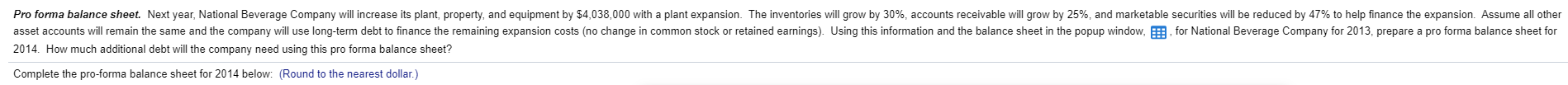

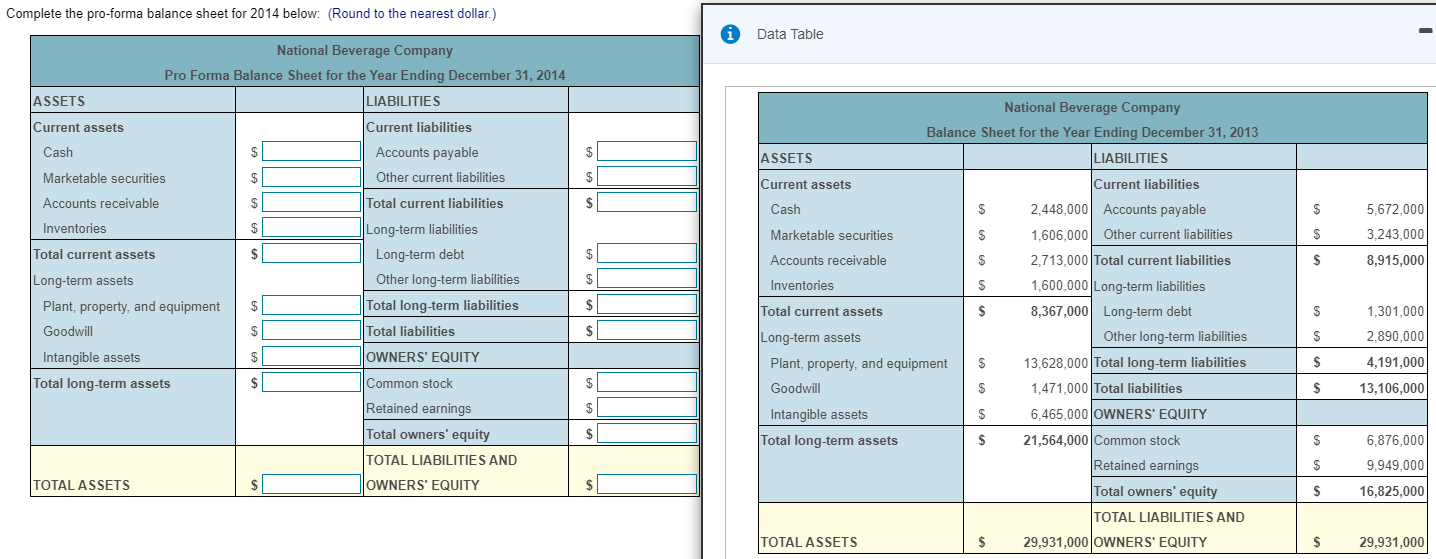

Pro forma balance sheet. Next year, National Beverage Company will increase its plant, property, and equipment by $4,038,000 with a plant expansion. The inventories will grow by 30%, accounts receivable will grow by 25%, and marketable securities will be reduced by 47% to help finance the expansion. Assume all other asset accounts will remain the same and the company will use long-term debt to finance the remaining expansion costs (no change in common stock or retained earnings). Using this information and the balance sheet in the popup window, B. for National Beverage Company for 2013, prepare a pro forma balance sheet for 2014. How much additional debt will the company need using this pro forma balance sheet? Complete the pro-forma balance sheet for 2014 below: (Round to the nearest dollar.) Complete the pro-forma balance sheet for 2014 below: (Round to the nearest dollar.) Data Table National Beverage Company Pro Forma Balance Sheet for the Year Ending December 31, 2014 LIABILITIES JASSETS Current assets National Beverage Company Balance Sheet for the Year Ending December 31, 2013 LIABILITIES Cash $ Current liabilities Accounts payable Other current liabilities Total current liabilities ASSETS $ Marketable securities Accounts receivable Current assets $ $ Cash S S 5,672,000 Inventories $ Current liabilities 2,448,000 Accounts payable 1,606,000| Other current liabilities 2,713,000 Total current liabilities $ $ 3,243,000 Total current assets $ $ Marketable securities Accounts receivable Inventories S $ 8,915,000 Long-term liabilities Long-term debt Other long-term liabilities Total long-term liabilities Total liabilities Long-term assets $ $ $ $ Total current assets $ $ 1,301,000 GA $ Plant, property, and equipment Goodwill Intangible assets Total long-term assets 2,890,000 1,600,000 Long-term liabilities 8,367,000 Long-term debt Other long-term liabilities 13,628,000 Total long-term liabilities 1,471,000 Total liabilities $ Long-term assets Plant, property, and equipment Goodwill OWNERS' EQUITY $ $ 4,191,000 $ Common stock $ S $ 13,106,000 $ $ S 6,465,000 OWNERS' EQUITY Retained earnings Total owners' equity TOTAL LIABILITIES AND OWNERS' EQUITY Intangible assets Total long-term assets $ $ 6,876,000 9,949,000 $ TOTAL ASSETS 21,564,000 Common stock Retained earnings Total owners' equity TOTAL LIABILITIES AND 29,931,000 OWNERS' EQUITY $ 16,825,000 TOTAL ASSETS S $ 29,931,000