Problem 2

You are given three companies, General Motors (GM), Renault (RNO) and Toyota Motors (TM) and you are asked to assess their valuation and the opportunity to combine those shares in the same portfolio.

1) From the figures given in appendix, compute the estimated growth rate of earnings for GM, RNO and TM. Show your calculations.

2) If you require a rate of return of 14% on an investment in RNO company, assuming that the payout ratio is constant, what price would you accept to pay for one RNO share if you value the share with the Gordon-growth formula? Show your calculations. Would you then buy shares of RNO on the market (quotation is 71.67)?

3) Do you find the use of the Gordon-growth formula relevant to value RNO? Explain your views.

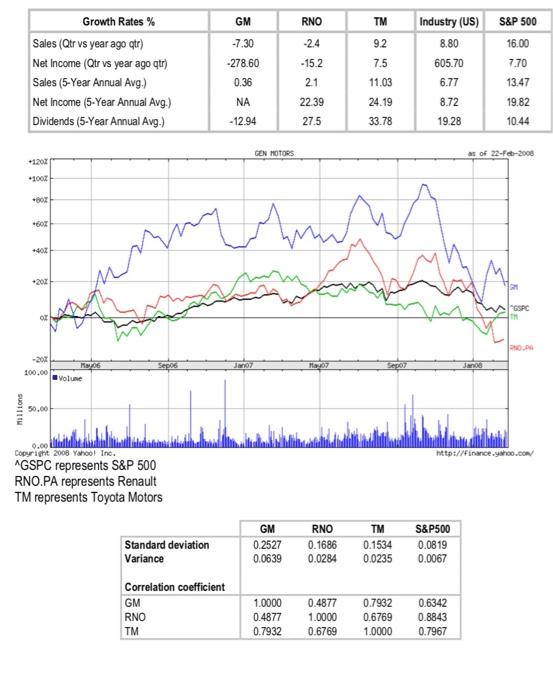

4) Do you think that combining GM, RNO and TM shares would be relevant for a diversified portfolio? Explain your views.

5) Compute beta for GM, RNO and TM shares with the appropriate benchmark and explain its signification. Which company would you consider the riskiest one? Round the beta with two decimals. Refer to the appendix to find the appropriate correlation coefficients and standard deviations. Show your calculations.

6) Compute an estimated return of GM, RNO and TM shares with CAPM. Estimated return of the market is 10% and the return of US T-Bills is 3%. Show your calculations and give an interpretation of your results for GM

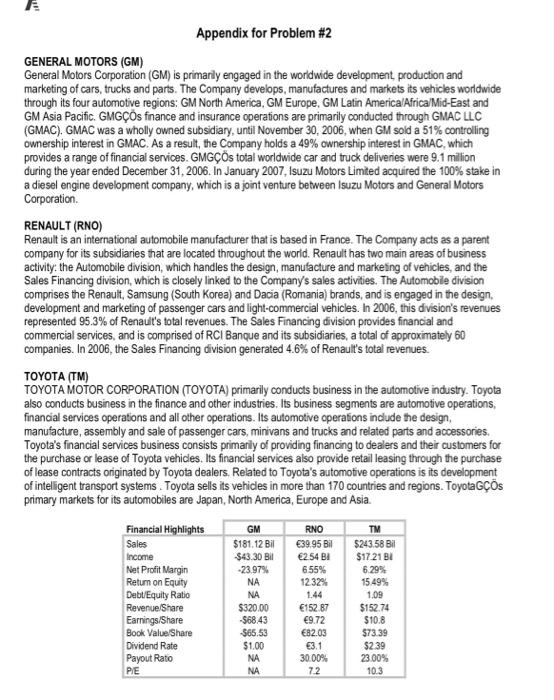

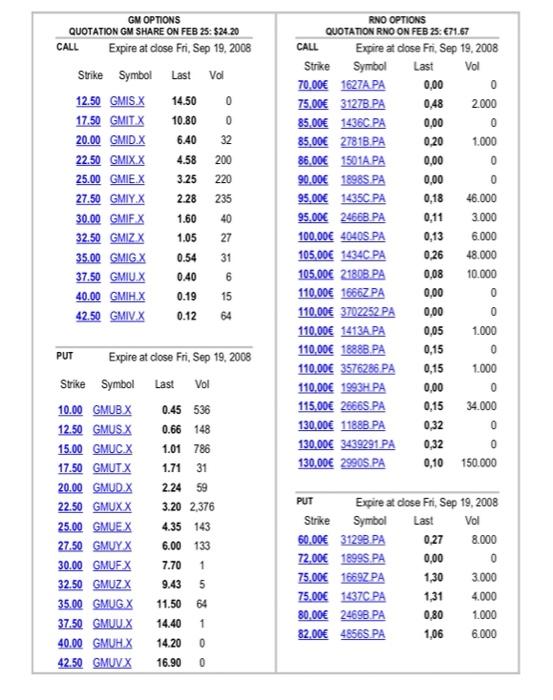

Appendix for Problem #2 GENERAL MOTORS (GM) General Motors Corporation (GM) is primarily engaged in the worldwide development production and marketing of cars, trucks and parts. The Company develops, manufactures and markets its vehicles worldwide through its four automotive regions: GM North America, GM Europe, GM Latin America/Africal Mid-East and GM Asia Pacific. GMGs fnance and insurance operations are primarily conducted through GMAC LLC (GMAC). GMAC was a wholly owned subsidiary, until November 30, 2006, when GM sold a 51% controlling ownership interest in GMAC. As a result , the Company holds a 49% ownership interest in GMAC, which provides a range of financial services. GMGs total worldwide car and truck deliveries were 9.1 milion during the year ended December 31, 2006. In January 2007, Isuzu Motors Limited acquired the 100% stake in a diesel engine development company, which is a joint venture between Isuzu Motors and General Motors Corporation RENAULT (RNO) Renault is an international automobile manufacturer that is based in France. The Company acts as a parent company for its subsidiaries that are located throughout the world. Renault has two main areas of business activity: the Automobile division, which handles the design, manufacture and marketing of vehicles, and the Sales Financing division, which is closely linked to the Company's sales activities. The Automobile division comprises the Renault , Samsung (South Korea) and Dacia (Romania) brands, and is engaged in the design. development and marketing of passenger cars and light-commercial vehicles. In 2006, this division's revenues represented 95.3% of Renault's total revenues. The Sales Financing division provides financial and commercial services, and is comprised of RCI Banque and its subsidiaries, a total of approximately 60 companies. In 2006, the Sales Financing division generated 4.6% of Renault's total revenues. TOYOTA (TM) TOYOTA MOTOR CORPORATION (TOYOTA) primarily conducts business in the automotive industry. Toyota also conducts business in the finance and other industries. Its business segments are automotive operations, financial services operations and all other operations. Its automotive operations include the design, manufacture, assembly and sale of passenger cars, minivans and trucks and related parts and accessories Toyota's financial services business consists primarily of providing financing to dealers and their customers for the purchase or lease of Toyota vehicles. Its financial services also provide retail leasing through the purchase of lease contracts originated by Toyota dealers. Related to Toyota's automotive operations is its development of intelligent transport systems Toyota sells its vehicles in more than 170 countries and regions. Toyota Gos primary markets for its automobiles are Japan, North America, Europe and Asia. RNO 39.95 Bil 2.54 B1 655% 1232 Financial Highlights Sales Income Net Profit Margin Return on Equity Debt/Equity Ratio Revenue/Share Earnings/Share Book Value Share Dividend Rate Payout Rato PE GM $181.12 Bil $43.30 Bil -23.97% NA NA $320.00 -$68.43 $65.53 $1.00 NA NA TM $243.58 Bil $17.21 BL 6.29% 15.49% 1.09 $152.74 $10.8 $73.39 $2.39 23.00% 10.3 152.87 9.72 82.03 3.1 30.00% 72 GM RNO TM S&P 500 Industry (US) 8.80 -7.30 -24 92 16.00 7.5 605.70 7.70 Growth Rates % Sales (Qtr vs year ago atr) Net Income (Qtr vs year ago qtr) Sales (5-Year Annual Avg.) Net Income (5-Year Annual Avg.) Dividends (5-Year Annual Avg.) -278.60 0.36 -15.2 21 11.03 6.77 13.47 NA 24.19 8.72 19.82 22.39 27.5 -12.94 33.78 19.28 10.44 GEN MOTORS as of 22-7-2008 Amm 202 m ASPC Or . JO Tayo Jano 100.00 M.06 Volume millions 50.00 http://finance.yahoo.com 0.00 Copyright 2008 Yooline. GSPC represents S&P 500 RNO.PA represents Renault TM represents Toyota Motors Standard deviation Variance GM 0.2527 0.0639 RNO 0.1686 0.0284 TM 0.1534 0.0235 S&P500 0.0819 0.0067 Correlation coefficient GM RNO TM 1.0000 0.4877 0.7932 0.4877 1.0000 0.6769 0.7932 0.6769 1.0000 0.6342 0.8843 0.7967 0,00 6.40 0,00 GM OPTIONS QUOTATION GM SHARE ON FEB 25: $24.20 CALL Expire at dose Fri Sep 19, 2008 Strike Symbol Last Vol 12.50 GMIS.X 14.50 0 17.50 GMITX 10.80 0 20.00 GMID.X 32 22.50 GMIX.X 4.58 200 25.00 GMIE.X 3.25 220 27.50 GMIY X 2.28 235 30.00 GMIFX 1.60 40 32.50 GMIZ.X 1.05 27 35.00 GMIG.X 0.54 31 37.50 GMIU.X 0.40 6 40.00 GMIH.X 0.19 15 42.50 GMIV.X 0.1264 RNO OPTIONS QUOTATION RNO ON FEB 25: 71.67 CALL Expire at dose Fri Sep 19, 2008 Strike Symbol Last Vol 70.00 1627A PA 0 75,00 3127B.PA 0,48 2.000 85.00 1436CPA 0,00 0 85,00 2781B.PA 0,20 1.000 86.00 1501A PA 0 90.00 1898S PA 0,00 0 95,00 1435C PA 0,18 46.000 95.00 24668 PA 0,11 3.000 100.00 4040S PA 0,13 6.000 105.00 1434C PA 48.000 105,00 21808 PA 0,08 10.000 110,00 1666Z PA 0,00 0 110.00 3702252 PA 0,00 0 110,00 1413A, PA 1.000 110,00 1888B.PA 0,15 0 110,00 3576286 PA 0,15 1.000 110.00 1993H PA 0,00 0 115,00 26668.PA 0,15 34.000 130,00 1188B PA 0,32 0 130,00 3439291 PA 0,32 0 130,00 2990S. PA 0,10 150.000 0.26 0,05 PUT Expire at close Fri, Sep 19, 2008 Strike Symbol Last Vol 10.00 GMUBX 0.45 536 12.50 GMUS.X 0.66 148 15.00 GMUC.X 1.01 786 17.50 GMUTX 1.71 31 20.00 GMUDX 2.24 59 22.50 GMUX X 3.20 2,376 25.00 GMUEX 4.35 143 27.50 GMUY X 6.00 133 30.00 GMUEX 7.70 1 32.50 GMUZX 9.43 5 35.00 GMUGX 11.50 64 37.50 GMUU.X 14.40 1 40.0 GMUH.X 14.20 42.50 GMUVX 16.90 0 PUT Expire at close Fri Sep 19, 2008 Strike Symbol Last Vol 60.00 31298 PA 0.27 8.000 72,00 18998 PA 0,00 0 75.00 1669Z PA 1,30 3.000 75.00 1437C PA 1,31 4.000 80.00 2469B PA 0,80 1.000 82.00 4856S PA 1,06 6.000 Appendix for Problem #2 GENERAL MOTORS (GM) General Motors Corporation (GM) is primarily engaged in the worldwide development production and marketing of cars, trucks and parts. The Company develops, manufactures and markets its vehicles worldwide through its four automotive regions: GM North America, GM Europe, GM Latin America/Africal Mid-East and GM Asia Pacific. GMGs fnance and insurance operations are primarily conducted through GMAC LLC (GMAC). GMAC was a wholly owned subsidiary, until November 30, 2006, when GM sold a 51% controlling ownership interest in GMAC. As a result , the Company holds a 49% ownership interest in GMAC, which provides a range of financial services. GMGs total worldwide car and truck deliveries were 9.1 milion during the year ended December 31, 2006. In January 2007, Isuzu Motors Limited acquired the 100% stake in a diesel engine development company, which is a joint venture between Isuzu Motors and General Motors Corporation RENAULT (RNO) Renault is an international automobile manufacturer that is based in France. The Company acts as a parent company for its subsidiaries that are located throughout the world. Renault has two main areas of business activity: the Automobile division, which handles the design, manufacture and marketing of vehicles, and the Sales Financing division, which is closely linked to the Company's sales activities. The Automobile division comprises the Renault , Samsung (South Korea) and Dacia (Romania) brands, and is engaged in the design. development and marketing of passenger cars and light-commercial vehicles. In 2006, this division's revenues represented 95.3% of Renault's total revenues. The Sales Financing division provides financial and commercial services, and is comprised of RCI Banque and its subsidiaries, a total of approximately 60 companies. In 2006, the Sales Financing division generated 4.6% of Renault's total revenues. TOYOTA (TM) TOYOTA MOTOR CORPORATION (TOYOTA) primarily conducts business in the automotive industry. Toyota also conducts business in the finance and other industries. Its business segments are automotive operations, financial services operations and all other operations. Its automotive operations include the design, manufacture, assembly and sale of passenger cars, minivans and trucks and related parts and accessories Toyota's financial services business consists primarily of providing financing to dealers and their customers for the purchase or lease of Toyota vehicles. Its financial services also provide retail leasing through the purchase of lease contracts originated by Toyota dealers. Related to Toyota's automotive operations is its development of intelligent transport systems Toyota sells its vehicles in more than 170 countries and regions. Toyota Gos primary markets for its automobiles are Japan, North America, Europe and Asia. RNO 39.95 Bil 2.54 B1 655% 1232 Financial Highlights Sales Income Net Profit Margin Return on Equity Debt/Equity Ratio Revenue/Share Earnings/Share Book Value Share Dividend Rate Payout Rato PE GM $181.12 Bil $43.30 Bil -23.97% NA NA $320.00 -$68.43 $65.53 $1.00 NA NA TM $243.58 Bil $17.21 BL 6.29% 15.49% 1.09 $152.74 $10.8 $73.39 $2.39 23.00% 10.3 152.87 9.72 82.03 3.1 30.00% 72 GM RNO TM S&P 500 Industry (US) 8.80 -7.30 -24 92 16.00 7.5 605.70 7.70 Growth Rates % Sales (Qtr vs year ago atr) Net Income (Qtr vs year ago qtr) Sales (5-Year Annual Avg.) Net Income (5-Year Annual Avg.) Dividends (5-Year Annual Avg.) -278.60 0.36 -15.2 21 11.03 6.77 13.47 NA 24.19 8.72 19.82 22.39 27.5 -12.94 33.78 19.28 10.44 GEN MOTORS as of 22-7-2008 Amm 202 m ASPC Or . JO Tayo Jano 100.00 M.06 Volume millions 50.00 http://finance.yahoo.com 0.00 Copyright 2008 Yooline. GSPC represents S&P 500 RNO.PA represents Renault TM represents Toyota Motors Standard deviation Variance GM 0.2527 0.0639 RNO 0.1686 0.0284 TM 0.1534 0.0235 S&P500 0.0819 0.0067 Correlation coefficient GM RNO TM 1.0000 0.4877 0.7932 0.4877 1.0000 0.6769 0.7932 0.6769 1.0000 0.6342 0.8843 0.7967 0,00 6.40 0,00 GM OPTIONS QUOTATION GM SHARE ON FEB 25: $24.20 CALL Expire at dose Fri Sep 19, 2008 Strike Symbol Last Vol 12.50 GMIS.X 14.50 0 17.50 GMITX 10.80 0 20.00 GMID.X 32 22.50 GMIX.X 4.58 200 25.00 GMIE.X 3.25 220 27.50 GMIY X 2.28 235 30.00 GMIFX 1.60 40 32.50 GMIZ.X 1.05 27 35.00 GMIG.X 0.54 31 37.50 GMIU.X 0.40 6 40.00 GMIH.X 0.19 15 42.50 GMIV.X 0.1264 RNO OPTIONS QUOTATION RNO ON FEB 25: 71.67 CALL Expire at dose Fri Sep 19, 2008 Strike Symbol Last Vol 70.00 1627A PA 0 75,00 3127B.PA 0,48 2.000 85.00 1436CPA 0,00 0 85,00 2781B.PA 0,20 1.000 86.00 1501A PA 0 90.00 1898S PA 0,00 0 95,00 1435C PA 0,18 46.000 95.00 24668 PA 0,11 3.000 100.00 4040S PA 0,13 6.000 105.00 1434C PA 48.000 105,00 21808 PA 0,08 10.000 110,00 1666Z PA 0,00 0 110.00 3702252 PA 0,00 0 110,00 1413A, PA 1.000 110,00 1888B.PA 0,15 0 110,00 3576286 PA 0,15 1.000 110.00 1993H PA 0,00 0 115,00 26668.PA 0,15 34.000 130,00 1188B PA 0,32 0 130,00 3439291 PA 0,32 0 130,00 2990S. PA 0,10 150.000 0.26 0,05 PUT Expire at close Fri, Sep 19, 2008 Strike Symbol Last Vol 10.00 GMUBX 0.45 536 12.50 GMUS.X 0.66 148 15.00 GMUC.X 1.01 786 17.50 GMUTX 1.71 31 20.00 GMUDX 2.24 59 22.50 GMUX X 3.20 2,376 25.00 GMUEX 4.35 143 27.50 GMUY X 6.00 133 30.00 GMUEX 7.70 1 32.50 GMUZX 9.43 5 35.00 GMUGX 11.50 64 37.50 GMUU.X 14.40 1 40.0 GMUH.X 14.20 42.50 GMUVX 16.90 0 PUT Expire at close Fri Sep 19, 2008 Strike Symbol Last Vol 60.00 31298 PA 0.27 8.000 72,00 18998 PA 0,00 0 75.00 1669Z PA 1,30 3.000 75.00 1437C PA 1,31 4.000 80.00 2469B PA 0,80 1.000 82.00 4856S PA 1,06 6.000