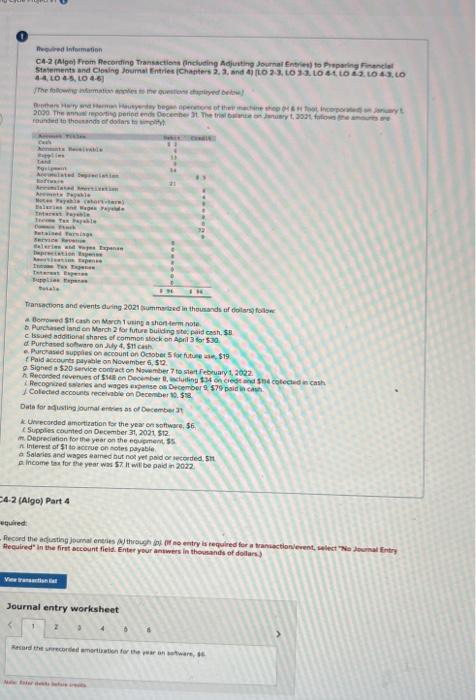

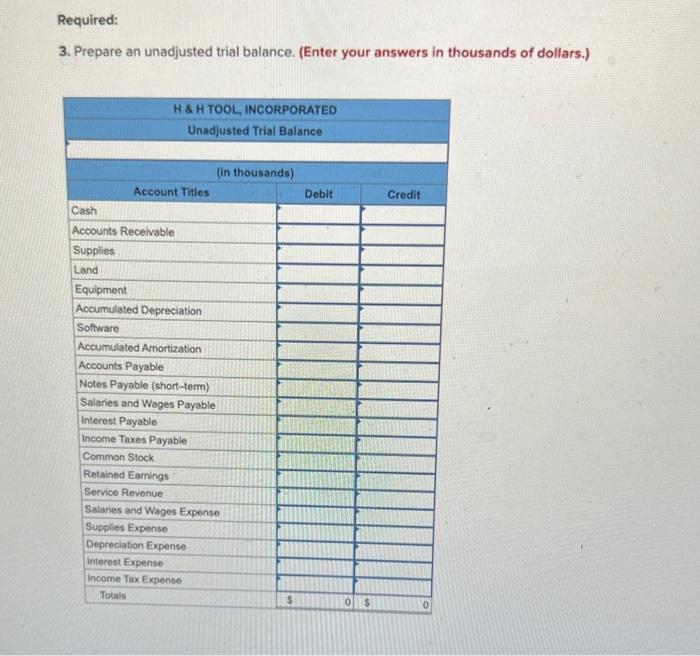

Presised informstion 4-4, t. 4. B. Li. 4.6 fitirnted to thest moth of doliars ta wi-pityl Tiansocoons and events duing 2021 trummerted in theusands of toidse) folse 2. Borrowed 511 cash on Merch 1 using a shortem note. b. Puesaled tana en March 2 for future buiking whe, paid cash, \$B C tssued additional thares of eommon stock on April 3 lot 530 . d. Purehted sotware on Jly 4 , 511 cath. e. Parcased supplies on eccount on Dcaober 5 lor tutuat ale, 519 . f. Paid acceunes palyatile on November 5,512 . g. Signed a 520 service conyact on Nawember 7 to stet february 1, 2022. if Pecogried toleres and wages expense cos Decermbor 2579 poid th cash. 1. Colected accourer receivabie an Decenber th. 518 . Date far tefintiva loumal erteries as of December 7t i. Wivecorded ambitization for the year on sottware, \$5. 1. 5upplies coutted on December 31, 2021, 512 m. Depreciation for the year on the eeupment \$s. -1. Inierest of $1 te accrue on notes poyatie a Salaries and wages eained but noe yet paid or aecorded, 5H. . Income tas for the year was 57 it wi be paid mi 202. C4.2 (Algo) Part 4 equired: Aecuired" in the first account fleid. Enter your antwers in thermands of dollars.) Journal entry worksheet 1424340 3. Prepare an unadjusted trial balance. (Enter your answers in thousands of dollars.) Presised informstion 4-4, t. 4. B. Li. 4.6 fitirnted to thest moth of doliars ta wi-pityl Tiansocoons and events duing 2021 trummerted in theusands of toidse) folse 2. Borrowed 511 cash on Merch 1 using a shortem note. b. Puesaled tana en March 2 for future buiking whe, paid cash, \$B C tssued additional thares of eommon stock on April 3 lot 530 . d. Purehted sotware on Jly 4 , 511 cath. e. Parcased supplies on eccount on Dcaober 5 lor tutuat ale, 519 . f. Paid acceunes palyatile on November 5,512 . g. Signed a 520 service conyact on Nawember 7 to stet february 1, 2022. if Pecogried toleres and wages expense cos Decermbor 2579 poid th cash. 1. Colected accourer receivabie an Decenber th. 518 . Date far tefintiva loumal erteries as of December 7t i. Wivecorded ambitization for the year on sottware, \$5. 1. 5upplies coutted on December 31, 2021, 512 m. Depreciation for the year on the eeupment \$s. -1. Inierest of $1 te accrue on notes poyatie a Salaries and wages eained but noe yet paid or aecorded, 5H. . Income tas for the year was 57 it wi be paid mi 202. C4.2 (Algo) Part 4 equired: Aecuired" in the first account fleid. Enter your antwers in thermands of dollars.) Journal entry worksheet 1424340 3. Prepare an unadjusted trial balance. (Enter your answers in thousands of dollars.)