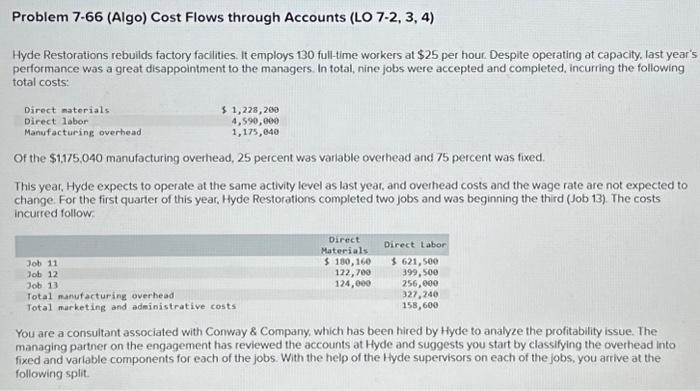

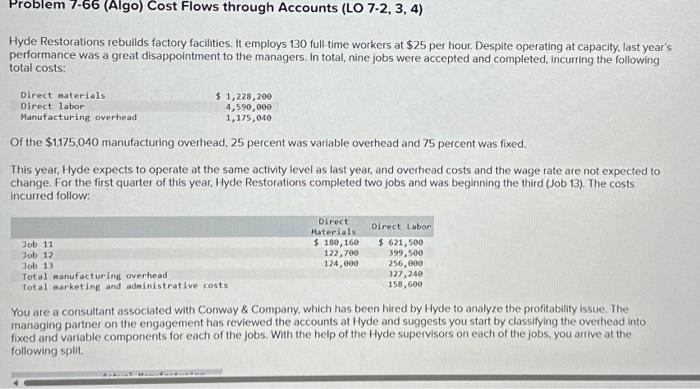

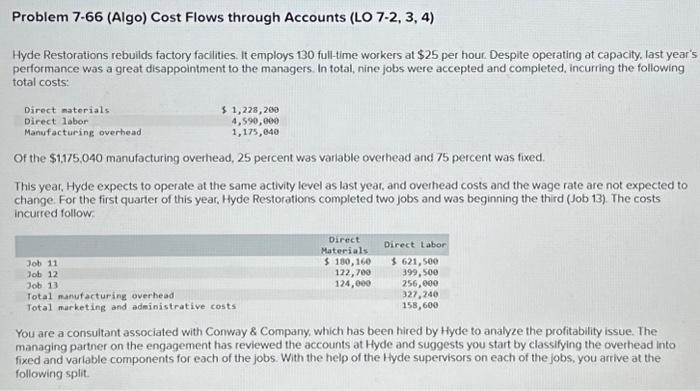

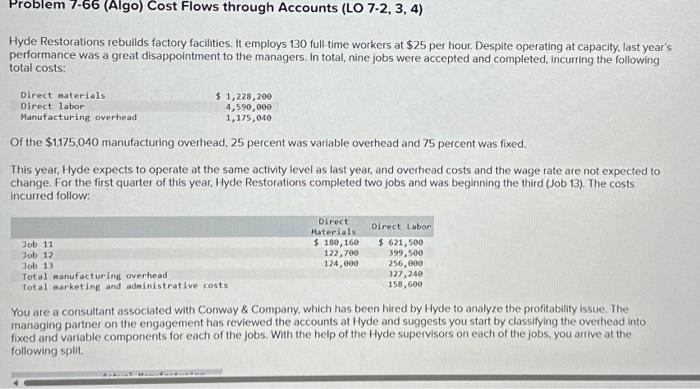

Problem 7-66 (Algo) Cost Flows through Accounts (LO 7-2, 3, 4) Hyde Restorations rebuilds factory facilities. It employs 130 full-time workers at $25 per hour. Despite operating at capacity, last year's performance was a great disappointment to the managers. In total, nine jobs were accepted and completed, incurring the following total costs: Direct materials. Direct labor Manufacturing overhead $ 1,228,200 4,590,000 1,175,040 Of the $1,175,040 manufacturing overhead, 25 percent was variable overhead and 75 percent was fixed. This year, Hyde expects to operate at the same activity level as last year, and overhead costs and the wage rate are not expected to change. For the first quarter of this year, Hyde Restorations completed two jobs and was beginning the third (Job 13). The costs incurred follow: Job 11 Job 12 Job 13 Total manufacturing overhead Total marketing and administrative costs Direct Materials $ 180, 160 122,700 124,000 Direct Labor $ 621,500 399,500 256,000 327,240 158,600 You are a consultant associated with Conway & Company, which has been hired by Hyde to analyze the profitability issue. The managing partner on the engagement has reviewed the accounts at Hyde and suggests you start by classifying the overhead into fixed and variable components for each of the jobs. With the help of the Hyde supervisors on each of the jobs, you arrive at the following split.

Problem 7-66 (Algo) Cost Flows through Accounts (LO 7-2, 3, 4) Hyde Restorations rebuilds factory faclities. It employs 130 full-time workers at $25 per hour. Despite operating at capacity, last year's performance was a great disappointment to the managers. In total, nine jobs were accepted and completed, incurring the following total costs: Of the $1,175,040 manufacturing overhead, 25 percent was variable overhead and 75 percent was fixed. This year, Hyde expects to operate at the same activity level as last year, and overhead costs and the wage rate are not expected to change. For the first quarter of this year, Hyde Restorations completed two jobs and was beginning the third (Job 13). The costs incurred follow You are a consultant associated with Conway \& Company, which has been hired by Hyde to analyze the profitability issue. The managing partner on the engagement has reviewed the accounts at Hyde and suggests you start by classifying the overhead into fixed and varlable components for each of the jobs. With the help of the Hyde supervisors on each of the jobs, you arrive at the following split. Hyde Restorations rebuilds factory facilities. It employs 130 full-time workers at $25 per hour. Despite operating at capacity, last year's performance was a great disappointment to the managers. In total, nine jobs were accepted and completed, incurring the following total costs: Of the $1,175,040 manufacturing overhead, 25 percent was variable overhead and 75 percent was fixed. This year. Hyde expects to operate at the same activity level as last year, and overhead costs and the wage rate are not expected to change. For the first quarter of this year, Hyde Restorations completed two jobs and was beginning the third (Job 13). The costs incurred follow: You are a consultant associated with Conway \& Company, which has been hired by Hyde to analyze the profitability issue. The managing partner on the engagement has reviewed the accounts at Hyde and suggests you start by classifying the overhead into fixed and variable components for each of the jobs. With the help of the Hyde supervisors on each of the jobs, you arrive at the following split. Problem 7-66 (Algo) Cost Flows through Accounts (LO 7-2, 3, 4) Hyde Restorations rebuilds factory faclities. It employs 130 full-time workers at $25 per hour. Despite operating at capacity, last year's performance was a great disappointment to the managers. In total, nine jobs were accepted and completed, incurring the following total costs: Of the $1,175,040 manufacturing overhead, 25 percent was variable overhead and 75 percent was fixed. This year, Hyde expects to operate at the same activity level as last year, and overhead costs and the wage rate are not expected to change. For the first quarter of this year, Hyde Restorations completed two jobs and was beginning the third (Job 13). The costs incurred follow You are a consultant associated with Conway \& Company, which has been hired by Hyde to analyze the profitability issue. The managing partner on the engagement has reviewed the accounts at Hyde and suggests you start by classifying the overhead into fixed and varlable components for each of the jobs. With the help of the Hyde supervisors on each of the jobs, you arrive at the following split. Hyde Restorations rebuilds factory facilities. It employs 130 full-time workers at $25 per hour. Despite operating at capacity, last year's performance was a great disappointment to the managers. In total, nine jobs were accepted and completed, incurring the following total costs: Of the $1,175,040 manufacturing overhead, 25 percent was variable overhead and 75 percent was fixed. This year. Hyde expects to operate at the same activity level as last year, and overhead costs and the wage rate are not expected to change. For the first quarter of this year, Hyde Restorations completed two jobs and was beginning the third (Job 13). The costs incurred follow: You are a consultant associated with Conway \& Company, which has been hired by Hyde to analyze the profitability issue. The managing partner on the engagement has reviewed the accounts at Hyde and suggests you start by classifying the overhead into fixed and variable components for each of the jobs. With the help of the Hyde supervisors on each of the jobs, you arrive at the following split