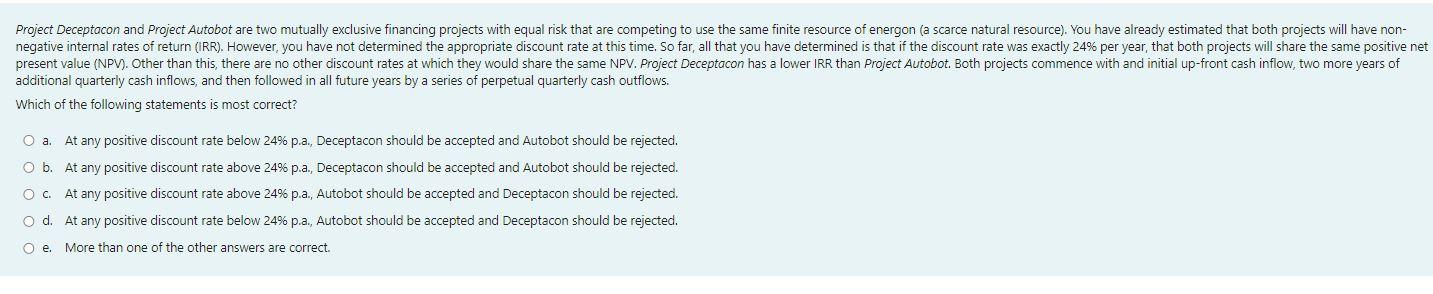

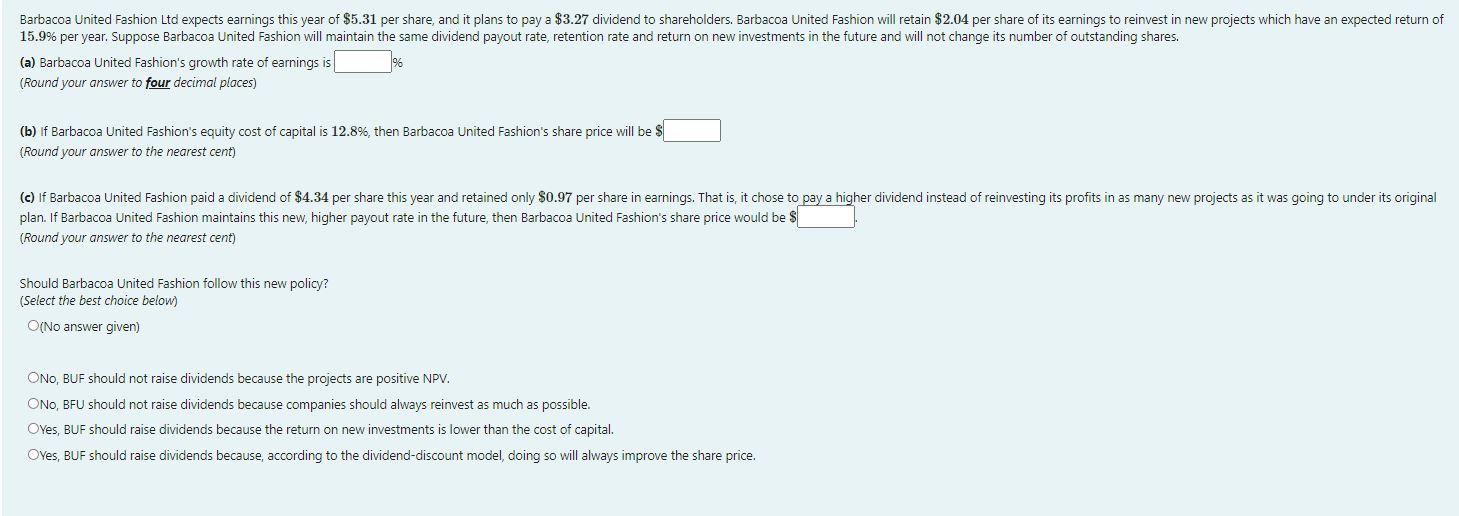

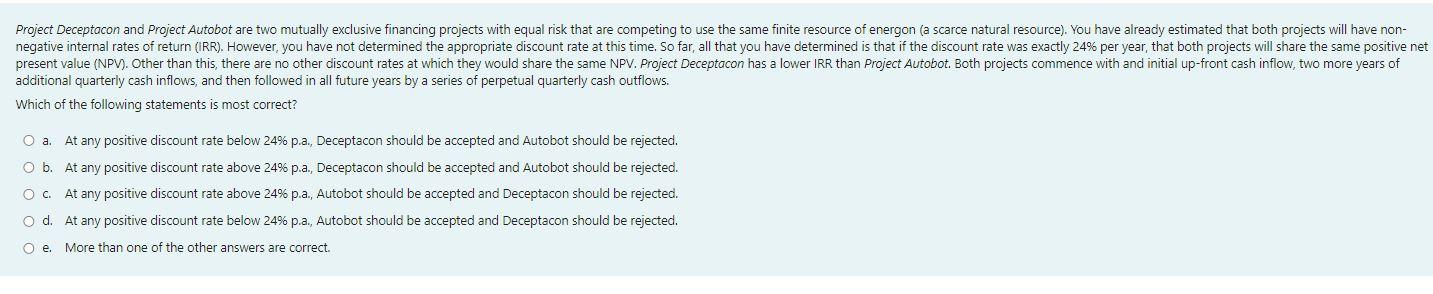

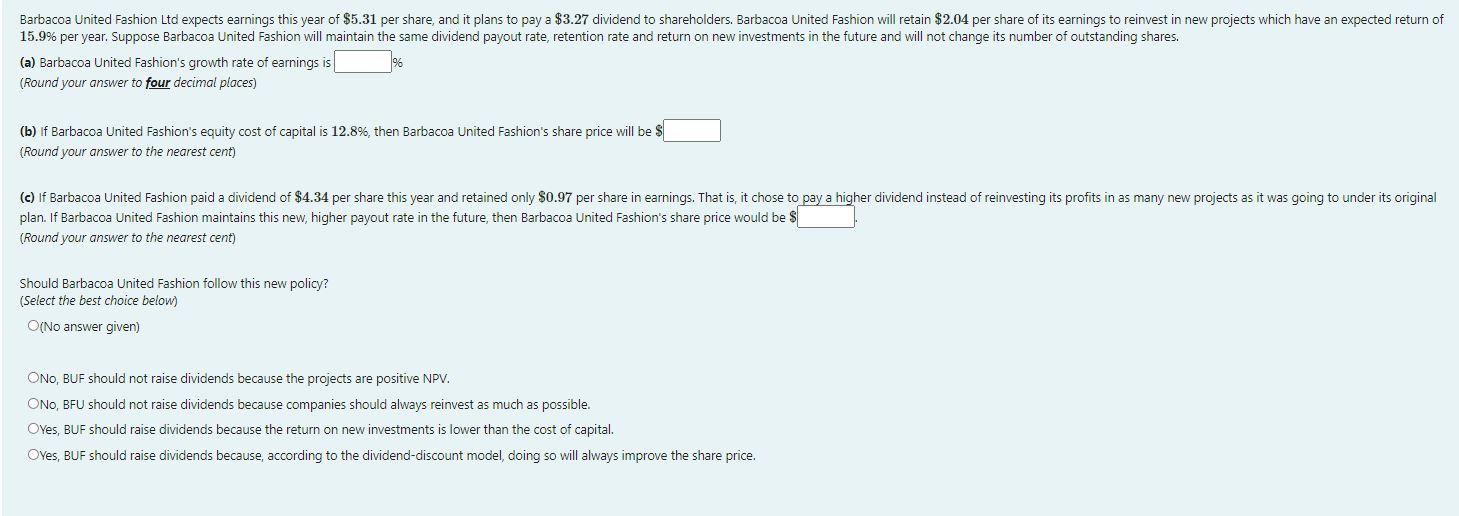

Project Deceptacon and Project Autobot are two mutually exclusive financing projects with equal risk that are competing to use the same finite resource of energon (a scarce natural resource). You have already estimated that both projects will have non- negative internal rates of return (IRR). However, you have not determined the appropriate discount rate at this time. So far, all that you have determined is that if the discount rate was exactly 24% per year, that both projects will share the same positive net present value (NPV). Other than this, there are no other discount rates at which they would share the same NPV. Project Deceptacon has a lower IRR than Project Autobot. Both projects commence with and initial up-front cash inflow, two more years of additional quarterly cash inflows, and then followed in all future years by a series of perpetual quarterly cash outflows. Which of the following statements is most correct? a. At any positive discount rate below 24% p.a., Deceptacon should be accepted and Autobot should be rejected. O b. At any positive discount rate above 24% p.a., Deceptacon should be accepted and Autobot should be rejected. Oc. At any positive discount rate above 24% p.a, Autobot should be accepted and Deceptacon should be rejected. O d. At any positive discount rate below 24% p.a., Autobot should be accepted and Deceptacon should be rejected. Oe. More than one of the other answers are correct. Barbacoa United Fashion Ltd expects earnings this year of $5.31 per share, and it plans to pay a $3.27 dividend to shareholders. Barbacoa United Fashion will retain $2.04 per share of its earnings to reinvest in new projects which have an expected return of 15.9% per year. Suppose Barbacoa United Fashion will maintain the same dividend payout rate, retention rate and return on new investments in the future and will not change its number of outstanding shares. (a) Barbacoa United Fashion's growth rate of earnings is (Round your answer to four decimal places) (b) If Barbacoa United Fashion's equity cost of capital is 12.8%, then Barbacoa United Fashion's share price will be $ (Round your answer to the nearest cent) (c) If Barbacoa United Fashion paid a dividend of $4.34 per share this year and retained only $0.97 per share in earnings. That is it chose to pay a higher dividend instead of reinvesting its profits in as many new projects as it was going to under its original plan. If Barbacoa United Fashion maintains this new, higher payout rate in the future, then Barbacoa United Fashion's share price would be $ (Round your answer to the nearest cent) Should Barbacoa United Fashion follow this new policy? (Select the best choice below) (No answer given) ONO, BUF should not raise dividends because the projects are positive NPV. ONO, BFU should not raise dividends because companies should always reinvest as much as possible. Oves, BUF should raise dividends because the return on new investments is lower than the cost of capital. Oves, BUF should raise dividends because, according to the dividend-discount model, doing so will always improve the share price