Prepare Form 1120 for the following:

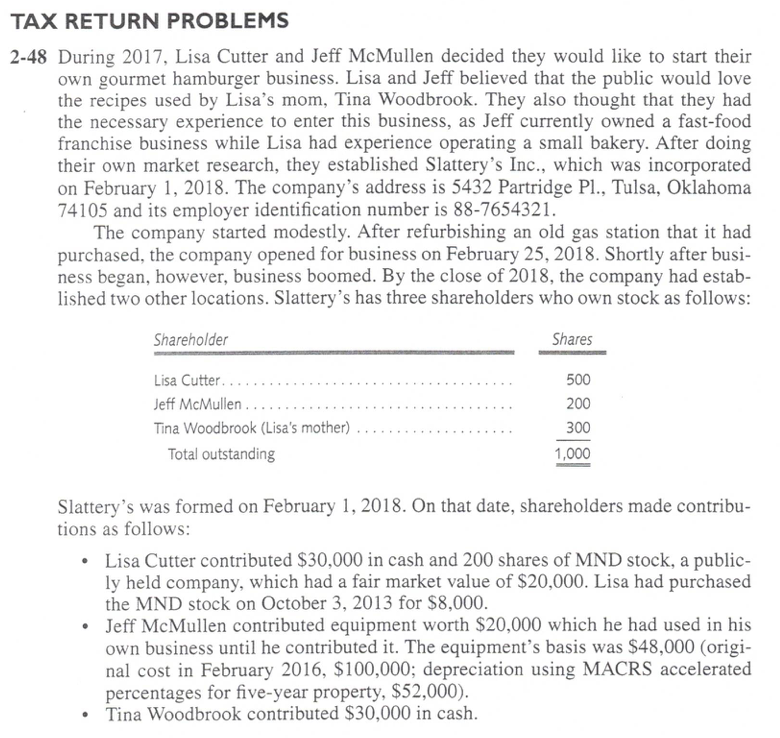

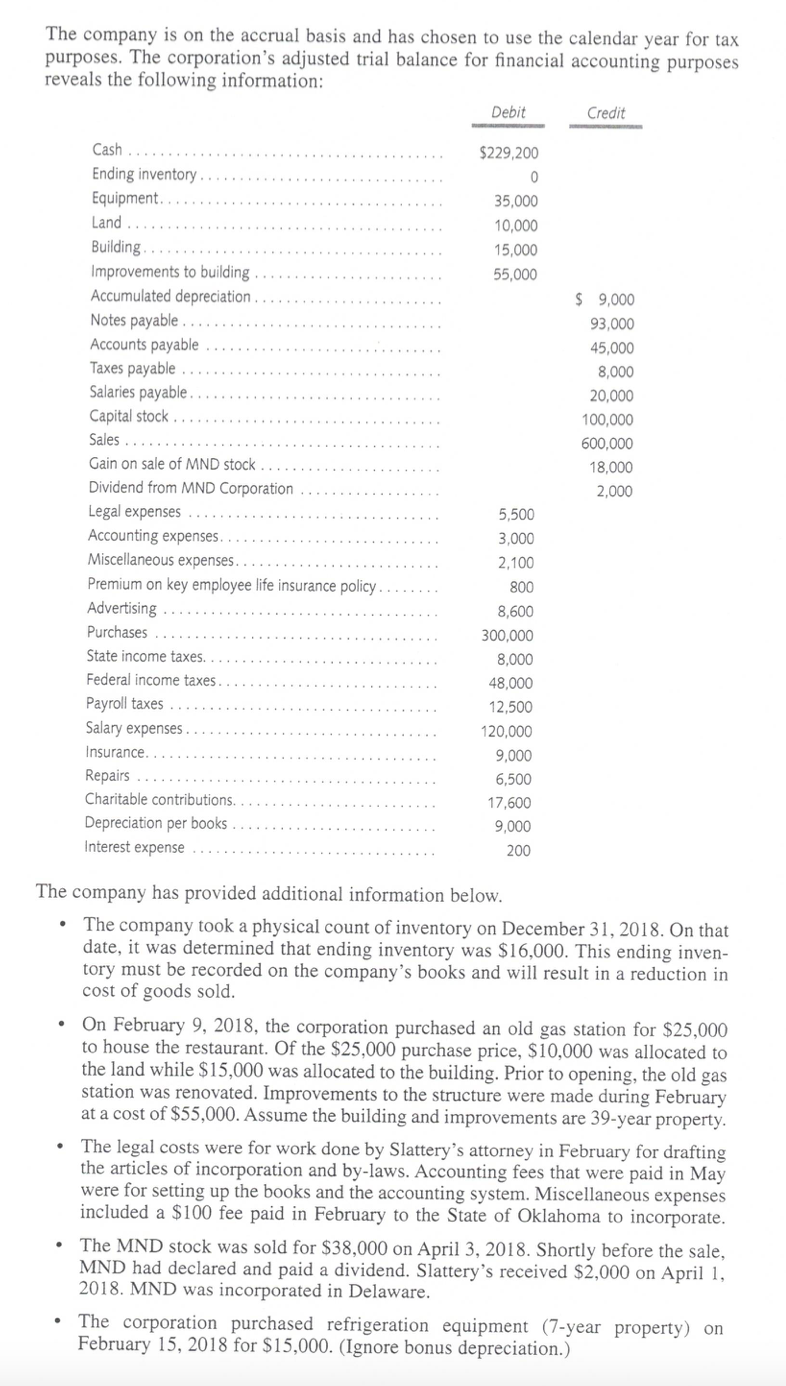

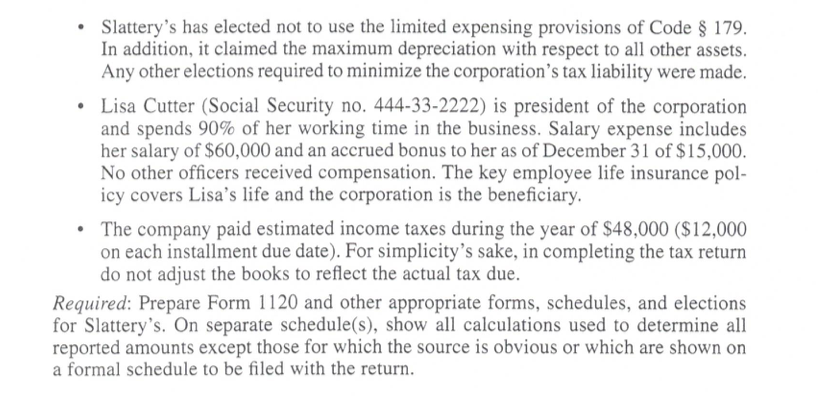

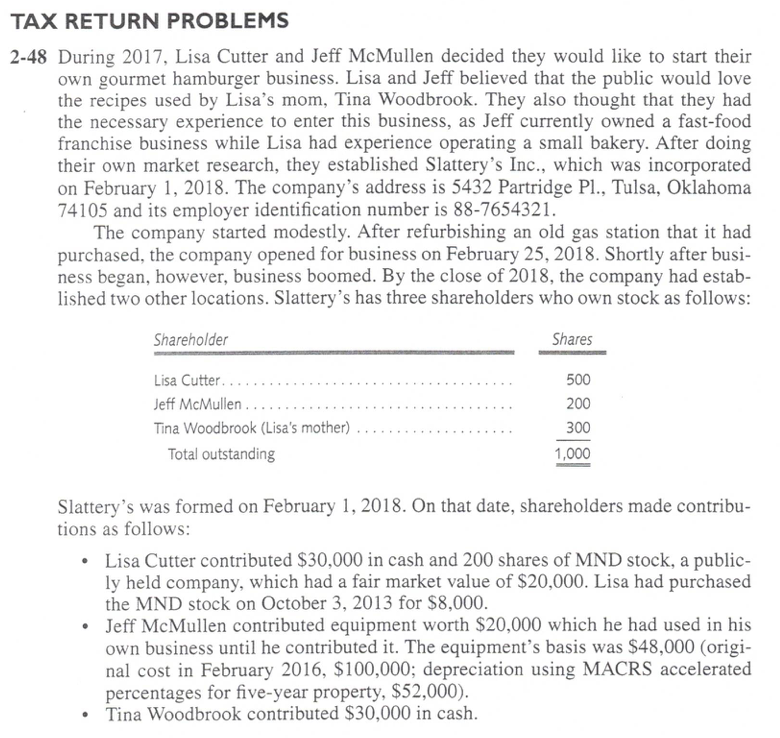

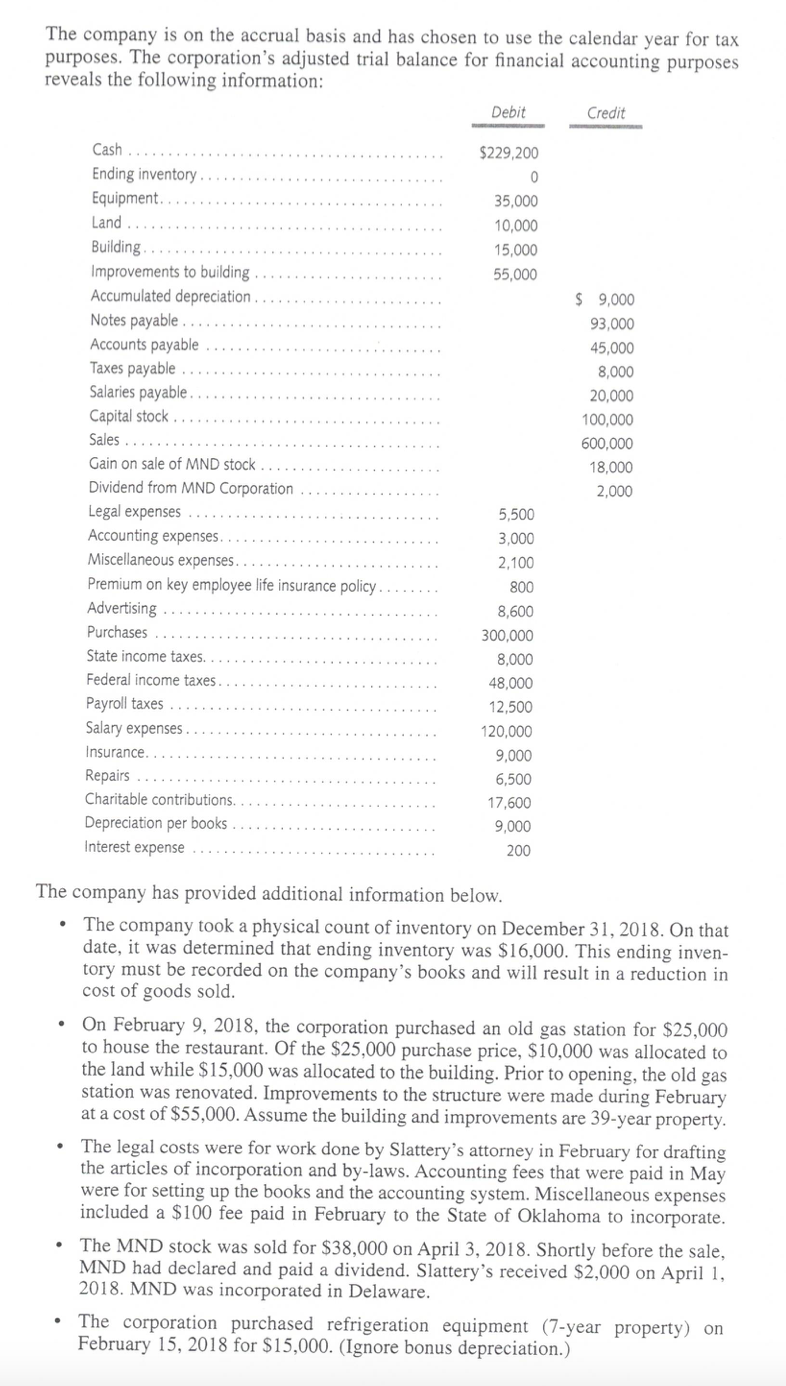

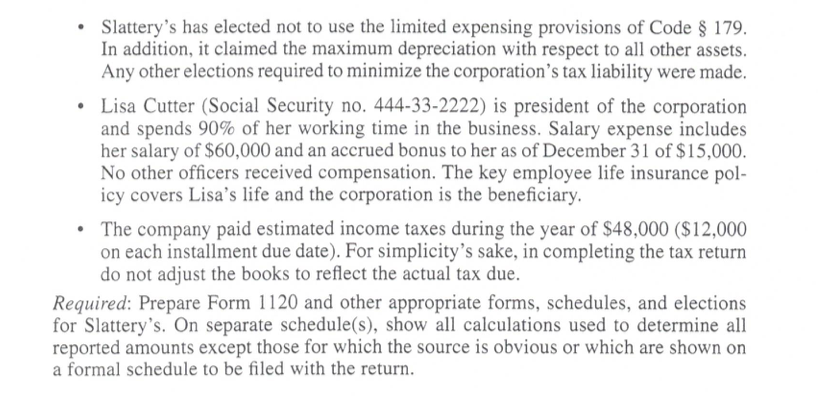

TAX RETURN PROBLEMS -48 During 2017, Lisa Cutter and Jeff McMullen decided they would like to start their own gourmet hamburger business. Lisa and Jeff believed that the public would love the recipes used by Lisa's mom, Tina Woodbrook. They also thought that they had the necessary experience to enter this business, as Jeff currently owned a fast-food franchise business while Lisa had experience operating a small bakery. After doing their own market research, they established Slattery's Inc., which was incorporated on February 1, 2018. The company's address is 5432 Partridge Pl., Tulsa, Oklahoma 74105 and its employer identification number is 88-7654321. The company started modestly. After refurbishing an old gas station that it had purchased, the company opened for business on February 25, 2018. Shortly after business began, however, business boomed. By the close of 2018 , the company had established two other locations. Slattery's has three shareholders who own stock as follows: Slattery's was formed on February 1, 2018. On that date, shareholders made contributions as follows: - Lisa Cutter contributed $30,000 in cash and 200 shares of MND stock, a publicly held company, which had a fair market value of $20,000. Lisa had purchased the MND stock on October 3, 2013 for $8,000. - Jeff McMullen contributed equipment worth $20,000 which he had used in his own business until he contributed it. The equipment's basis was $48,000 (original cost in February 2016, $100,000; depreciation using MACRS accelerated percentages for five-year property, $52,000 ). - Tina Woodbrook contributed $30,000 in cash. The company is on the accrual basis and has chosen to use the calendar year for tax purposes. The corporation's adjusted trial balance for financial accounting purposes reveals the following information: The company has provided additional information below. - The company took a physical count of inventory on December 31, 2018. On that date, it was determined that ending inventory was $16,000. This ending inventory must be recorded on the company's books and will result in a reduction in cost of goods sold. - On February 9, 2018, the corporation purchased an old gas station for $25,000 to house the restaurant. Of the $25,000 purchase price, $10,000 was allocated to the land while $15,000 was allocated to the building. Prior to opening, the old gas station was renovated. Improvements to the structure were made during February at a cost of $55,000. Assume the building and improvements are 39-year property. - The legal costs were for work done by Slattery's attorney in February for drafting the articles of incorporation and by-laws. Accounting fees that were paid in May were for setting up the books and the accounting system. Miscellaneous expenses included a $100 fee paid in February to the State of Oklahoma to incorporate. - The MND stock was sold for $38,000 on April 3, 2018. Shortly before the sale, MND had declared and paid a dividend. Slattery's received $2,000 on April 1 , 2018. MND was incorporated in Delaware. - The corporation purchased refrigeration equipment (7-year property) on February 15,2018 for $15,000. (Ignore bonus depreciation.) - Slattery's has elected not to use the limited expensing provisions of Code 179. In addition, it claimed the maximum depreciation with respect to all other assets. Any other elections required to minimize the corporation's tax liability were made. - Lisa Cutter (Social Security no. 444-33-2222) is president of the corporation and spends 90% of her working time in the business. Salary expense includes her salary of $60,000 and an accrued bonus to her as of December 31 of $15,000. No other officers received compensation. The key employee life insurance policy covers Lisa's life and the corporation is the beneficiary. - The company paid estimated income taxes during the year of $48,000($12,000 on each installment due date). For simplicity's sake, in completing the tax return do not adjust the books to reflect the actual tax due. Required: Prepare Form 1120 and other appropriate forms, schedules, and elections for Slattery's. On separate schedule(s), show all calculations used to determine all reported amounts except those for which the source is obvious or which are shown on a formal schedule to be filed with the return. TAX RETURN PROBLEMS -48 During 2017, Lisa Cutter and Jeff McMullen decided they would like to start their own gourmet hamburger business. Lisa and Jeff believed that the public would love the recipes used by Lisa's mom, Tina Woodbrook. They also thought that they had the necessary experience to enter this business, as Jeff currently owned a fast-food franchise business while Lisa had experience operating a small bakery. After doing their own market research, they established Slattery's Inc., which was incorporated on February 1, 2018. The company's address is 5432 Partridge Pl., Tulsa, Oklahoma 74105 and its employer identification number is 88-7654321. The company started modestly. After refurbishing an old gas station that it had purchased, the company opened for business on February 25, 2018. Shortly after business began, however, business boomed. By the close of 2018 , the company had established two other locations. Slattery's has three shareholders who own stock as follows: Slattery's was formed on February 1, 2018. On that date, shareholders made contributions as follows: - Lisa Cutter contributed $30,000 in cash and 200 shares of MND stock, a publicly held company, which had a fair market value of $20,000. Lisa had purchased the MND stock on October 3, 2013 for $8,000. - Jeff McMullen contributed equipment worth $20,000 which he had used in his own business until he contributed it. The equipment's basis was $48,000 (original cost in February 2016, $100,000; depreciation using MACRS accelerated percentages for five-year property, $52,000 ). - Tina Woodbrook contributed $30,000 in cash. The company is on the accrual basis and has chosen to use the calendar year for tax purposes. The corporation's adjusted trial balance for financial accounting purposes reveals the following information: The company has provided additional information below. - The company took a physical count of inventory on December 31, 2018. On that date, it was determined that ending inventory was $16,000. This ending inventory must be recorded on the company's books and will result in a reduction in cost of goods sold. - On February 9, 2018, the corporation purchased an old gas station for $25,000 to house the restaurant. Of the $25,000 purchase price, $10,000 was allocated to the land while $15,000 was allocated to the building. Prior to opening, the old gas station was renovated. Improvements to the structure were made during February at a cost of $55,000. Assume the building and improvements are 39-year property. - The legal costs were for work done by Slattery's attorney in February for drafting the articles of incorporation and by-laws. Accounting fees that were paid in May were for setting up the books and the accounting system. Miscellaneous expenses included a $100 fee paid in February to the State of Oklahoma to incorporate. - The MND stock was sold for $38,000 on April 3, 2018. Shortly before the sale, MND had declared and paid a dividend. Slattery's received $2,000 on April 1 , 2018. MND was incorporated in Delaware. - The corporation purchased refrigeration equipment (7-year property) on February 15,2018 for $15,000. (Ignore bonus depreciation.) - Slattery's has elected not to use the limited expensing provisions of Code 179. In addition, it claimed the maximum depreciation with respect to all other assets. Any other elections required to minimize the corporation's tax liability were made. - Lisa Cutter (Social Security no. 444-33-2222) is president of the corporation and spends 90% of her working time in the business. Salary expense includes her salary of $60,000 and an accrued bonus to her as of December 31 of $15,000. No other officers received compensation. The key employee life insurance policy covers Lisa's life and the corporation is the beneficiary. - The company paid estimated income taxes during the year of $48,000($12,000 on each installment due date). For simplicity's sake, in completing the tax return do not adjust the books to reflect the actual tax due. Required: Prepare Form 1120 and other appropriate forms, schedules, and elections for Slattery's. On separate schedule(s), show all calculations used to determine all reported amounts except those for which the source is obvious or which are shown on a formal schedule to be filed with the return