Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem FORW - 7 9 B Today is time 0 . In what follows, we regard the dollar as the domestic currency and the

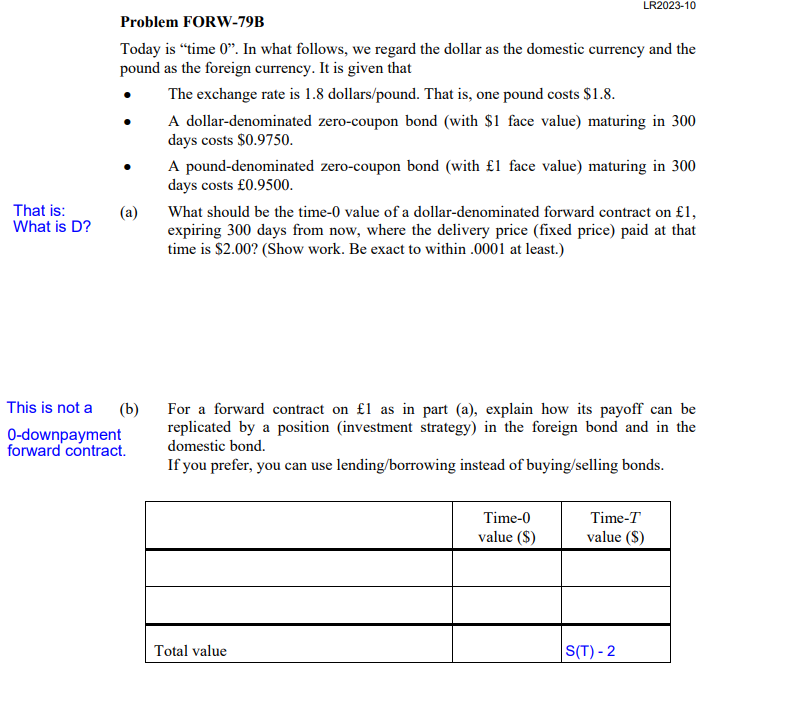

Problem FORWB

Today is "time In what follows, we regard the dollar as the domestic currency and the

pound as the foreign currency. It is given that

The exchange rate is dollarspound That is one pound costs $

A dollardenominated zerocoupon bond with $ face value maturing in

days costs $

A pounddenominated zerocoupon bond with face value maturing in

days costs

a What should be the time value of a dollardenominated forward contract on

expiring days from now, where the delivery price fixed price paid at that

time is $Show work. Be exact to within at least.

downpayment

forward contract.

b For a forward contract on as in part a explain how its payoff can be

replicated by a position investment strategy in the foreign bond and in the

domestic bond.

If you prefer, you can use lendingborrowing instead of buyingselling bonds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started