Answered step by step

Verified Expert Solution

Question

1 Approved Answer

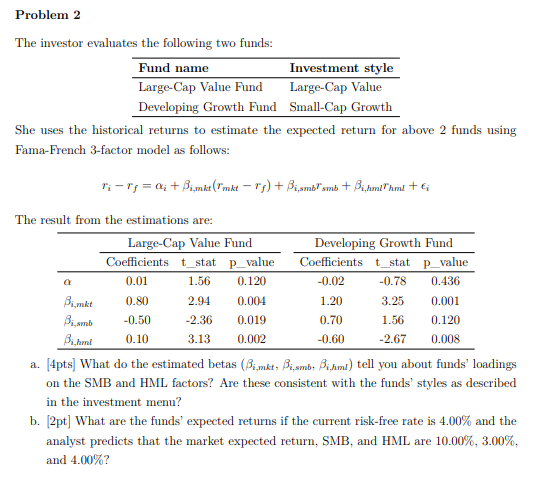

Problem 2 The investor evaluates the following two funds: She uses the historical returns to estimate the expected return for above 2 funds using Fama

Problem

The investor evaluates the following two funds:

She uses the historical returns to estimate the expected return for above funds using

FamaFrench factor model as follows:

The result from the estimations are:

apts What do the estimated betas tell you about funds' loadings

on the SMB and HML factors? Are these consistent with the funds' styles as described

in the investment menu?

bpt What are the funds' expected returns if the current riskfree rate is and the

analyst predicts that the market expected return, SMB and HML are

and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started