what am i missing? because it states the question is incomplete.

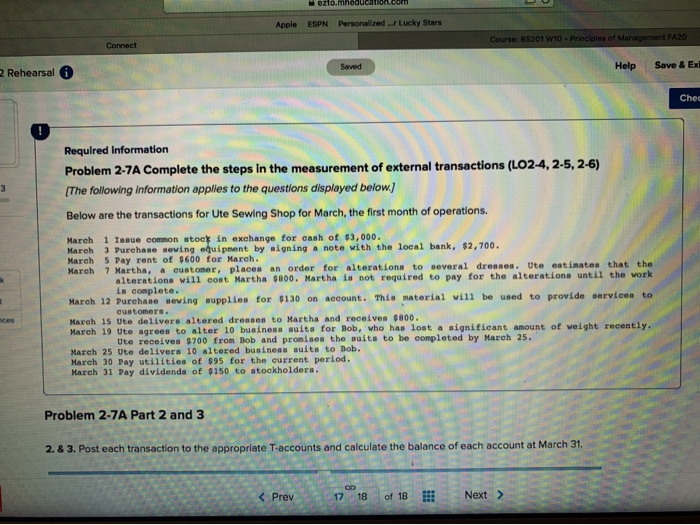

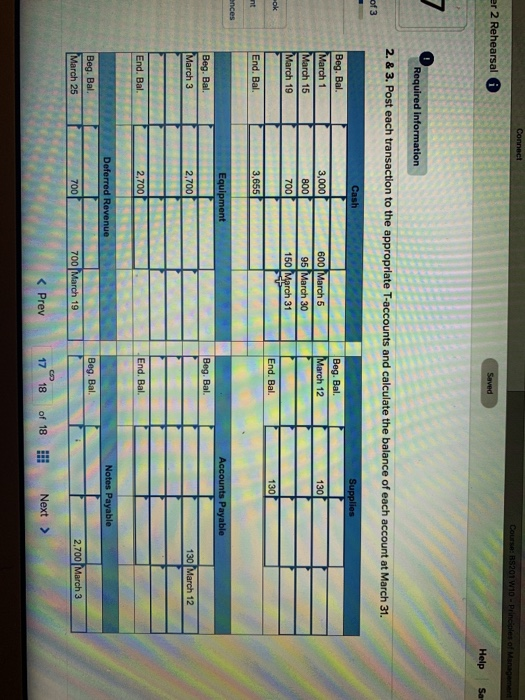

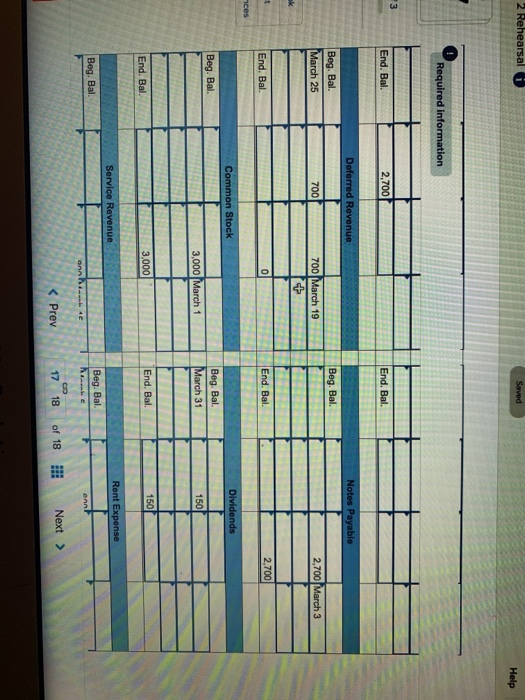

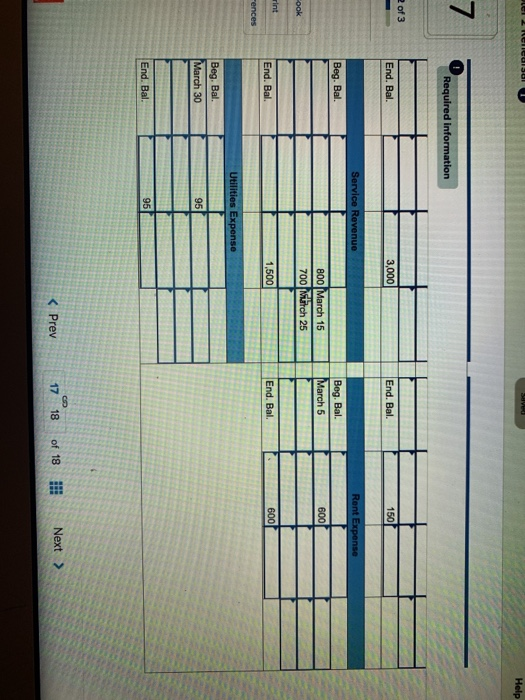

ezto.mheducation.com Apple ESPN Personalized. Lucky Stars Course: BS201 W10 - Principles of Management FA20 Connect Saved Help Save & Ex 2 Rehearsal Chec 3 Required Information Problem 2-7A Complete the steps in the measurement of external transactions (LO2-4, 2-5, 2-6) [The following information applies to the questions displayed below) Below are the transactions for Ute Sewing Shop for March, the first month of operations. March 1 Issue common stoet in exchange for cash of $3,000. March 3 Purchase sewing equipment by signing a note with the local bank, $2,700. March 5 Pay rent of $600 for Marah. March 7 Martha, a customer, places an order for alterations to several dresses. Ute estimates that the alterations will cont Martha $800. Martha is not required to pay for the alterations until the work is complete. March 12 Purchase sewing supplies for $130 on account. This material will be used to provide services to customers. March 15 Ute delivers altered dresses to Martha and receives $800. March 19 Ute agrees to alter 10 business suits for Bob, who has lost a significant amount of weight recently. Ute receives $700 from Bob and promises the suits to be completed by March 25. March 25 Ute delivers 10 altered business suits to Bob. March 30 Pay utilities of $95 for the current period. March 31 Pay dividends of $150 to stockholders. ces Problem 2-7A Part 2 and 3 2. & 3. Post each transaction to the appropriate T-accounts and calculate the balance of each account at March 31. Connect Cour RS201 W10 - Principles of Manage er 2 Rehearsal Saved Help Sa 7 Required information 2. & 3. Post each transaction to the appropriate T-accounts and calculate the balance of each account at March 31 of 3 Cash Supplies Beg. Bal Bog. Bal. March 12 130 March 1 March 15 March 19 3,000 800 700 600 March 5 95 March 30 150 March 31 ok End. Bal. 130 nt End. Bal. 3,655 ences Equipment Accounts Payable Beg. Bal. Beg. Bal. March 3 2,700 130 March 12 End. Bal 2,700 End. Bal. Deferred Revenue Notes Payable Beg. Bal. Beg. Bal. March 25 700 700 March 19 2,700 March 3 2 Rehearsal Saved Help Required information 3 End. Bal. 2,700 End. Bal. Deferred Revenue Notes Payable Beg. Bal Beg. Bal. March 25 700 700 March 19 2,700 March 3 + End. Bal. 0 End. Bal. 2,700 ces Common Stock Dividends Beg. Bal. Beg. Bal. 3,000 March 1 March 31 150 3,000 End. Bal. 150 End. Bal Service Revenue Rent Expense Beg. Bal. Beg. Bal. hen online el HellediSUI SV Help 7 Required information 2 of 3 End. Bal. 3,000 End. Bal. 1501 Service Revenue Rent Expense Beg. Bal. Beg. Bal. March 5 600 800 March 15 700 Mitarch 25 ook rint End. Bal. 1,500 End. Bal. 600 Fences Utilities Expense Beg. Bal. March 30 95 End. Bal. 95