Answered step by step

Verified Expert Solution

Question

1 Approved Answer

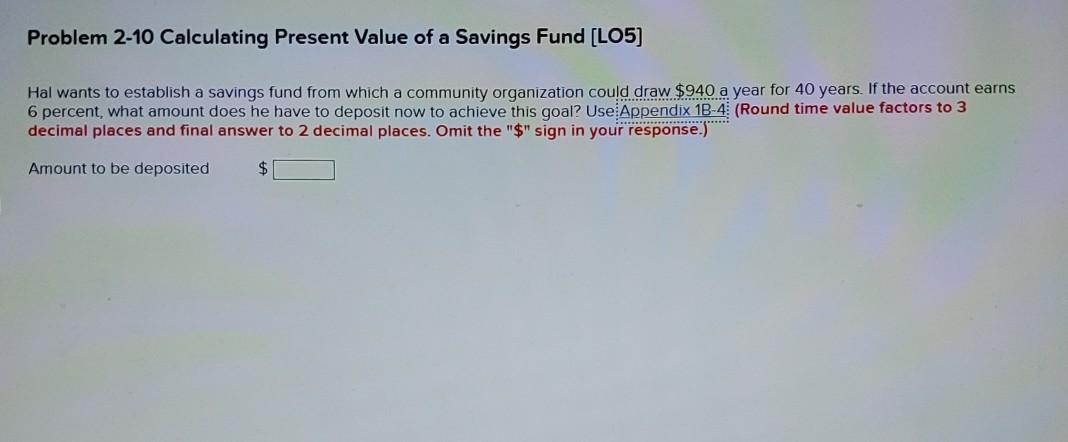

Problem 2-10 Calculating Present Value of a Savings Fund (LO5] Hal wants to establish a savings fund from which a community organization could draw $940

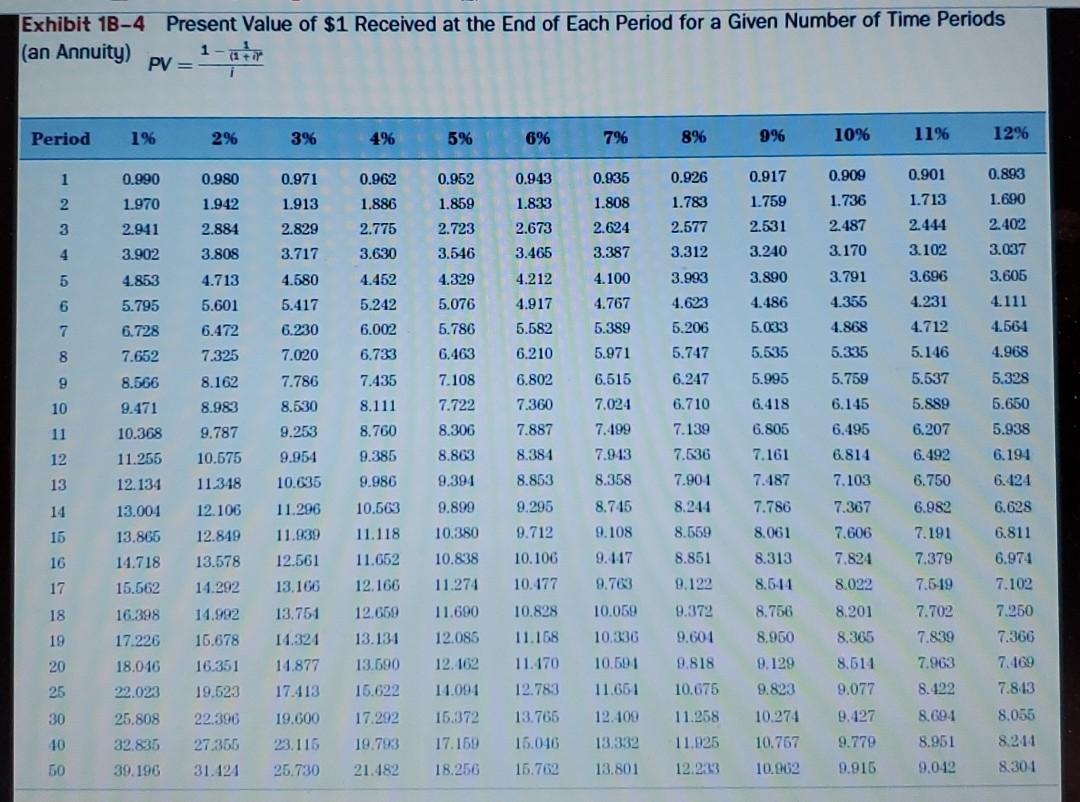

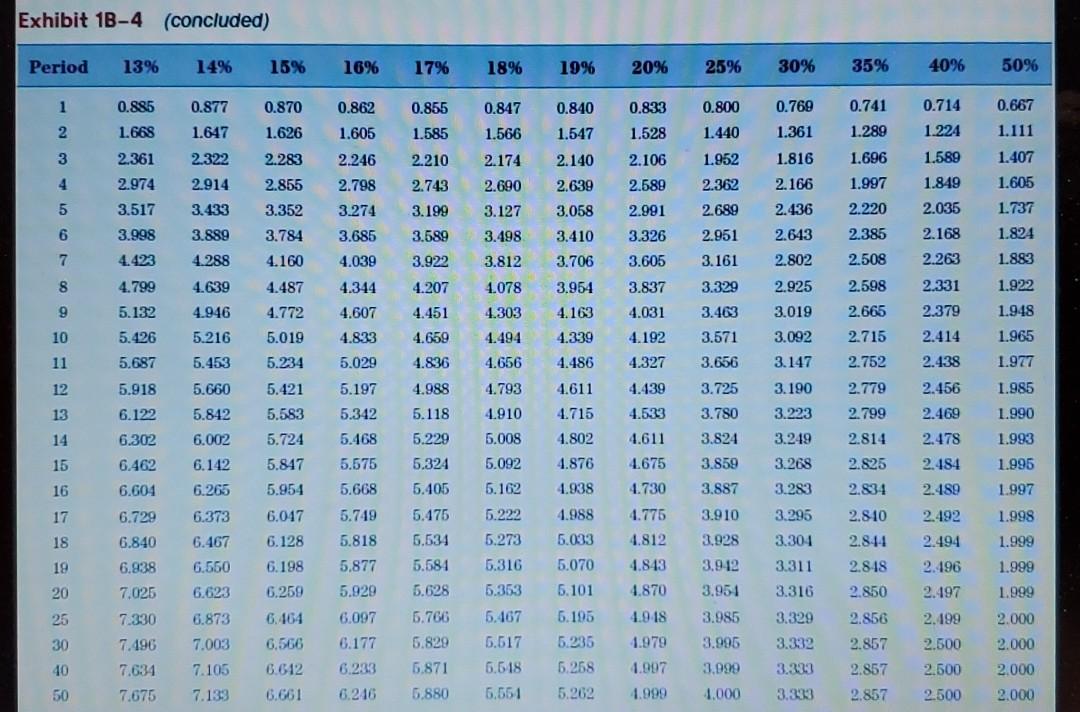

Problem 2-10 Calculating Present Value of a Savings Fund (LO5] Hal wants to establish a savings fund from which a community organization could draw $940 a year for 40 years. If the account earns 6 percent, what amount does he have to deposit now to achieve this goal? Use Appendix 1B-4 (Round time value factors to 3 decimal places and final answer to 2 decimal places. Omit the "$" sign in your response.) Amount to be deposited $ Exhibit 1B-4 Present Value of $1 Received at the End of Each Period for a Given Number of Time Periods (an Annuity) 1 PV = Period 196 2% 3% 4% 5% 696 796 8% 996 1096 11% 12% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.901 0.893 0.935 1.808 2 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1.690 0.917 1.759 2.531 3.240 0.909 1.736 2.487 3.170 3 2.941 2.775 2.673 2.624 2.577 2.884 3.808 2.829 3.717 2.723 3.546 1.713 2.444 3.102 2.402 3.037 4 3.902 3.630 3.465 3.387 5 4.853 4.713 4.329 3.890 3.312 3.993 4.623 3.791 3.696 4.580 5.417 3.605 4.100 4.767 6 5.795 5.601 4.486 4.355 4.231 4.111 4.452 5.242 6.002 6.733 5.076 5.786 4.212 4.917 5.582 6.210 7 6.728 5.206 4.868 6.472 7.325 6.230 7.020 5.389 5.971 5.033 5.535 8 6.463 5.335 4.664 4.968 5.328 7.652 8.566 9.471 4.712 5.146 5.537 5.889 9 7.786 7.435 7.108 6.802 5.759 5.747 6.247 6.710 7.139 5.995 6.418 10 8.530 7.360 7.887 6.145 6.495 11 10.368 8.162 8.983 9.787 10.575 11.348 12.106 6.515 7.024 7.499 7.943 8.358 6.805 7.722 8.306 8.863 9,394 5.650 5.938 6.194 12 8.111 8.760 9.385 9.986 10,503 11.118 11.255 12.134 8.381 8.853 7.636 7.901 7.161 7.187 6.207 6.492 6.750 6.814 7.103 13 6.424 14 9.253 9.954 10.635 11.296 11.939 12.561 13.106 13.004 9.899 9.295 8.715 8.244 6.628 16 12.849 9.712 10.106 9.108 9.117 8.559 8.851 7.786 8.061 8.313 7.367 7.606 7.824 6.811 6.974 6.982 7.191 7.379 7.6.19 16 13.865 14.718 15.562 16.398 17.226 10,380 10.838 11.274 11.690 17 11.652 12.166 12.669 10.177 9.703 8.5.14 8.022 7.102 18 13.578 14.292 14.992 15.678 16.351 19.623 9.122 9.372 9.601 8.756 19 12.085 13.751 14.324 14.877 17.413 7.702 7.839 7.963 20 18.046 22.023 7.250 7.366 7.169 7.8.13 8.950 9.129 9.823 10.828 11.168 11.170 12.783 13.765 15.016 9.818 10.676 10.059 10,336 10.691 11.661 12.100 13.332 13.801 25 13.131 13.690 15.622 17.292 19.793 21.482 12.162 11.094 15.372 17.159 8.201 8.365 8.514 9.077 9.127 9.779 9.915 8.422 30 19.600 25.808 32.835 22.396 27.350 10 23.116 25.730 11.258 11.925 12.233 10.274 10.767 10.902 8.694 8.951 9.042 8.055 8.214 8.301 50 39.196 31.124 18.256 15.762 Exhibit 1B-4 (concluded) Period 13% 14% 15% 16% 17% 1896 19% 20% 2596 30% 35% 4096 50% 1 0.885 0.870 0.855 0.847 0.833 0.877 1.647 0.862 1.605 0.840 1.547 0.800 1.440 0.769 1.361 0.741 1.289 0.714 1.224 0.667 1.111 2 1.668 1.626 1.585 1.528 3 2.361 2322 2.140 2.283 2.855 4 1.566 2.174 2.690 3.127 2.246 2.798 3.274 2.974 3.517 2.210 2.743 3.199 2.914 3.433 2.639 2.106 2.589 2.991 1.952 2.362 2.689 1.816 2.166 2.436 2.643 1.696 1.997 2.220 2.385 1.589 1.849 2.035 5 3.352 3,058 1.407 1.605 1.737 1.824 1.883 6 3.889 3.784 3.685 3.589 3.410 2.951 3.998 4.423 3.326 3.605 2.168 2.263 7 4.288 4.160 4.039 3.922 3.706 3.161 2.508 8 4.639 4.344 3.837 3.329 3.498 3.812 4.078 4.303 4.494 2.331 9 4.607 4.799 5.132 5.426 5.687 4.031 4.207 4.451 4.659 3.463 4.487 4.772 5.019 5.234 4.946 5.216 5.453 3.954 4.163 4.339 4.486 2.802 2.925 3.019 3.092 3.147 2.598 2.665 2.715 2.752 10 1.922 1.948 1.965 1.977 4.833 4.192 4.327 2.379 2.414 2.438 3.571 3.656 11 5.029 4.836 4.656 12 5.660 5.197 4.611 4.439 4.793 4.910 3.190 3.223 1.985 1.990 13 5.842 5.342 4.533 3.725 3.780 3.824 14 5.421 5.583 5.724 5.817 5.954 2.779 2.799 2.814 2.825 6.002 4.715 4.802 4.876 5.468 5.008 15 1.993 1.995 6.142 2.456 2.469 2.478 2.484 2.189 5.575 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.838 5.092 4.611 4.675 4.730 3.859 3.249 3.268 3.283 4.988 5.118 5.229 5.324 5.405 5.475 6.534 5.584 5.628 16 6.265 5.668 5.162 4.938 2.834 1.997 3.887 3.910 17 6.373 5.222 4.988 6,047 6.128 2.8 10 2.844 2.492 2.494 1.998 1.999 18 5.273 3.928 6.467 6.550 5.749 5.818 5.877 5.929 3.295 3.301 3.311 4.775 4.812 4.843 4.870 19 5.033 5.070 5.101 6.198 2.8.18 5.316 5.353 1.999 3.9-12 3.951 2.196 2.197 20 7,025 6.623 6.259 2.850 1.999 6.873 4.9.18 3.985 2.000 25 30 6.097 6.177 1.979 7.330 7.496 7.634 7.675 3.996 7.003 7.105 6.464 6,566 6.612 6.661 5.766 5.829 5.871 5.880 6.195 5.235 6,258 5.467 6.517 6,618 6,551 3.316 3.329 3.332 3.333 3.333 2.856 2.857 2.857 2.857 2.199 2.500 2.500 2.500 2.000 2.000 40 6.233 6.216 4.097 1.999 3.099 1.000 50 7.133 5.262 2.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started