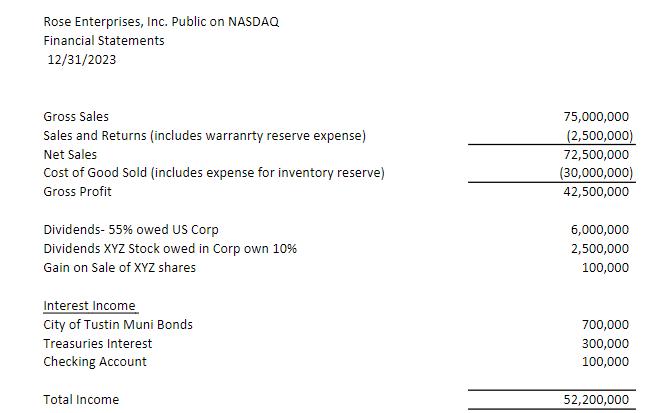

Rose Enterprises, Inc. Public on NASDAQ Financial Statements 12/31/2023 Gross Sales 75,000,000 Sales and Returns (includes warranty reserve expense) Net Sales (2,500,000) 72,500,000 Cost of Good Sold (includes expense for inventory reserve) (30,000,000) Gross Profit Dividends- 55% owed US Corp 42,500,000 6,000,000 Dividends XYZ Stock owed in Corp own 10% Gain on Sale of XYZ shares 2,500,000 100,000 Interest Income City of Tustin Muni Bonds Treasuries Interest Checking Account Total Income 700,000 300,000 100,000 52,200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App