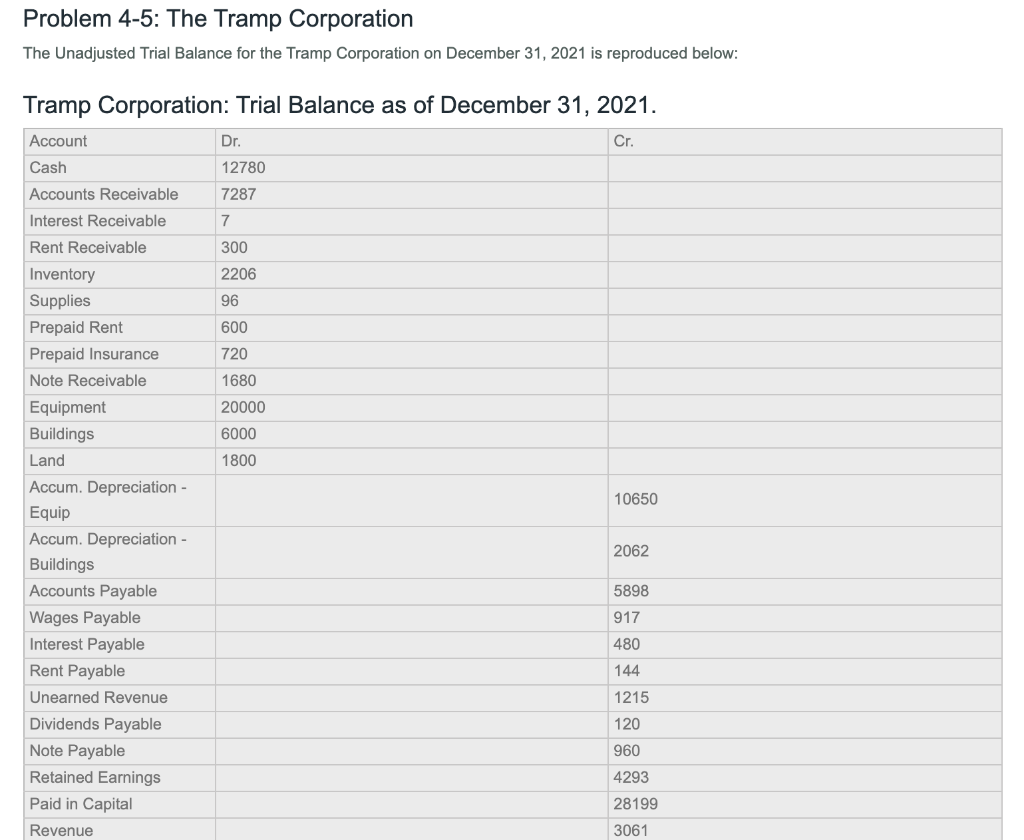

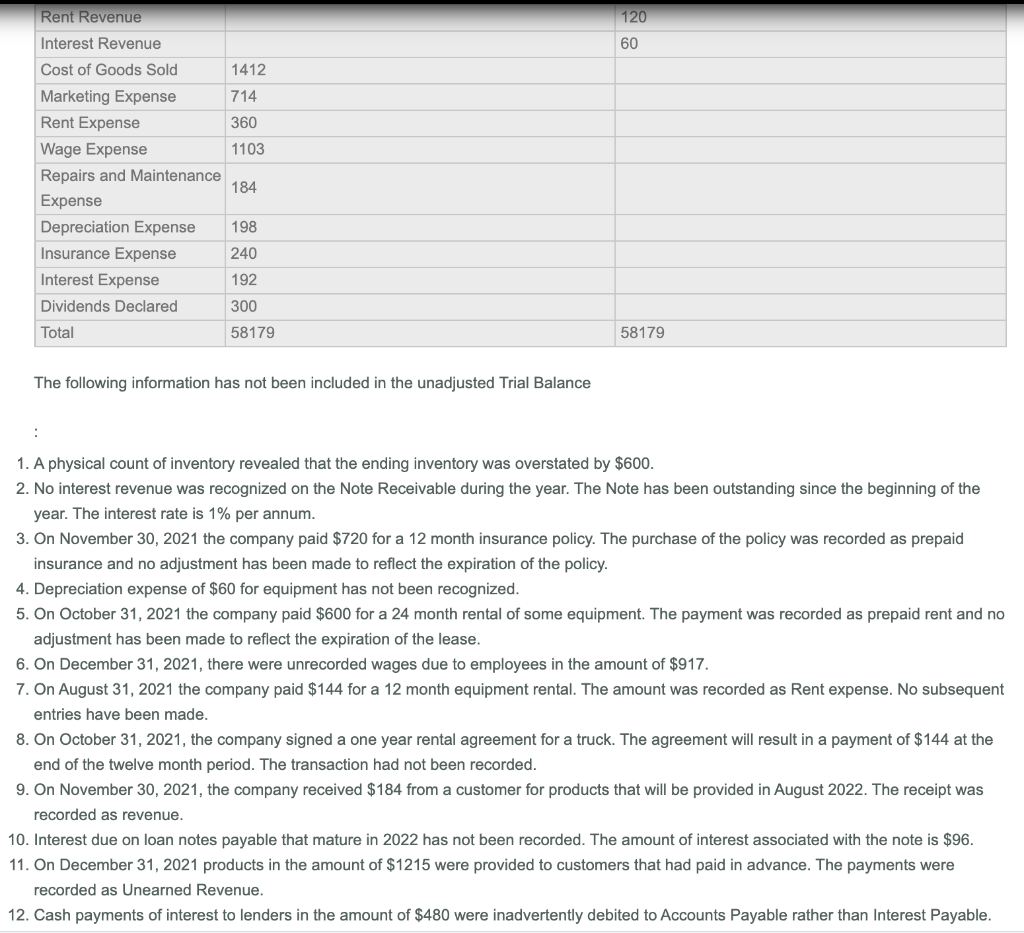

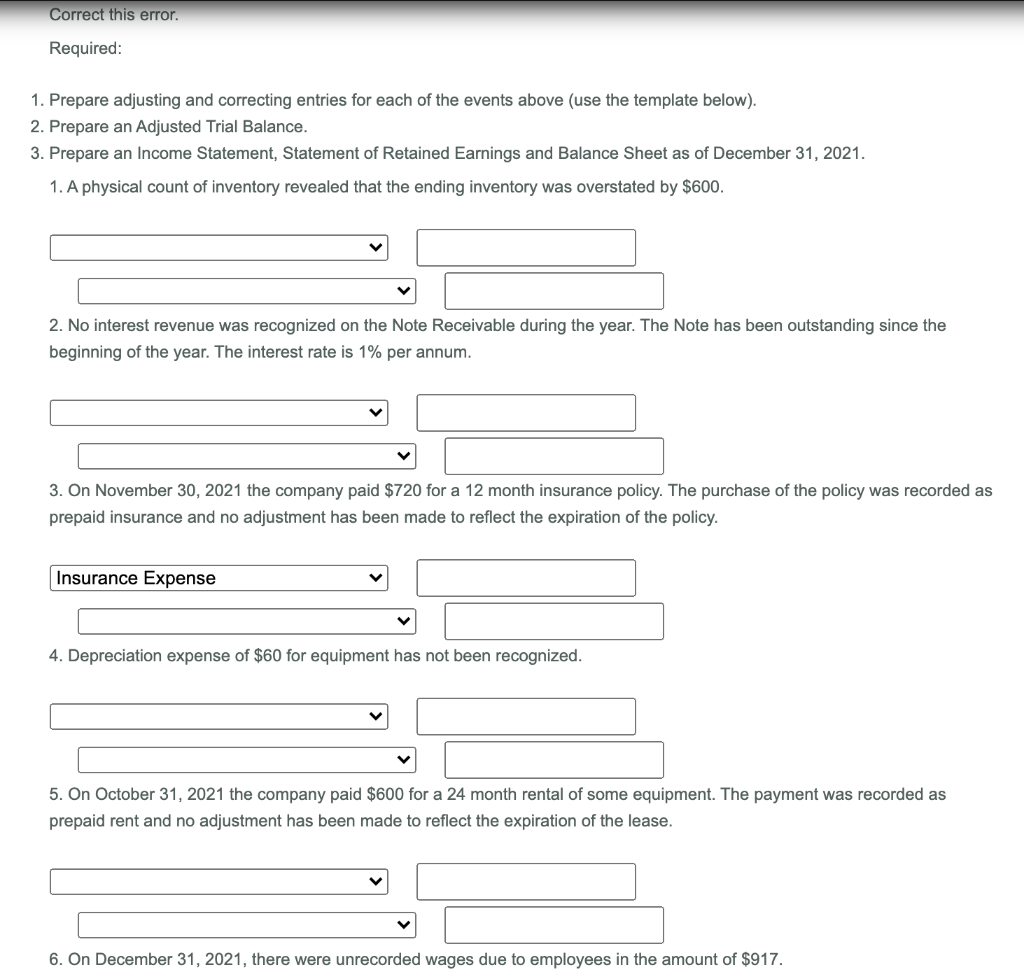

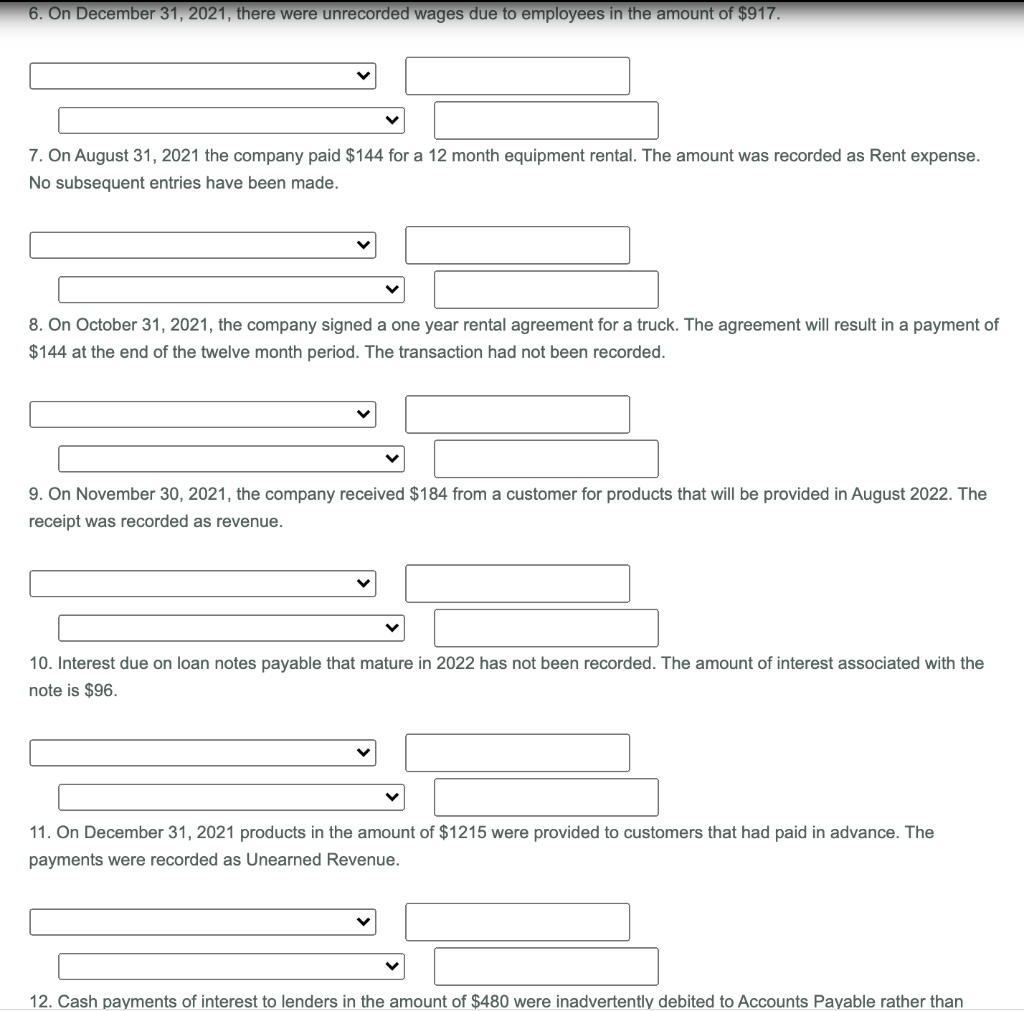

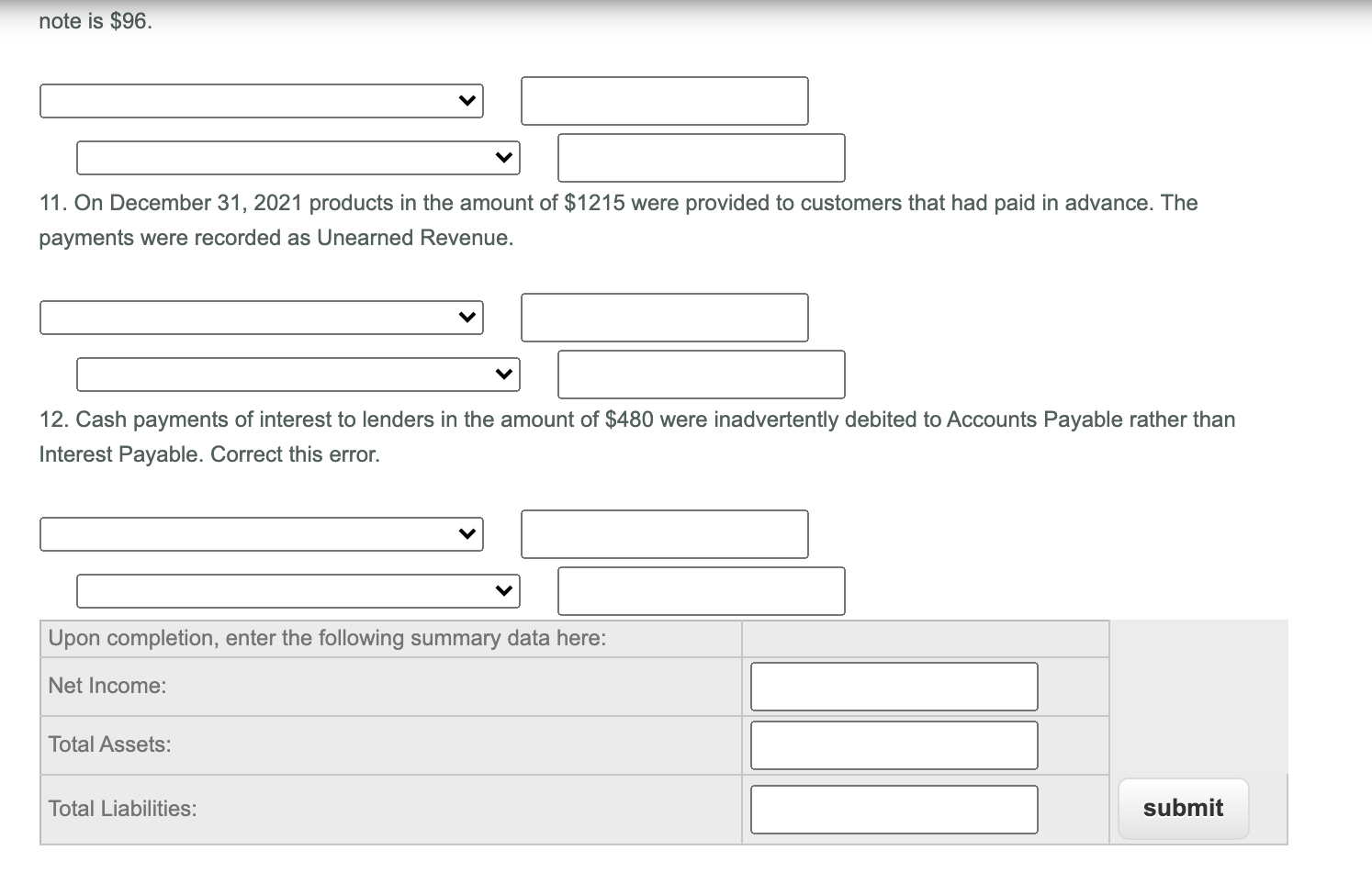

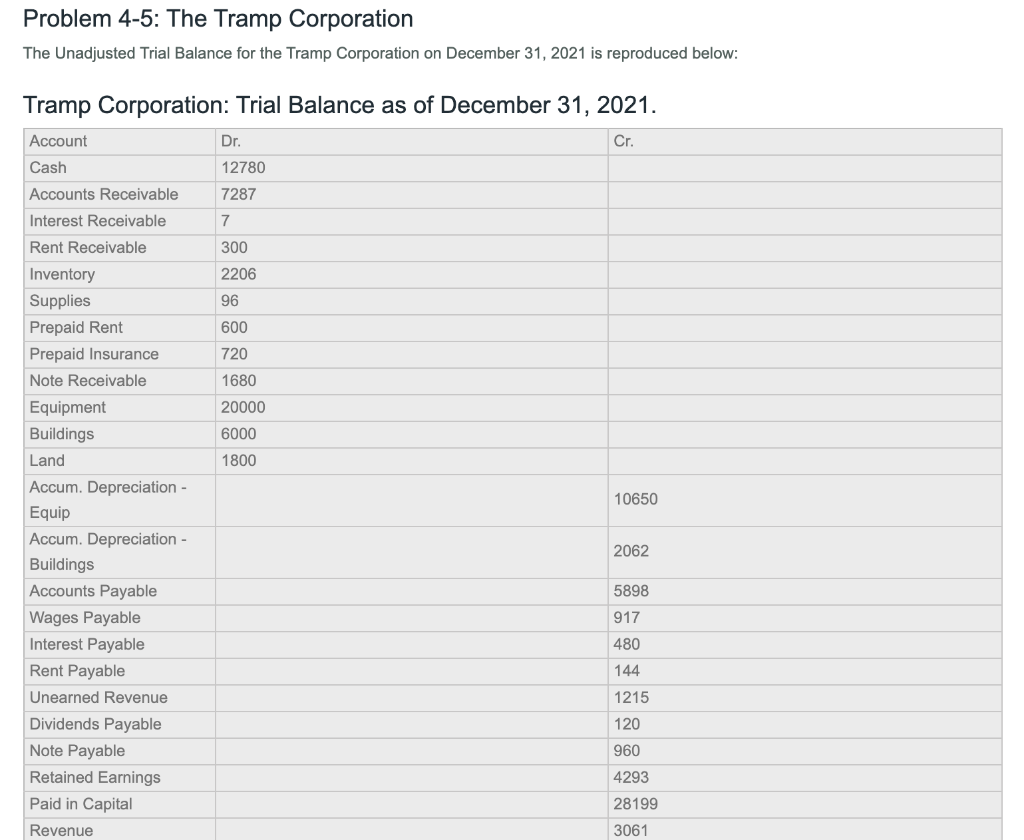

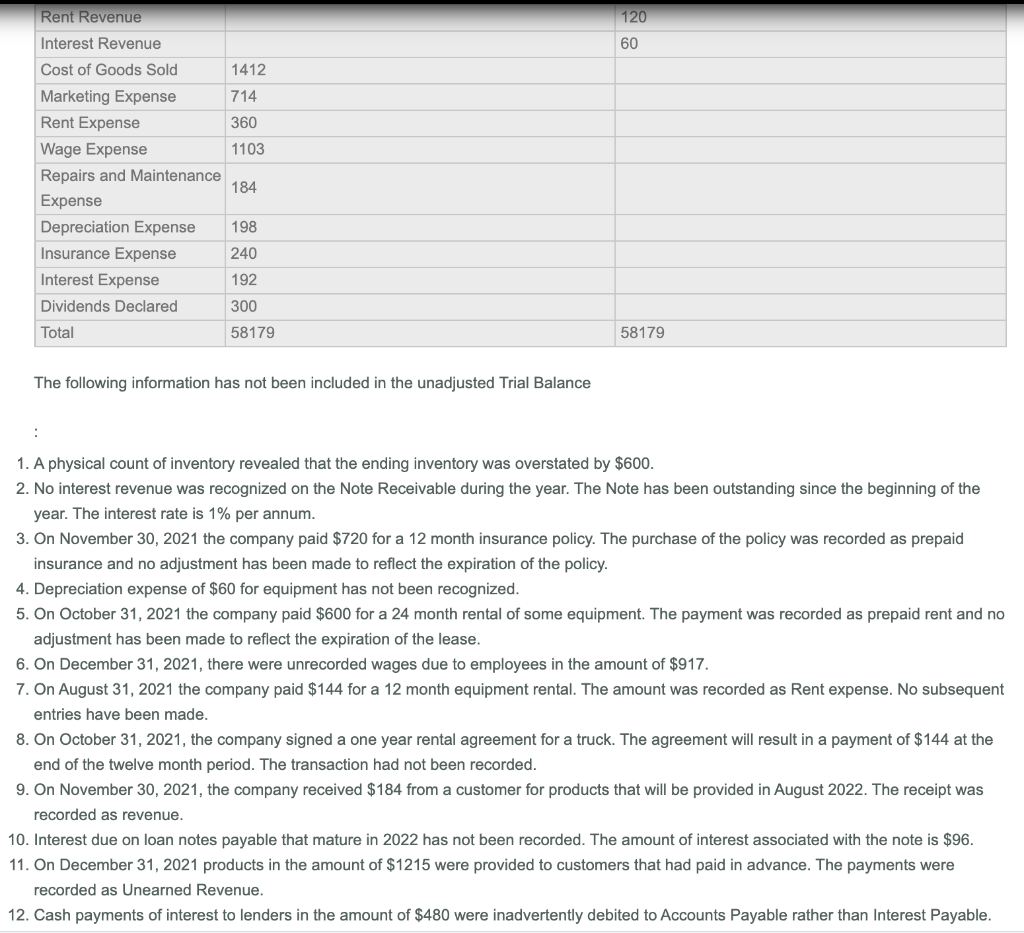

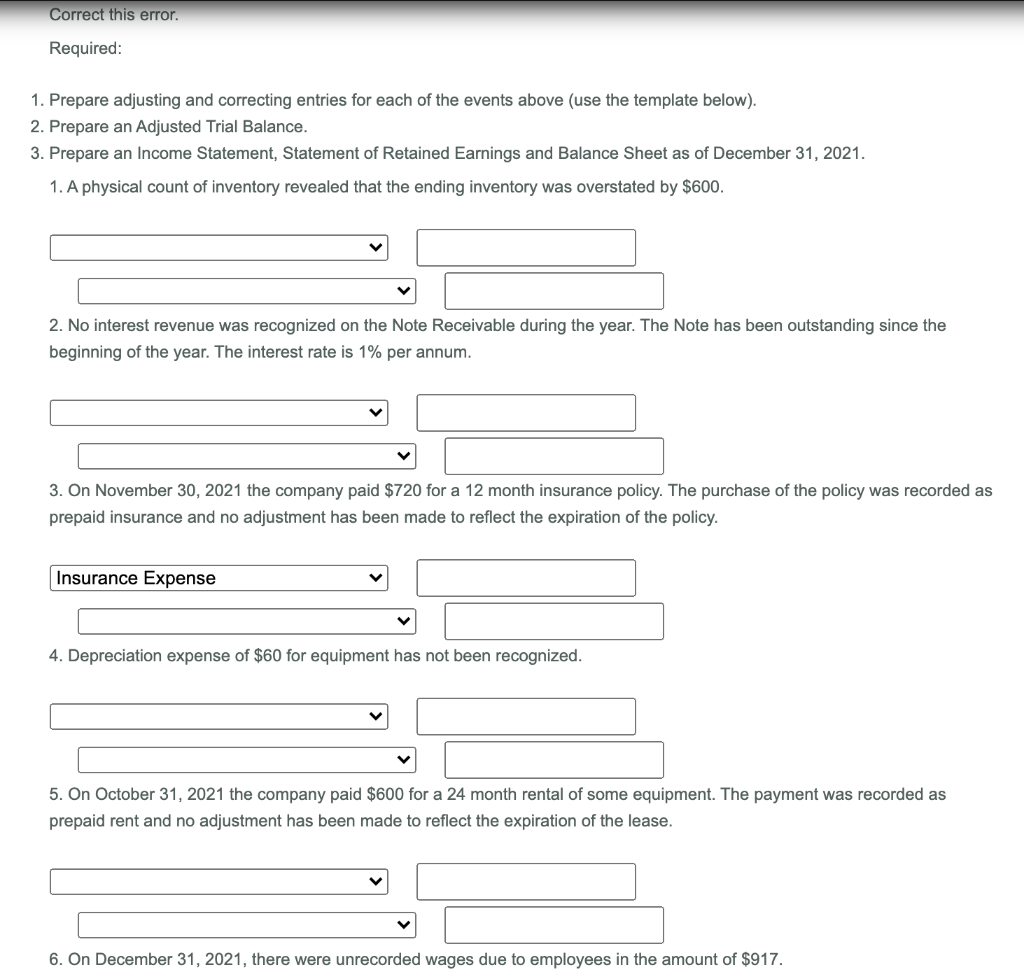

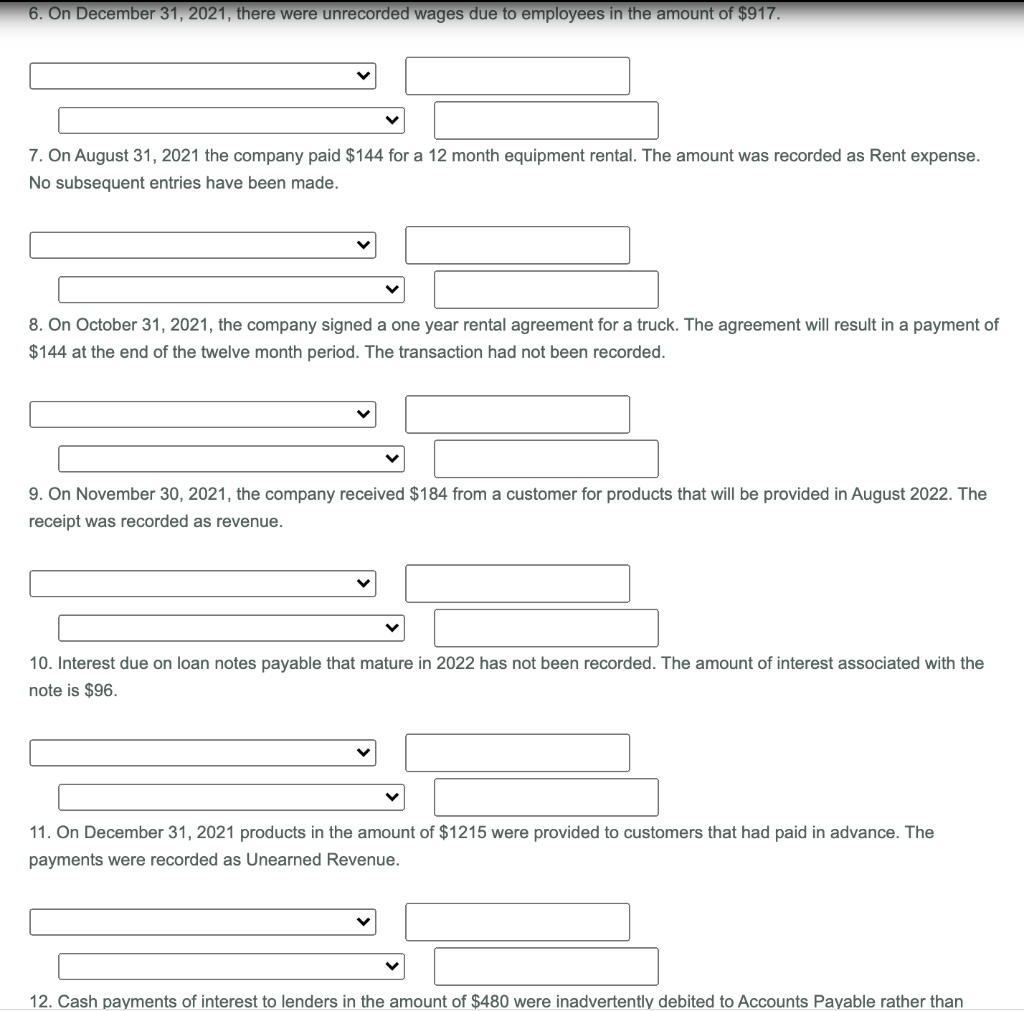

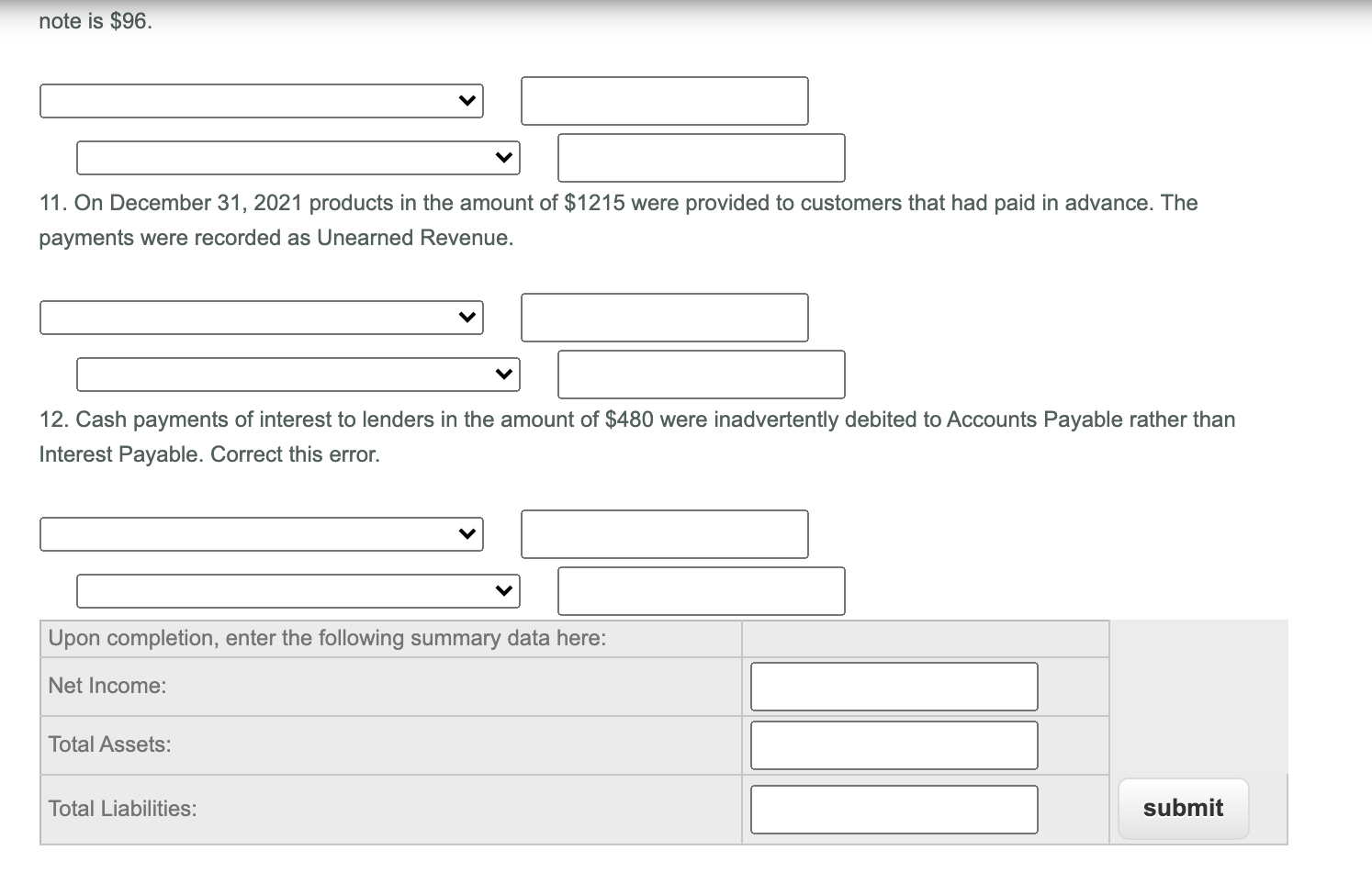

Problem 4-5: The Tramp Corporation The Unadjusted Trial Balance for the Tramp Corporation on December 31, 2021 is reproduced below: Tramp Corporation: Trial Balance as of December 31, 2021. Dr. Cr. 12780 Account Cash Accounts Receivable Interest Receivable 7287 7 Rent Receivable 300 2206 96 600 720 1680 20000 6000 1800 10650 Inventory Supplies Prepaid Rent Prepaid Insurance Note Receivable Equipment Buildings Land Accum. Depreciation - Equip Accum. Depreciation - Buildings Accounts Payable Wages Payable Interest Payable Rent Payable Unearned Revenue Dividends Payable Note Payable Retained Earnings Paid in Capital Revenue 2062 5898 917 480 144 1215 120 960 4293 28199 3061 120 60 1412 714 360 1103 Rent Revenue Interest Revenue Cost of Goods Sold Marketing Expense Rent Expense Wage Expense Repairs and Maintenance Expense Depreciation Expense Insurance Expense Interest Expense Dividends Declared 184 198 240 192 300 Total 58179 58179 The following information has not been included in the unadjusted Trial Balance 1. A physical count of inventory revealed that the ending inventory was overstated by $600. 2. No interest revenue was recognized on the Note Receivable during the year. The Note has been outstanding since the beginning of the year. The interest rate is 1% per annum. 3. On November 30, 2021 the company paid $720 for a 12 month insurance policy. The purchase of the policy was recorded as prepaid insurance and no adjustment has been made to reflect the expiration of the policy. 4. Depreciation expense of $60 for equipment has not been recognized. 5. On October 31, 2021 the company paid $600 for a 24 month rental of some equipment. The payment was recorded as prepaid rent and no adjustment has been made to reflect the expiration of the lease. 6. On December 31, 2021, there were unrecorded wages due to employees in the amount of $917. 7. On August 31, 2021 the company paid $144 for a 12 month equipment rental. The amount was recorded as Rent expense. No subsequent entries have been made. 8. On October 31, 2021, the company signed a one year rental agreement for a truck. The agreement will result in a payment of $144 at the end of the twelve month period. The transaction had not been recorded. 9. On November 30, 2021, the company received $184 from a customer for products that will be provided in August 2022. The receipt was recorded as revenue. 10. Interest due on loan notes payable that mature in 2022 has not been recorded. The amount of interest associated with the note is $96. 11. On December 31, 2021 products in the amount of $1215 were provided to customers that had paid in advance. The payments were recorded as Unearned Revenue. 12. Cash payments of interest to lenders in the amount of $480 were inadvertently debited to Accounts Payable rather than Interest Payable. Correct this error. Required: 1. Prepare adjusting and correcting entries for each of the events above (use the template below). 2. Prepare an Adjusted Trial Balance. 3. Prepare an Income Statement, Statement of Retained Earnings and Balance Sheet as of December 31, 2021. 1. A physical count of inventory revealed that the ending inventory was overstated by $600. 2. No interest revenue was recognized on the Note Receivable during the year. The Note has been outstanding since the beginning of the year. The interest rate is 1% per annum. 3. On November 30, 2021 the company paid $720 for a 12 month insurance policy. The purchase of the policy was recorded as prepaid insurance and no adjustment has been made to reflect the expiration of the policy. Insurance Expense 4. Depreciation expense of $60 for equipment has not been recognized. 5. On October 31, 2021 the company paid $600 for a 24 month rental of some equipment. The payment was recorded as prepaid rent and no adjustment has been made to reflect the expiration of the lease. 6. On December 31, 2021, there were unrecorded wages due to employees in the amount of $917. 6. On December 31, 2021, there were unrecorded wages due to employees in the amount of $917. 7. On August 31, 2021 the company paid $144 for a 12 month equipment rental. The amount was recorded as Rent expense. No subsequent entries have been made. 8. On October 31, 2021, the company signed a one year rental agreement for a truck. The agreement will result in a payment of $144 at the end of the twelve month period. The transaction had not been recorded. 9. On November 30, 2021, the company received $184 from a customer for products that will be provided in August 2022. The receipt was recorded as revenue. 10. Interest due on loan notes payable that mature in 2022 has not been recorded. The amount of interest associated with the note is $96. 11. On December 31, 2021 products in the amount of $1215 were provided to customers that had paid in advance. The payments were recorded as Unearned Revenue. 12. Cash payments of interest to lenders in the amount of $480 were inadvertently debited to Accounts Payable rather than note is $96. 11. On December 31, 2021 products in the amount of $1215 were provided to customers that had paid in advance. The payments were recorded as Unearned Revenue. 12. Cash payments of interest to lenders in the amount of $480 were inadvertently debited to Accounts Payable rather than Interest Payable. Correct this error. Upon completion, enter the following summary data here: Net Income: Total Assets: Total Liabilities: submit