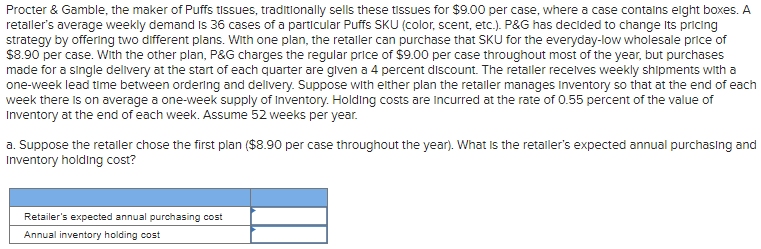

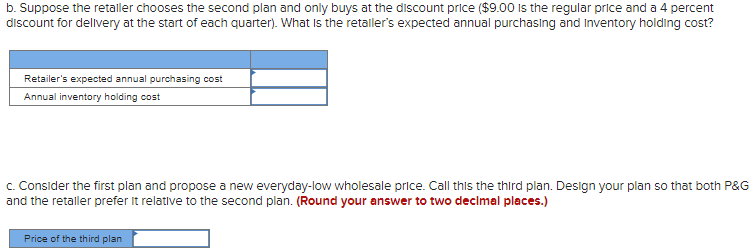

Procter \& Gamble, the maker of Puffs tlssues, traditionally sells these tissues for $9.00 per case, where a case contains eight boxes. A retaller's average weekly demand is 36 cases of a particular Puffs SKU (color, scent, etc.). P\&G has decided to change Its pricing strategy by offering two different plans. With one plan, the retaller can purchase that SKU for the everyday-low wholesale price of $8.90 per case. With the other plan, P\&G charges the regular price of $9.00 per case throughout most of the year, but purchases made for a single delivery at the start of each quarter are given a 4 percent discount. The retailer recelves weekly shipments with a one-week lead time between ordering and dellvery. Suppose with elther plan the retaller manages inventory so that at the end of each week there is on average a one-week supply of Inventory. Holding costs are Incurred at the rate of 0.55 percent of the value of Inventory at the end of each week. Assume 52 weeks per year. a. Suppose the retaller chose the first plan ( $8.90 per case throughout the year). What Is the retaller's expected annual purchasing and Inventory holding cost? b. Suppose the retaller chooses the second plan and only buys at the discount price ( $9.00 is the regular price and a 4 percent discount for delivery at the start of each quarter). What is the retaller's expected annual purchasing and Inventory holding cost? c. Consider the first plan and propose a new everyday-low wholesale price. Call this the third plan. Design your plan so that both P\&c and the retaller prefer it relatlve to the second plan. (Round your answer to two decimal places.) Procter \& Gamble, the maker of Puffs tlssues, traditionally sells these tissues for $9.00 per case, where a case contains eight boxes. A retaller's average weekly demand is 36 cases of a particular Puffs SKU (color, scent, etc.). P\&G has decided to change Its pricing strategy by offering two different plans. With one plan, the retaller can purchase that SKU for the everyday-low wholesale price of $8.90 per case. With the other plan, P\&G charges the regular price of $9.00 per case throughout most of the year, but purchases made for a single delivery at the start of each quarter are given a 4 percent discount. The retailer recelves weekly shipments with a one-week lead time between ordering and dellvery. Suppose with elther plan the retaller manages inventory so that at the end of each week there is on average a one-week supply of Inventory. Holding costs are Incurred at the rate of 0.55 percent of the value of Inventory at the end of each week. Assume 52 weeks per year. a. Suppose the retaller chose the first plan ( $8.90 per case throughout the year). What Is the retaller's expected annual purchasing and Inventory holding cost? b. Suppose the retaller chooses the second plan and only buys at the discount price ( $9.00 is the regular price and a 4 percent discount for delivery at the start of each quarter). What is the retaller's expected annual purchasing and Inventory holding cost? c. Consider the first plan and propose a new everyday-low wholesale price. Call this the third plan. Design your plan so that both P\&c and the retaller prefer it relatlve to the second plan. (Round your answer to two decimal places.)