Answered step by step

Verified Expert Solution

Question

1 Approved Answer

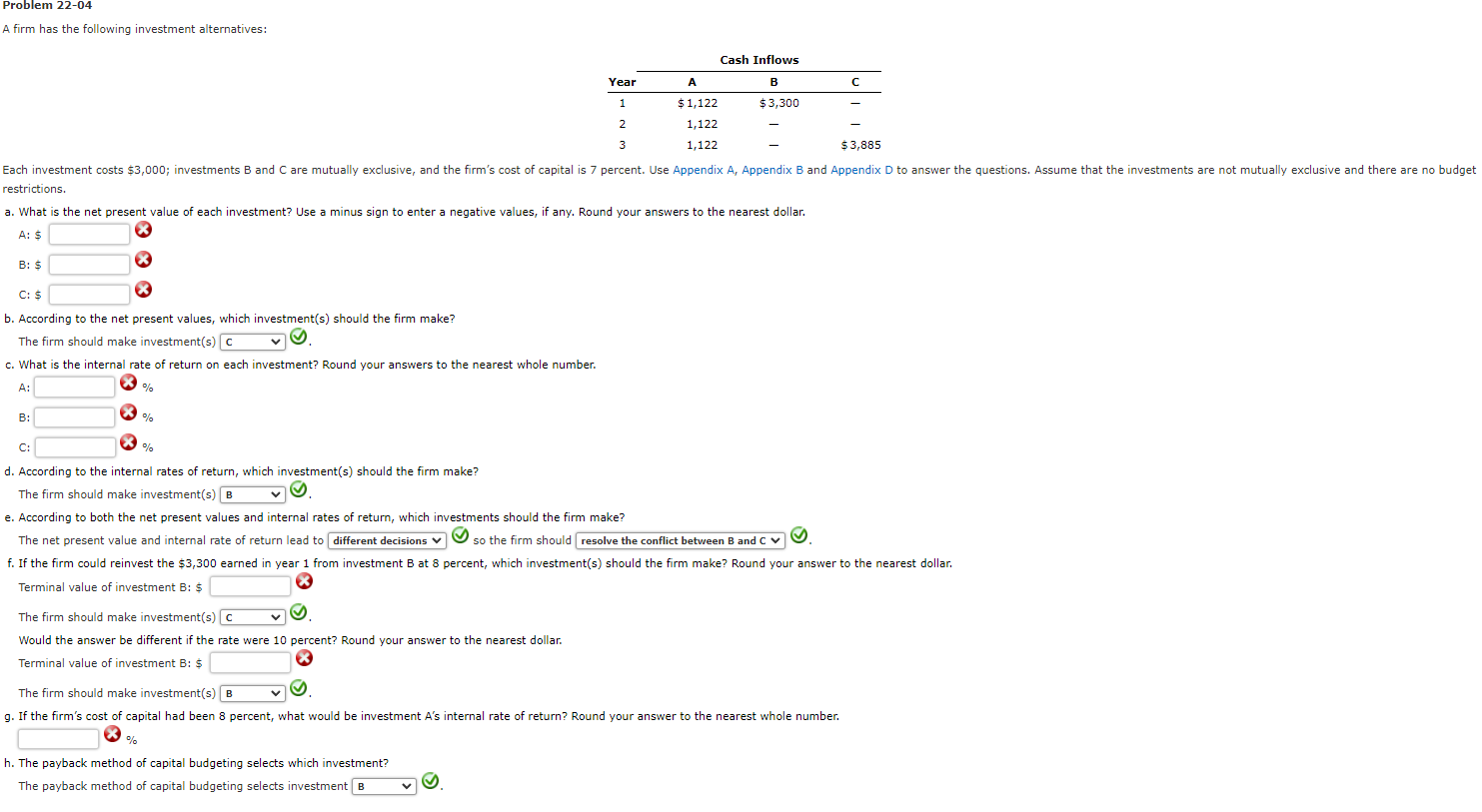

Problem 22-04 A firm has the following investment alternatives: restrictions. a. What is the net present value of each investment? Use a minus sign to

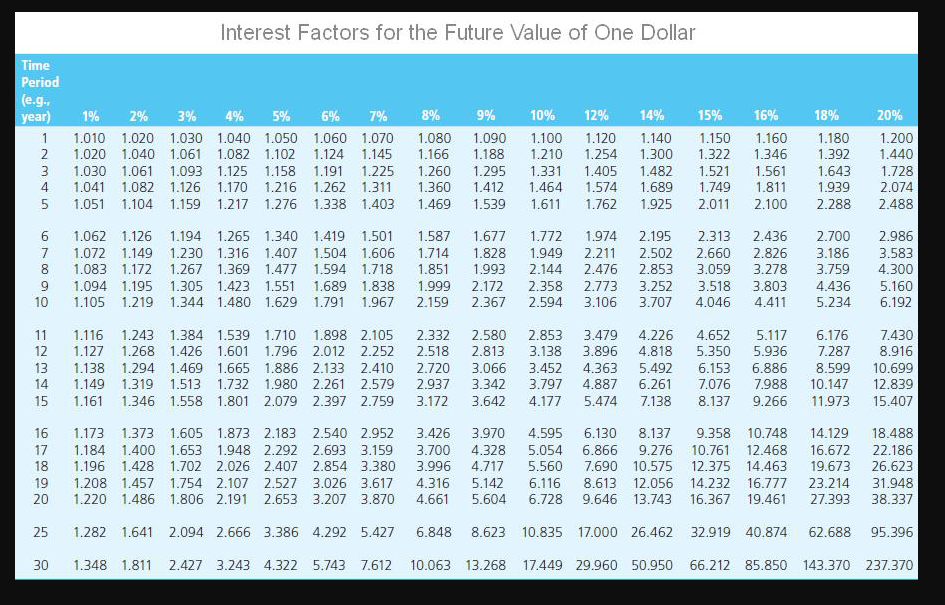

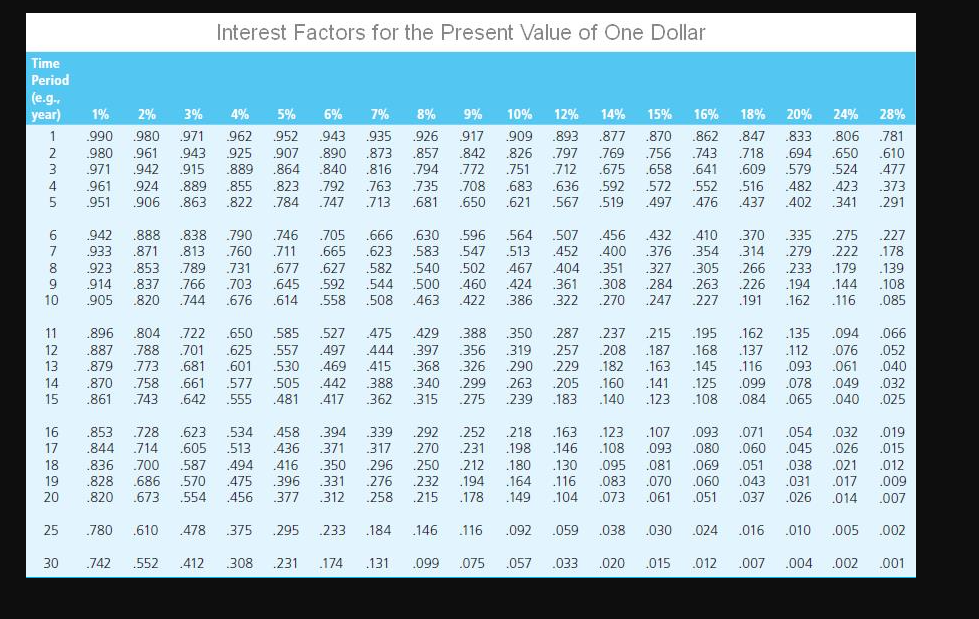

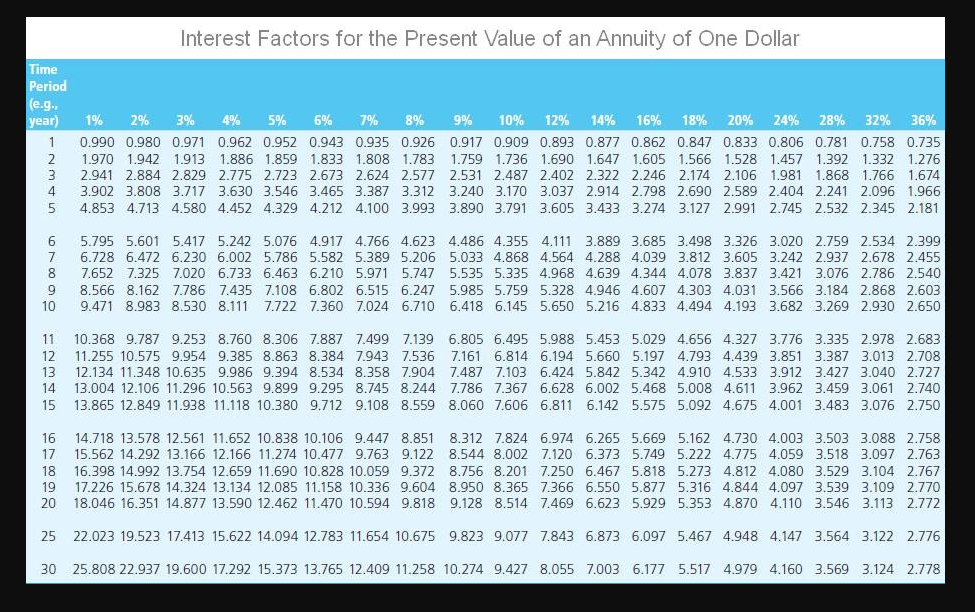

Problem 22-04 A firm has the following investment alternatives: restrictions. a. What is the net present value of each investment? Use a minus sign to enter a negative values, if any. Round your answers to the nearest dollar. A: $ B: $ C: $ b. According to the net present values, which investment(s) should the firm make? The firm should make investment(s) c. What is the internal rate of return on each investment? Round your answers to the nearest whole number. A:B:C:%%3 d. According to the internal rates of return, which investment(s) should the firm make? The firm should make investment(s) C. e. According to both the net present values and internal rates of return, which investments should the firm make? The net present value and internal rate of return lead to so the firm shoulc 3. f. If the firm could reinvest the $3,300 earned in year 1 from investment B at 8 percent, which investment(s) should the firm make? Round your answer to the nearest dollar. Terminal value of investment B:$ The firm should make investment(s) 0. Would the answer be different if the rate were 10 percent? Round your answer to the nearest dollar. Terminal value of investment B:$ The firm should make investment(s) (3. g. If the firm's cost of capital had been 8 percent, what would be investment A's internal rate of return? Round your answer to the nearest whole number. h. The payback method of capital budgeting selects which investment? The payback method of capital budgeting selects investment V. Interect Fartare far the Fi iti ire l/ali is af One Nnllar Interest Factors for the Present Value of One Dollar Time Period (e.g. 6789101112131415.942.933.923.914.905.896.887.879.870.861.888.871.853.837.820.804.788.773.758.743.838.813.789.766.744.722.701.681.661.642.790.760.731.703.676.650.625.601.577.555.746.711.677.645.614.585.557.530.505.481.705.665.627.592.558.527.497.469.442.417.666.623.582.544.508.475.444.415.388.362.630.583.540.500.463.429.397.368.340.315.596.547.502.460.422.388.356.326.299.275.564.513.467.424.386.350.319.290.263.239.507.452.404.361.322.287.257.229.205.183.456.400.351.308.270.237.208.182.160.140.432.376.327.284.247.215.187.163.141.123.410.354.305.263.227.195.168.145.125.108.370.314.266.226.191.162.137.116.099.084.335.279.233.194.162.135.112.093.078.065.275.222.179.144.116.094.076.061.049.040.227.178.139.108.085.066.052.040.032.025 16171819202530.853.844.836.828.820.780.742.728.714.700.686.673.610.552.623.605.587.570.554.478.412.534.513.494.475.456.375.308.458.436.416.396.377.295.231.394.371.350.331.312.233.174.339.317.296.276.258.184.131.292.270.250.232.215.146.099.252.231.212.194.178.116.075.218.198.180.164.149.092.057.163.146.130.116.104.059.033.123.108.095.083.073.038.020.107.093.081.070.061.030.015.093.080.069.060.051.024.012.071.060.051.043.037.016.007.054.045.038.031.026.010.004.032.026.021.017.014.005.002.019.015.012.009.007.002.001 Interest Factors for the Present Value of an Annuity of One Dollar Problem 22-04 A firm has the following investment alternatives: restrictions. a. What is the net present value of each investment? Use a minus sign to enter a negative values, if any. Round your answers to the nearest dollar. A: $ B: $ C: $ b. According to the net present values, which investment(s) should the firm make? The firm should make investment(s) c. What is the internal rate of return on each investment? Round your answers to the nearest whole number. A:B:C:%%3 d. According to the internal rates of return, which investment(s) should the firm make? The firm should make investment(s) C. e. According to both the net present values and internal rates of return, which investments should the firm make? The net present value and internal rate of return lead to so the firm shoulc 3. f. If the firm could reinvest the $3,300 earned in year 1 from investment B at 8 percent, which investment(s) should the firm make? Round your answer to the nearest dollar. Terminal value of investment B:$ The firm should make investment(s) 0. Would the answer be different if the rate were 10 percent? Round your answer to the nearest dollar. Terminal value of investment B:$ The firm should make investment(s) (3. g. If the firm's cost of capital had been 8 percent, what would be investment A's internal rate of return? Round your answer to the nearest whole number. h. The payback method of capital budgeting selects which investment? The payback method of capital budgeting selects investment V. Interect Fartare far the Fi iti ire l/ali is af One Nnllar Interest Factors for the Present Value of One Dollar Time Period (e.g. 6789101112131415.942.933.923.914.905.896.887.879.870.861.888.871.853.837.820.804.788.773.758.743.838.813.789.766.744.722.701.681.661.642.790.760.731.703.676.650.625.601.577.555.746.711.677.645.614.585.557.530.505.481.705.665.627.592.558.527.497.469.442.417.666.623.582.544.508.475.444.415.388.362.630.583.540.500.463.429.397.368.340.315.596.547.502.460.422.388.356.326.299.275.564.513.467.424.386.350.319.290.263.239.507.452.404.361.322.287.257.229.205.183.456.400.351.308.270.237.208.182.160.140.432.376.327.284.247.215.187.163.141.123.410.354.305.263.227.195.168.145.125.108.370.314.266.226.191.162.137.116.099.084.335.279.233.194.162.135.112.093.078.065.275.222.179.144.116.094.076.061.049.040.227.178.139.108.085.066.052.040.032.025 16171819202530.853.844.836.828.820.780.742.728.714.700.686.673.610.552.623.605.587.570.554.478.412.534.513.494.475.456.375.308.458.436.416.396.377.295.231.394.371.350.331.312.233.174.339.317.296.276.258.184.131.292.270.250.232.215.146.099.252.231.212.194.178.116.075.218.198.180.164.149.092.057.163.146.130.116.104.059.033.123.108.095.083.073.038.020.107.093.081.070.061.030.015.093.080.069.060.051.024.012.071.060.051.043.037.016.007.054.045.038.031.026.010.004.032.026.021.017.014.005.002.019.015.012.009.007.002.001 Interest Factors for the Present Value of an Annuity of One Dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started