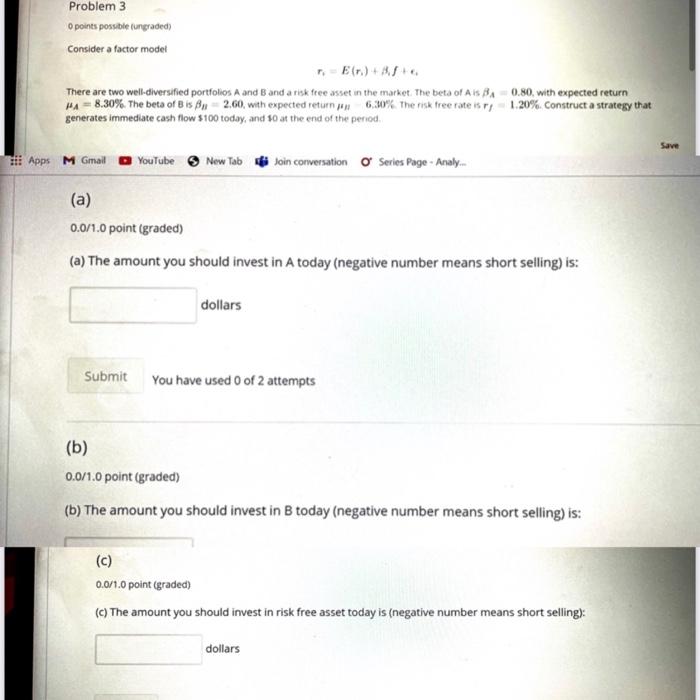

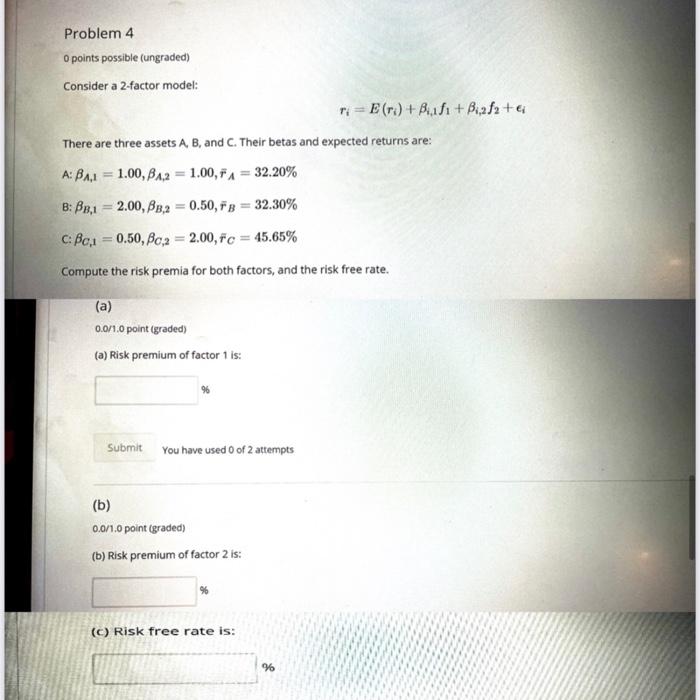

Problem 3 o points possible (ungraded Consider a factor modet (n.) +A There are two well-diversified portfolios A and B and a risk free asset in the market. The beta of Ais BA 0.80, with expected return HA = 8.30%. The beta of B is B. 2.60, with expected return 6.30% The risk free rate is 1.20%. Construct a strategy that generates immediate cash flow $100 today, and 10 at the end of the period Save Hi Apps M Gmail YouTube New Tab Join conversation Series Page - Analy... (a) 0.0/1.0 point (graded) (a) The amount you should invest in A today (negative number means short selling) is: dollars Submit You have used 0 of 2 attempts (b) 0.0/1.0 point (graded) (b) The amount you should invest in B today (negative number means short selling) is: 0.0/1.0 point (graded) (c) The amount you should invest in risk free asset today is (negative number means short selling): dollars Problem 4 0 points possible (ungraded) Consider a 2-factor model: Ti = E(r) + Bufi+Buaf2+ There are three assets A, B, and C. Their betas and expected returns are: A: BAL=1.00, BA2 = 1.00,7 A = 32.20% B: B3,1 = 2.00,BB,2 = 0.50, FB = 32.30% C: Bei = 0.50, 30,2 = 2.00, Fc = 45.65% Compute the risk premia for both factors, and the risk free rate. (a) 0.0/1.0 point (graded) (a) Risk premium of factor 1 is: Submit You have used 0 of 2 attempts (b) 0.0/1.0 point (graded) (b) Risk premium of factor 2 is: (C) Risk free rate is: % Problem 3 o points possible (ungraded Consider a factor modet (n.) +A There are two well-diversified portfolios A and B and a risk free asset in the market. The beta of Ais BA 0.80, with expected return HA = 8.30%. The beta of B is B. 2.60, with expected return 6.30% The risk free rate is 1.20%. Construct a strategy that generates immediate cash flow $100 today, and 10 at the end of the period Save Hi Apps M Gmail YouTube New Tab Join conversation Series Page - Analy... (a) 0.0/1.0 point (graded) (a) The amount you should invest in A today (negative number means short selling) is: dollars Submit You have used 0 of 2 attempts (b) 0.0/1.0 point (graded) (b) The amount you should invest in B today (negative number means short selling) is: 0.0/1.0 point (graded) (c) The amount you should invest in risk free asset today is (negative number means short selling): dollars Problem 4 0 points possible (ungraded) Consider a 2-factor model: Ti = E(r) + Bufi+Buaf2+ There are three assets A, B, and C. Their betas and expected returns are: A: BAL=1.00, BA2 = 1.00,7 A = 32.20% B: B3,1 = 2.00,BB,2 = 0.50, FB = 32.30% C: Bei = 0.50, 30,2 = 2.00, Fc = 45.65% Compute the risk premia for both factors, and the risk free rate. (a) 0.0/1.0 point (graded) (a) Risk premium of factor 1 is: Submit You have used 0 of 2 attempts (b) 0.0/1.0 point (graded) (b) Risk premium of factor 2 is: (C) Risk free rate is: %