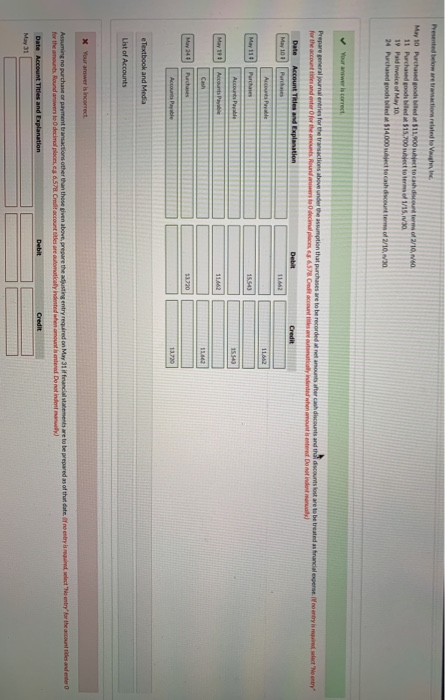

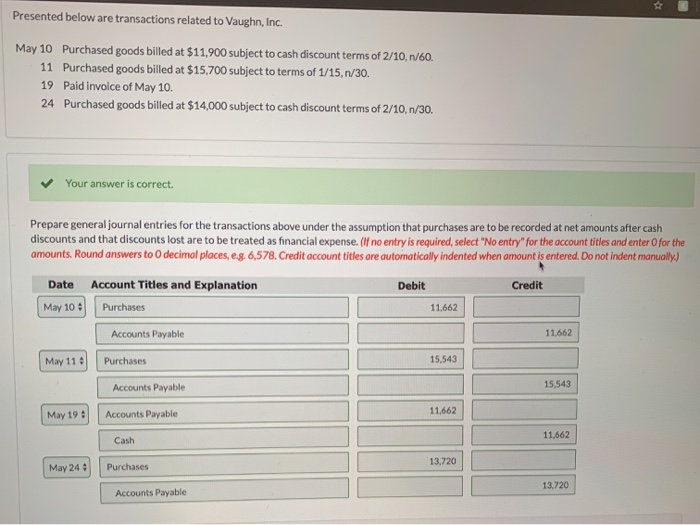

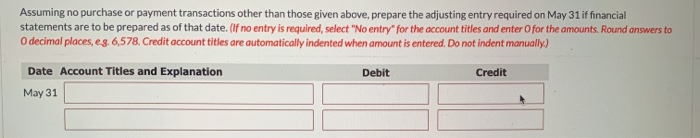

Presented below are transaction related to hinc May 10 Perchased goods 11 Purchased god led 19 Paldinvoice of May 10 24 Purchased goods led $11.900 $15.700 och discount forms of/10. tons of 1/15.30 $14.000 cash counterm of 2/10,30 Your awer is correct Prepare general al entries for the transactions above under the assumption that purchases are to be recorded M for the accounts and enter for them to decimal places . 6.578. Ce n a s tercash discounts and discounts lost are to be treated as financial when amount is entered Donde story to try y Date Account Tales and Explanation Debit Accountable May 11 May 240 e Textbook and Media List of Accounts x your answer is incorrect Assuming no purchase or payment transactions other than those given above, prepare the susting entry required on May 31 if financial sta for the amounts Round anwers to decimal places, 657 Creditaccount e maty Indented her mounte d Do not indien t s are to be prepared as of that date freesty l e Mentor the countries and entero Date Account Titles and Explanation May 31 Presented below are transactions related to Vaughn, Inc. May 10 Purchased goods billed at $11,900 subject to cash discount terms of 2/10, 1/60 11 Purchased goods billed at $15,700 subject to terms of 1/15,n/30. 19 Paid invoice of May 10. 24 Purchased goods billed at $14,000 subject to cash discount terms of 2/10, 1/30. Your answer is correct. Prepare general journal entries for the transactions above under the assumption that purchases are to be recorded at net amounts after cash discounts and that discounts lost are to be treated as financial expense. (if no entry is required, select "No entry for the account titles and enter for the amounts. Round answers to decimal places, e.g. 6,578. Credit account titles are automatically indented when amount is entered. Do not indent manually) Debit Credit Date May 10 Account Titles and Explanation Purchases 11,662 Accounts Payable 11,662 May 11 Purchases 15,543 Accounts Payable 15,543 May 19 : Accounts Payable 11.662 11.662 I Cash 13,720 May 24 Purchases 13.720 Accounts Payable Assuming no purchase or payment transactions other than those given above, prepare the adjusting entry required on May 31 if financial statements are to be prepared as of that date. (If no entry is required, select "No entry for the account titles and enter for the amounts. Round answers to O decimal places, e g. 6,578. Credit account titles are automatically indented when amount is entered. Do not indent manually) Debit Credit Date Account Titles and Explanation May 31