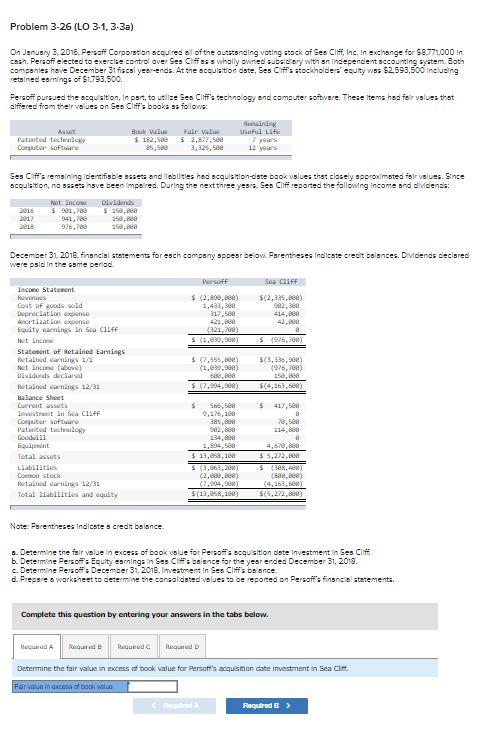

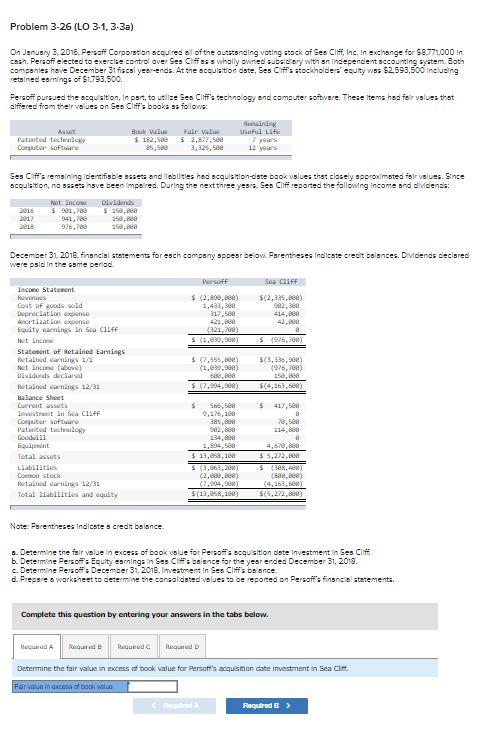

Problem 3-26 (LO 3-1, 3-3a) On January 3, 2016. Persoft Corporation acquired of the outstanding voting stock of Sea Cliff, Inc. In exchange for $8771000 In cash. Persoff elected to exercise control over Ses Css a wholly owned subsidiary with an independent accounting system. Both companies have December 31 fiscal year-ends. At the scouisition oste, Sess stockholders eculty was $2.593,500 including retained earnings of $1.793.500. Persoit pursued the acquisition, in part, to utilize Sea Cliff's technology and computer software. These items he fair values that differed from their values on Sea Clif's books as follows: ASSAT Patented technology Computer Software Book value $ 182,5 Fair value $ 2,87,500 3,325,500 Useful Life 7 years 12 years as, Ses Cit's remaining Identifiabe assess and abilities has acquisitionste baok slues that closely approdested isir values. Since sCoulsto, nossses have been impaired. During the next three years. Sea Cliff resorted the following income and dividends: Net Incom Dividends 2016 5.981,780 $ 150,00 2017 941,200 158, 2018 975,70 158,808 December 31 2018. Financial statements for esch company sppear be ow. Parentheses Indicate credit balances. Dividends decised were psic in the same period Pusoff Se cuir Income Statement Hovus $ (2,200,000) $(2,135,00) Cost of goods sold 1,433,388 992, Depreciation expense $17.500 414,600 Artization expense 421,88 42,8848 Equity warnings in Sea Cliff (321,00) Net Enco S (5,639,9ee) $ 976,722) Statement of stained Earnings Retained earnings 2/3 5 (7,555,200) 5(3,135,000) Net Income (above) (1,639.9ea) (925,700) Dividends declared 250,00 Putain canings 12/31 $ 7,994,908) $(4,361,00) Balance Sheet Current assets 5 $ Invest in Sea Cliff 9,276,160 a Computer software 385, 78.500 Patriced technology 2. 314, Goodwin 13 Equipment 1,004, se 4,670,00 Total assets 5 13.08.16 55,272, Liabilities $ (3,663,200) S388,48 Common stock (2,600,00) (882,0) Retainad earning 12/31 (7,994,902) (4.33.0 Total abilities and equity $(13,658,160) 5(5,272,2) 5665 Note: Parentheses Indientes credt balance a. Determine the fair value in excess of book value for Persos equisition date Investment in Ses Cli b. Determine Persor: Equity esmingin Ses since for the year ended December 31, 2019. c. Determine Person : December 31 2018. Investment in Sea Cliff's bo snce d. Prepare a worksheet to determine the consolidated values to be reported on Persaff's fines statements. Complete this question by entering your answers in the tabs below. Required A cured B Required Red D Determine the fair value in excess of book value for Persoft's acquisition date investment in Sea Cle Fair valin book was Required > Problem 3-26 (LO 3-1, 3-3a) On January 3, 2016. Persoft Corporation acquired of the outstanding voting stock of Sea Cliff, Inc. In exchange for $8771000 In cash. Persoff elected to exercise control over Ses Css a wholly owned subsidiary with an independent accounting system. Both companies have December 31 fiscal year-ends. At the scouisition oste, Sess stockholders eculty was $2.593,500 including retained earnings of $1.793.500. Persoit pursued the acquisition, in part, to utilize Sea Cliff's technology and computer software. These items he fair values that differed from their values on Sea Clif's books as follows: ASSAT Patented technology Computer Software Book value $ 182,5 Fair value $ 2,87,500 3,325,500 Useful Life 7 years 12 years as, Ses Cit's remaining Identifiabe assess and abilities has acquisitionste baok slues that closely approdested isir values. Since sCoulsto, nossses have been impaired. During the next three years. Sea Cliff resorted the following income and dividends: Net Incom Dividends 2016 5.981,780 $ 150,00 2017 941,200 158, 2018 975,70 158,808 December 31 2018. Financial statements for esch company sppear be ow. Parentheses Indicate credit balances. Dividends decised were psic in the same period Pusoff Se cuir Income Statement Hovus $ (2,200,000) $(2,135,00) Cost of goods sold 1,433,388 992, Depreciation expense $17.500 414,600 Artization expense 421,88 42,8848 Equity warnings in Sea Cliff (321,00) Net Enco S (5,639,9ee) $ 976,722) Statement of stained Earnings Retained earnings 2/3 5 (7,555,200) 5(3,135,000) Net Income (above) (1,639.9ea) (925,700) Dividends declared 250,00 Putain canings 12/31 $ 7,994,908) $(4,361,00) Balance Sheet Current assets 5 $ Invest in Sea Cliff 9,276,160 a Computer software 385, 78.500 Patriced technology 2. 314, Goodwin 13 Equipment 1,004, se 4,670,00 Total assets 5 13.08.16 55,272, Liabilities $ (3,663,200) S388,48 Common stock (2,600,00) (882,0) Retainad earning 12/31 (7,994,902) (4.33.0 Total abilities and equity $(13,658,160) 5(5,272,2) 5665 Note: Parentheses Indientes credt balance a. Determine the fair value in excess of book value for Persos equisition date Investment in Ses Cli b. Determine Persor: Equity esmingin Ses since for the year ended December 31, 2019. c. Determine Person : December 31 2018. Investment in Sea Cliff's bo snce d. Prepare a worksheet to determine the consolidated values to be reported on Persaff's fines statements. Complete this question by entering your answers in the tabs below. Required A cured B Required Red D Determine the fair value in excess of book value for Persoft's acquisition date investment in Sea Cle Fair valin book was Required >