Answered step by step

Verified Expert Solution

Question

1 Approved Answer

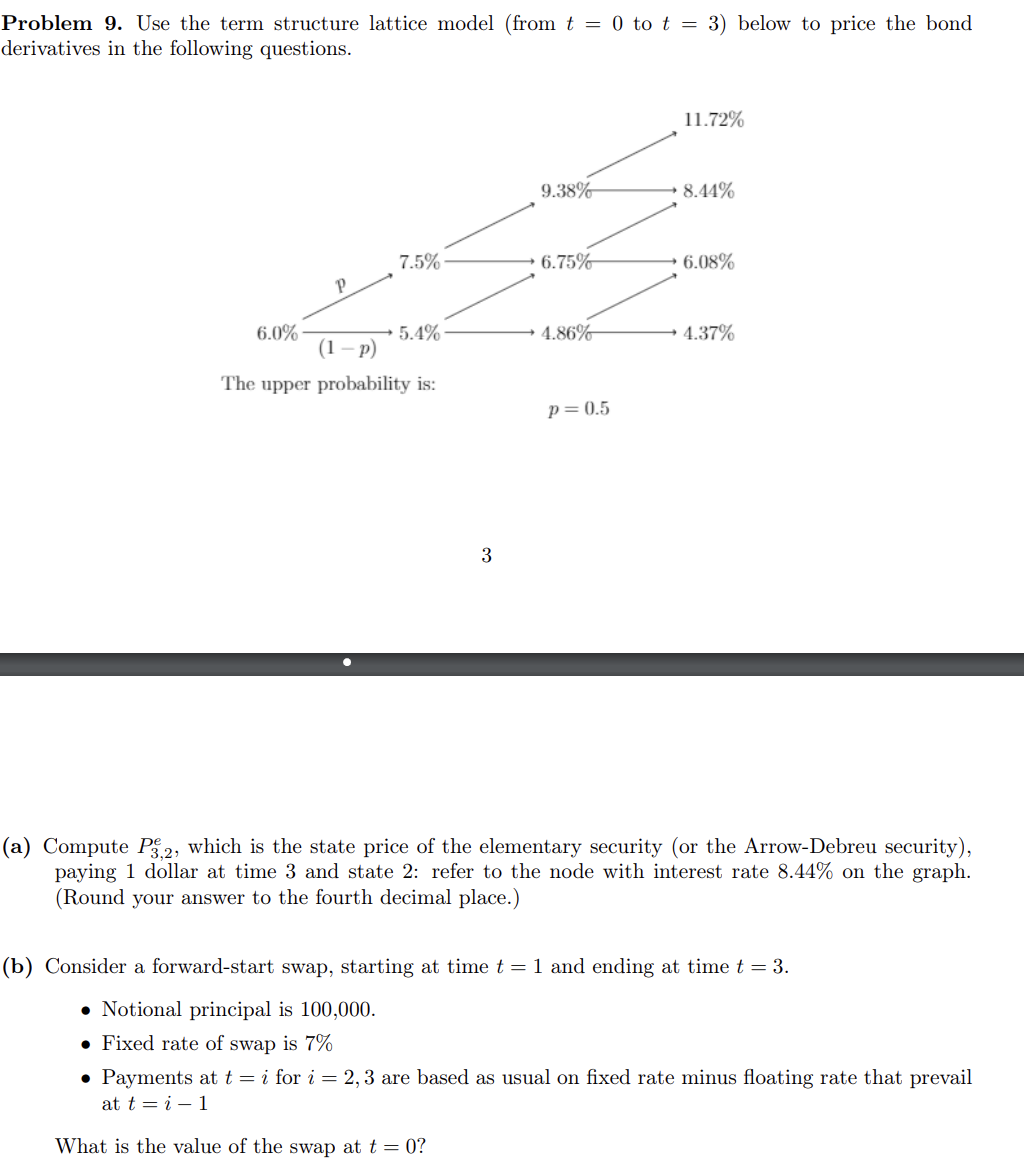

Problem 9. Use the term structure lattice model (from t = 0 to t = 3) below to price the bond derivatives in the

Problem 9. Use the term structure lattice model (from t = 0 to t = 3) below to price the bond derivatives in the following questions. 11.72% 9.38% 8.44% 7.5% 6.75% 6.08% P 6.0% 5.4% (1-p) 4.86% 4.37% The upper probability is: 3 p = 0.5 (a) Compute P32, which is the state price of the elementary security (or the Arrow-Debreu security), paying 1 dollar at time 3 and state 2: refer to the node with interest rate 8.44% on the graph. (Round your answer to the fourth decimal place.) (b) Consider a forward-start swap, starting at time t = 1 and ending at time t = 3. Notional principal is 100,000. Fixed rate of swap is 7% Payments at t = i for i = 2, 3 are based as usual on fixed rate minus floating rate that prevail at ti 1 What is the value of the swap at t = 0?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started