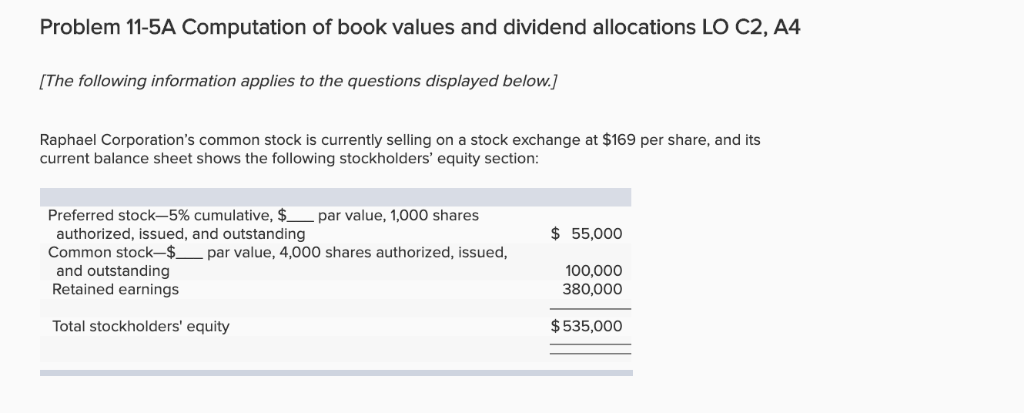

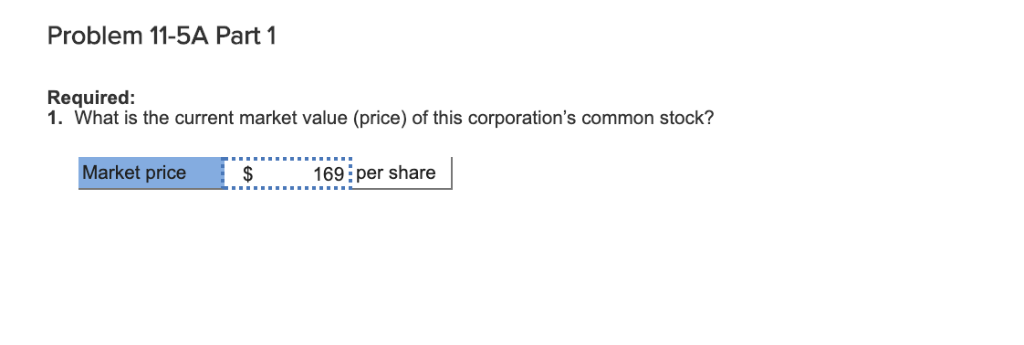

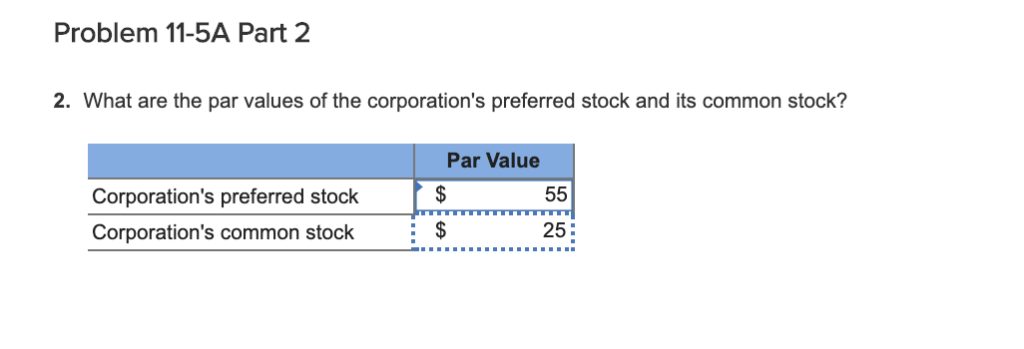

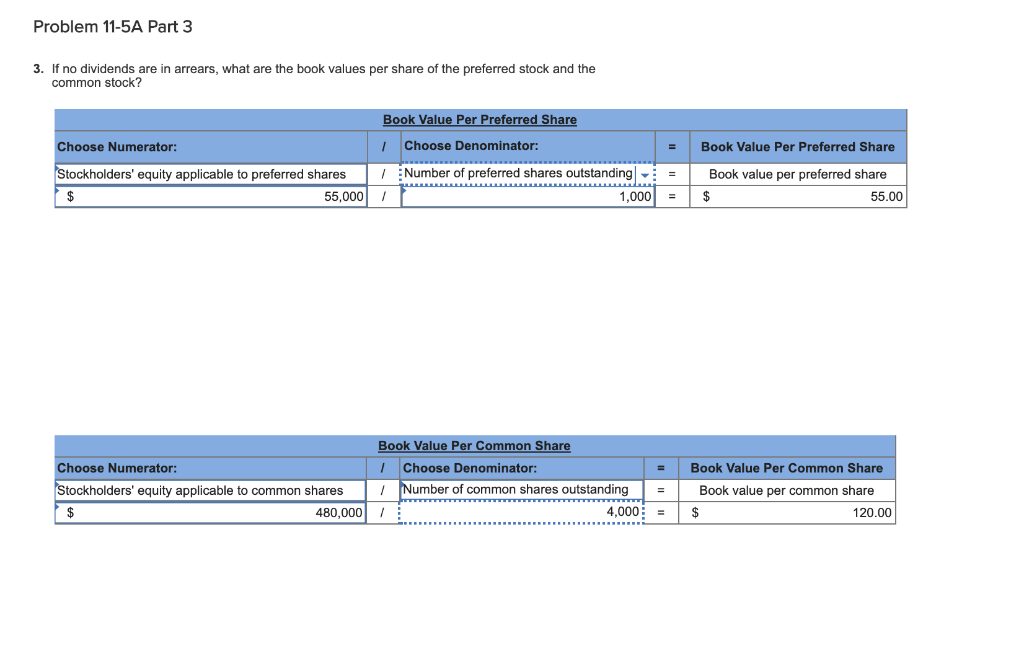

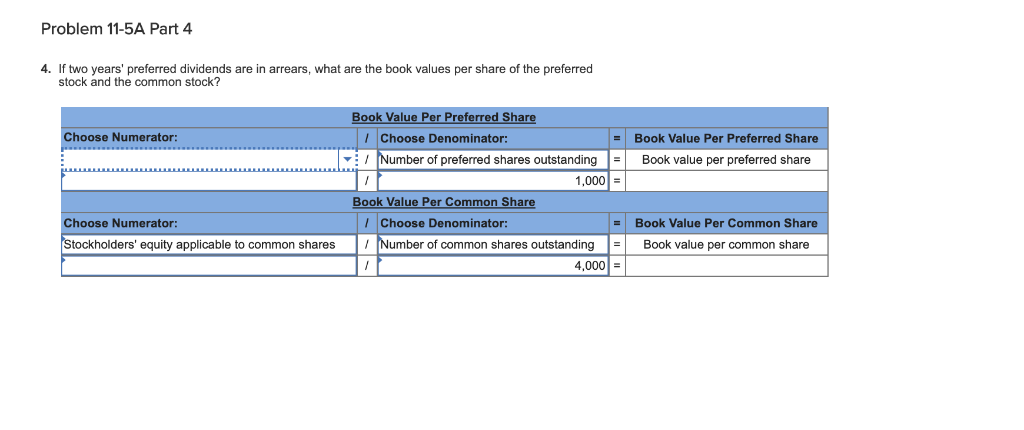

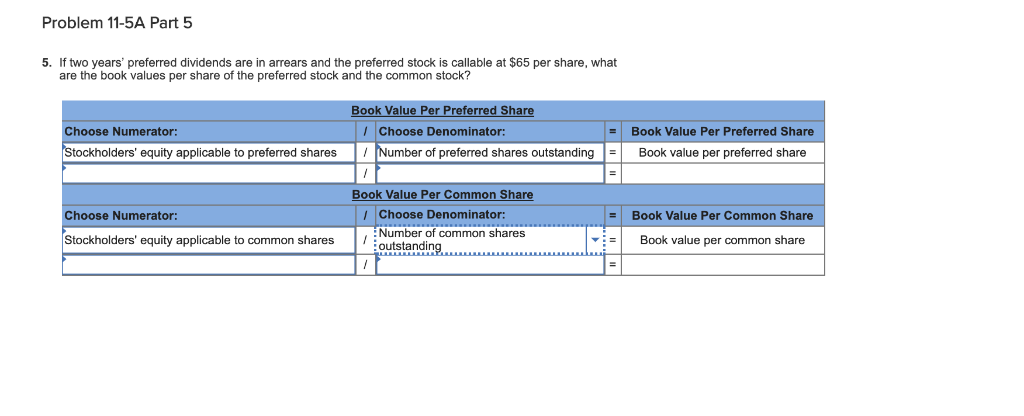

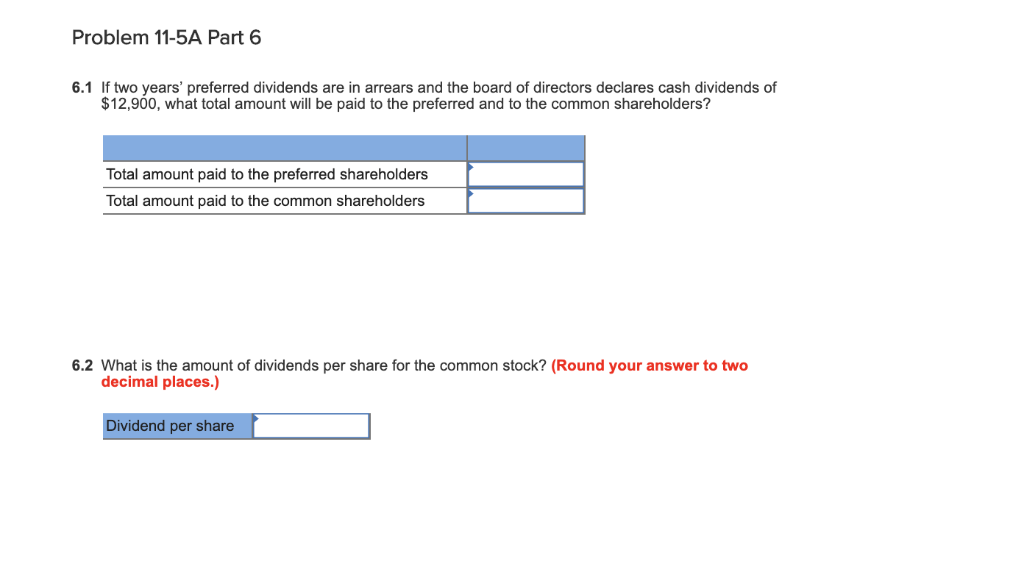

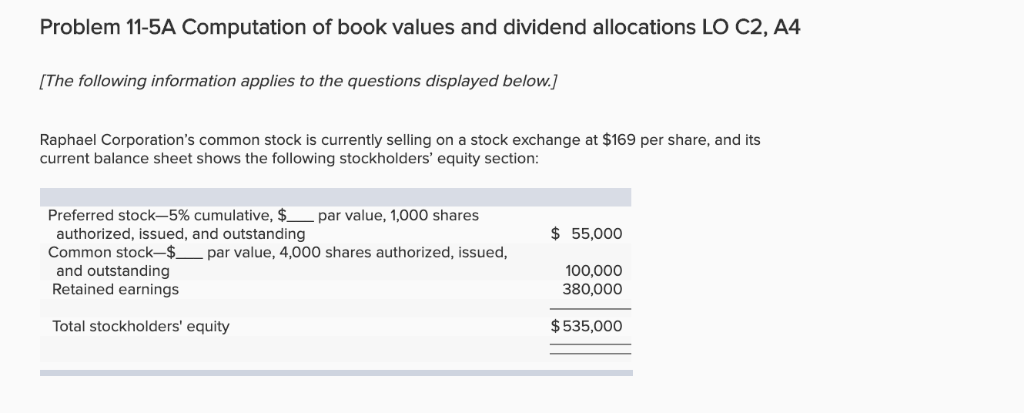

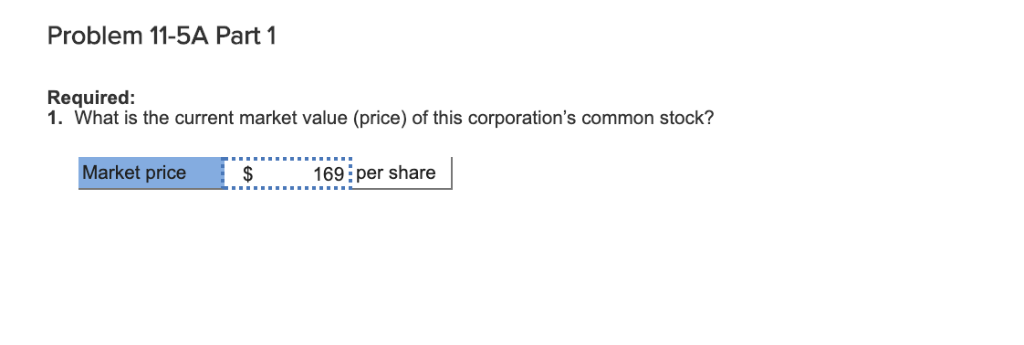

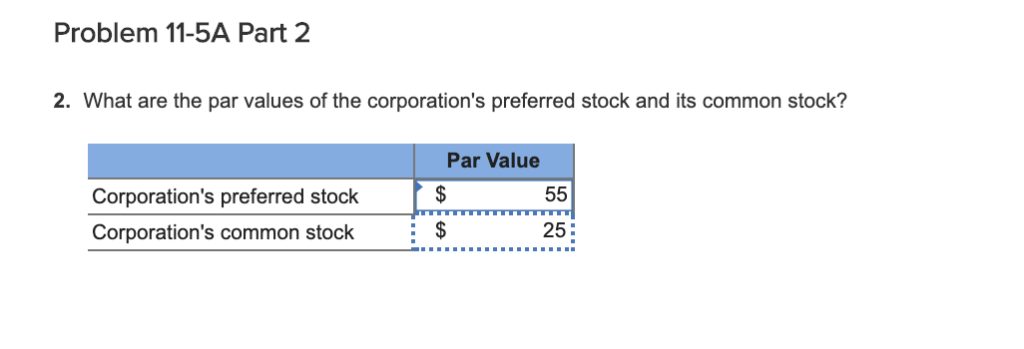

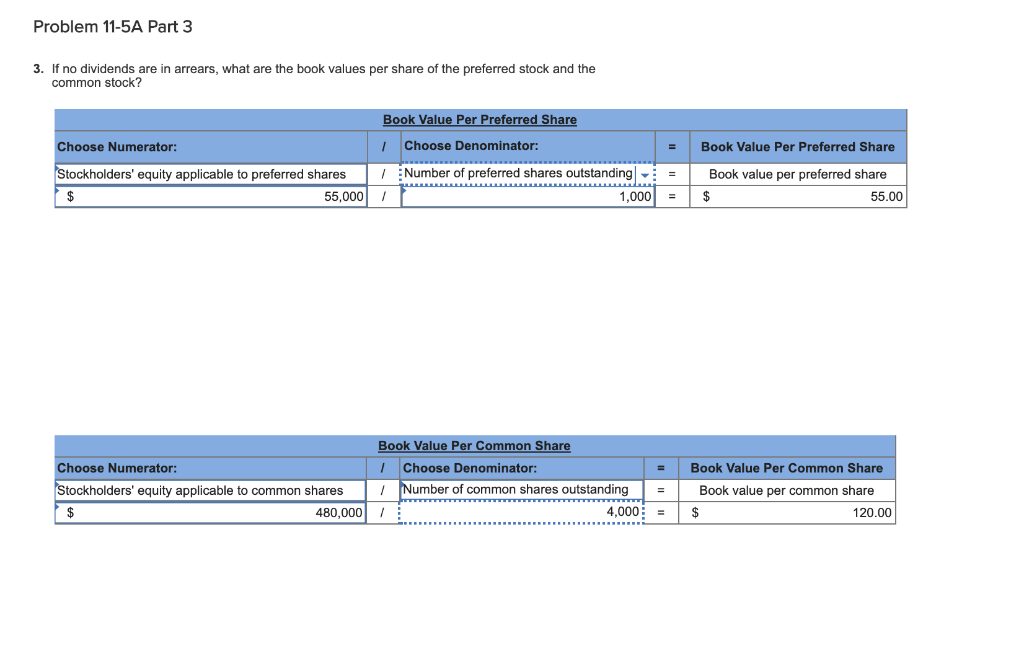

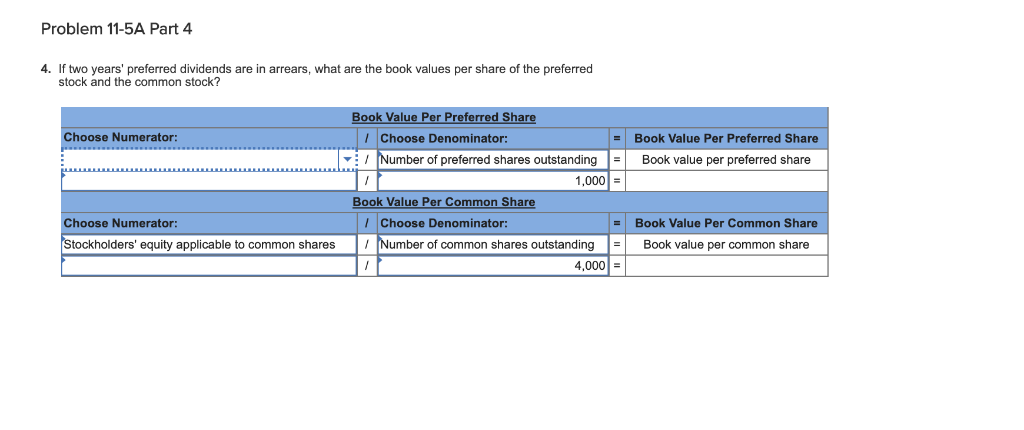

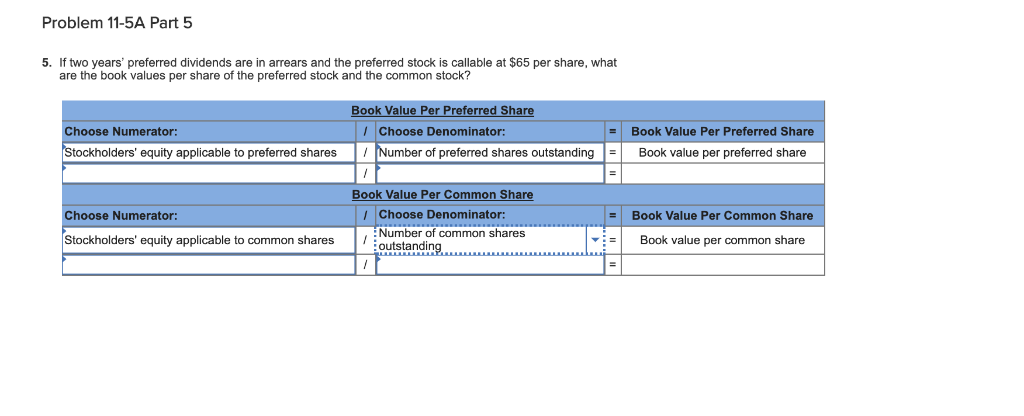

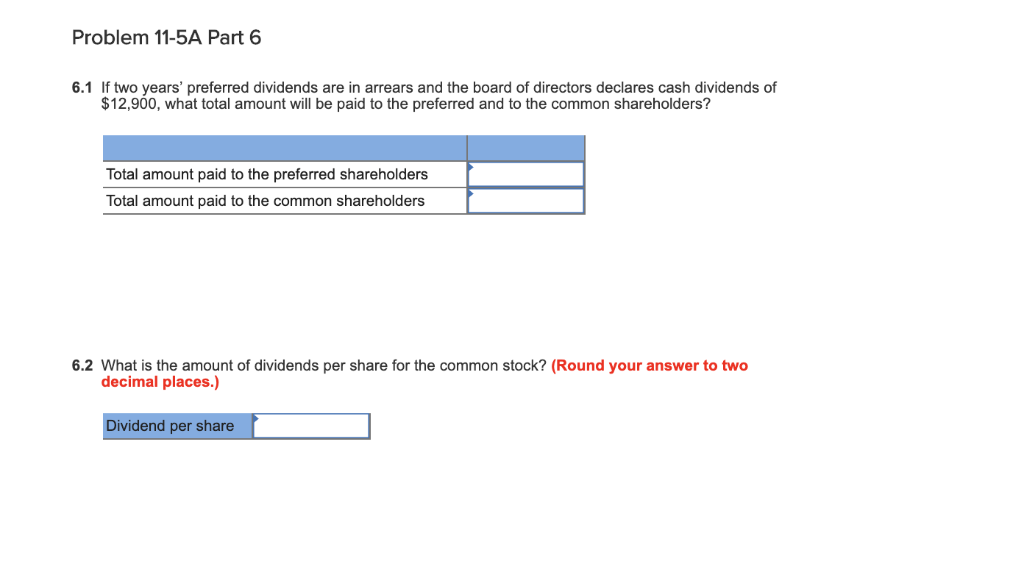

Problem 11-5A Computation of book values and dividend allocations LO C2, A4 The following information applies to the questions displayed below. Raphael Corporation's common stock is currently selling on a stock exchange at $169 per share, and its current balance sheet shows the following stockholders' equity section Preferred stock-5% cumulative, $ par value, 1,000 shares authorized, issued, and outstanding Common stock-$--par value, 4,000 shares authorized, issued, and outstanding Retained earnings $55,000 100,000 380,000 Total stockholders' equity $535,000 Problem 11-5A Part 1 Required 1. What is the current market value (price) of this corporation's common stock? Market price $169 :per share Problem 11-5A Part 2 2. What are the par values of the corporation's preferred stock and its common stock? Par Value Corporation's preferred stock Corporation's common stock$ 25: Problem 11-5A Part 3 3. If no dividends are in arrears, what are the book values per share of the preferred stock and the common stock? Book Value Per Preferred Share Choose Denominator: Choose Numerator: Book Value Per Preferred Share | : Number of preferred shares outstanding | tockholders' equity applicable to preferred shares / Book value per preferred share 55,0007 1,000 55.00 Book Value Per Common Share Choose Numerator: Choose Denominator Book Value Per Common Share Number of common shares outstandingBook value per common share tockholders' equity applicable to common shares 4,000$ 480,000 120.00 Problem 11-5A Part 4 4. If two years' preferred dividends are in arrears, what are the book values per share of the preferred stock and the common stock? Book Value Per Preferred Share Choose Numerator: Choose Denominator Book Value Per Preferred Share Number of preferred shares outstandingBook value per preferred share 1.0001 = Book Value Per Common Share Choose Numerator: Choose Denominator: Book Value Per Common Share - Stockholders' equity applicable to common sharesNumber of common shares outstandingBook value per common share 4,000 Problem 11-5A Part 5 5. If two years' preferred dividends are in arrears and the preferred stock is callable at $65 per share, what are the book values per share of the preferred stock and the common stock? Book Value Per Preferred Share Choose Numerator Stockholders' equity applicable to preferred shares Choose Denominator: Number o preferred shares outstanding- Book Value Per Preferred Share Book value per referred share Book Value Per Common Share Choose Denominator Number of common shares outstanding Choose Numerator: Book Value Per Common Share Stockholders' equity applicable to common shares Book value per common share Problem 11-5A Part 6 6.1 If two years' preferred dividends are in arrears and the board of directors declares cash dividends of $12,900, what total amount will be paid to the preferred and to the common shareholders? Total amount paid to the preferred shareholders Total amount paid to the common shareholders 6.2 What is the amount of dividends per share for the common stock? (Round your answer to two decimal places.) Dividend per share