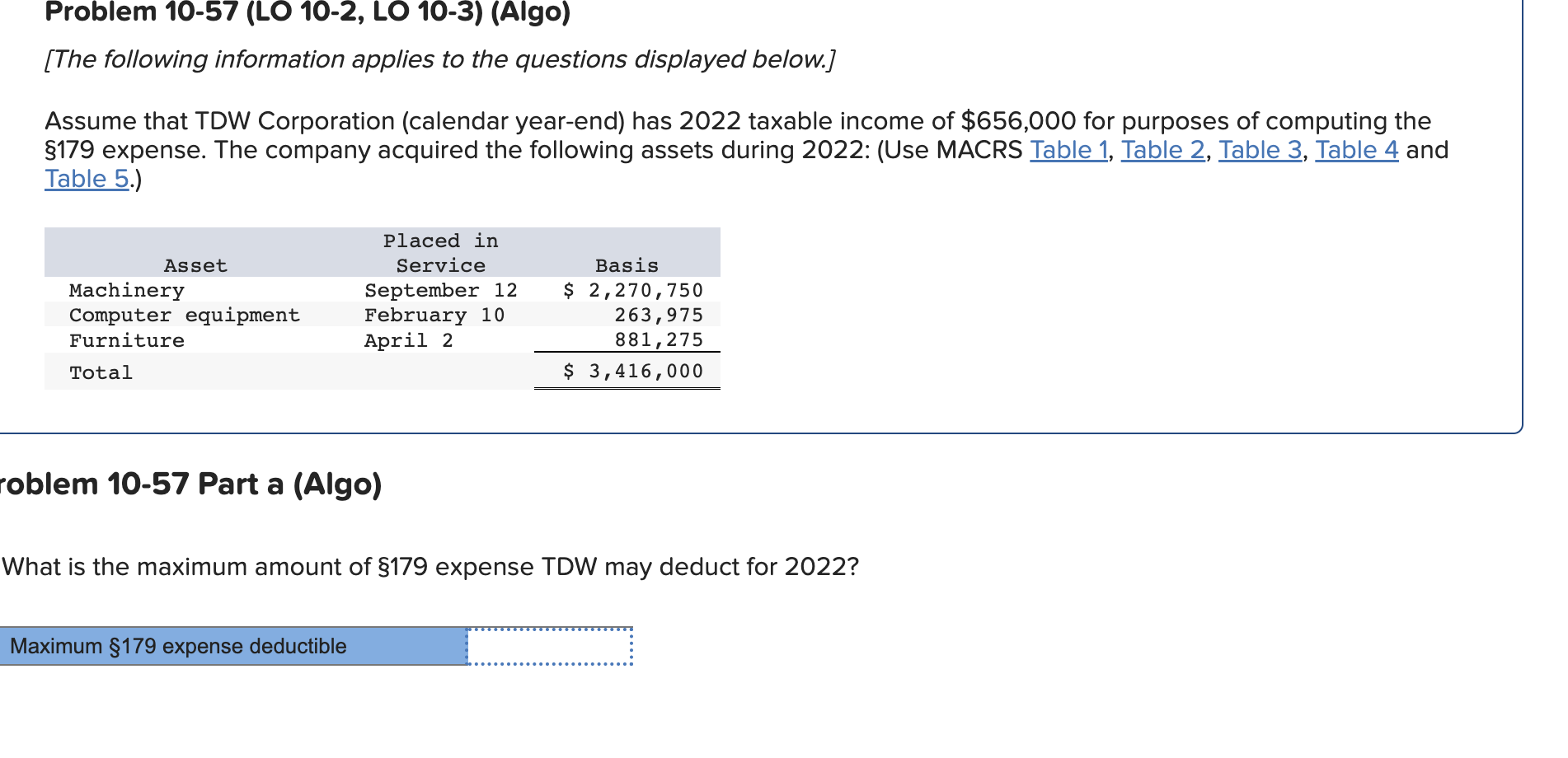

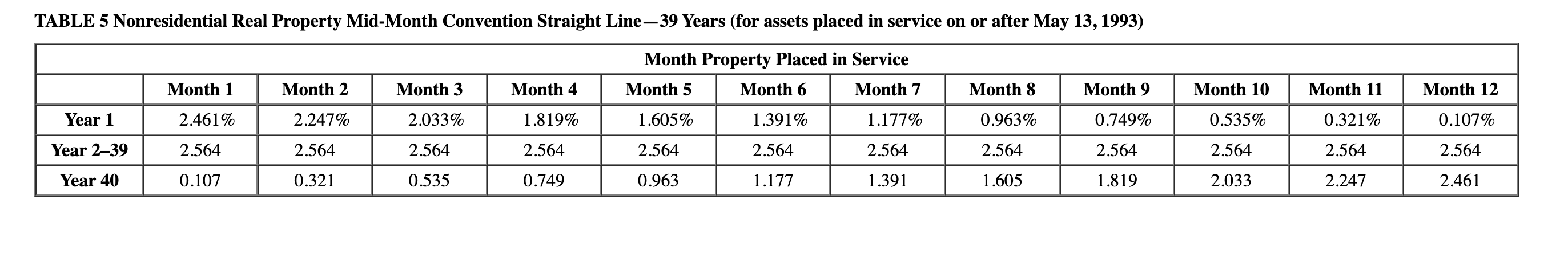

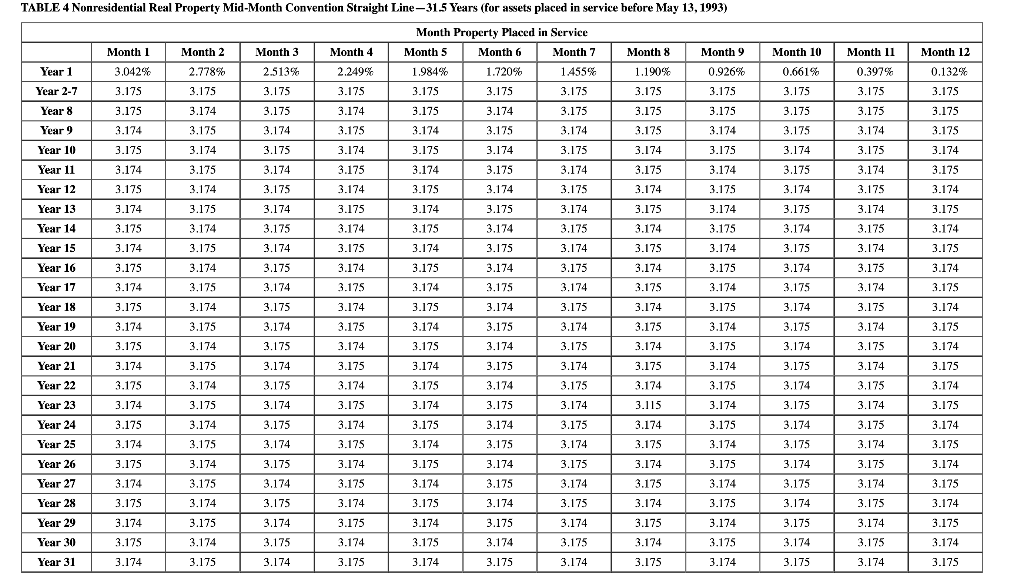

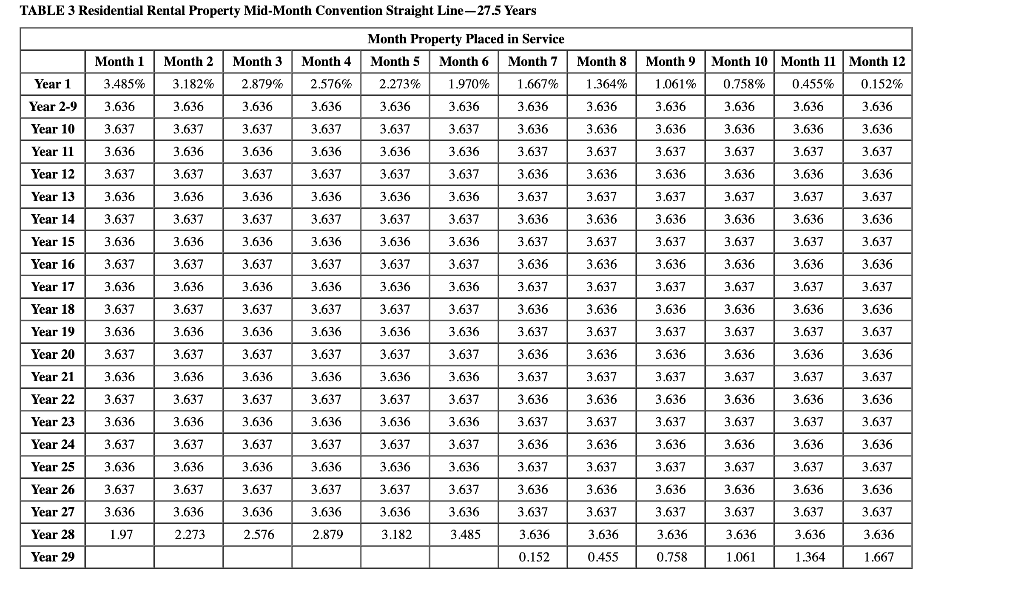

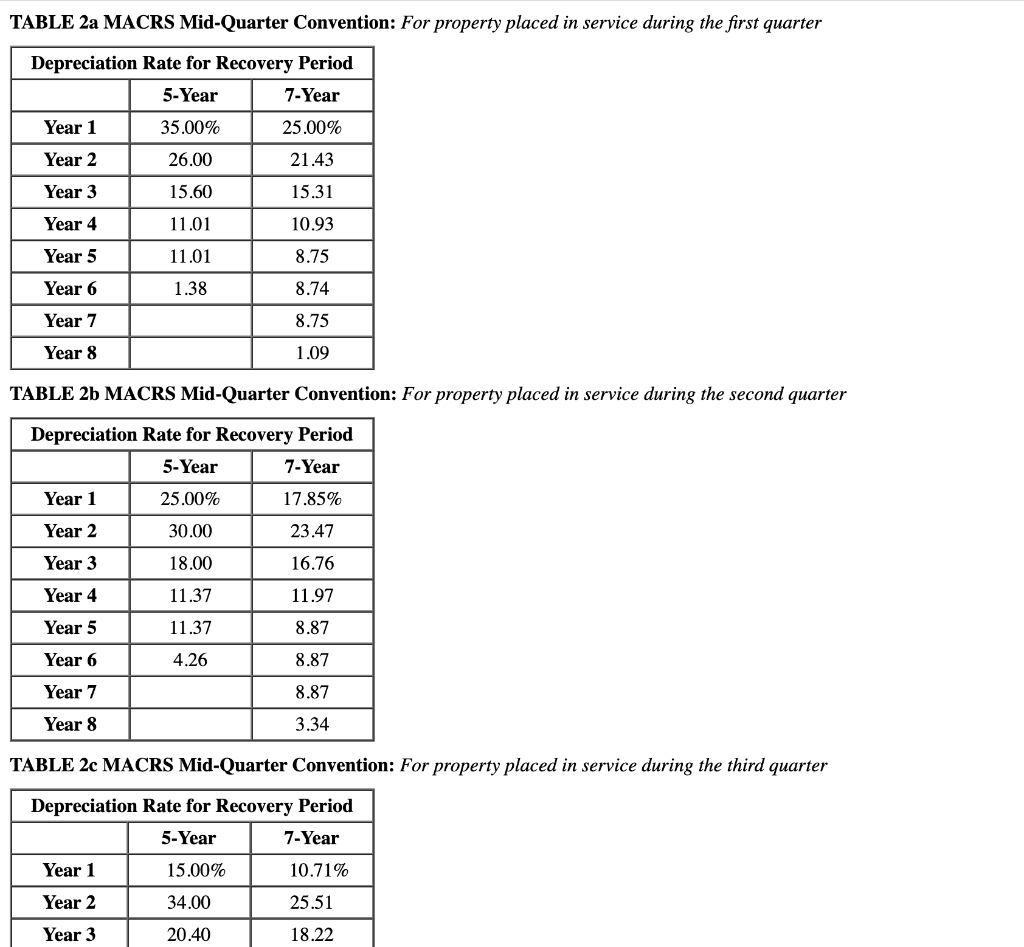

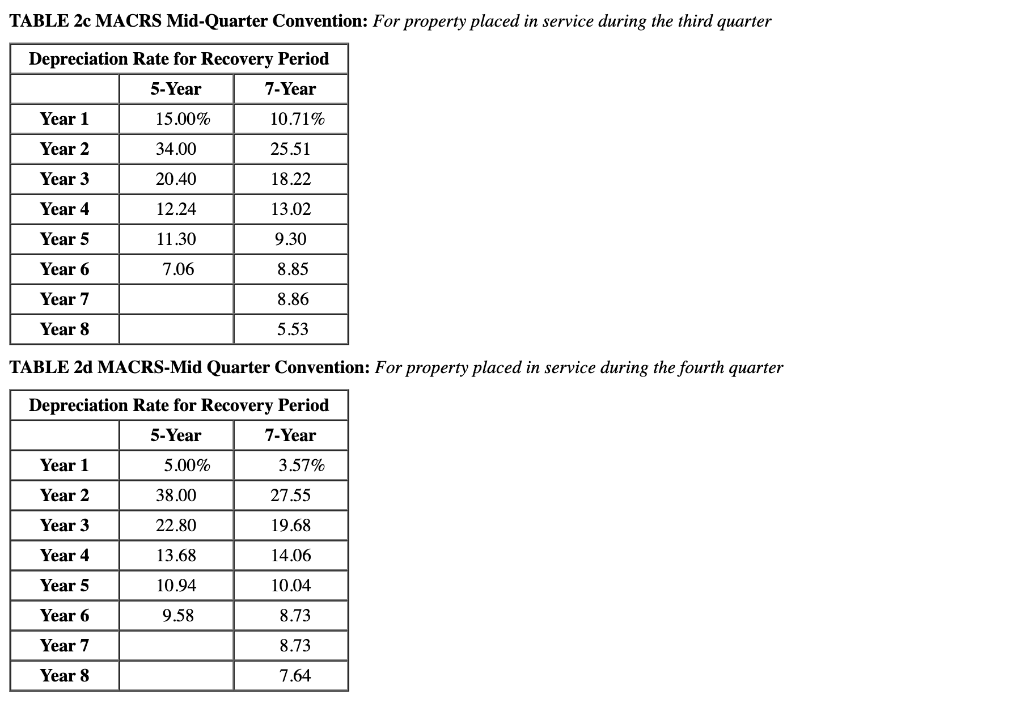

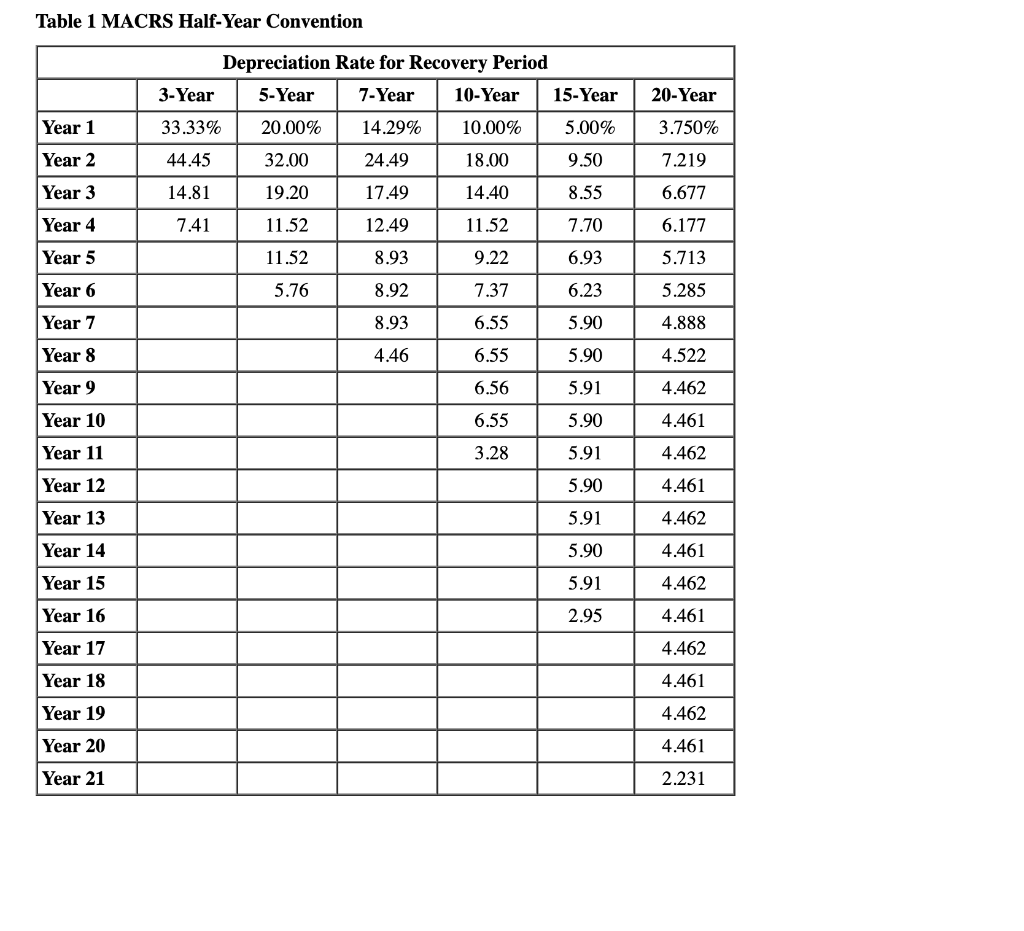

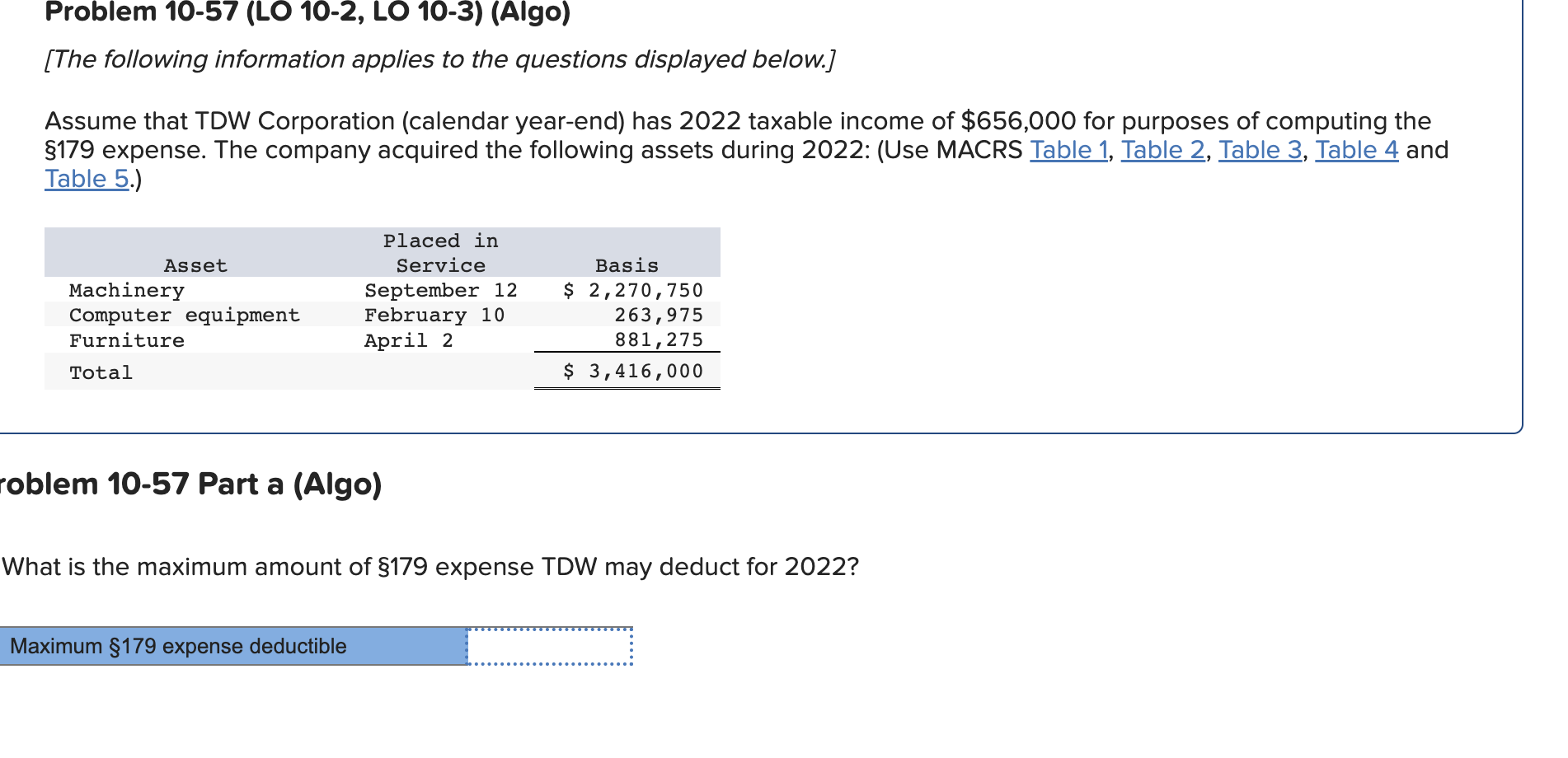

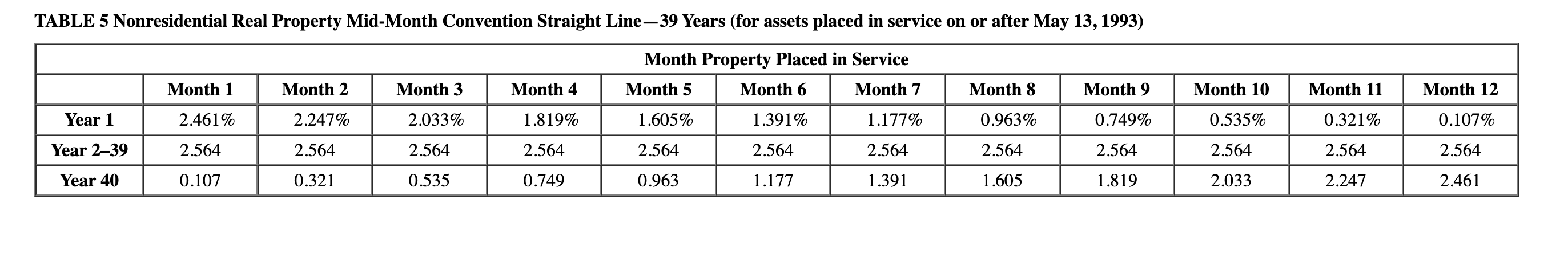

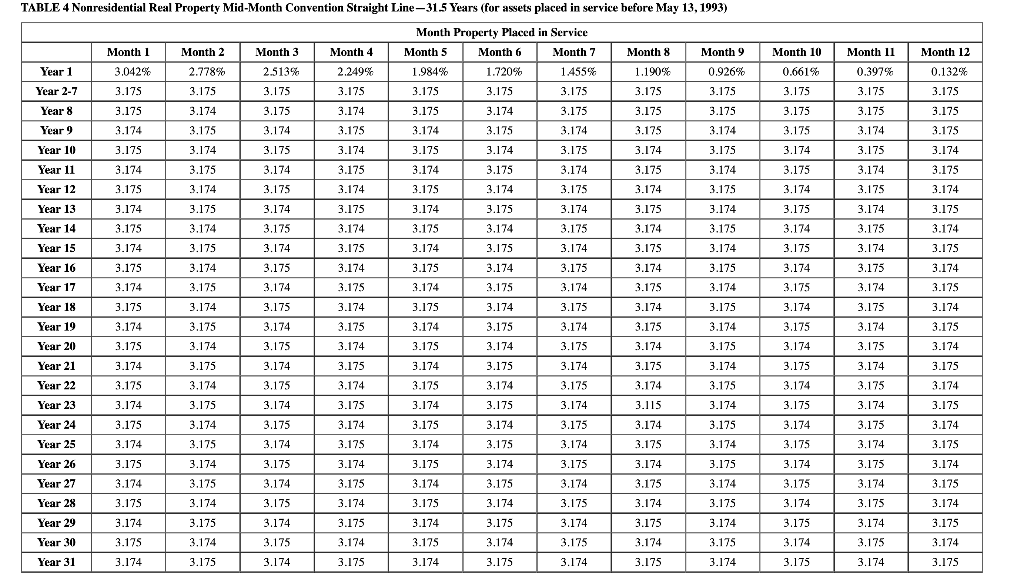

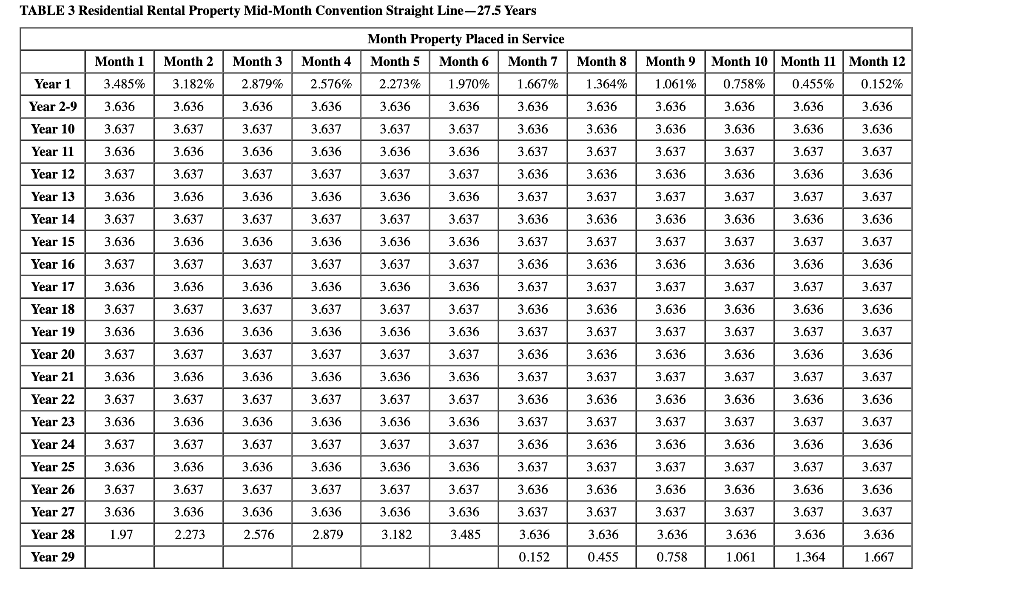

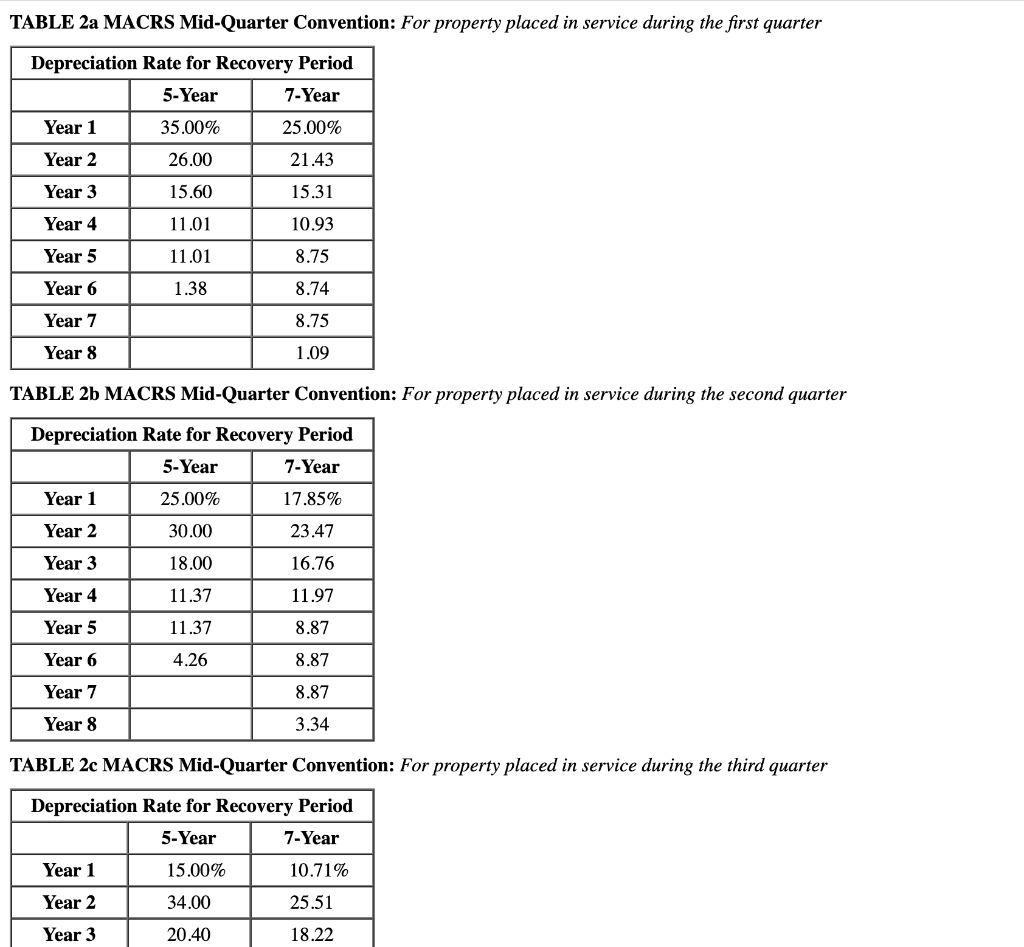

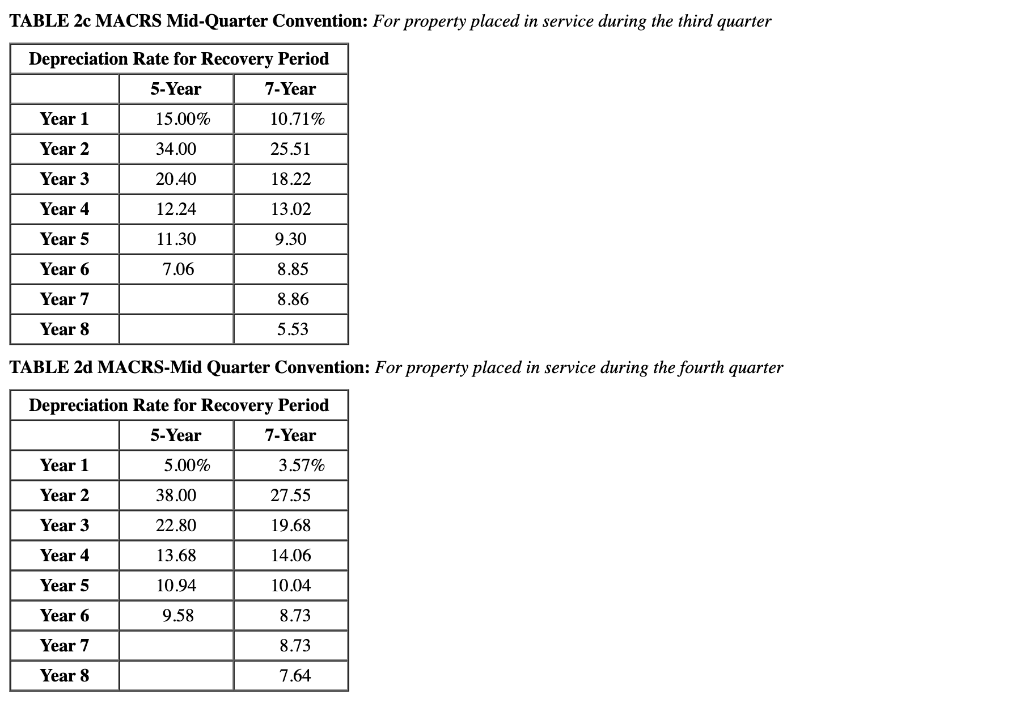

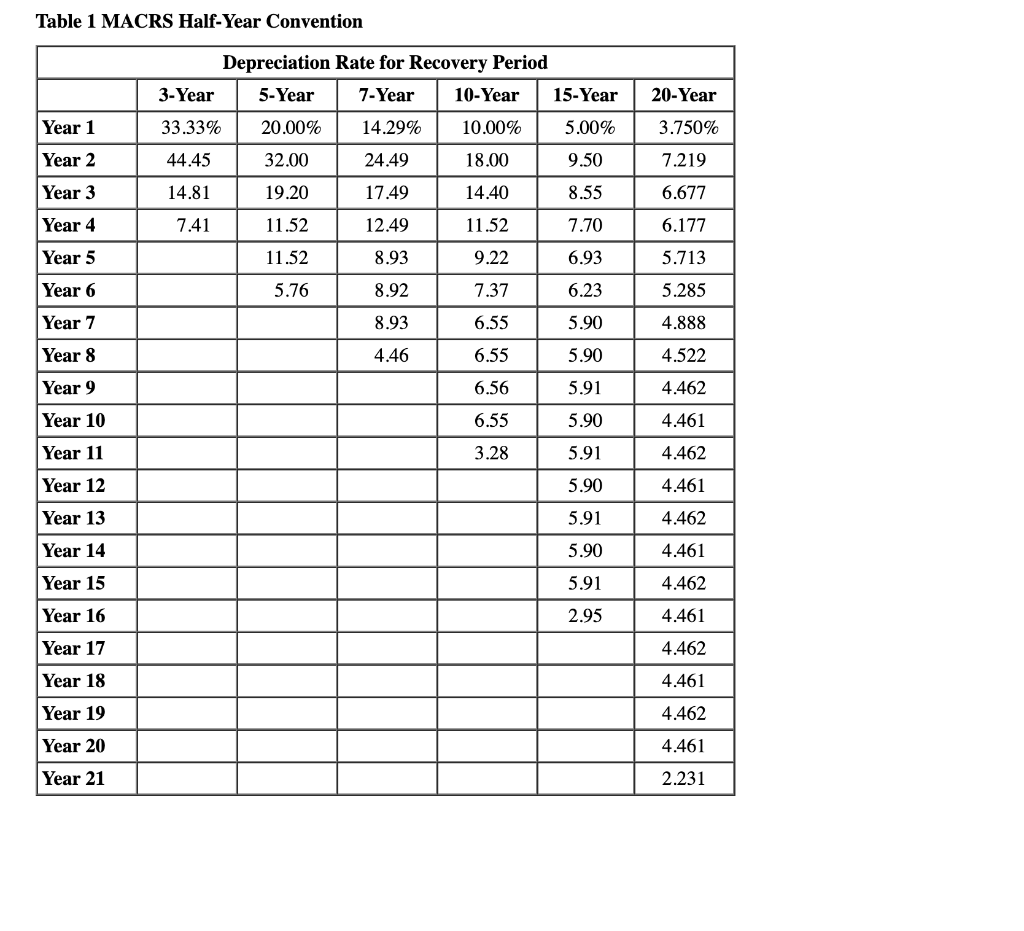

Problem 10-57 (LO 10-2, LO 10-3) (AlgO) [The following information applies to the questions displayed below.] Assume that TDW Corporation (calendar year-end) has 2022 taxable income of $656,000 for purposes of computing the \$179 expense. The company acquired the following assets during 2022: (Use MACRS Table 1, Table 2, Table 3 , Table 4 and Table 5.) oblem 10-57 Part a (Algo) What is the maximum amount of 179 expense TDW may deduct for 2022? TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line 31.5 Years (for assets placed in service before May 13, 1993) \begin{tabular}{|l|l|l|l|l|l|l} \hline \multicolumn{2}{|l|}{ Month Property Placed in Service } \\ \hline \end{tabular} TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Table 1 MACRS Half-Year Convention Problem 10-57 (LO 10-2, LO 10-3) (AlgO) [The following information applies to the questions displayed below.] Assume that TDW Corporation (calendar year-end) has 2022 taxable income of $656,000 for purposes of computing the \$179 expense. The company acquired the following assets during 2022: (Use MACRS Table 1, Table 2, Table 3 , Table 4 and Table 5.) oblem 10-57 Part a (Algo) What is the maximum amount of 179 expense TDW may deduct for 2022? TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line 31.5 Years (for assets placed in service before May 13, 1993) \begin{tabular}{|l|l|l|l|l|l|l} \hline \multicolumn{2}{|l|}{ Month Property Placed in Service } \\ \hline \end{tabular} TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Table 1 MACRS Half-Year Convention