Question

Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On January 1 of Year 1, Stealth Company sold a machine (classified as

Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On January 1 of Year 1, Stealth Company sold a machine (classified as inventory) that had a list price of $36,000. The customer paid $6,000 cash and signed a three-year, $30,000 note that specified a stated rate of 3%. Annual interest on the full amount of the principal is payable each December 31. The principal is payable on December 31, three years later. The market rate for a note of this risk is 10%.

Required

a. Compute the present value of this note.

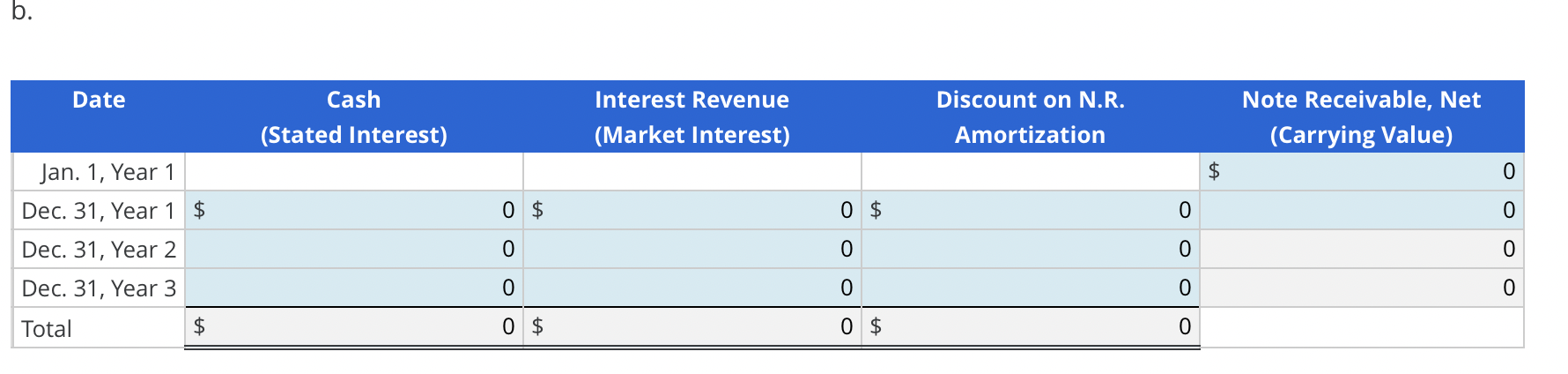

b. Prepare an effective interest schedule for this note.

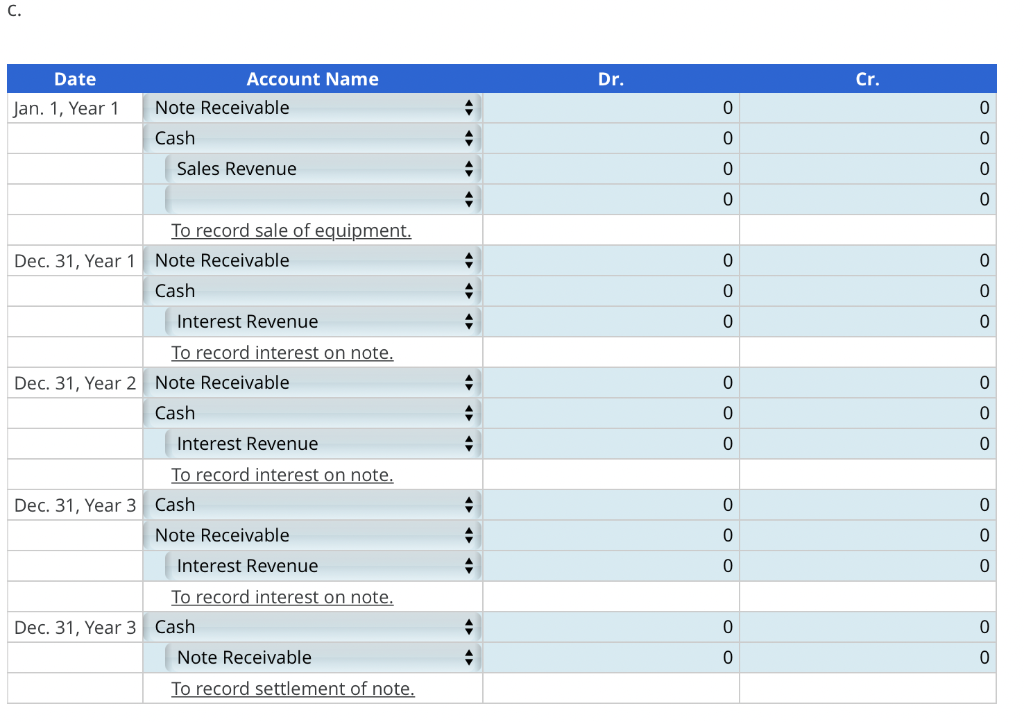

c. Prepare entries required by Stealth for this note on January 1 of Year 1, and December 31 of Year 1, Year 2, and Year 3.

Note: Round answers to the nearest whole dollar.

a. Present value of note: $

b.

c.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started