Answered step by step

Verified Expert Solution

Question

1 Approved Answer

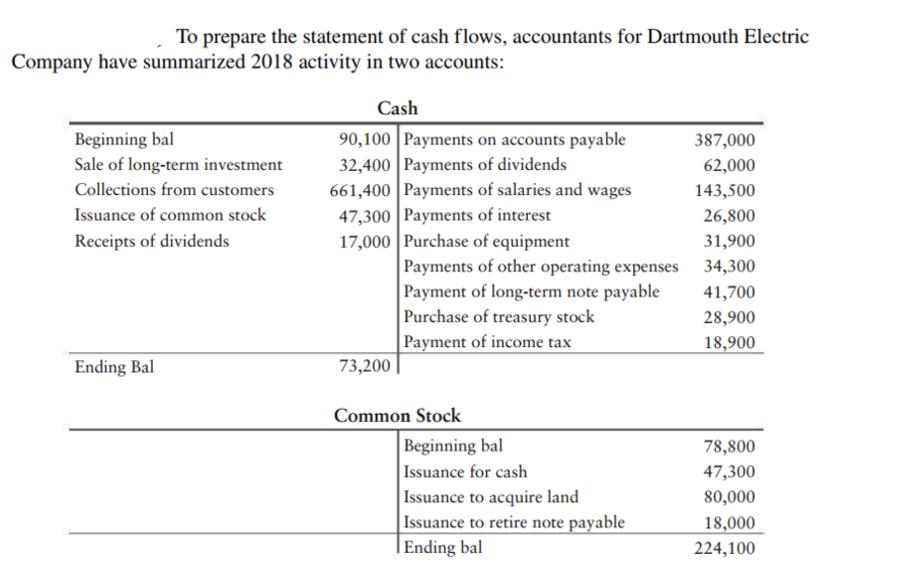

To prepare the statement of cash flows, accountants for Dartmouth Electric Company have summarized 2018 activity in two accounts: Cash Beginning bal Sale of

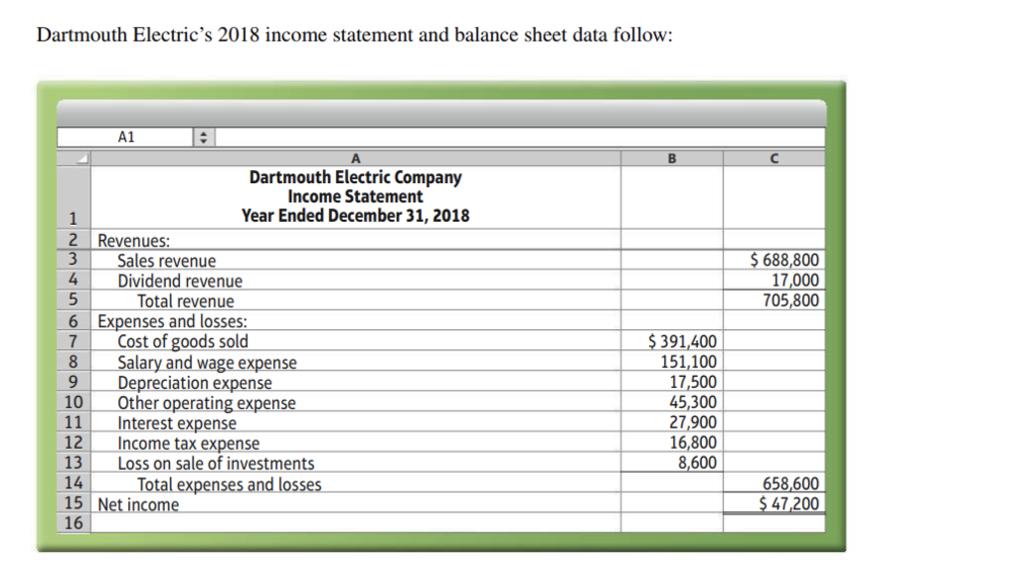

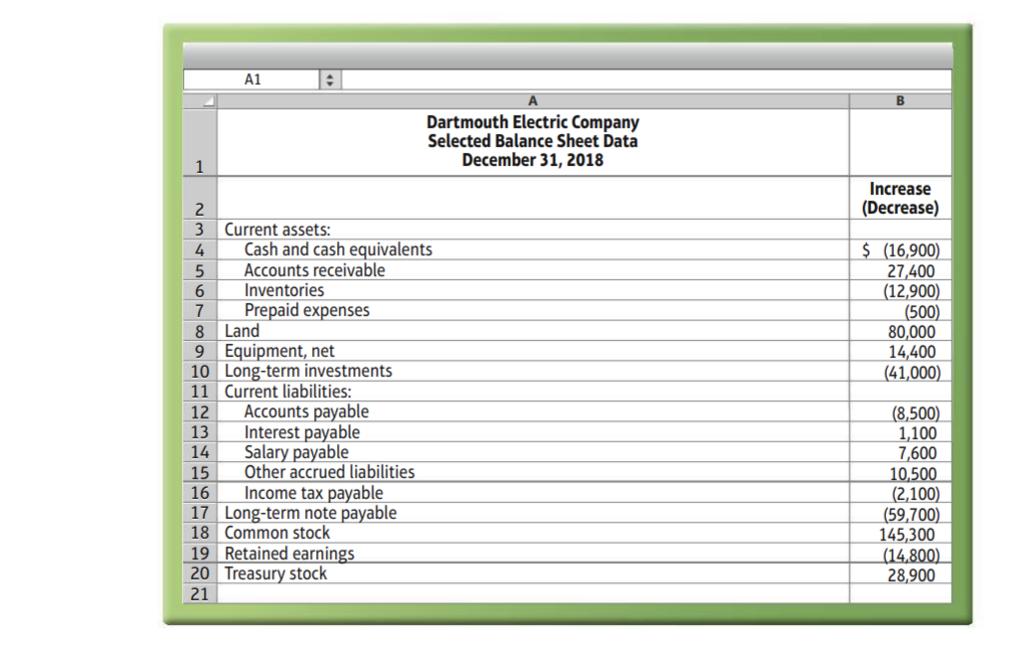

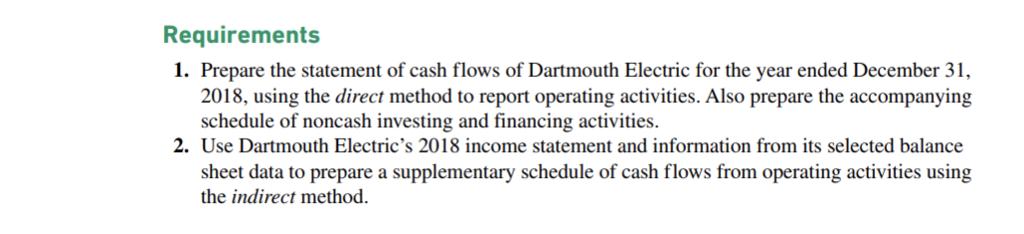

To prepare the statement of cash flows, accountants for Dartmouth Electric Company have summarized 2018 activity in two accounts: Cash Beginning bal Sale of long-term investment Collections from customers 90,100 Payments on accounts payable 387,000 32,400 Payments of dividends 62,000 661,400 Payments of salaries and wages 143,500 47,300 Payments of interest 17,000 Purchase of equipment Payments of other operating expenses 34,300 Payment of long-term note payable Purchase of treasury stock Payment of income tax Issuance of common stock 26,800 Receipts of dividends 31,900 41,700 28,900 18,900 Ending Bal 73,200 Common Stock Beginning bal Issuance for cash Issuance to acquire land Issuance to retire note payable |Ending bal 78,800 47,300 80,000 18,000 224,100 Dartmouth Electric's 2018 income statement and balance sheet data follow: A1 Dartmouth Electric Company Income Statement Year Ended December 31, 2018 1 2 Revenues: 3 Sales revenue Dividend revenue Total revenue 6 Expenses and losses: $ 688,800 17,000 705,800 5. Cost of goods sold Salary and wage expense Depreciation expense Other operating expense Interest expense Income tax expense Loss on sale of investments Total expenses and losses $ 391,400 151,100 17,500 45,300 27,900 16,800 8,600 7 10 11 12 13 658,600 $ 47,200 14 15 Net income 16 A1 Dartmouth Electric Company Selected Balance Sheet Data December 31, 2018 1 Increase (Decrease) 2 Current assets: Cash and cash equivalents Accounts receivable Inventories $ (16,900) 27,400 (12,900) (500) 80,000 14,400 (41,000) 6 Prepaid expenses Land 9 Equipment, net 10 Long-term investments 11 Current liabilities: Accounts payable 7 8 12 (8,500) 1,100 7,600 10,500 (2,100) (59,700) 145,300 (14,800) 28,900 Interest payable 14 13 Salary payable Other accrued liabilities Income tax payable 17 Long-term note payable 18 Common stock 19 Retained earnings 20 Treasury stock 15 16 21 Requirements 1. Prepare the statement of cash flows of Dartmouth Electric for the year ended December 31, 2018, using the direct method to report operating activities. Also prepare the accompanying schedule of noncash investing and financing activities. 2. Use Dartmouth Electric's 2018 income statement and information from its selected balance sheet data to prepare a supplementary schedule of cash flows from operating activities using the indirect method. To prepare the statement of cash flows, accountants for Dartmouth Electric Company have summarized 2018 activity in two accounts: Cash Beginning bal Sale of long-term investment Collections from customers 90,100 Payments on accounts payable 387,000 32,400 Payments of dividends 62,000 661,400 Payments of salaries and wages 143,500 47,300 Payments of interest 17,000 Purchase of equipment Payments of other operating expenses 34,300 Payment of long-term note payable Purchase of treasury stock Payment of income tax Issuance of common stock 26,800 Receipts of dividends 31,900 41,700 28,900 18,900 Ending Bal 73,200 Common Stock Beginning bal Issuance for cash Issuance to acquire land Issuance to retire note payable |Ending bal 78,800 47,300 80,000 18,000 224,100 Dartmouth Electric's 2018 income statement and balance sheet data follow: A1 Dartmouth Electric Company Income Statement Year Ended December 31, 2018 1 2 Revenues: 3 Sales revenue Dividend revenue Total revenue 6 Expenses and losses: $ 688,800 17,000 705,800 5. Cost of goods sold Salary and wage expense Depreciation expense Other operating expense Interest expense Income tax expense Loss on sale of investments Total expenses and losses $ 391,400 151,100 17,500 45,300 27,900 16,800 8,600 7 10 11 12 13 658,600 $ 47,200 14 15 Net income 16 A1 Dartmouth Electric Company Selected Balance Sheet Data December 31, 2018 1 Increase (Decrease) 2 Current assets: Cash and cash equivalents Accounts receivable Inventories $ (16,900) 27,400 (12,900) (500) 80,000 14,400 (41,000) 6 Prepaid expenses Land 9 Equipment, net 10 Long-term investments 11 Current liabilities: Accounts payable 7 8 12 (8,500) 1,100 7,600 10,500 (2,100) (59,700) 145,300 (14,800) 28,900 Interest payable 14 13 Salary payable Other accrued liabilities Income tax payable 17 Long-term note payable 18 Common stock 19 Retained earnings 20 Treasury stock 15 16 21 Requirements 1. Prepare the statement of cash flows of Dartmouth Electric for the year ended December 31, 2018, using the direct method to report operating activities. Also prepare the accompanying schedule of noncash investing and financing activities. 2. Use Dartmouth Electric's 2018 income statement and information from its selected balance sheet data to prepare a supplementary schedule of cash flows from operating activities using the indirect method.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Direct Method Dartmouth Electric Company Statement of Cash Flows For the year ended December 31 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started