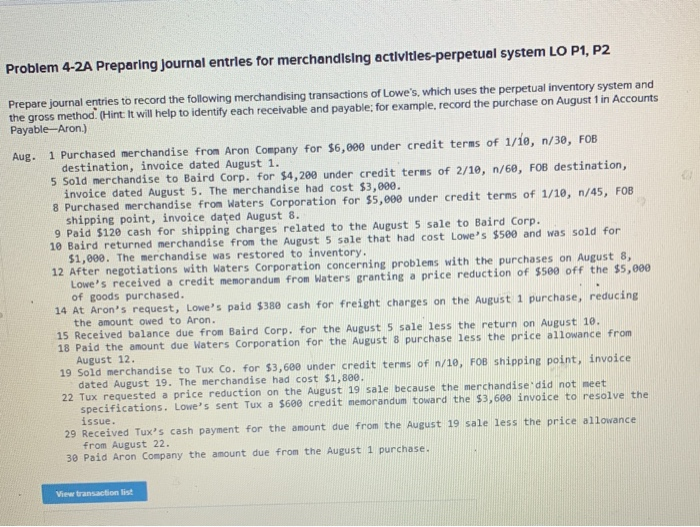

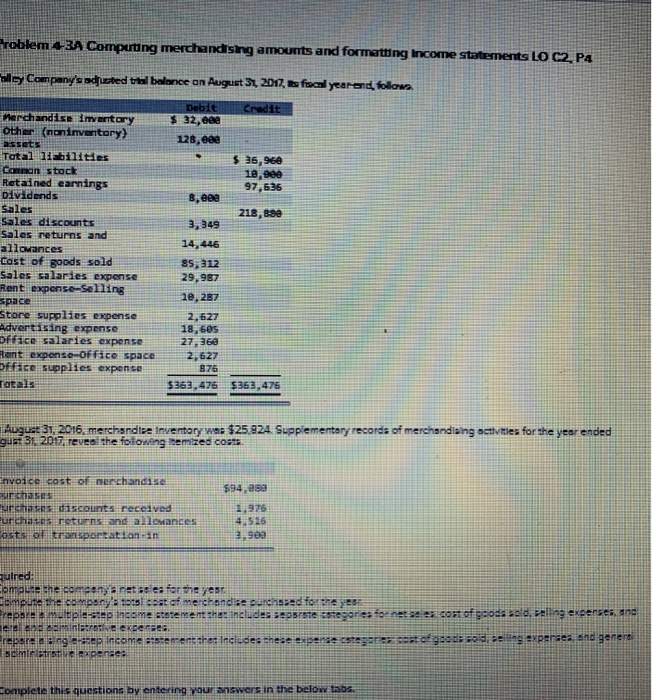

Problem 4-2A Preparing journal entries for merchandising activities-perpetual system LO P1, P2 Prepare journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual inventory system and the gross method. (Hint: It will help to identify each receivable and payable; for example, record the purchase on August 1 in Accounts Payable-Aron.) Aug. 1 Purchased merchandise from Aron Company for $6,000 under credit terms of 1/10, 1/30, FOB destination, invoice dated August 1. 5 Sold merchandise to Baird Corp. for $4,200 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5. The merchandise had cost $3,000. 8 Purchased merchandise from Waters Corporation for $5,000 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8. 9 Paid $120 cash for shipping charges related to the August 5 sale to Baird Corp. 10 Baird returned merchandise from the August 5 sale that had cost Lowe's $500 and was sold for $1,000. The merchandise was restored to inventory. 12 After negotiations with Waters Corporation concerning problems with the purchases on August 8, Lowe's received a credit memorandum from Waters granting a price reduction of $500 off the $5,000 of goods purchased. 14 At Aron's request, Lowe's paid $388 cash for freight charges on the August 1 purchase, reducing the amount owed to Aron. 15 Received balance due from Baird Corp. for the August 5 sale less the return on August 10. 18 Paid the amount due Waters Corporation for the August 8 purchase less the price allowance from August 12. 19 Sold merchandise to Tux Co. for $3,600 under credit terms of n/10, FOB shipping point, invoice dated August 19. The merchandise had cost $1,800. 22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet specifications. Lowe's sent Tux a $600 credit memorandum toward the $3,600 invoice to resolve the issue. 29 Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22. 30 Paid Aron Company the amount due from the August 1 purchase. View transaction list Problem 4 2A Computing merchandising amounts and formatting Income statements LO C2, P4 allsy Company's aduated the balance on August 31, 2017, fiscal year and follow Credit Debit $ 32, 128,eee $ 16,96 18,eee 97,536 8, eee 218, 890 3, 349 herchandise inventory Other (noninventory) assets Tatal liabilities Cantman stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances cost of goods sold Sales salaries expense Rent expense-selling space Store supplies expense Advertising expense office salaries expense Rent expense-Office space office supplies expense Totals 14,446 85, 312 29, 987 1e, 287 2,527 19,685 27, 360 2,627 876 $363,476 5363,475 LUGE 31, 2016. merchandise Inventory was $25.924 Supplementary records of merchandizing activities for the year ended gust 31, 2017. reveal the following itemizes costs. $94, asa Envoice cost of merchandise chases urchases discounts received urchase returns and allowances osts or transportation in 1,976 4.516 3,90a quired: omale she comesys netas e for this yes, ampute the comp 10151 cost of merchandise durchseed for the Prepare multiple-step income statement the includes separate categorier for et sees ont of goods sold selling expenses and Team expenses PAGAR. Crecept Income stoerenthe: Includes these expense categories of 900 300. Peiling Experses. Ane senere mirt penge: Complete this questions by entering your answers in the below tabs