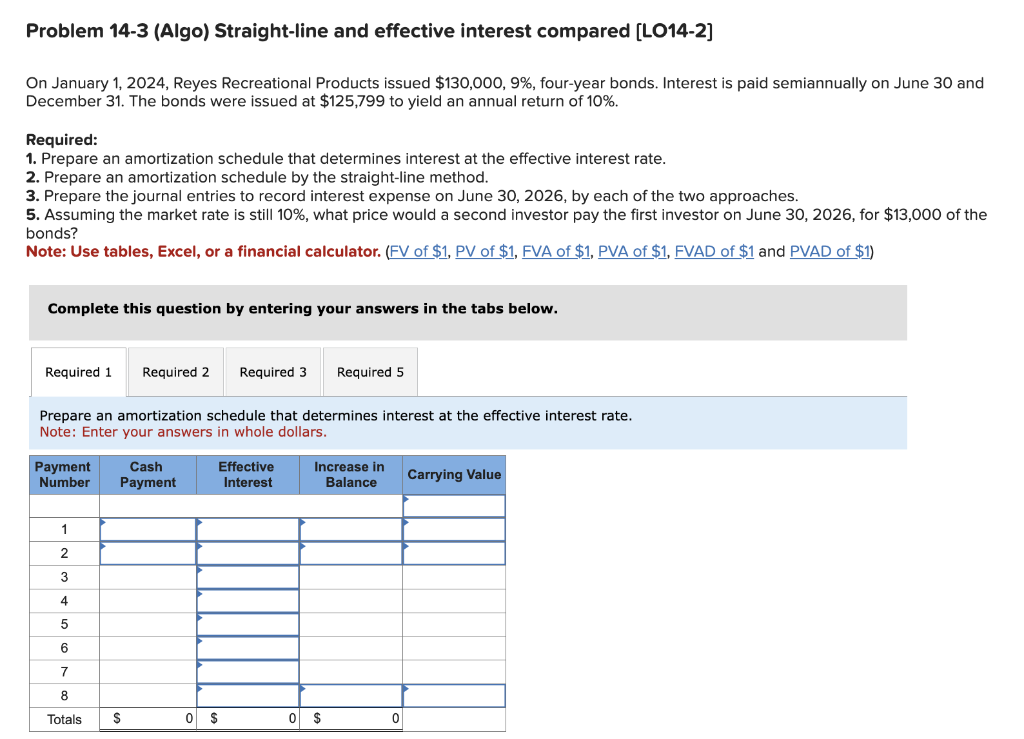

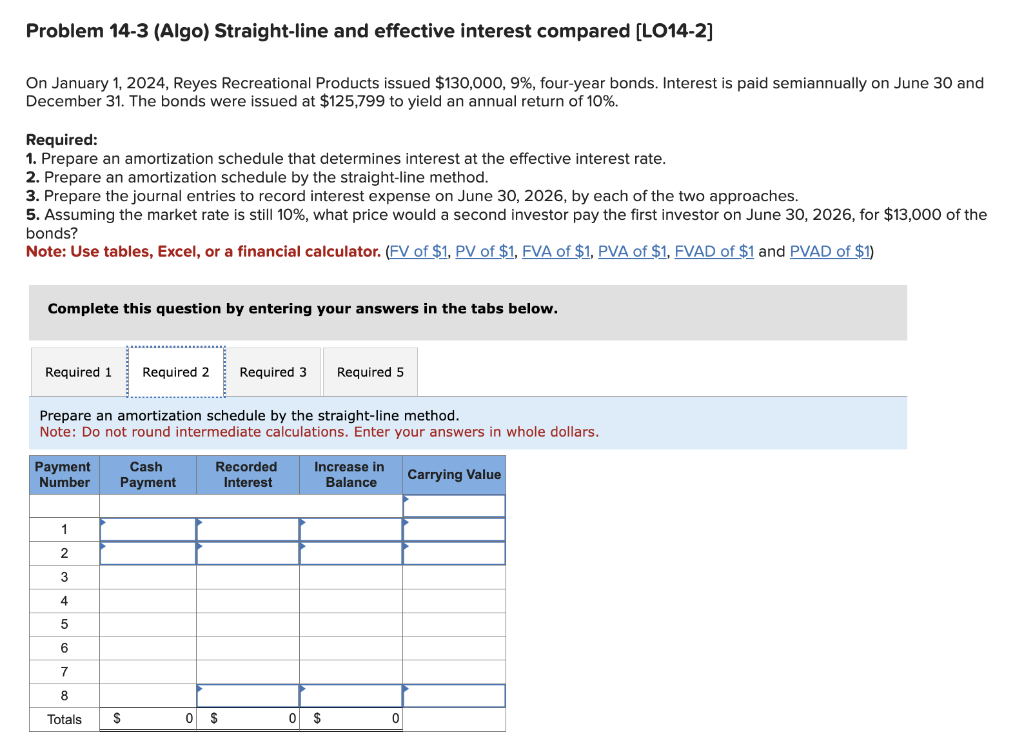

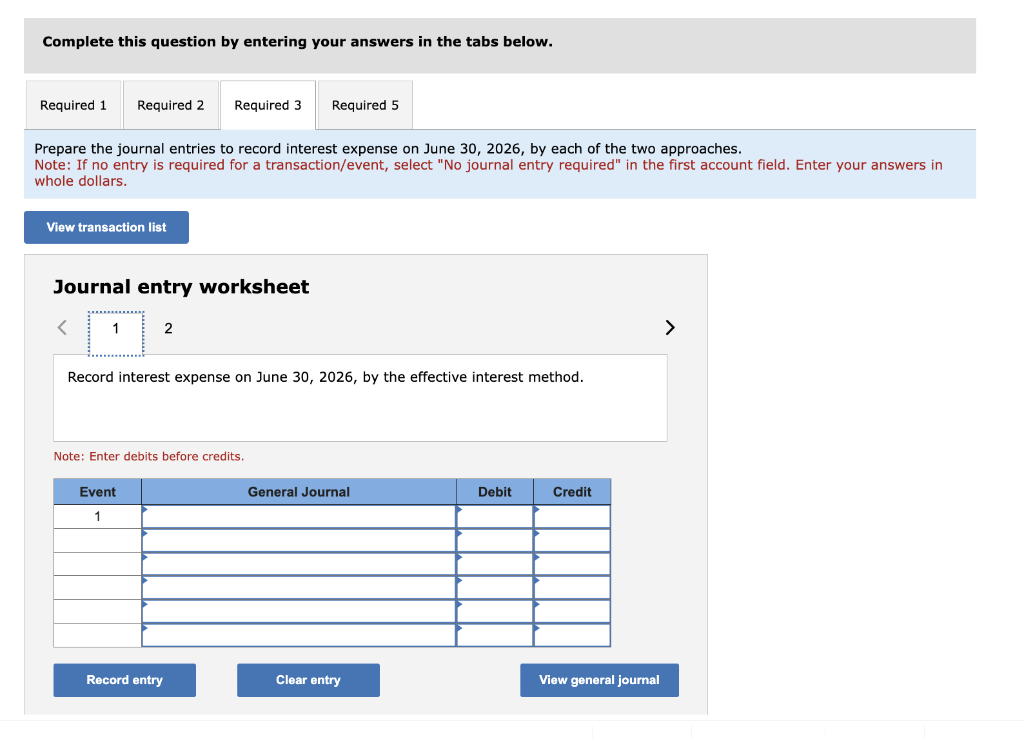

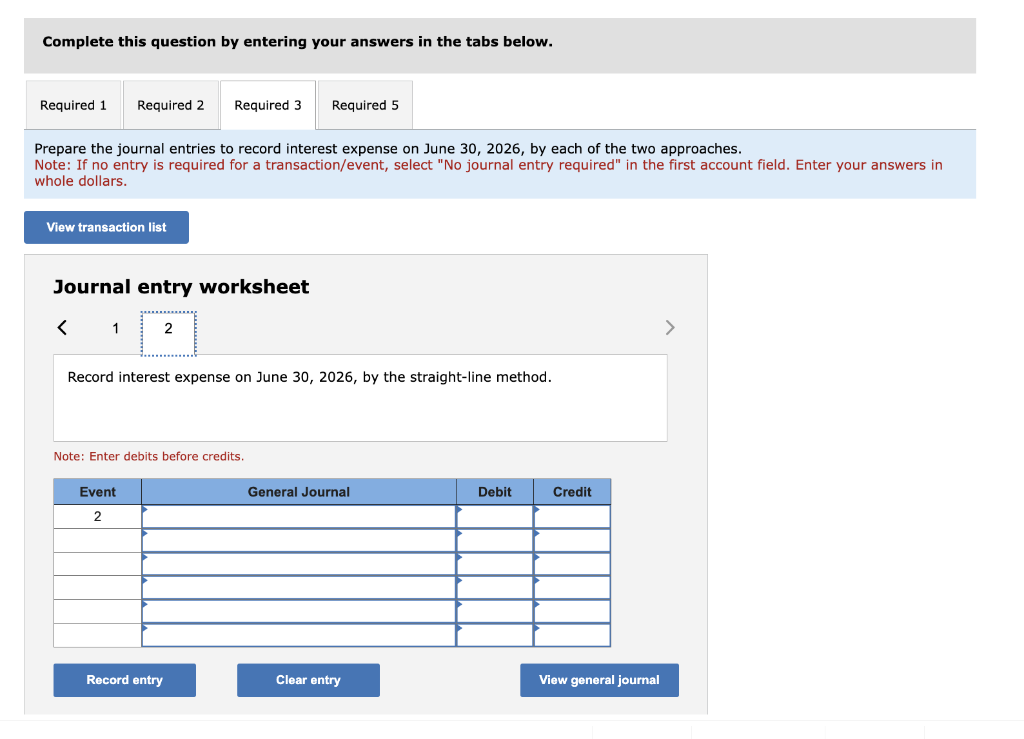

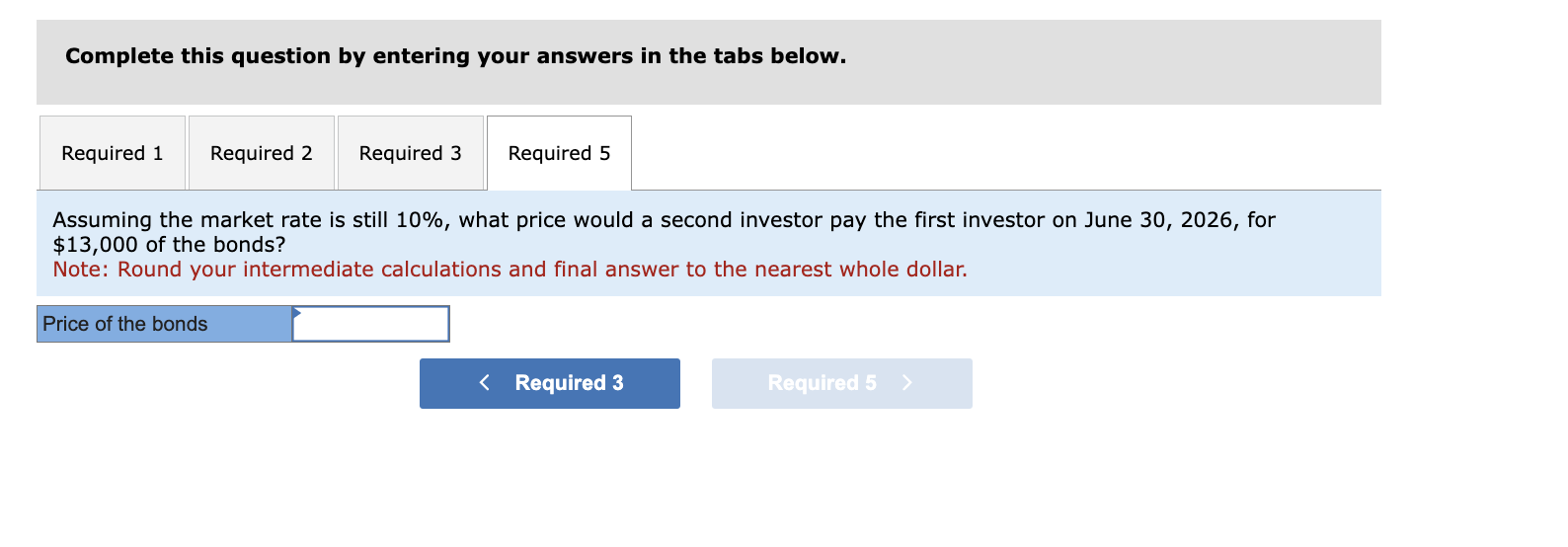

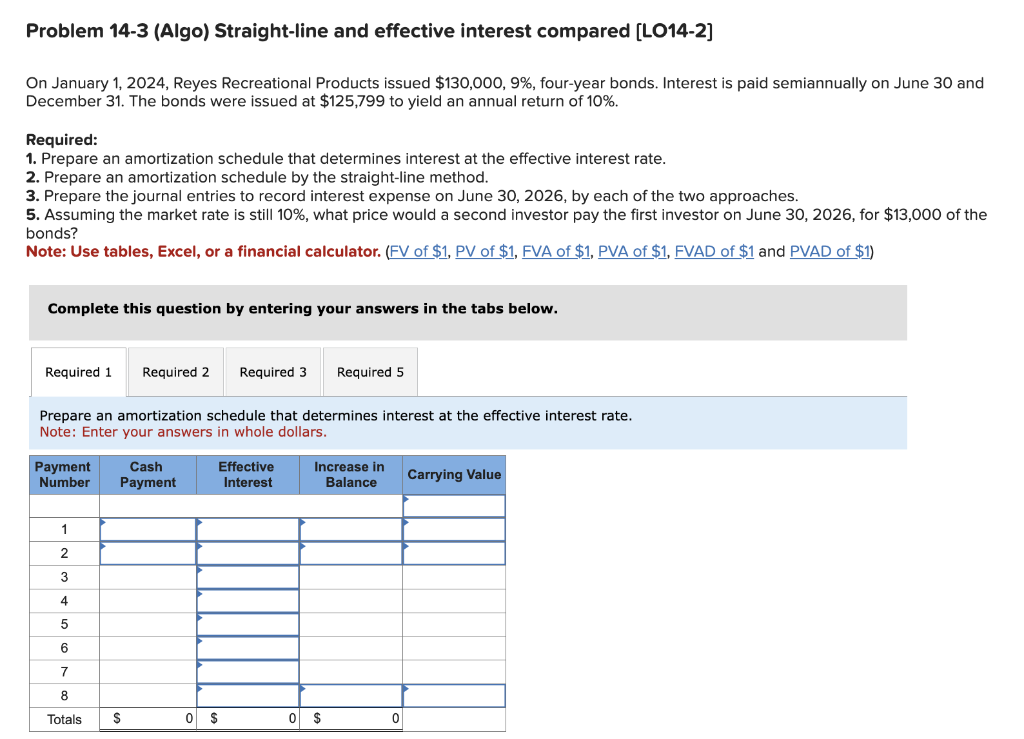

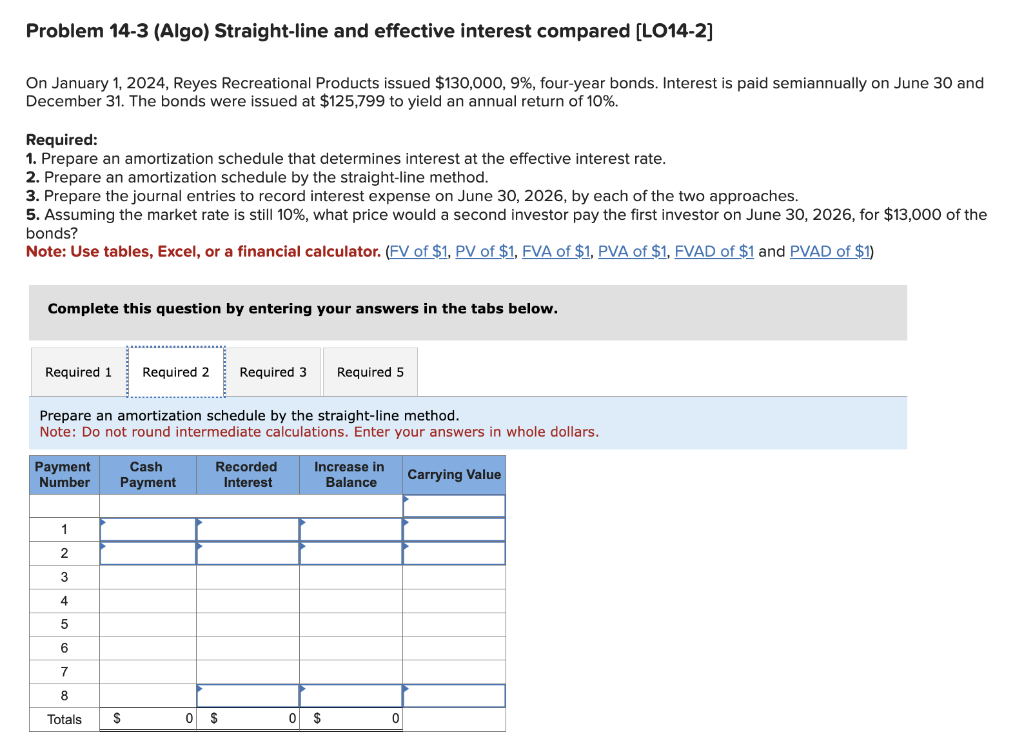

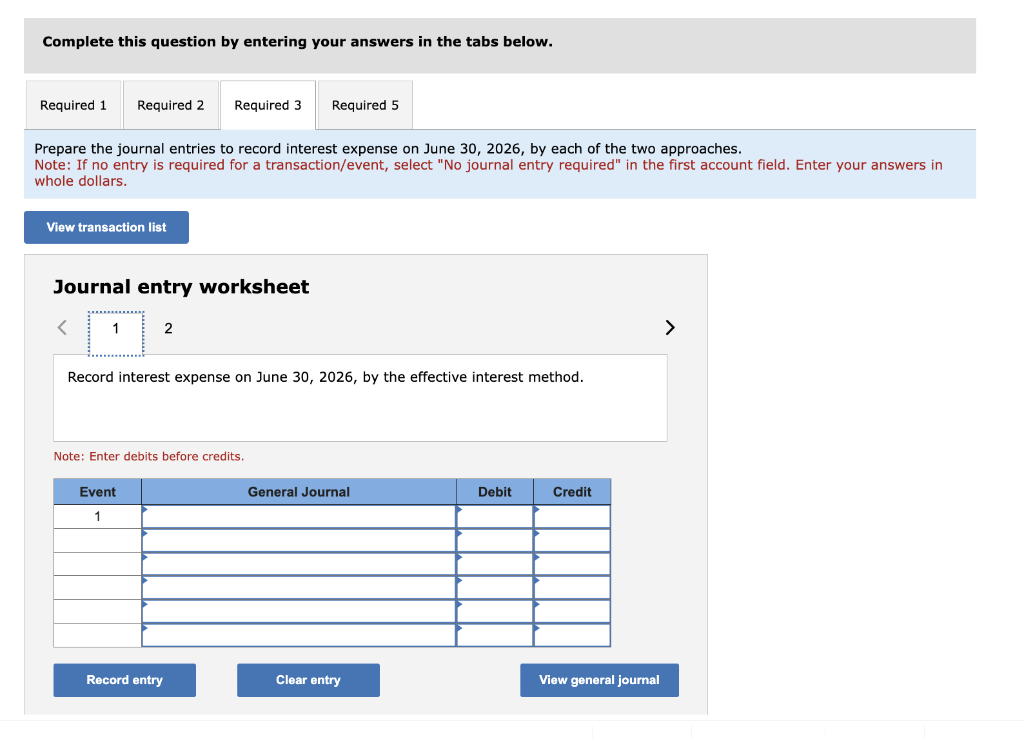

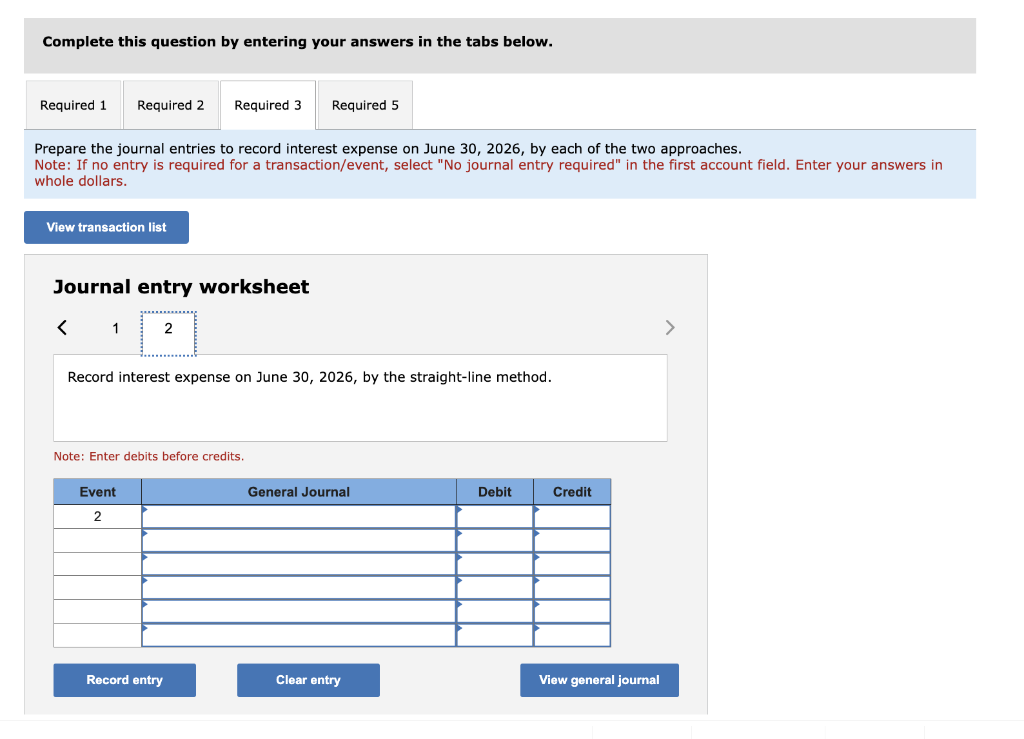

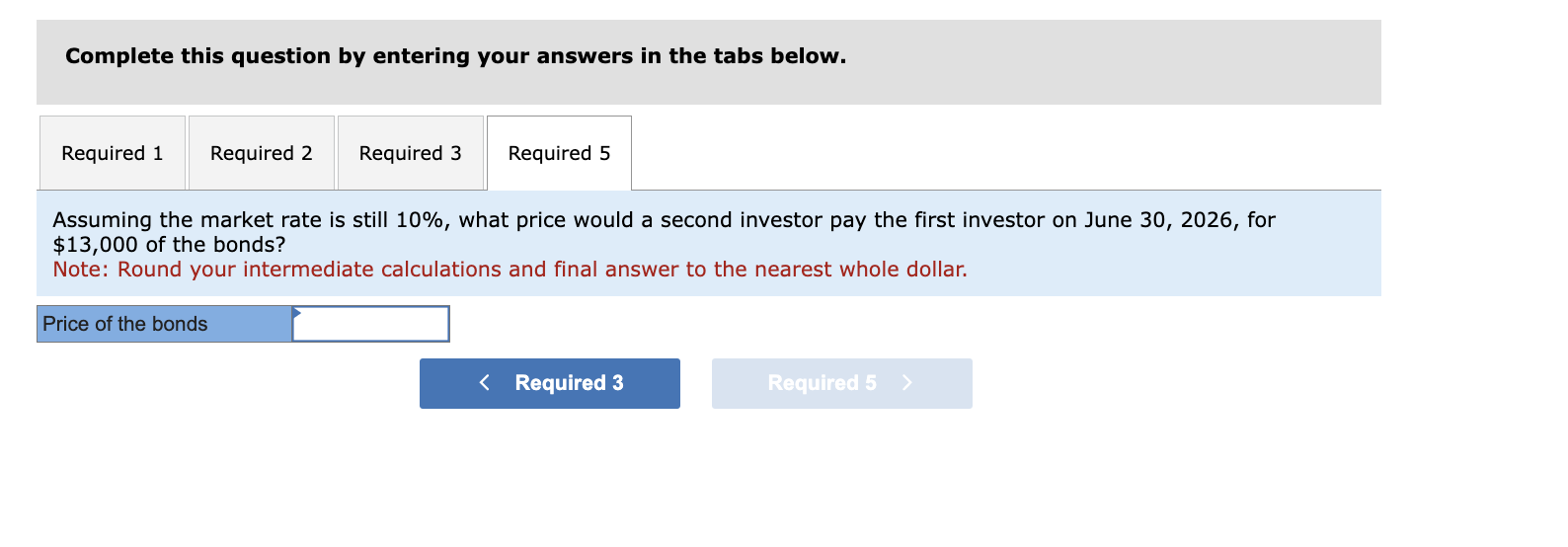

Problem 14-3 (Algo) Straight-line and effective interest compared [LO14-2] On January 1, 2024, Reyes Recreational Products issued $130,000,9%, four-year bonds. Interest is paid semiannually on June 30 and December 31 . The bonds were issued at $125,799 to yield an annual return of 10%. Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule by the straight-line method. 3. Prepare the journal entries to record interest expense on June 30,2026 , by each of the two approaches. 5. Assuming the market rate is still 10%, what price would a second investor pay the first investor on June 30,2026 , for $13,000 of the bonds? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1,FVAD of $1 and PVAD of $1 ) Complete this question by entering your answers in the tabs below. Prepare an amortization schedule that determines interest at the effective interest rate. Note: Enter your answers in whole dollars. Problem 14-3 (Algo) Straight-line and effective interest compared [LO14-2] On January 1, 2024, Reyes Recreational Products issued $130,000,9%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $125,799 to yield an annual return of 10%. Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule by the straight-line method. 3. Prepare the journal entries to record interest expense on June 30,2026 , by each of the two approaches. 5. Assuming the market rate is still 10%, what price would a second investor pay the first investor on June 30,2026 , for $13,000 of the bonds? Note: Use tables, Excel, or a financial calculator. (FV of $1,PV of $1, FVA of $1, PVA of $1,FVAD of $1 and PVAD of $1 ) Complete this question by entering your answers in the tabs below. Prepare an amortization schedule by the straight-line method. Note: Do not round intermediate calculations. Enter your answers in whole dollars. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record interest expense on June 30,2026 , by each of the two approaches. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars. Journal entry worksheet Record interest expense on June 30,2026 , by the effective interest method. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record interest expense on June 30,2026 , by each of the two approaches. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars. Journal entry worksheet Record interest expense on June 30,2026 , by the straight-line method. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Assuming the market rate is still 10%, what price would a second investor pay the first investor on June 30 , 2026, for $13,000 of the bonds? Note: Round your intermediate calculations and final answer to the nearest whole dollar