Question

Project 2 Case Questions The case presents the student with financial ratios for eight pairs of companies and asks them to match the description of

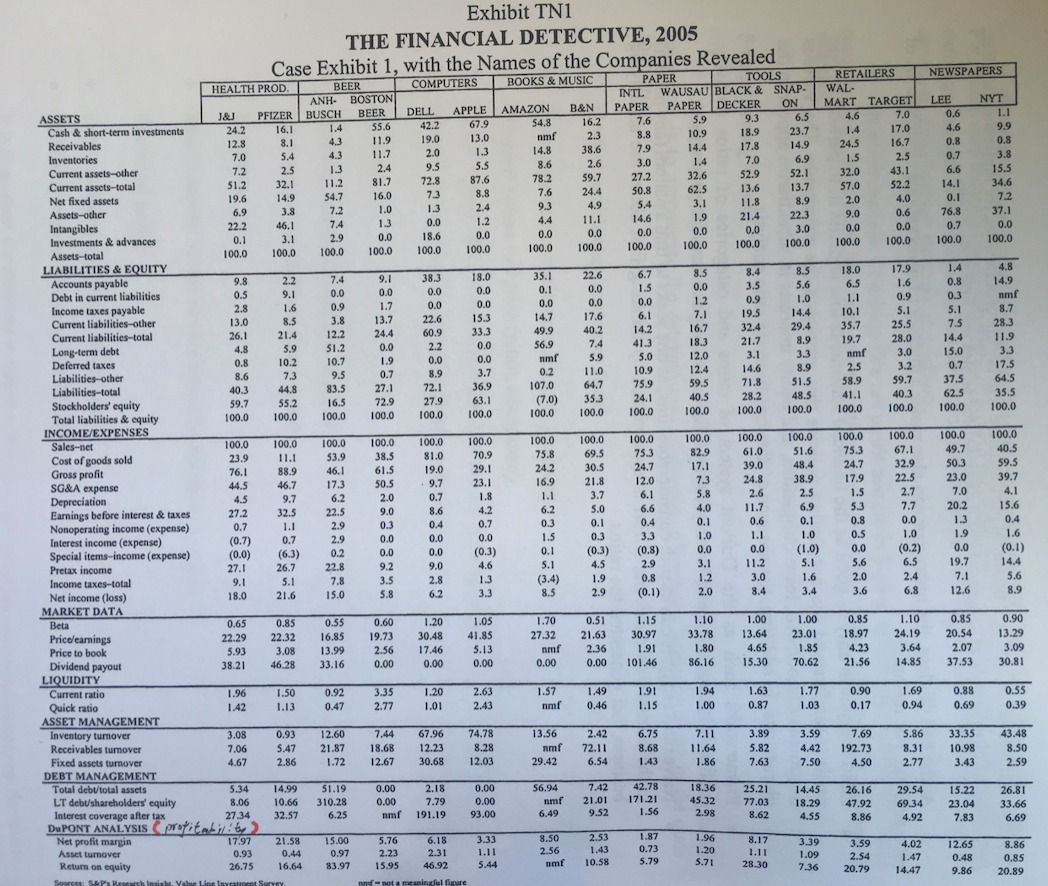

Project 2 Case Questions The case presents the student with financial ratios for eight pairs of companies and asks them to match the description of the company with the financial profile derived from the ratios. In addition to this, please give an explanation as to why you have made the choice between ratio and firm that you have. Explain your logic using average ratios within each industry as well as the different strategies firms with differing maturities and size, within the same industry. This will be the only deliverable required for this project. Also notes that the due date is December 17th. The choice of firms for the matching process is as follows: 1. Johnson & Johnson 2. Anheuser-Busch Companies 3. Dell, Inc 4. Amazon.com 5. International Paper Company 6. Black @ Decker Corporation 7. Wal-Mart Stores, Inc 8. Lee Enterprises 9. Target Corporation 10. Barnes @ Noble, Inc 11. Snap-on Inc 12. Pfizer Inc

13. The Boston Beer Company 14. The New York Times 15. Apple Computer Inc, 16. Wausau Paper Company

Project 2 Guidance Please read the descriptions of each of the firms (under the headings of their Industries). Also take note of how this would be reflected in certain ratios derived from the Common-Sized Financial Data and Ratios under exhibit 1. Below, under the headings of the industries is some further guidance. Please note the ratios mentioned should not create the sole basis of your conclusion but should point you in the right direction.

Health Product Companies A high intangibles percentage would reflect higher amount of patents or increase R&D while a higher inventory turnover may indicate a firm which sells directly to the public (bare in mind most drugs you need a prescription from a physician). Increased patents may also result in a higher Net Profit due to Patent protected pricing power.

Beer Companies A relatively high level of property, plant, and equipment (PP&E) is consistent with a firm that makes a greater quantity of product. Higher Debt to assets and equity is consistent with a more established firm that has more access to the debt markets. A larger firm with mass market approach would have a higher inventory turnover than one which provides a more specialized product. Lastly, note the differences in net and gross profit. Higher gross profit is consistent with more specialty premium pricing while a larger net profit could reflect economies of scale.

Computers One firm will have a higher accounts payable percentage than the other. Bear in mind one of the computer firms makes built-to-order products and the other does not, hence a greater reliance on suppliers. A greater reliance on suppliers would also be reflected in higher fixed asset turnovers. If you compare the SG&A percentage, which one is more consistent with a highly visible storefront and which is not? Also, please note that the financial statements were 2005. This should also feature in your analysis when you look up information about them. In particular, understand that a greater holding of cash and short-term investments percentage, is an insurance against further difficulty.

Book and Music One company must maintain higher stock of books, videos and CD's (this was 2005 when most have you young Turks were still in kindergarten..). This would be reflected in a higher inventory's percentage, while also being reflected in a low inventory turnover. One firm is primarily online while the other has primarily physical stores. This would be reflected in differing net fixed asset percentages.

Paper products It would be best to look up the paper corporations on the list and the realize that COGs sold will be lower for a larger company that can take advantage of economies of scale. However, a larger firm would have higher SG&A expense.

Hardware and tools One of these firms is known for high quality tools that are directly sold to professionals. The other is known to sell to DIYers through larger wholesale stores. This would be reflected in lower receivables percentage. One firms dividend payout ratio is much higher than the other and this would suggest that one firm needs a much lower reinvestment than the other firm. One firm has a higher gross profit than the other, showing that it sells lower priced, less specialized merchandise but the firm selling more specialized equipment must maintain a larger selling staff and as such this will be shown in that firm having a lower net profit.

Retailing One firm has a higher COGS and receivables percentage than the other. This would be consistent with offering a wide array of goods, by a firm in control of many of its own supply chains.

Newspapers One of these firms is large and centralized while the other is nor and this is reflected in ratio differences. The larger more established firm has higher net fixed assets and COGS percentage. On the other hand, the newer, less established firm may have a higher PE ratio, indicating a greater expectation of growth and a higher Net profit margin due to localized monopolization.

Exhibit TN1 THE FINANCIAL DETECTIVE, 2005 Case Exhibit 1, with the Names of the Companies Revealed NEWSPAPERS BOOKS & MUSIC HEALTH PROD COMPUTERS BEER ANH- BOSTON BUSCH BEER 55.6 4.3 11.9 4.3 11.7 1.3 2.4 11.2 81.7 54.7 16.0 7.2 1.0 7.4 1.3 0.0 100.0 100.0 DELL 422 19.0 2.0 9.5 72.8 73 1.3 0.0 18.6 100.0 APPLE 67.9 13.0 1.3 5.5 87.6 8.8 2.4 1.2 0.0 100.0 AMAZON 54.8 nmf 14.8 8.6 78.2 7.6 9.3 4.4 0.0 100.0 B&N 16.2 2.3 38.6 2.6 59.7 24.4 4.9 11.1 0.0 100.0 PAPER TOOLS INTL WAUSAU BLACK & SNAP- PAPER PAPER DECKER ON 7.6 5.9 9.3 6.5 8.8 10.9 18.9 23.7 7.9 14.4 17.8 14.9 3.0 1.4 7.0 6,9 27.2 32.6 52.9 52.1 50.8 62.5 13.6 13.7 5.4 3.1 11.8 8.9 14.6 1.9 21.4 22.3 0.0 0.0 0.0 3.0 100,0 100.0 100.0 100.0 RETAILERS WAL MART TARGET 4.6 7.0 17.0 24.5 16.7 1.5 2.5 32.0 43.1 57.0 52.2 2.0 4.0 9.0 0.6 0.0 0.0 100.0 100.0 LEE 0.6 4.6 0.8 0.7 6.6 14.1 0.1 76.8 0.7 100.0 NYT 1.1 9.9 0.8 3.8 15.5 34.6 7.2 37.1 0.0 100.0 2.9 7.4 0.0 0.9 3.8 12.2 51.2 10.7 9.5 83.5 16.5 100.0 9.1 0.0 1.7 13.7 24.4 0.0 1.9 0.7 27.1 72.9 100.0 38.3 0.0 0.0 22.6 60.9 2.2 0.0 8.9 72.1 27.9 100.0 18.0 0.0 0.0 15.3 33.3 0.0 0.0 3.7 36.9 63.1 100.0 35.1 0.1 0.0 14.7 49.9 56.9 nmr 0.2 107.0 (7.0) 100.0 22.6 0.0 0.0 17.6 40.2 7.4 5.9 11.0 64.7 35.3 100.0 6.7 1.5 0.0 6.1 14.2 41.3 5.0 10.9 75.9 24.1 100.0 8.5 0.0 1.2 7.1 16.7 18.3 12.0 12.4 59.5 40.5 100.0 8.4 3.5 0.9 19.5 32.4 21.7 3.1 14.6 71.8 28.2 100.0 8.5 5.6 1.0 14.4 29.4 8.9 3.3 8.9 51.5 48.5 100.0 18.0 6.5 1.1 10.1 35.7 19.7 nmf 2.5 58.9 41.1 100.0 17.9 1.6 0.9 5. 25.5 28.0 3.0 3.2 59.7 40.3 100.0 1.4 0.8 0.3 5.1 7.5 14.4 15.0 0.7 37.5 62.5 100.0 4.8 14.9 nmf 8.7 28.3 11.9 3.3 17.5 64.5 35.5 100.0 100.0 75.3 24.7 17.9 ASSETS J&J PFIZER Cash & short-term investments 24.2 16.1 Receivables 12.8 8.1 Inventories 7.0 5.4 Current assets-other 7.2 2.5 Current assets-total 51.2 32.1 Net fixed assets 19.6 14.9 Assets-other 6.9 3.8 Intangibles 22.2 46.1 Investments & advances 0.1 3.1 Assets-total 100.0 100.0 LIABILITIES & EQUITY Accounts payable 9.8 2.2 Debt in current liabilities 0.5 9.1 Income taxes payable 2.8 1.6 Current liabilities-other 13.0 8.5 Current liabilities-total 26.1 21.4 Long-term debt 4.8 5.9 Deferred taxes 0.8 10.2 Liabilities other 8.6 7.3 Liabilities-total 40.3 44.8 Stockholders' equity 59.7 55.2 Total liabilities & equity 100.0 100.0 INCOME/EXPENSES Sales-net 100.0 100.0 Cost of goods sold 23.9 11.1 Gross profit 76.1 88.9 SG&A expense 44.5 46.7 Depreciation 4,5 9.7 Earnings before interest & taxes 27.2 32.5 Nonoperating income (expense) 0.7 Interest income (expense) (0.7) Special items-income (expense) (0.0) (6.3) Pretax income 27.1 26.7 Income taxes-total 9. 5.1 Net income (loss) 18.0 21.6 MARKET DATA Beta 0.65 0.85 Price/earnings 22.29 22.32 Price to book 5.93 3.08 Dividend payout 38.21 46.28 LIQUIDITY Current ratio 1.96 1.50 Quick ratio 1.42 1.13 ASSET MANAGEMENT Inventory turnover 3.08 0.93 Receivables turnover 7.06 5.47 Fixed assets turnover 4.67 2.86 DEBT MANAGEMENT Total debu total assets 5.34 14.99 LT debushareholders' equity 8.06 10.66 Interest coverage after tax 27.34 32.57 DUPONT ANALYSIS profitability Net profit margin 17.97 21.58 Asset turnover 0.93 0.44 Return on equity 26.75 16.64 Source S&P's Rescuchish Value Line Love Survey 1.5 100.0 53.9 46.1 17.3 6.2 22.5 2.9 2.9 0.2 22.8 7.8 15.0 100.0 38.5 61.5 50.5 2.0 9.0 0.3 0.0 0.0 9.2 3.5 5.8 100.0 81.0 19.0 9.7 0.7 8.6 0.4 0.0 0.0 9.0 2.8 6.2 100.0 70.9 29.1 23.1 1.8 4.2 0.7 0.0 (0.3) 4.6 1.3 3.3 100.0 75.8 24.2 16.9 1.1 6.2 0.3 1.5 0.1 5.1 (3.4) 8.5 100.0 69.5 30.5 21.8 3.7 5.0 0.1 0.3 (0.3) 4.5 1.9 2.9 100.0 75.3 24.7 12.0 6.1 6.6 0.4 3.3 (0.8) ( 2.9 0.8 (0.1) 100.0 61.0 39.0 24.8 2.6 11.7 0.6 100.0 82.9 17.1 73 5,8 4.0 0.1 1.0 0.0 3.1 1.2 2.0 100.0 51.6 48.4 38.9 2.5 6.9 0.1 1.0 (1.0) 5.1 1.6 3,4 100.0 67.1 32.9 22.5 2.7 7.7 0.0 1.0 (0.2) 6.5 2.4 6.8 100.0 49.7 50.3 23.0 7.0 20.2 1.3 1.9 0.0 19.7 7.1 12.6 5.3 0.8 0.5 0.0 5.6 2.0 3.6 100.0 40.5 59.5 39.7 4.1 15.6 0.4 1.6 (0.1) 14.4 5.6 8.9 0.7 0.0 11.2 3.0 8.4 0.55 16.85 13.99 33.16 0.60 19.73 2.56 0.00 1.20 30.48 17.46 0.00 1.05 41.85 5.13 0.00 1.70 27.32 nmf 0.00 0.51 21.63 2.36 0.00 1.15 30.97 1.91 101.46 1.10 33.78 1.80 86.16 1.00 13.64 4.65 15.30 1.00 23.01 1.85 70.62 0.85 18.97 4.23 21.56 1.10 24.19 3.64 14.85 0.85 20.54 2.07 37.53 0.90 13.29 3.09 30.81 0.92 0.47 3.35 2.77 1.20 1.01 2.63 2.43 1.57 nmr 1.49 0.46 1.91 1.15 1.94 1.00 1.63 0.87 1.77 1.03 0.90 0.17 1.69 0.94 0.88 0.69 0.55 0.39 6.75 12.60 21.87 1.72 7.44 18.68 12.67 67.96 12.23 30.68 74.78 8.28 12.03 13.56 nmf 29.42 2.42 72.11 6.54 8.68 1.43 7.11 11.64 1.86 3.89 5.82 7.63 3.59 4.42 7.50 7.69 192.73 4.50 5.86 8.31 2.77 33.35 10.98 3.43 43.48 8.50 2.59 51.19 310.28 6.25 0.00 0.00 nmf 2.18 7.79 191.19 0.00 0.00 93.00 56.94 nmf 6.49 7.42 21.01 9.52 42.78 171.21 1.56 18.36 45.32 2.98 25.21 77.03 8.62 14.45 18.29 4.55 26.16 47.92 8.86 29.54 69.34 4.92 15.22 23.04 7.83 26.81 33.66 6.69 2.53 15.00 0.97 83.97 5.76 2.23 15.95 6.18 2.31 46.92 3.33 1.11 5.44 8.50 2.56 mmf 1.87 0.73 5.79 1.96 1.20 5.71 8.17 1.11 28.30 3.39 1.09 3.59 2.54 20.79 4.02 1.47 14.47 10.58 12.65 0.48 9.86 8.86 0.85 20.89 7.36 mnot meaningful figure Exhibit TN1 THE FINANCIAL DETECTIVE, 2005 Case Exhibit 1, with the Names of the Companies Revealed NEWSPAPERS BOOKS & MUSIC HEALTH PROD COMPUTERS BEER ANH- BOSTON BUSCH BEER 55.6 4.3 11.9 4.3 11.7 1.3 2.4 11.2 81.7 54.7 16.0 7.2 1.0 7.4 1.3 0.0 100.0 100.0 DELL 422 19.0 2.0 9.5 72.8 73 1.3 0.0 18.6 100.0 APPLE 67.9 13.0 1.3 5.5 87.6 8.8 2.4 1.2 0.0 100.0 AMAZON 54.8 nmf 14.8 8.6 78.2 7.6 9.3 4.4 0.0 100.0 B&N 16.2 2.3 38.6 2.6 59.7 24.4 4.9 11.1 0.0 100.0 PAPER TOOLS INTL WAUSAU BLACK & SNAP- PAPER PAPER DECKER ON 7.6 5.9 9.3 6.5 8.8 10.9 18.9 23.7 7.9 14.4 17.8 14.9 3.0 1.4 7.0 6,9 27.2 32.6 52.9 52.1 50.8 62.5 13.6 13.7 5.4 3.1 11.8 8.9 14.6 1.9 21.4 22.3 0.0 0.0 0.0 3.0 100,0 100.0 100.0 100.0 RETAILERS WAL MART TARGET 4.6 7.0 17.0 24.5 16.7 1.5 2.5 32.0 43.1 57.0 52.2 2.0 4.0 9.0 0.6 0.0 0.0 100.0 100.0 LEE 0.6 4.6 0.8 0.7 6.6 14.1 0.1 76.8 0.7 100.0 NYT 1.1 9.9 0.8 3.8 15.5 34.6 7.2 37.1 0.0 100.0 2.9 7.4 0.0 0.9 3.8 12.2 51.2 10.7 9.5 83.5 16.5 100.0 9.1 0.0 1.7 13.7 24.4 0.0 1.9 0.7 27.1 72.9 100.0 38.3 0.0 0.0 22.6 60.9 2.2 0.0 8.9 72.1 27.9 100.0 18.0 0.0 0.0 15.3 33.3 0.0 0.0 3.7 36.9 63.1 100.0 35.1 0.1 0.0 14.7 49.9 56.9 nmr 0.2 107.0 (7.0) 100.0 22.6 0.0 0.0 17.6 40.2 7.4 5.9 11.0 64.7 35.3 100.0 6.7 1.5 0.0 6.1 14.2 41.3 5.0 10.9 75.9 24.1 100.0 8.5 0.0 1.2 7.1 16.7 18.3 12.0 12.4 59.5 40.5 100.0 8.4 3.5 0.9 19.5 32.4 21.7 3.1 14.6 71.8 28.2 100.0 8.5 5.6 1.0 14.4 29.4 8.9 3.3 8.9 51.5 48.5 100.0 18.0 6.5 1.1 10.1 35.7 19.7 nmf 2.5 58.9 41.1 100.0 17.9 1.6 0.9 5. 25.5 28.0 3.0 3.2 59.7 40.3 100.0 1.4 0.8 0.3 5.1 7.5 14.4 15.0 0.7 37.5 62.5 100.0 4.8 14.9 nmf 8.7 28.3 11.9 3.3 17.5 64.5 35.5 100.0 100.0 75.3 24.7 17.9 ASSETS J&J PFIZER Cash & short-term investments 24.2 16.1 Receivables 12.8 8.1 Inventories 7.0 5.4 Current assets-other 7.2 2.5 Current assets-total 51.2 32.1 Net fixed assets 19.6 14.9 Assets-other 6.9 3.8 Intangibles 22.2 46.1 Investments & advances 0.1 3.1 Assets-total 100.0 100.0 LIABILITIES & EQUITY Accounts payable 9.8 2.2 Debt in current liabilities 0.5 9.1 Income taxes payable 2.8 1.6 Current liabilities-other 13.0 8.5 Current liabilities-total 26.1 21.4 Long-term debt 4.8 5.9 Deferred taxes 0.8 10.2 Liabilities other 8.6 7.3 Liabilities-total 40.3 44.8 Stockholders' equity 59.7 55.2 Total liabilities & equity 100.0 100.0 INCOME/EXPENSES Sales-net 100.0 100.0 Cost of goods sold 23.9 11.1 Gross profit 76.1 88.9 SG&A expense 44.5 46.7 Depreciation 4,5 9.7 Earnings before interest & taxes 27.2 32.5 Nonoperating income (expense) 0.7 Interest income (expense) (0.7) Special items-income (expense) (0.0) (6.3) Pretax income 27.1 26.7 Income taxes-total 9. 5.1 Net income (loss) 18.0 21.6 MARKET DATA Beta 0.65 0.85 Price/earnings 22.29 22.32 Price to book 5.93 3.08 Dividend payout 38.21 46.28 LIQUIDITY Current ratio 1.96 1.50 Quick ratio 1.42 1.13 ASSET MANAGEMENT Inventory turnover 3.08 0.93 Receivables turnover 7.06 5.47 Fixed assets turnover 4.67 2.86 DEBT MANAGEMENT Total debu total assets 5.34 14.99 LT debushareholders' equity 8.06 10.66 Interest coverage after tax 27.34 32.57 DUPONT ANALYSIS profitability Net profit margin 17.97 21.58 Asset turnover 0.93 0.44 Return on equity 26.75 16.64 Source S&P's Rescuchish Value Line Love Survey 1.5 100.0 53.9 46.1 17.3 6.2 22.5 2.9 2.9 0.2 22.8 7.8 15.0 100.0 38.5 61.5 50.5 2.0 9.0 0.3 0.0 0.0 9.2 3.5 5.8 100.0 81.0 19.0 9.7 0.7 8.6 0.4 0.0 0.0 9.0 2.8 6.2 100.0 70.9 29.1 23.1 1.8 4.2 0.7 0.0 (0.3) 4.6 1.3 3.3 100.0 75.8 24.2 16.9 1.1 6.2 0.3 1.5 0.1 5.1 (3.4) 8.5 100.0 69.5 30.5 21.8 3.7 5.0 0.1 0.3 (0.3) 4.5 1.9 2.9 100.0 75.3 24.7 12.0 6.1 6.6 0.4 3.3 (0.8) ( 2.9 0.8 (0.1) 100.0 61.0 39.0 24.8 2.6 11.7 0.6 100.0 82.9 17.1 73 5,8 4.0 0.1 1.0 0.0 3.1 1.2 2.0 100.0 51.6 48.4 38.9 2.5 6.9 0.1 1.0 (1.0) 5.1 1.6 3,4 100.0 67.1 32.9 22.5 2.7 7.7 0.0 1.0 (0.2) 6.5 2.4 6.8 100.0 49.7 50.3 23.0 7.0 20.2 1.3 1.9 0.0 19.7 7.1 12.6 5.3 0.8 0.5 0.0 5.6 2.0 3.6 100.0 40.5 59.5 39.7 4.1 15.6 0.4 1.6 (0.1) 14.4 5.6 8.9 0.7 0.0 11.2 3.0 8.4 0.55 16.85 13.99 33.16 0.60 19.73 2.56 0.00 1.20 30.48 17.46 0.00 1.05 41.85 5.13 0.00 1.70 27.32 nmf 0.00 0.51 21.63 2.36 0.00 1.15 30.97 1.91 101.46 1.10 33.78 1.80 86.16 1.00 13.64 4.65 15.30 1.00 23.01 1.85 70.62 0.85 18.97 4.23 21.56 1.10 24.19 3.64 14.85 0.85 20.54 2.07 37.53 0.90 13.29 3.09 30.81 0.92 0.47 3.35 2.77 1.20 1.01 2.63 2.43 1.57 nmr 1.49 0.46 1.91 1.15 1.94 1.00 1.63 0.87 1.77 1.03 0.90 0.17 1.69 0.94 0.88 0.69 0.55 0.39 6.75 12.60 21.87 1.72 7.44 18.68 12.67 67.96 12.23 30.68 74.78 8.28 12.03 13.56 nmf 29.42 2.42 72.11 6.54 8.68 1.43 7.11 11.64 1.86 3.89 5.82 7.63 3.59 4.42 7.50 7.69 192.73 4.50 5.86 8.31 2.77 33.35 10.98 3.43 43.48 8.50 2.59 51.19 310.28 6.25 0.00 0.00 nmf 2.18 7.79 191.19 0.00 0.00 93.00 56.94 nmf 6.49 7.42 21.01 9.52 42.78 171.21 1.56 18.36 45.32 2.98 25.21 77.03 8.62 14.45 18.29 4.55 26.16 47.92 8.86 29.54 69.34 4.92 15.22 23.04 7.83 26.81 33.66 6.69 2.53 15.00 0.97 83.97 5.76 2.23 15.95 6.18 2.31 46.92 3.33 1.11 5.44 8.50 2.56 mmf 1.87 0.73 5.79 1.96 1.20 5.71 8.17 1.11 28.30 3.39 1.09 3.59 2.54 20.79 4.02 1.47 14.47 10.58 12.65 0.48 9.86 8.86 0.85 20.89 7.36 mnot meaningful figureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started