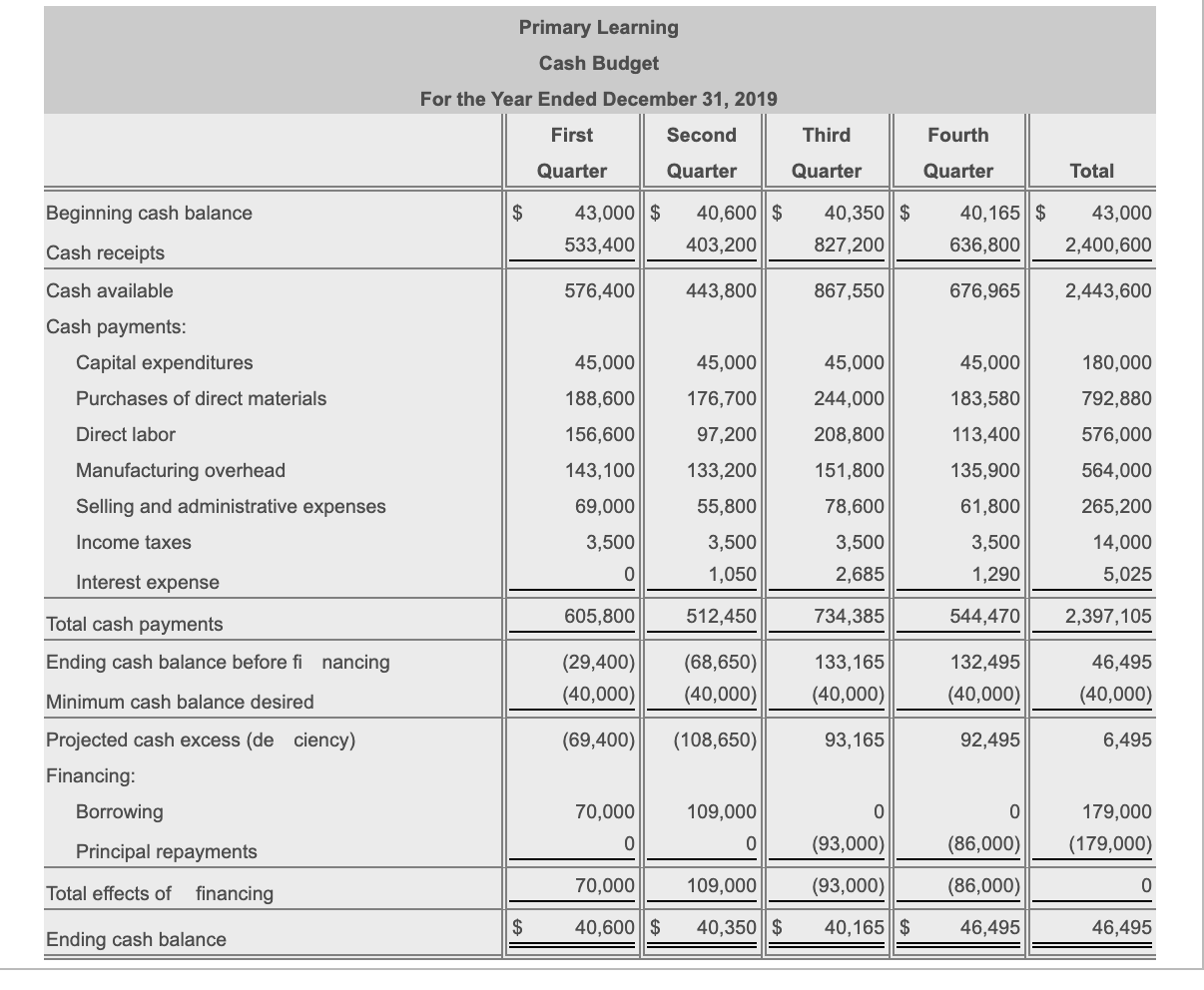

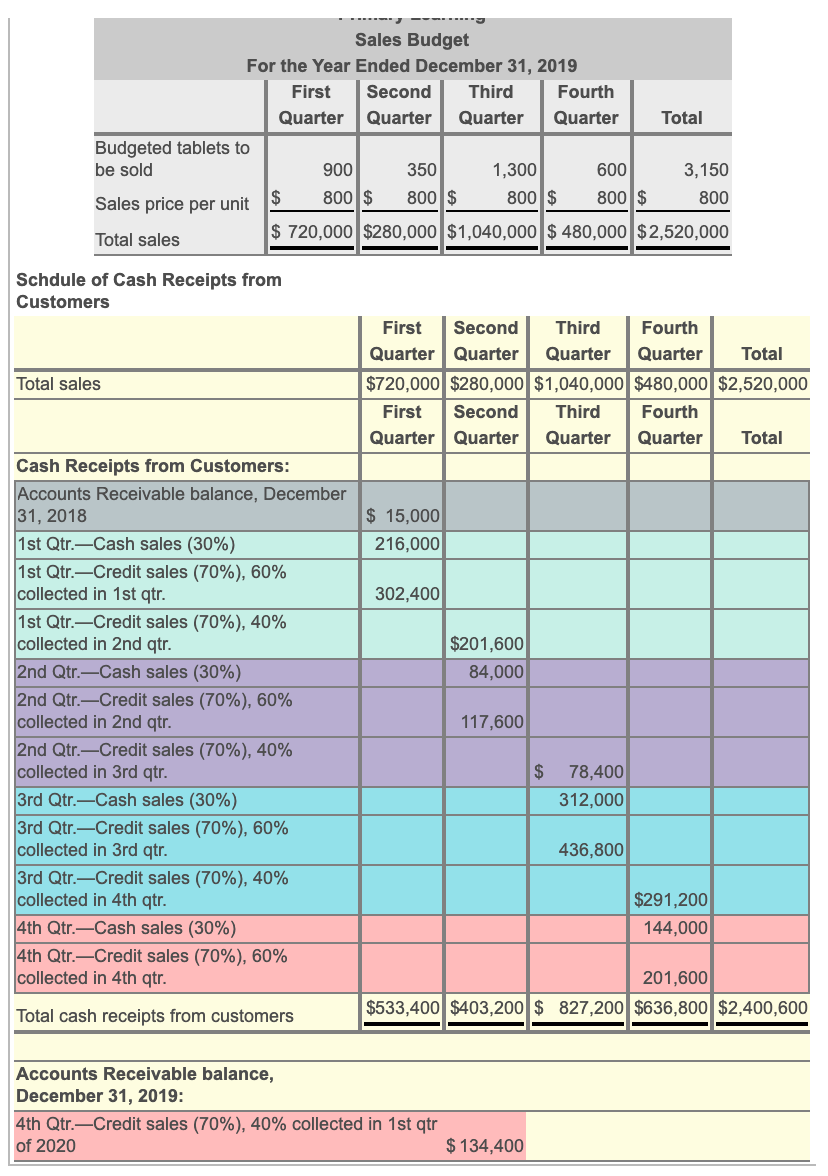

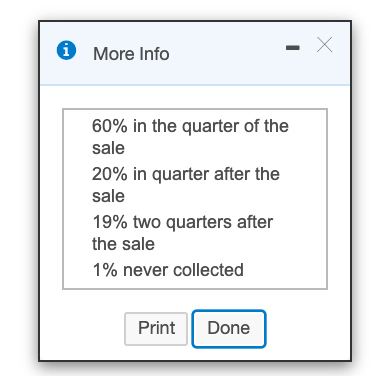

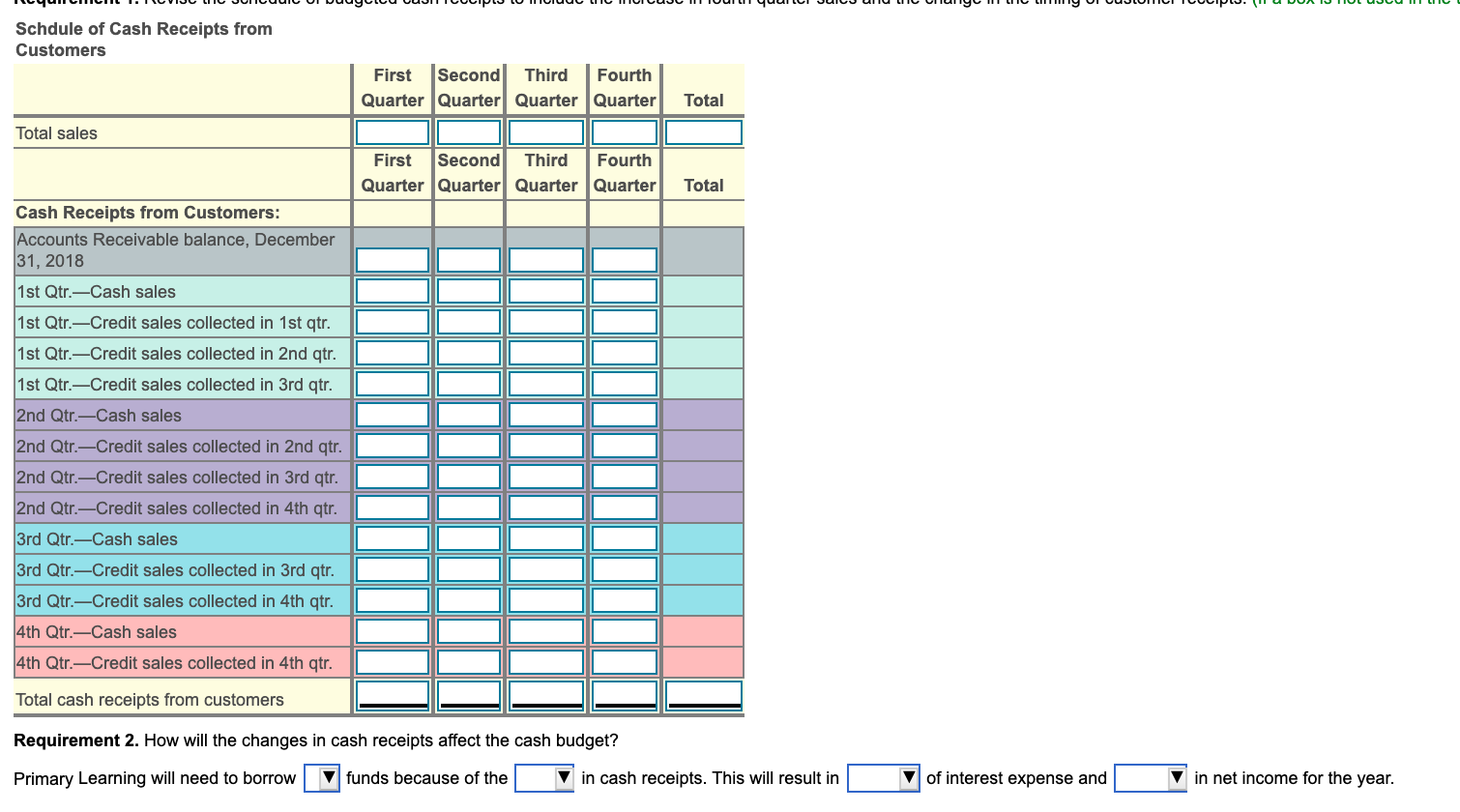

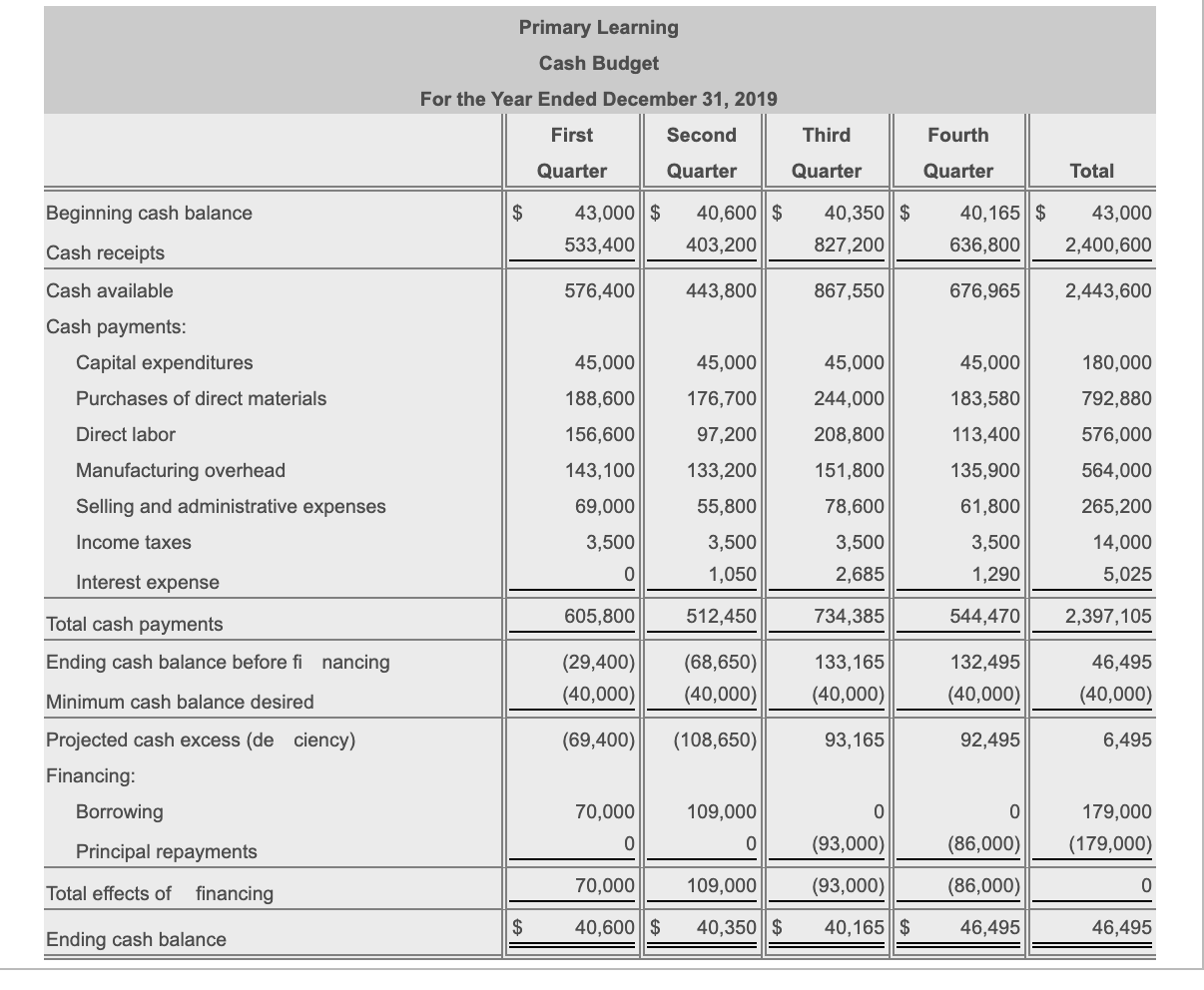

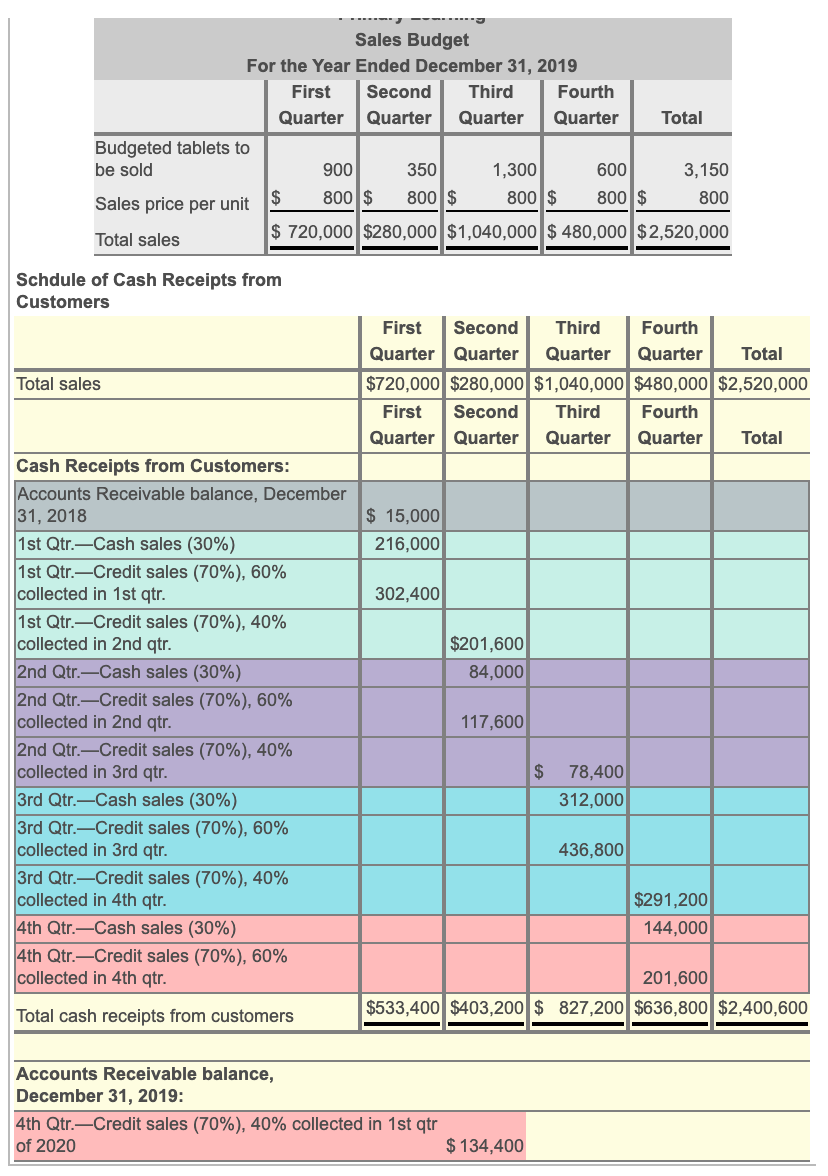

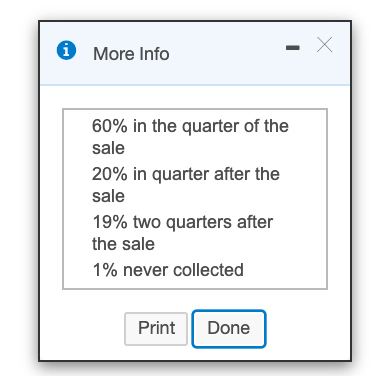

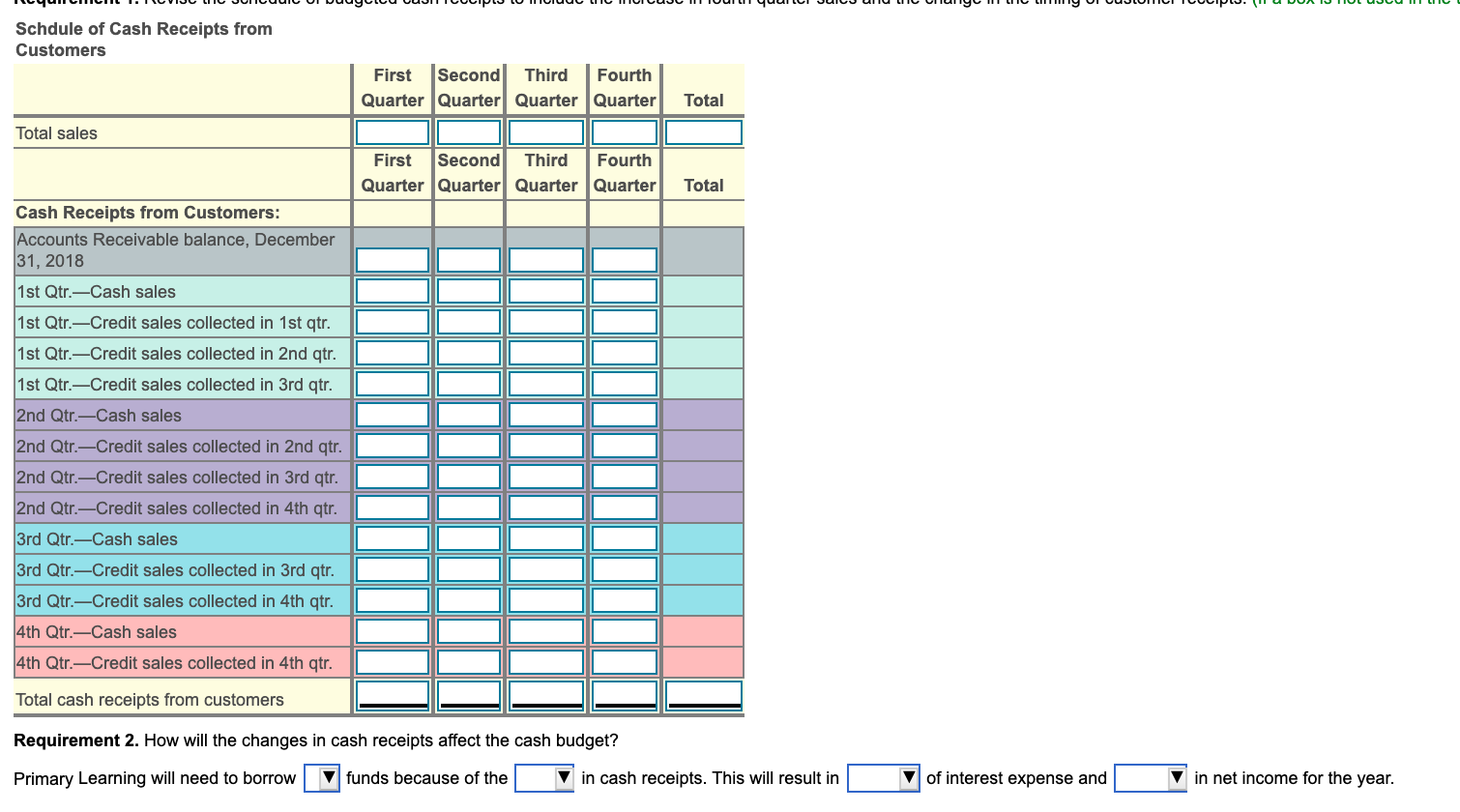

Primary Learning Cash Budget For the Year Ended December 31, 2019 First Second Quarter Quarter Third Fourth Quarter Quarter Total Beginning cash balance $ 43,000 | $ 533,400 40,600 || $ 403,200 40,350 $ 827,200 40,165|| $ 636,800 43,000 2,400,600 Cash receipts 576,400 443,800 867,550 676,965 2,443,600 Cash available Cash payments: Capital expenditures Purchases of direct materials 45,000 45,000 180,000 Direct labor 45,000 188,600 156,600 143,100 69,000 Manufacturing overhead Selling and administrative expenses 45,000 176,700 97,200 133,200 55,800 3,500 1,050 244,000 208,800 151,800 78,600 3,500 2,685 183,580 113,400 135,900 61,800 3,500 1,290 792,880 576,000 564,000 265,200 14,000 5,025 Income taxes 3,500 Interest expense 605,800 512,450 734,385 544,470 2,397,105 Total cash payments Ending cash balance before financing (29,400) (40,000) (68,650) (40,000) 133,165 (40,000) 132,495 (40,000) 46,495 (40,000) Minimum cash balance desired (69,400) (108,650) 93,165 92,495 6,495 Projected cash excess (de ciency) Financing: Borrowing 109,000 70,000 0 179,000 (179,000) Principal repayments (93,000) (86,000) Total effects of financing 70,000 109,000 (93,000) (86,000) 40,600 $ 40,350 $ 40,165 $ 46,495 46,495 Ending cash balance Sales Budget For the Year Ended December 31, 2019 First Second Third Fourth Quarter I Quarter Quarter Quarter Total Budgeted tablets to be sold 900 350 1,300 600 3,150 Sales price per unit $ 800 $ 800 $ 800 $ 800 $ 800 Total sales $ 720,000 $280,000 $1,040,000 $ 480,000 $2,520,000 Schdule of Cash Receipts from Customers Total sales First Second Third Fourth Quarter Quarter Quarter Quarter Total $720,000 $280,000 $1,040,000 $480,000 $2,520,000 First Second Third Fourth Quarter Quarter Quarter Quarter Total $ 15,000 216,000 302,400 $201,600 84,000 Cash Receipts from Customers: Accounts Receivable balance, December 31, 2018 1st Qtr.Cash sales (30%) 1st Qtr.Credit sales (70%), 60% collected in 1st qtr. 1st Qtr.Credit sales (70%), 40% collected in 2nd qtr. 2nd Qtr.Cash sales (30%) 2nd Qtr.Credit sales (70%), 60% collected in 2nd qtr. 2nd Qtr.Credit sales (70%), 40% collected in 3rd qtr. 3rd Qtr.Cash sales (30%) 3rd Qtr.Credit sales (70%), 60% collected in 3rd qtr. 3rd Qtr.Credit sales (70%), 40% collected in 4th qtr. 4th Qtr.Cash sales (30%) 4th Qtr.Credit sales (70%), 60% collected in 4th qtr. 117,600 $ 78,400 312,000 436,800 $291,200 144,000 201,600 $533,400 $403,200 $ 827,200 $636,800 $2,400,600 Total cash receipts from customers Accounts Receivable balance, December 31, 2019: 4th Qtr.-Credit sales (70%), 40% collected in 1st qtr of 2020 $ 134,400 6 More Info - 60% in the quarter of the sale 20% in quarter after the sale 19% two quarters after the sale 1% never collected Print Done ICYUI CIL 1.II VIJU LIIC JUILUUIU UI WUuYCU UUDIILUCIU LUMIUIUU LIIC IIIUITUJ IUUILITYUUICI JUICU UULIT UIIUITY III LIIULILITY UI UUUULICITUPU. (11 U VUAJTIULUJU LIIC Schdule of Cash Receipts from Customers First Second Third Fourth Quarter Quarter Quarter Quarter Total Total sales First Third Fourth Quarter Quarter Quarter Quarter! Total Cash Receipts from Customers: Accounts Receivable balance, December 31, 2018 1st Qtr.Cash sales 1st Qtr.Credit sales collected in 1st qtr. 1st Qtr.-Credit sales collected in 2nd qtr. 1st Qtr.Credit sales collected in 3rd qtr. 2nd Qtr.Cash sales 2nd Qtr.-Credit sales collected in 2nd qtr. 2nd Qtr.-Credit sales collected in 3rd qtr. 2nd Qtr.-Credit sales collected in 4th qtr. 3rd Qtr. Cash sales 3rd Qtr.-Credit sales collected in 3rd qtr. 3rd Qtr.Credit sales collected in 4th qtr. 4th Qtr.Cash sales 4th Qtr.-Credit sales collected in 4th qtr. Total cash receipts from customers Requirement 2. How will the changes in cash receipts affect the cash budget? Primary Learning will need to borrow V funds because of the in cash receipts. This will result in of interest expense and in net income for the year