Question

Prepare the Rolling River Company balance sheet as of 1/1/17 assuming Rolling River Company purchased the Denmark Wheel Company in an ASSET ACQUISITION for $14

Prepare the Rolling River Company balance sheet as of 1/1/17 assuming Rolling River Company purchased the Denmark Wheel Company in an ASSET ACQUISITION for $14 million dollars. Provide enough detail for your CEO to understand the accounting.

Include the following:

Calculate (show your work) the amount of goodwill that will be recorded.

Provide the ASSET ACQUISTION journal entry (show separate from the schedule below).

Prepare a schedule showing

Pre-Asset Acquisition 1/1/17 Rolling River Company balance sheet account balances

Adjustments for the ASSET ACQUISTION journal entry

Post-Asset Acquisition 1/1/17 Rolling River Company balance sheet account balances

Other: Denmark Wheel Assets and Liabilities not included in the above balance sheet.

Patent $1,000,000 (Asset)

Brand Name $3,000,000 (Asset)

Lawsuit $1,700,000 (Liability)

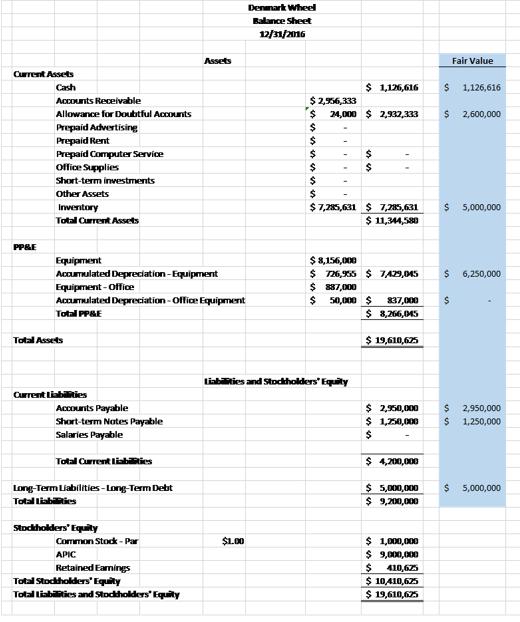

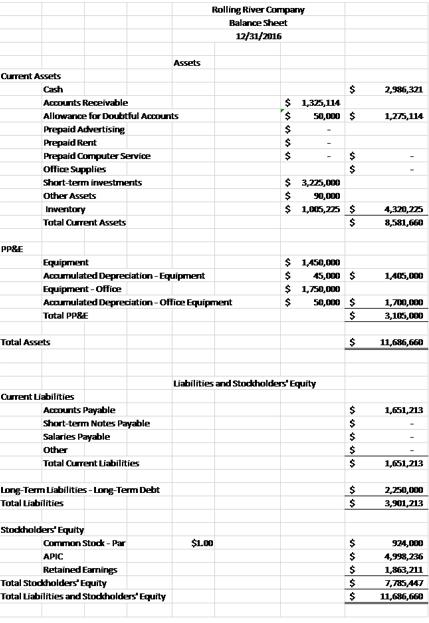

Current Assets Cash PP&E Accounts Receivable Allowance for Doubtful Accounts Prepaid Advertising Prepaid Rent Prepaid Computer Service Office Supplies Short-term investments Other Assets Inventory Total Current Assets Equipment Accumulated Depreciation-Equipment Equipment Office Accumulated Depreciation Office Equipment Total PP&E Total Assets Current Liabilities Accounts Payable Short-term Notes Payable Salaries Payable Total Current Liabilities Long-Term Liabilities-Long-Term Debt Total Liabilities Stockholders' Equity Common Stock-Par APIC Retained Earnings Assets Total Stockholders' Equity Total Liabilities and Stockholders' Equity Denmark Wheel Balance Sheet 12/31/2016 $1.00 $ 1,126,616 $ 2,956,333 $ 24,000 $2,932,333 $ $ $ $ $ $ $ $ Liabilities and Stockholders' Equity - $ 8,156,000 $ 726,955 $ 7/29,045 $ 887,000 $ 50,000 $ 837,000 $ 3,266,045 $ 19,610,675 $ $ $7,285,631 $ 7,285,631 $ 5,000,000 $ 11,344,580 $ 1,000,000 $ 9,000,000 $ 410,625 $ 10,410,625 $ 19,610,675 $ Fair Value $ 1,126,616 2,600,000 6,250,000 $ 2,950,000 $ 2,950,000 $ 1,250,000 $ 1,250,000 $ $ 4,200,000 $ 5,000,000 $ 5,000,000 $ 9,200,000

Step by Step Solution

3.24 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Interest dividends and annuities income are classified as Passi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started