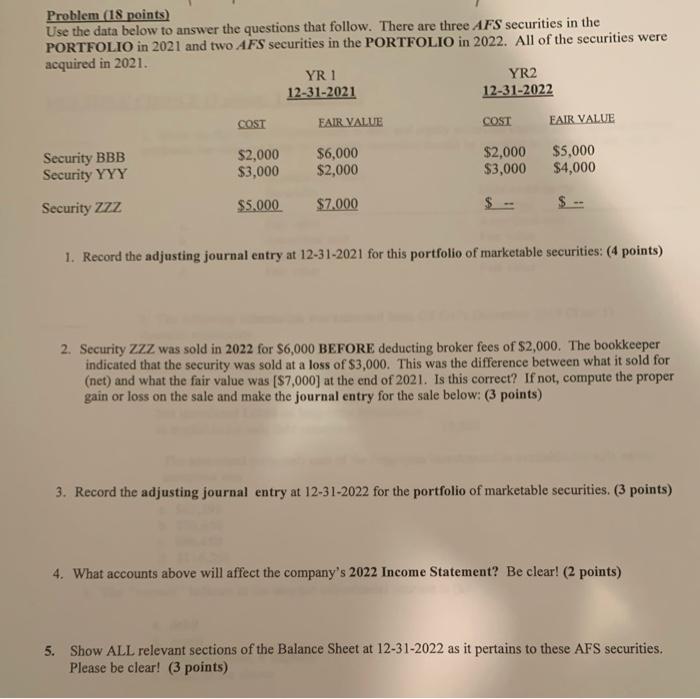

Problem (18 points) Use the data below to answer the questions that follow. There are three AFS securities in the PORTFOLIO in 2021 and two AFS securities in the PORTFOLIO in 2022. All of the securities were 1. Record the adjusting journal entry at 12-31-2021 for this portfolio of marketable securities: (4 points) 2. Security ZZZ was sold in 2022 for $6,000 BEFORE deducting broker fees of $2,000. The bookkeeper indicated that the security was sold at a loss of $3,000. This was the difference between what it sold for (net) and what the fair value was [$7,000] at the end of 2021. Is this correct? If not, compute the proper gain or loss on the sale and make the journal entry for the sale below: (3 points) 3. Record the adjusting journal entry at 12-31-2022 for the portfolio of marketable securities. (3 points) 4. What accounts above will affect the company's 2022 Income Statement? Be clear! (2 points) 5. Show ALL relevant sections of the Balance Sheet at 12-31-2022 as it pertains to these AFS securities. Please be clear! (3 points) 6. Would any of your journal entries be different if these securities were Trading instead of AFS? If so, indicate which ones and show the differences. (1 point) 7. Would anything in parts (4) and (5) be different if these securities were Trading instead of AFS. If so, please explain and show the differences. (2 points) Problem (18 points) Use the data below to answer the questions that follow. There are three AFS securities in the PORTFOLIO in 2021 and two AFS securities in the PORTFOLIO in 2022. All of the securities were 1. Record the adjusting journal entry at 12-31-2021 for this portfolio of marketable securities: (4 points) 2. Security ZZZ was sold in 2022 for $6,000 BEFORE deducting broker fees of $2,000. The bookkeeper indicated that the security was sold at a loss of $3,000. This was the difference between what it sold for (net) and what the fair value was [$7,000] at the end of 2021. Is this correct? If not, compute the proper gain or loss on the sale and make the journal entry for the sale below: (3 points) 3. Record the adjusting journal entry at 12-31-2022 for the portfolio of marketable securities. (3 points) 4. What accounts above will affect the company's 2022 Income Statement? Be clear! (2 points) 5. Show ALL relevant sections of the Balance Sheet at 12-31-2022 as it pertains to these AFS securities. Please be clear! (3 points) 6. Would any of your journal entries be different if these securities were Trading instead of AFS? If so, indicate which ones and show the differences. (1 point) 7. Would anything in parts (4) and (5) be different if these securities were Trading instead of AFS. If so, please explain and show the differences. (2 points)