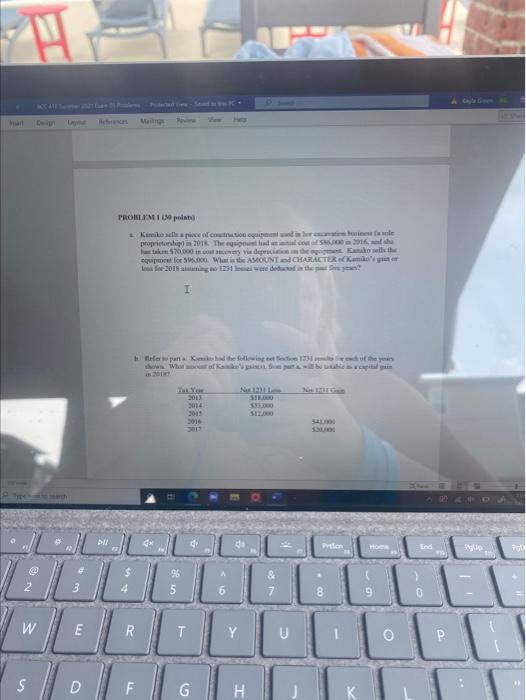

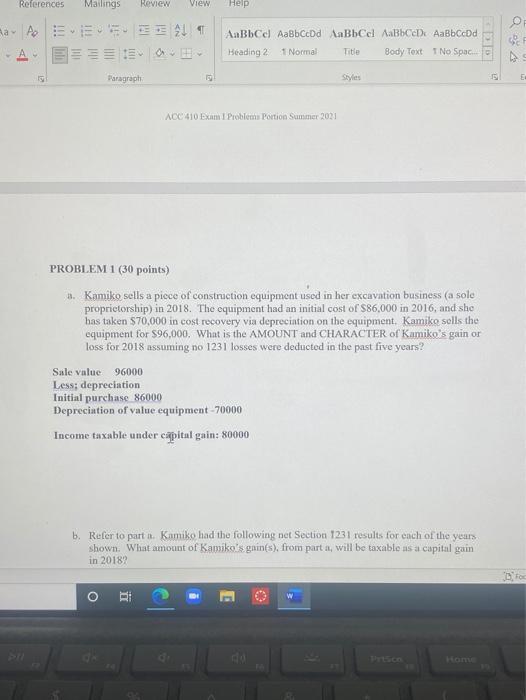

PROBLEM 100 pm suite EMfprintarahi hai be a lead a aal se Meani tak 50.000 is com video the most que los. Wat is AMOUNT CHAETACTER 1 fa pena War 3015 2016 2011 ho End | | | | 5 w E R T Y 0 P $ D F G H References Mailings Review View Help O a A 21 A AaBbce AaBbCcDd aBb Cel ABCD AaBbcd Heading 2 1 Normal Title Body Text T No Spac. Paragraphe 15 Styles E ACC 410 Exam Problems Portion Summer 2021 PROBLEM 1 (30 points) 3. Kamiko sells a piece of construction equipment used in her excavation business (a sole proprietorship) in 2018. The equipment had an initial cost of $86,000 in 2016, and she has taken $70,000 in cost recovery via depreciation on the equipment. Kamiko sells the equipment for 596,000. What is the AMOUNT and CHARACTER of Kamiko's gain or loss for 2018 assuming no 1231 losses were deducted in the past five years? Sale value 96000 Less; depreciation Initial purchase 86000 Depreciation of value equipment -70000 Income taxable under capital gain: 80000 b. Refer to parts. Kamiko had the following net Section 1231 results for each of the years shown. What amount of Kamiko's gain(s), from part a, will be taxable us a capital gain in 2018? Do PROBLEM 100 pm suite EMfprintarahi hai be a lead a aal se Meani tak 50.000 is com video the most que los. Wat is AMOUNT CHAETACTER 1 fa pena War 3015 2016 2011 ho End | | | | 5 w E R T Y 0 P $ D F G H References Mailings Review View Help O a A 21 A AaBbce AaBbCcDd aBb Cel ABCD AaBbcd Heading 2 1 Normal Title Body Text T No Spac. Paragraphe 15 Styles E ACC 410 Exam Problems Portion Summer 2021 PROBLEM 1 (30 points) 3. Kamiko sells a piece of construction equipment used in her excavation business (a sole proprietorship) in 2018. The equipment had an initial cost of $86,000 in 2016, and she has taken $70,000 in cost recovery via depreciation on the equipment. Kamiko sells the equipment for 596,000. What is the AMOUNT and CHARACTER of Kamiko's gain or loss for 2018 assuming no 1231 losses were deducted in the past five years? Sale value 96000 Less; depreciation Initial purchase 86000 Depreciation of value equipment -70000 Income taxable under capital gain: 80000 b. Refer to parts. Kamiko had the following net Section 1231 results for each of the years shown. What amount of Kamiko's gain(s), from part a, will be taxable us a capital gain in 2018? Do