Question

Problem 1: Recording transactions in the journal, posting to T accounts and trial balance (30 points) On February 20, Jane Doe began a new business

-

Problem 1: Recording transactions in the journal, posting to T accounts and trial balance (30 points)

On February 20, Jane Doe began a new business called Doe Printing, which provides typing, duplicating, and printing services. The following six transactions were completed by the business during February.

1. Issued to Jane 1,000 shares of capital stock in exchange for her investment of $200,000 cash. (4 points) 2. Purchased land and a small building for $550,000, paying $150,000 cash and signing a note payable for the balance. The land was worth $240,000 and the building $310,000. (5 points) 3. Purchased office equipment for $50,000 from Staples, Inc.

4. Paid $18,000 cash and agreed to pay the balance within 60 days. (4 points) Purchased a motorcycle on credit for $3,500 to be used for making deliveries to customers and agreed to make payment to Spokes, Inc. within 10 days. (4 points)

5. Paid in full the account payable to Spokes, Inc. (4 points) 6. Borrowed $40,000 from a bank and signed a note payable due in six months. (4 points)

Instructions: 1. Record the above transactions in general journal form. (18 points)

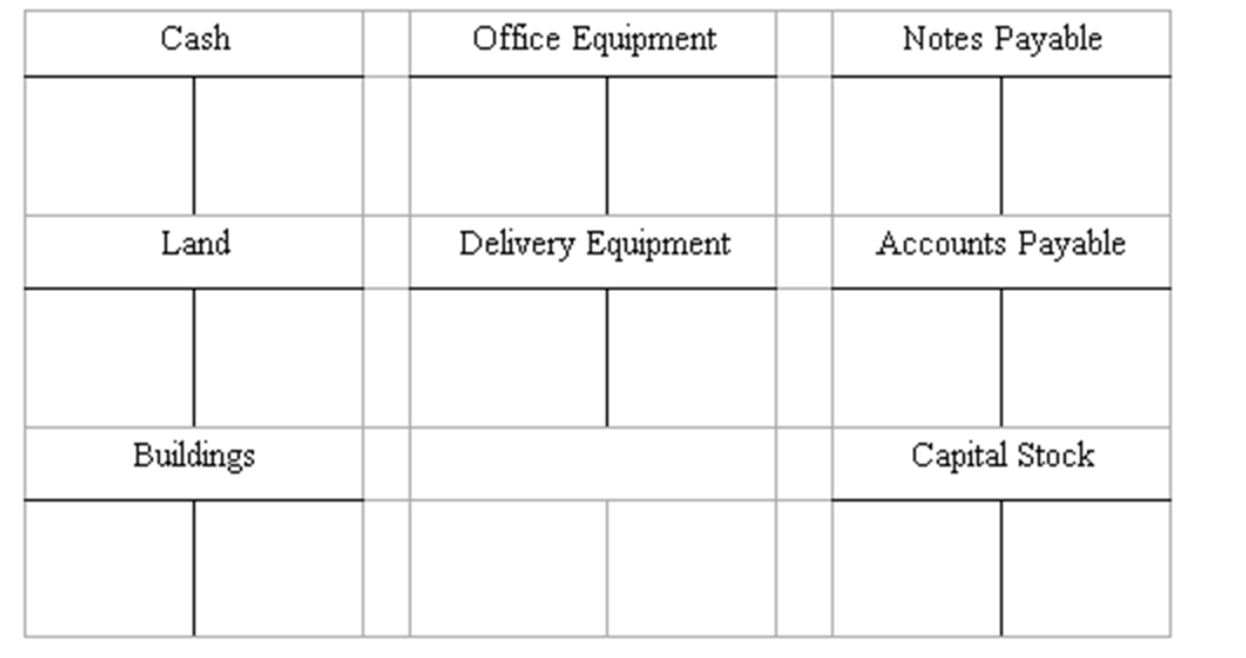

2. Post the entries in the T accounts below. (12 points)

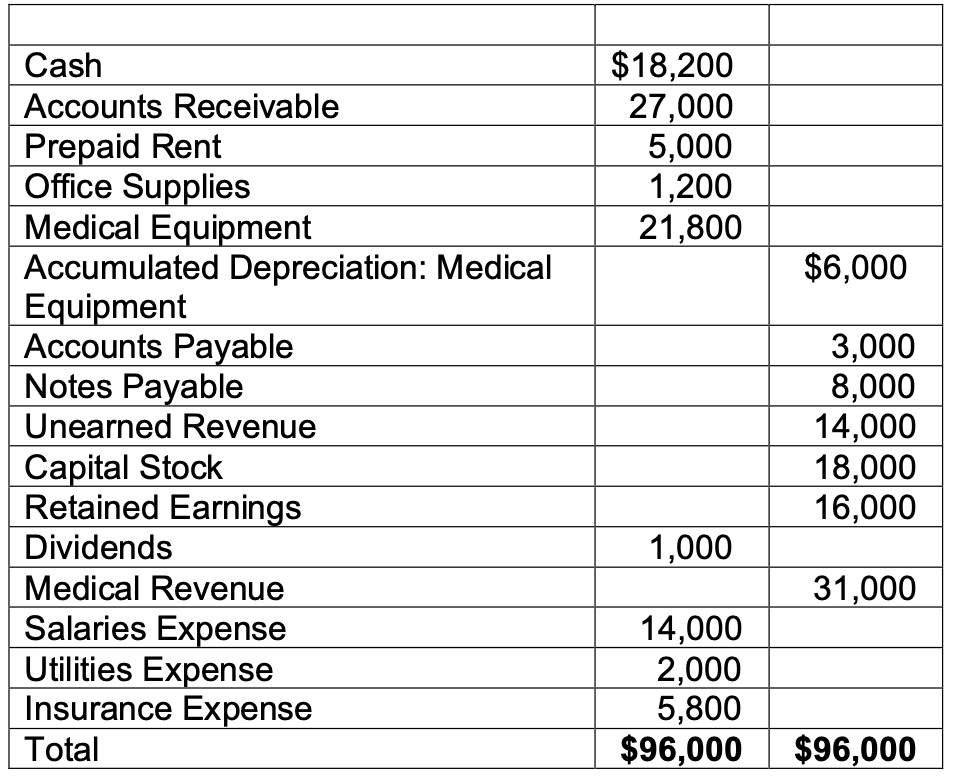

Hollander Laboratory adjusts and closes its accounts at the end of each month. The trial balance on September 30, 2020, before adjustments is as follows:

Hollander Laboratory adjusts and closes its accounts at the end of each month. The trial balance on September 30, 2020, before adjustments is as follows:

The following information relates to month end adjustments:

(1) Office supplies consumed during September 30 amounted to $600. (2) The useful life of the medical equipment was estimated to be 10 years. (3) Many patients pay in advance for major medical procedures. Fees of $7,000 were earned during the month by performing procedures patients who had paid in advance. (4) Salaries earned by employees during the month but not yet recorded amounted to $2,500. (5) On September 1 Hollander Laboratory paid $5,000 for 2 month's rent in advance. (6) Medical procedures performed during the month but not yet billed or recorded amounted to $8,600.

Instructions: Prepare the adjusting entries required at September 30. (4 points per entry)

Cash Office Equipment Notes Payable Land Delivery Equipment Accounts Payable Buildings Capital Stock $18,200 27,000 5,000 1,200 21,800 $6,000 Cash Accounts Receivable Prepaid Rent Office Supplies Medical Equipment Accumulated Depreciation: Medical Equipment Accounts Payable Notes Payable Unearned Revenue Capital Stock Retained Earnings Dividends Medical Revenue Salaries Expense Utilities Expense Insurance Expense Total 3,000 8,000 14,000 18,000 16,000 1,000 31,000 14,000 2,000 5,800 $96,000 $96,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started