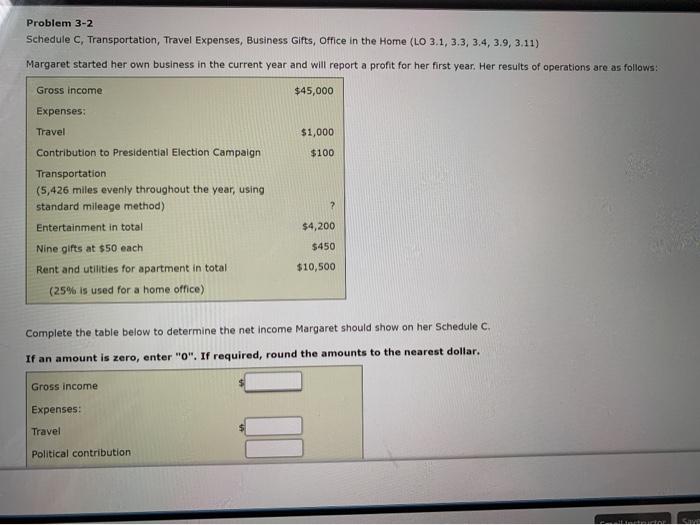

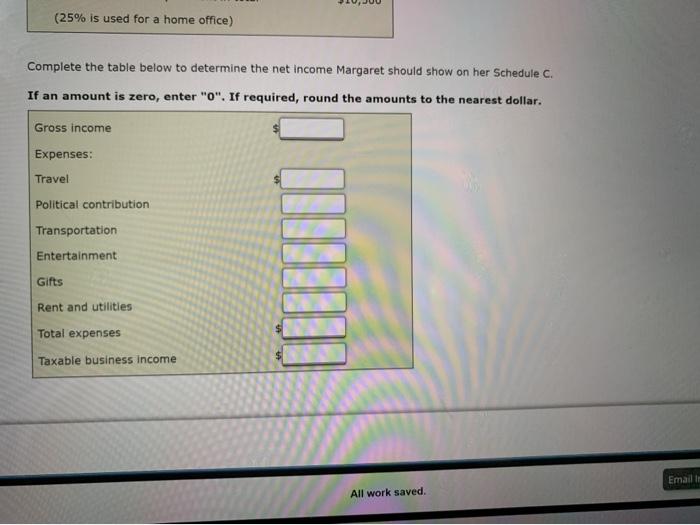

Problem 3-2 Schedule C, Transportation, Travel Expenses, Business Gifts, Office in the Home (LO 3.1, 3.3, 3.4, 3.9, 3.11) Margaret started her own business in the current year and will report a profit for her first year. Her results of operations are as follows: Gross income $45,000 Expenses: Travel $1,000 $100 ? Contribution to Presidential Election Campaign Transportation (5,426 miles evenly throughout the year, using standard mileage method) Entertainment in total Nine gifts at $50 each Rent and utilities for apartment in total (25% is used for a home office) $4,200 $450 $10,500 Complete the table below to determine the net income Margaret should show on her Schedule c. If an amount is zero, enter "O". If required, round the amounts to the nearest dollar. Gross income Expenses: Travel Political contribution (25% is used for a home office) Complete the table below to determine the net income Margaret should show on her Schedule C. If an amount is zero, enter "O". If required, round the amounts to the nearest dollar. Gross income Expenses: Travel Political contribution Transportation Entertainment Gifts Rent and utilities Total expenses Taxable business income Email All work saved. Problem 3-2 Schedule C, Transportation, Travel Expenses, Business Gifts, Office in the Home (LO 3.1, 3.3, 3.4, 3.9, 3.11) Margaret started her own business in the current year and will report a profit for her first year. Her results of operations are as follows: Gross income $45,000 Expenses: Travel $1,000 $100 ? Contribution to Presidential Election Campaign Transportation (5,426 miles evenly throughout the year, using standard mileage method) Entertainment in total Nine gifts at $50 each Rent and utilities for apartment in total (25% is used for a home office) $4,200 $450 $10,500 Complete the table below to determine the net income Margaret should show on her Schedule c. If an amount is zero, enter "O". If required, round the amounts to the nearest dollar. Gross income Expenses: Travel Political contribution (25% is used for a home office) Complete the table below to determine the net income Margaret should show on her Schedule C. If an amount is zero, enter "O". If required, round the amounts to the nearest dollar. Gross income Expenses: Travel Political contribution Transportation Entertainment Gifts Rent and utilities Total expenses Taxable business income Email All work saved