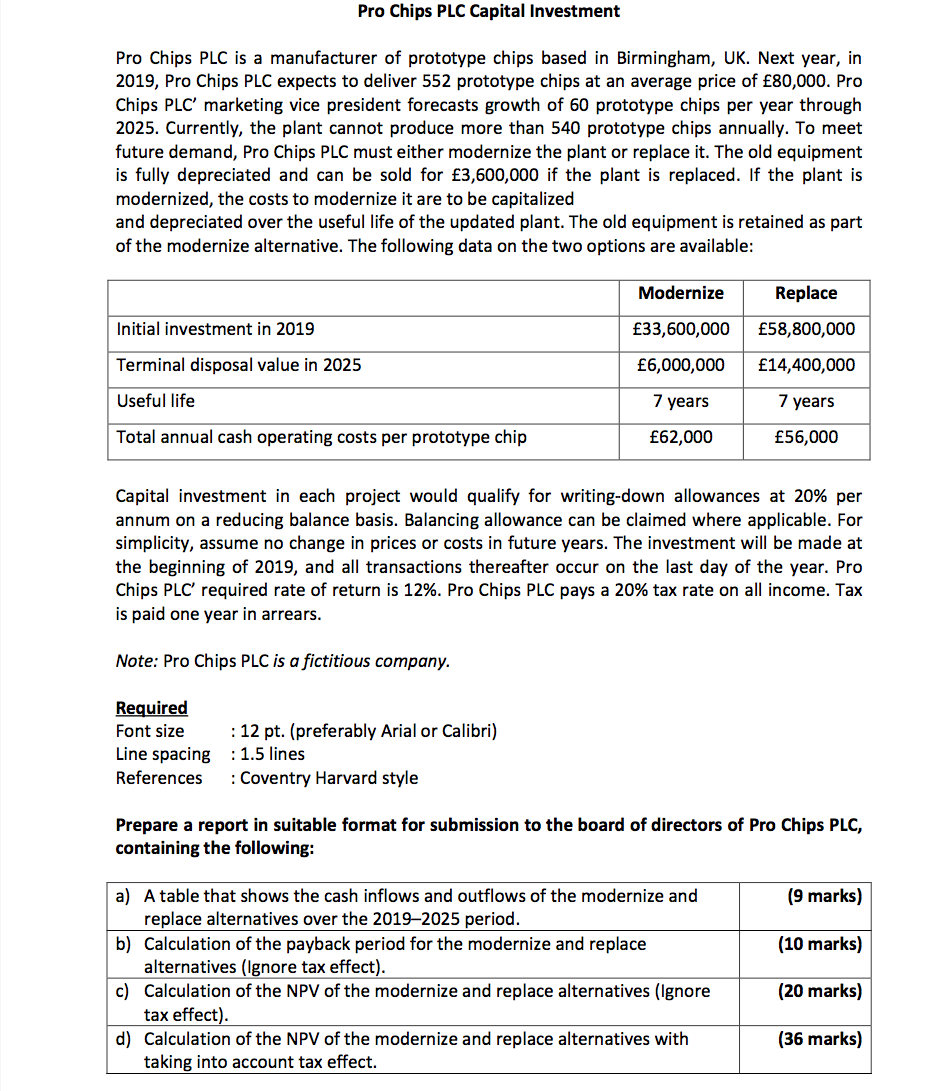

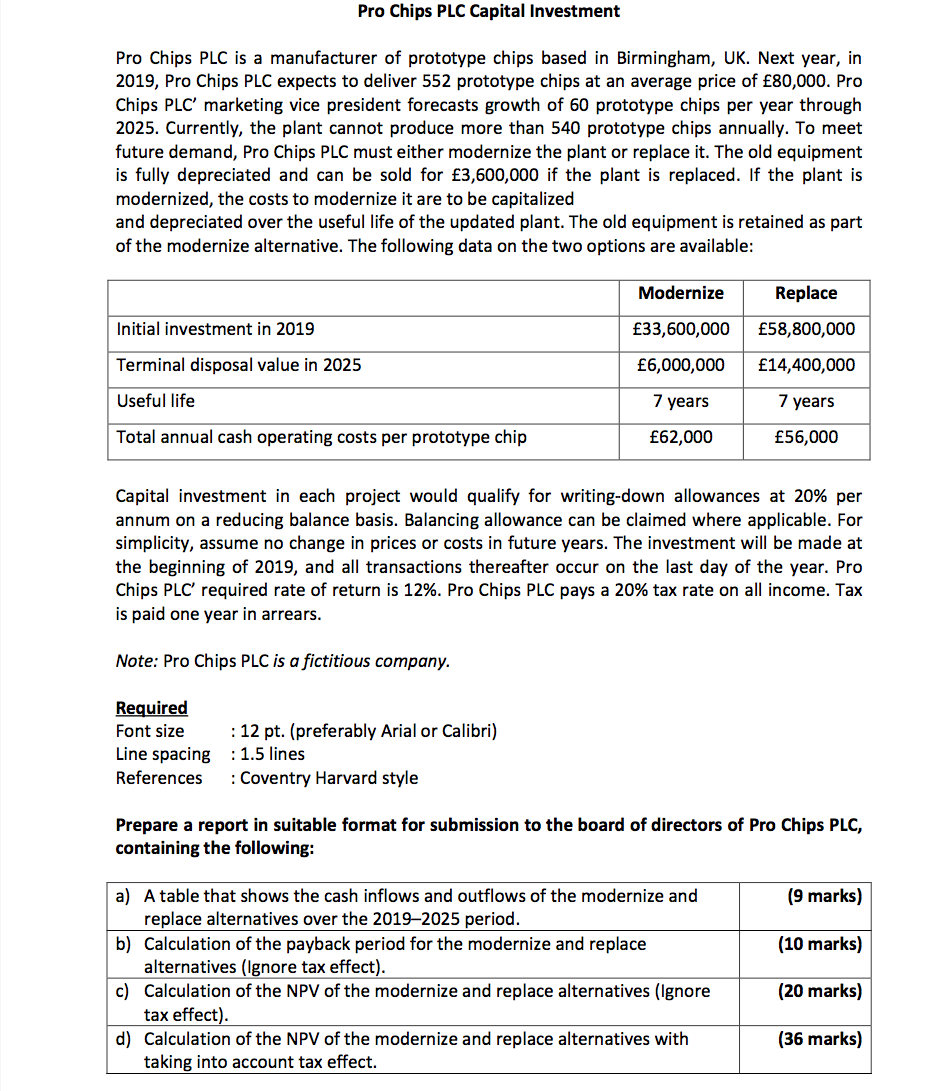

Pro Chips PLC Capital Investment Pro Chips PLC is a manufacturer of prototype chips based in Birmingham, UK. Next year, in 2019, Pro Chips PLC expects to deliver 552 prototype chips at an average price of 80,000. Pro Chips PLC marketing vice president forecasts growth of 60 prototype chips per year through 2025. Currently, the plant cannot produce more than 540 prototype chips annually. To meet future demand, Pro Chips PLC must either modernize the plant or replace it. The old equipment is fully depreciated and can be sold for 3,600,000 if the plant is replaced. If the plant is modernized, the costs to modernize it are to be capitalized and depreciated over the useful life of the updated plant. The old equipment is retained as part of the modernize alternative. The following data on the two options are available: Modernize Replace Initial investment in 2019 33,600,000 6,000,000 58,800,000 14,400,000 Terminal disposal value in 2025 Useful life 7 years 7 years Total annual cash operating costs per prototype chip 62,000 56,000 Capital investment in each project would qualify for writing-down allowances at 20% per annum on a reducing balance basis. Balancing allowance can be claimed where applicable. For simplicity, assume no change in prices or costs in future years. The investment will be made at the beginning of 2019, and all transactions thereafter occur on the last day of the year. Pro Chips PLC' required rate of return is 12%. Pro Chips PLC pays a 20% tax rate on all income. Tax is paid one year in arrears. Note: Pro Chips PLC is a fictitious company. Required Font size Line spacing References : 12 pt. (preferably Arial or Calibri) : 1.5 lines : Coventry Harvard style Prepare a report in suitable format for submission to the board of directors of Pro Chips PLC, containing the following: (9 marks) (10 marks) a) A table that shows the cash inflows and outflows of the modernize and replace alternatives over the 2019-2025 period. b) Calculation of the payback period for the modernize and replace alternatives (Ignore tax effect). c) Calculation of the NPV of the modernize and replace alternatives (Ignore tax effect). d) Calculation of the NPV of the modernize and replace alternatives with taking into account tax effect. (20 marks) (36 marks) Pro Chips PLC Capital Investment Pro Chips PLC is a manufacturer of prototype chips based in Birmingham, UK. Next year, in 2019, Pro Chips PLC expects to deliver 552 prototype chips at an average price of 80,000. Pro Chips PLC marketing vice president forecasts growth of 60 prototype chips per year through 2025. Currently, the plant cannot produce more than 540 prototype chips annually. To meet future demand, Pro Chips PLC must either modernize the plant or replace it. The old equipment is fully depreciated and can be sold for 3,600,000 if the plant is replaced. If the plant is modernized, the costs to modernize it are to be capitalized and depreciated over the useful life of the updated plant. The old equipment is retained as part of the modernize alternative. The following data on the two options are available: Modernize Replace Initial investment in 2019 33,600,000 6,000,000 58,800,000 14,400,000 Terminal disposal value in 2025 Useful life 7 years 7 years Total annual cash operating costs per prototype chip 62,000 56,000 Capital investment in each project would qualify for writing-down allowances at 20% per annum on a reducing balance basis. Balancing allowance can be claimed where applicable. For simplicity, assume no change in prices or costs in future years. The investment will be made at the beginning of 2019, and all transactions thereafter occur on the last day of the year. Pro Chips PLC' required rate of return is 12%. Pro Chips PLC pays a 20% tax rate on all income. Tax is paid one year in arrears. Note: Pro Chips PLC is a fictitious company. Required Font size Line spacing References : 12 pt. (preferably Arial or Calibri) : 1.5 lines : Coventry Harvard style Prepare a report in suitable format for submission to the board of directors of Pro Chips PLC, containing the following: (9 marks) (10 marks) a) A table that shows the cash inflows and outflows of the modernize and replace alternatives over the 2019-2025 period. b) Calculation of the payback period for the modernize and replace alternatives (Ignore tax effect). c) Calculation of the NPV of the modernize and replace alternatives (Ignore tax effect). d) Calculation of the NPV of the modernize and replace alternatives with taking into account tax effect. (20 marks) (36 marks)