Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1. Suppose in the next period there are two possible states of the world, a good weather state and a bad weather state,

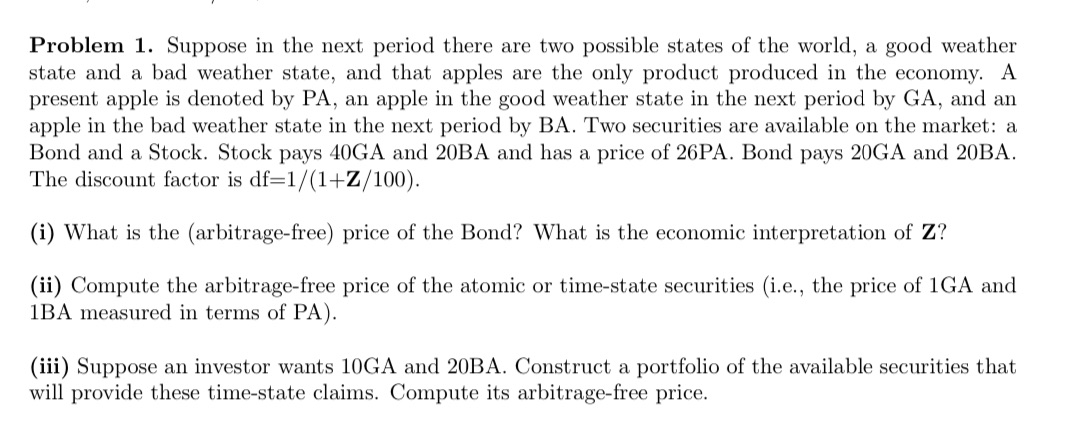

Problem 1. Suppose in the next period there are two possible states of the world, a good weather state and a bad weather state, and that apples are the only product produced in the economy. A present apple is denoted by PA, an apple in the good weather state in the next period by GA, and an apple in the bad weather state in the next period by BA. Two securities are available on the market: a Bond and a Stock. Stock pays 40GA and 20BA and has a price of 26PA. Bond pays 20GA and 20BA. The discount factor is df=1/(1+Z/100). (i) What is the (arbitrage-free) price of the Bond? What is the economic interpretation of Z? (ii) Compute the arbitrage-free price of the atomic or time-state securities (i.e., the price of 1GA and 1BA measured in terms of PA). (iii) Suppose an investor wants 10GA and 20BA. Construct a portfolio of the available securities that will provide these time-state claims. Compute its arbitrage-free price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started